Warren Buffett had this to say about IPOs: “It’s almost a mathematical impossibility to imagine that, out of the thousands of things for sale on a given day, the most attractively priced is the one being sold by a knowledgeable seller (company insiders) to a less-knowledgeable buyer(investors).”

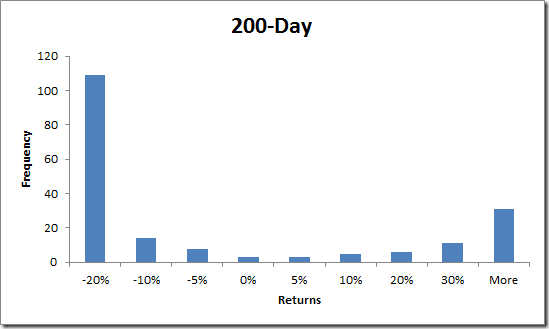

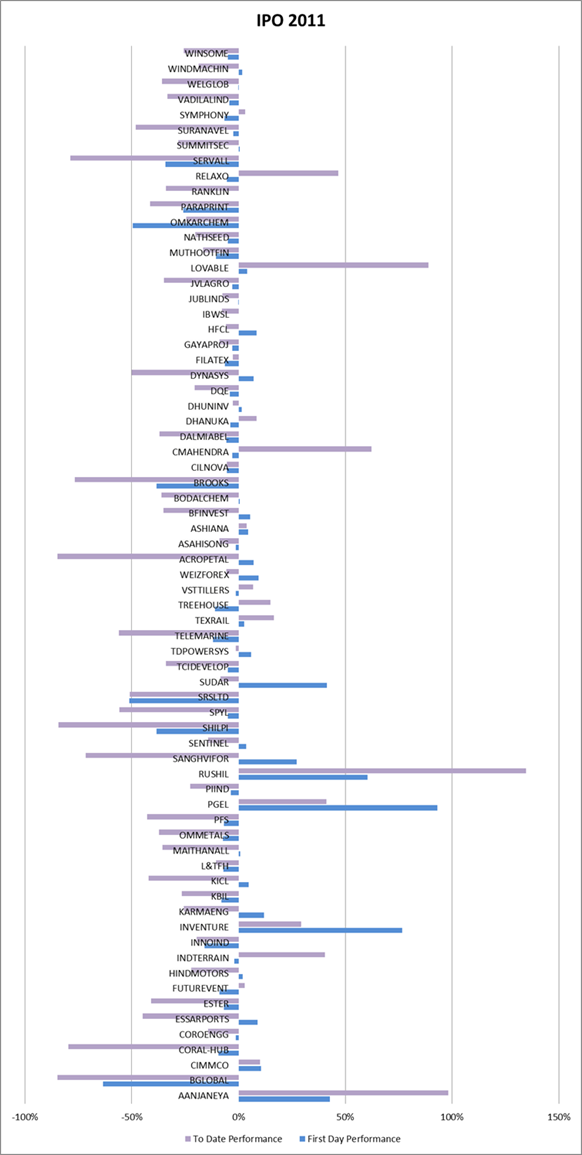

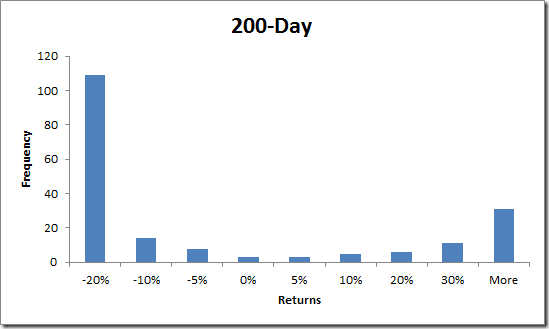

How have Indian IPO investors fared lately? To answer this question, StockViz analyzed over 250 IPOs since 2010 and compared them to returns that an investor would get if he had bought the Nifty [stockquote]NIFTYBEES[/stockquote] or the Junior Nifty [stockquote]JUNIORBEES[/stockquote] ETFs instead. The headline: over 200 trading days, IPOs on an average tanked -20% while the ETFs were -0.1% and -4.5% over the same period. Obviously, performance varies depending on the scrip and IPOs, as a group, tend to exhibit volatile returns (a standard deviation, σ , of 0.66 vs. Nifty’s 0.12 for 200 day returns.) So much for “buy-and-hold.”

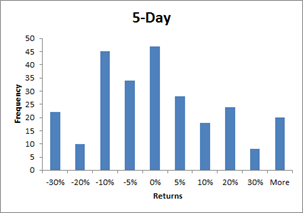

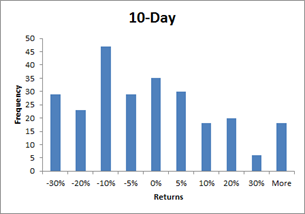

How did the “flippers” fare? The 5 and 10-day returns are not that much better either: +0.5% and –1.7% on an average, with the Nifty faring better in both the cases.

So why buy IPOs at all? If you look at the histograms, there are about 20-30 stocks that gave more than 30% returns. For example, Peria Karamalai [stockquote]PERIATEA[/stockquote] 200-day return is at 300%. Anecdotes about “friends-of-friends” making a killing in IPOs is a powerful motivation indeed.

Is there a way to play IPOs while managing downside risks at the same time? Turns out there is. If it’s a dog stock, you’ll know it before 5 days. Stocks that doubled 20-days from the day of listing exhibited an average return of 65% within the first 5 days. Stocks that doubled 50-days from the day of listing exhibited an average return of 50% within the first 5 days. The rule of thumb is: If it doesn’t pop within the first 5 days, chances are that it never will.

Follow the StockViz 5-day rule for IPOs and add that extra juice to your portfolio!