The paper Beta Dispersion and Market-Timing (SSRN) argues that one can predict crashes by tracking the dispersion of betas of the constituents of an index. The intuition presented in the paper is that when beta dispersion is high, any shock to the high beta stocks could spill over to the low beta stocks and create a broad market correction.

Although the paper proceeds to present a back-test on the US S&P 500 index, there some questions that need to be answered before deploying this strategy:

- What is the performance if you remove 2000 and 2008 from the data? Perhaps most of the out-performance can be attributed to skipping these two periods purely due to chance?

- Are the results robust over different markets? Perhaps it is unique to the US?

- What happens if you change the look-back period of beta calculations? Perhaps it is being data-mined?

- What happens if the calculations are continuous rather than sampled at the end of the month? Perhaps its an end-of-the-month effect?

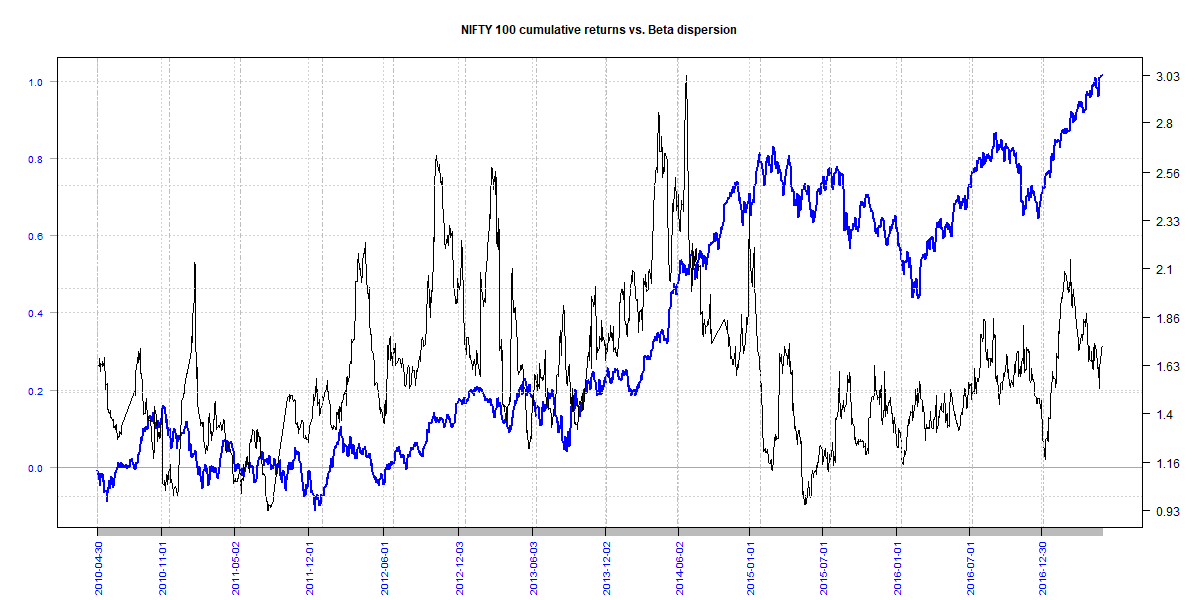

Unfortunately, we don’t have a robust data-set to put this theory to test. However, the chart of the cumulative returns of the NIFTY 100 index vs. the beta-dispersion of its components does not lead to the same conclusion made in the paper.

The code for this analysis is on github.