Relative Strength Index (RSI)

This week we are taking a detour in our journey. We will look at an indicator and not a continuous price pattern. I wanted to take up the very basic and the indicator that I learned about first. Relative strength Index (RSI), it is one of the many oscillators that are used vastly in the technical sphere. Appeared in the year 1978, and created by J. Wells Welder is very popular with traders.

Just like any oscillator indicator it solves the 2 basic problems with any momentum analysis.

- It was identified in the very early days of technical trading that erratic price movements can cause a huge distortion in the momentum for all the previous days / trading periods. This led to the need of a price normalisation / smoothing methodology. One of the methods is used for RSI.

- For comparison across various industries, stocks, countries and all different variables you need to have a standard range. RSI looks into this issue as well in the way the values are calculated.

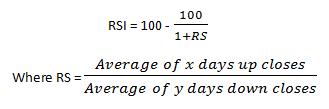

RSI solves both the problems of erratic price movements smoothing and constant upper and lower boundary very efficiently. Let us look at the formula to understand the indicator in a better manner.

For the daily RSI calculation 14 days are used. For weekly charts, 14 weeks data would be used. Well I will not go into the details of how RS is calculated and how RSI itself is calculated now. To make it easier for all of you, we have provided this technical absolutely free of cost. I will take you all directly to the uses of the same and how to apply them into trading.

The value of RSI ranges always from 0 to 100. It is plotted on a vertical scale. In the technical community a value over 70 is considered to be overbought and a value below 30 is considered oversold.

Let’s talk about failure swings. These swings were considered the most important feature by Welder. There are 2 types of failures, Top failure swings and bottom failure swings. A top failure swings takes place when the RSI is above 70 and the peak fails to exceed a prior peak in an uptrend and breaks the previous trough to confirm the top failure swing. The same way for a bottom failure swing, the RSI in the downtrend is unable to penetrate beyond the last trough and continuous beyond the last peak.

Another very important indicator is divergence. Just like any other oscillator we can use the indication provided by RSI to identify divergence. Especially in the overbought and oversold regions if a downward trend in RSI levels is indicated with a rising price levels, it should be considered as a warning sign. Same rule applies for the upward sloping indicator and downward sloping prices that the direction of movement might change soon.

As said in the book: Technical analysis of financial markets – by John J. Murphy that “the first movement across the signal line is just a warning. The signal to pay close attention to is the second move by the oscillator into the danger zone. If the second move fails to confirm the price move, a possible divergence exists.”

The 70 and 30 levels are used in the community, but it completely dependent on the individual to assign his personalised signal levels for the overbought and oversold point. It directly depends on the risk taking levels of the individual involved too.

In case of an overbought signal it is suggested to sell, as the prices are about to fall. The reverse holds true for the oversold signal. Also it should be noticed that in a trending market the RSI levels can stay in the danger zone for a long period, and an exit at greater than 70 or 30 level in such condition can lead to a premature exit from a potential profitable trend.

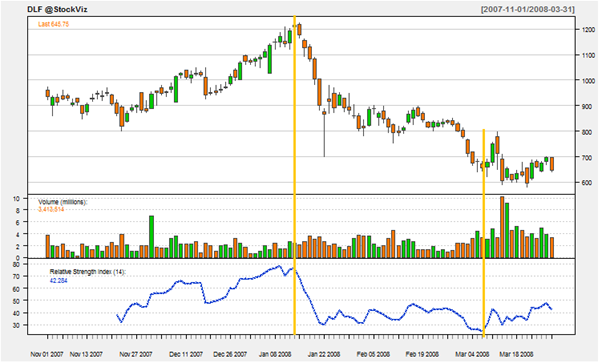

Let us look at the DLF chart for the period of Nov 2007 – March 2008. The two orange lines define the two places where the RSI’s have crossed 70 and 30 levels. In the part of above 70, look at how the current peak was unable to move forward above the previous peak and hence eventually a decline in price happened.

So finally, trading with RSI can act as a boon to your trading if used in a correct manner. But yes, all the technical tools should be used in combination with other confirming tools as well. We will talk about other technical tools in the forthcoming posts in the series.

To look up RSI levels and plots for any stock visit stockviz.biz, select the stock from the search bar and from the list on the right hand side select the RSI indicator to be shown on the chart and update the chart to look at the levels.

See you guys next week with some more awesome technicals!

You can post your suggestions and your comments about the sessions on facebook page or the comment box after the post.