This week’s pick is [stockquote]ITC[/stockquote]. Trading at 52 week high of Rs. 280, the stock has a return of close to 40% over the last 12 month period. The stock has been in a consistent uptrend for the last year, a small correction happened close to Rs. 250, but a pullback was seen from the Rs. 227 levels with affirming volumes.

Oscillators like RSI and CMO are at currently at the levels of 66 and 60. At this high level, there surely can be a correction in the short term. Although looking at the previous highs of RSI, the stock can see an up move till RSI reaches 80. MACD line and signal line are drifting apart from each other and histogram levels are on a rise. Not suggesting any corrections.

Looking at GMMA for a medium to long term outlook is not giving a lot of indication. The long term lines are moving away from each other (signaling a continuation of the previous trend). The increasing separation in the short term lines also suggests a positive outlook for the near term. The stock seems to be on a roll. It is a long term green flag for this stock.

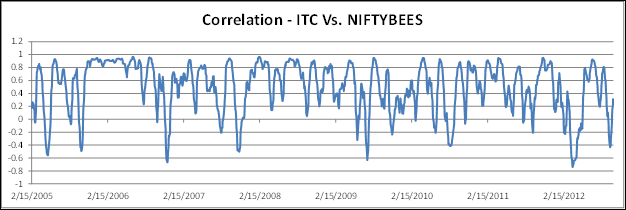

ITC’s average correlation of 0.49 with the [stockquote]NIFTYBEES[/stockquote] suggests that the correlation is strong and positive, Although the movements will not be of the same magnitude as Niftybees.

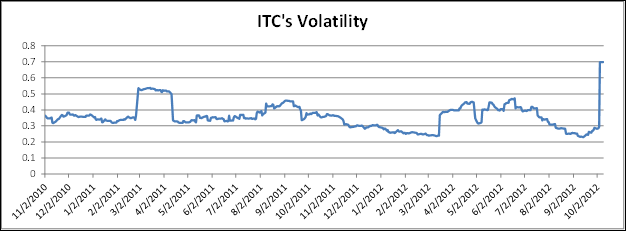

ITC has volatility in the range of 0.4 to 0.6 for the most part (except for the high regions during 2010) which is not a very big range. The volatility is currently at 0.70, higher compared to the recent past. A constant eye is required on the scrip in case it makes a sudden move.

The up-trend is quite prominent. For a short term until the RSI levels start to decrease it is suggested to hold the scrip. And for the long term we do not have any standard to measure if it has any resistance at any levels. This stock can just be another example to prove the proverb “the trend is your friend” true.