MACD – Moving Average Convergence Divergence

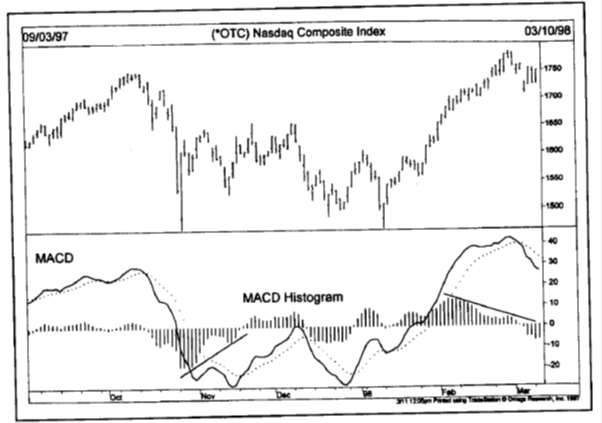

MACD was developed by Gerald Appel. In this indicator you will see 2 lines. The two lines are called MACD line and Signal line. MACD line is actually formed by subtracting 2 exponential smoothed moving averages, the days used to calculate the same as suggested by Gerald are the last 26 days and 12 days price. This line is actually the faster line of the two. The signal line is a 9 day exponentially smoothed line.

Just like the moving average crossovers that we saw in the initial sessions, the crossovers work here as well. Hence when the MACD line penetrates the signal line from below, it gives a upward movement signal or a buy signal. The reverse holds true for MACD crossover from above which gives the sell signal.

The MACD line and the signal line also move above and below 0, hence exhibiting the oscillator characteristics. It signals an overbought market if the two lines are too far above the zero line, an oversold signal is present when the lines are below the zero level.

Now we are ready to look into the convergence and divergence feature of this tool. Before that let us just understand what we mean by convergence and divergence.

Convergence as the word suggests means being in sync or together or in the same direction. In the technical analysis it majorly focuses on 2 indicators or lines. So lets say, if 2 lines indicating various things are moving in the same direction, or imply the same trend they are said to be convergent lines.

Divergence is just the opposite of convergence. If two of the lines or indicators are going in the opposite directions, they are said to be divergent and the phenomenon is called divergence. So if 1 line is moving up and the other indicator is moving down the two lines are said to be in divergence.

In the MACD the divergences are appear between the trend of MACD lines and the price line. A negative or bearish divergence exists when the MACD lines are well above the zero line (Overbought) and start to weaken while prices continue to trend higher. This is usually a warning for a market top. A bullish or positive divergence exists when the MACD lines are too much below zero (Oversold) and start to move up ahead of the price line. It is an early sign of a market bottom.

You can either draw simple trendline on the MACD lines or you can use the MACD histograms. The MACD histogram is created by plotting the difference of the two MACD lines in vertical bars. This has a zero line of its own. If the MACD line (faster moving) is above the signal line, we have a positive vertical line, in the opposite case when the MACD line is below the signal line we have a negative bar and hence it is below the zero line.

You can also use the histograms to look for the divergence just the same way as using the MACD lines. It also gives a very good indication about the spread between the two lines, whether it is widening or narrowing. When the histogram is in the positive space but starts to fall towards the zero line, the uptrend is weakening. Conversely when the histogram is in the negative zone (below the zero line) and it starts moving towards the zero line, the downtrend is losing momentum. The buy or sell signals are not given until actual movement across the zero lines. Turns in the histogram back toward the zero line always precede the actual crossover signals. Histograms turns are best used for spotting early exit signals from existing position.

Let us look at the live working of the tool in the Indian markets. We have used L&T from the period October 2011 – June 2012. We will see all these 3 important signals in the figure below:

- Breaking of the signal line for bullish or bearish signals – Boxes in the fig

- How the MACD line shows an divergence – Pink lines in the fig

- Drop in the MACD histograms suggesting of an imminent change – Blue oval

You might wonder why does the signal starts in December and not in October itself? It is because it takes 26 days to start calculating the MACD line.

Try to identify these patterns in the live markets. It is a very frequently used technical tool across world and one of the favoured tools of mine too.

Hope to see you all the next week. Till then Happy technical trading.