This is a review of the 7th chapter of John J. Murphy’s Technical Analysis of the Financial Markets.

Volume and Open Interest

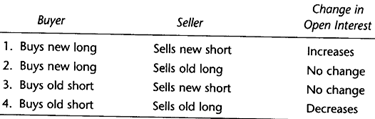

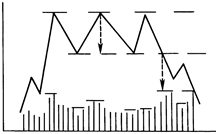

Volume and Open Interest (OI for short) are used as confirming indicators. OI is simply the total number of outstanding contracts at the end of each day in the options/futures market. This handy table explains how OI changes:

(In #3 for example, the seller is initiating a new short where as the buyer is covering an old long.)

General rules

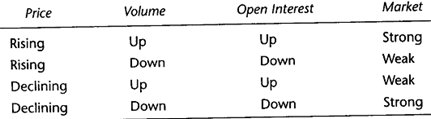

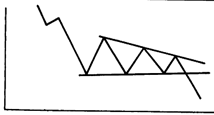

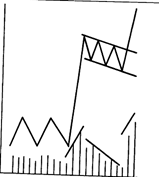

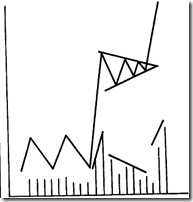

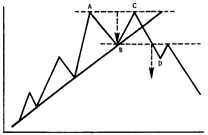

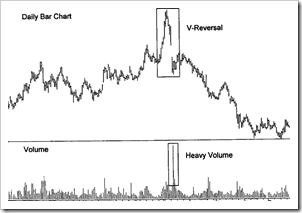

Simply put: volume should increase in the direction of the existing price trend. For example, in an uptrend, if a penetration of a previous high occurs on diminishing volume, the divergence should alert the trader. As a rule, all breakouts should occur on high volume.

On the other hand, if Open interest is

- Rising in an uptrend, it is bullish (new money is entering the market)

- Declining in an uptrend, it is bearish (short covering rally)

- Rising in a downtrend, it is bearish (new money is entering the market)

- Declining in a downtrend, it is bullish (longs are getting liquidated)

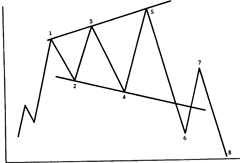

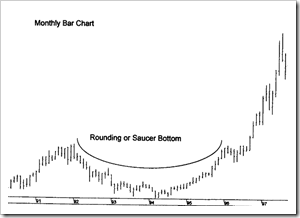

On Balance Volume (OBV)

OBV is used to bring out the trend in volume. OBV is calculated by adding (subtracting) each day’s volume to a running cumulative total when the security’s price closes higher (lower). As a general rule: OBV should follow the same direction as the price trend. The Money Flow Index is a variation of OBV that is weighted by the price.

Put/Call Ratios

Monitoring the volume in calls (bulls) vs. puts (bears) allows us to gauge the degree of bullishness/bearishness i.e., when option traders are bullish, Put/Call ratios fall and v.v. It is usually used as a contrary indicator. A very high ratio signals an oversold market. A very low ratio warns of an overbought market.

Up Next: Chapter 9 – Moving Averages