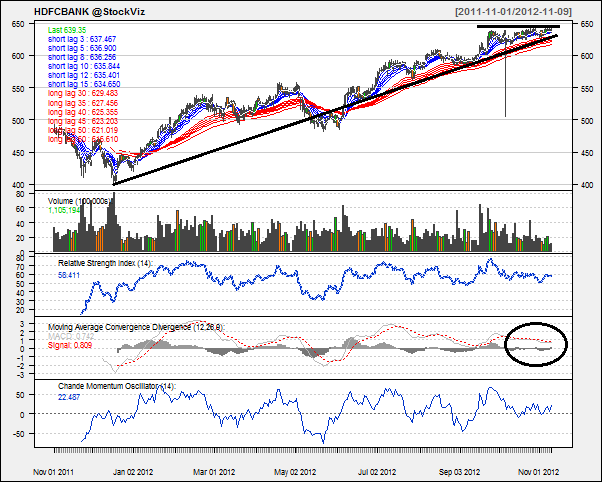

Today’s pick is [stockquote]HDFCBANK[/stockquote]. The stock has been in an up-trend since lows of last December. However, the last one and a half month has seen a range bound movement for the stock. In the last three month period, the stock was up 7% same as that of Nifty’s return. The stock is currently trading around its 52-week high at 645 levels.

Oscillators RSI and CMO are at currently at 58 and 22 are hovering around the over-bought territory but are not suggesting any direction.

MACD line and the signal line are moving very close to each other since a long time and are not suggesting any trend. The short-term technicals are looking pretty good: both the 4×9 Cross-Over and 4×18 Cross-Over are bullish.

The GMMA chart shows that long-term lines are parallel to each other which is a bullish sign for the stock. The short-term lines are entangled because of the last months range bound movement.

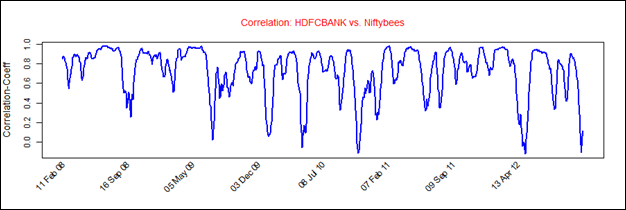

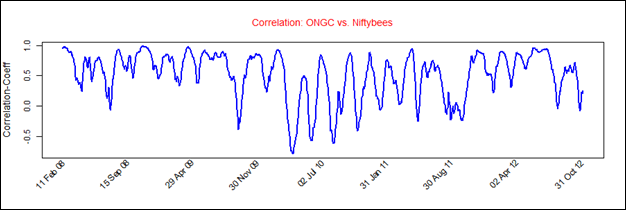

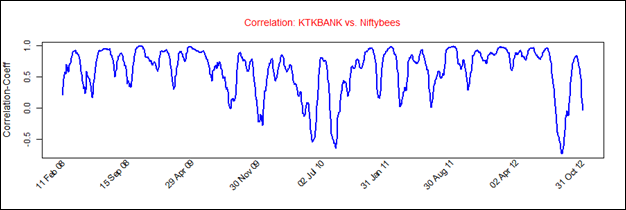

HDFCBANK’s average correlation of 0.73 with the Nifty is positive and quite strong. The stock will replicate the movements of Nifty closely because of the high co-efficient. [stockquote]NIFTYBEES[/stockquote]

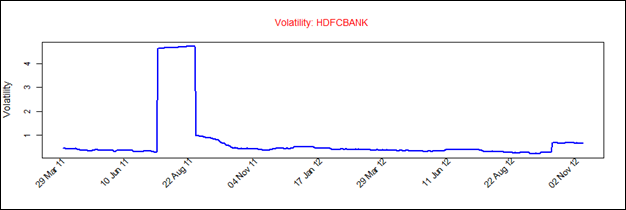

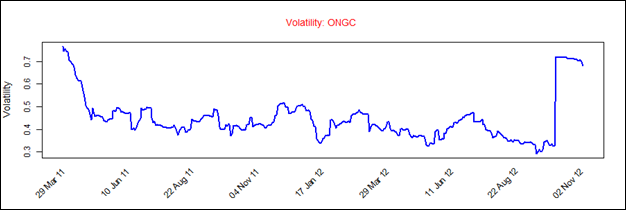

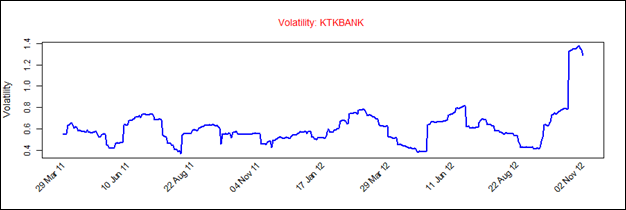

HDFCBANK has a historical volatility in the range of 0.4 to 4 which is a very big range. The scrip’s volatility is currently in the lower side of the range and hence should not be a concern.

Analysts have mixed expectations regarding this stock. Next set of earnings can help bring a different picture on the charts. Also, the magnitude of buys and sells from insiders crossed each other out.

Looking at these technicals a short-term buy is suggested. A break-out of the pennant in either direction will trigger a longer-term call.