Introduction

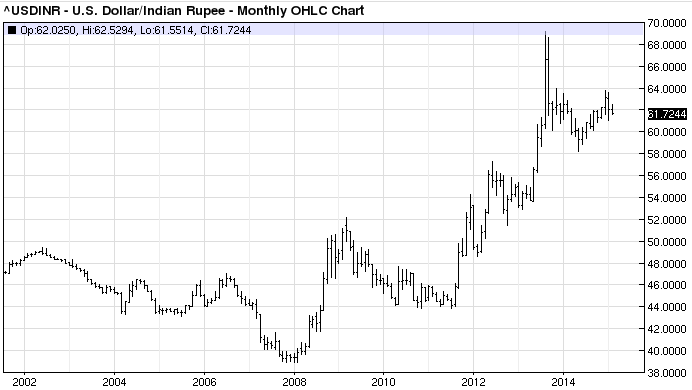

Indian investors have a significant home bias – we tend to hold a high proportion of our portfolio, sometimes 100%, in Indian assets. However, if you look at how the rupee has behaved vis-a-vis the US Dollar, the advantage of international diversification becomes obvious.

USDINR has been a one-way trade

Historically, the rupee has only depreciated against the dollar. It is the price we pay for being a socialist democracy with poor fiscal responsibility and an unaccountable central bank.

Depreciation quantified

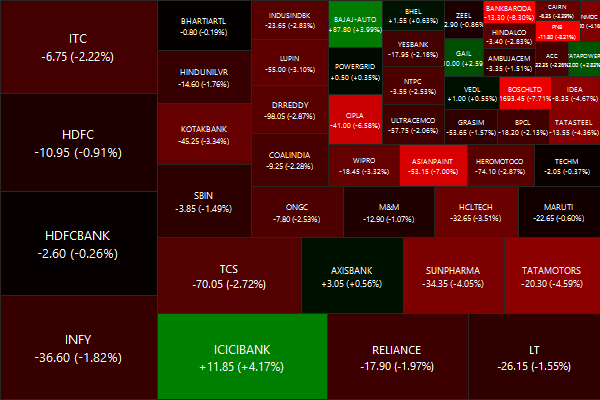

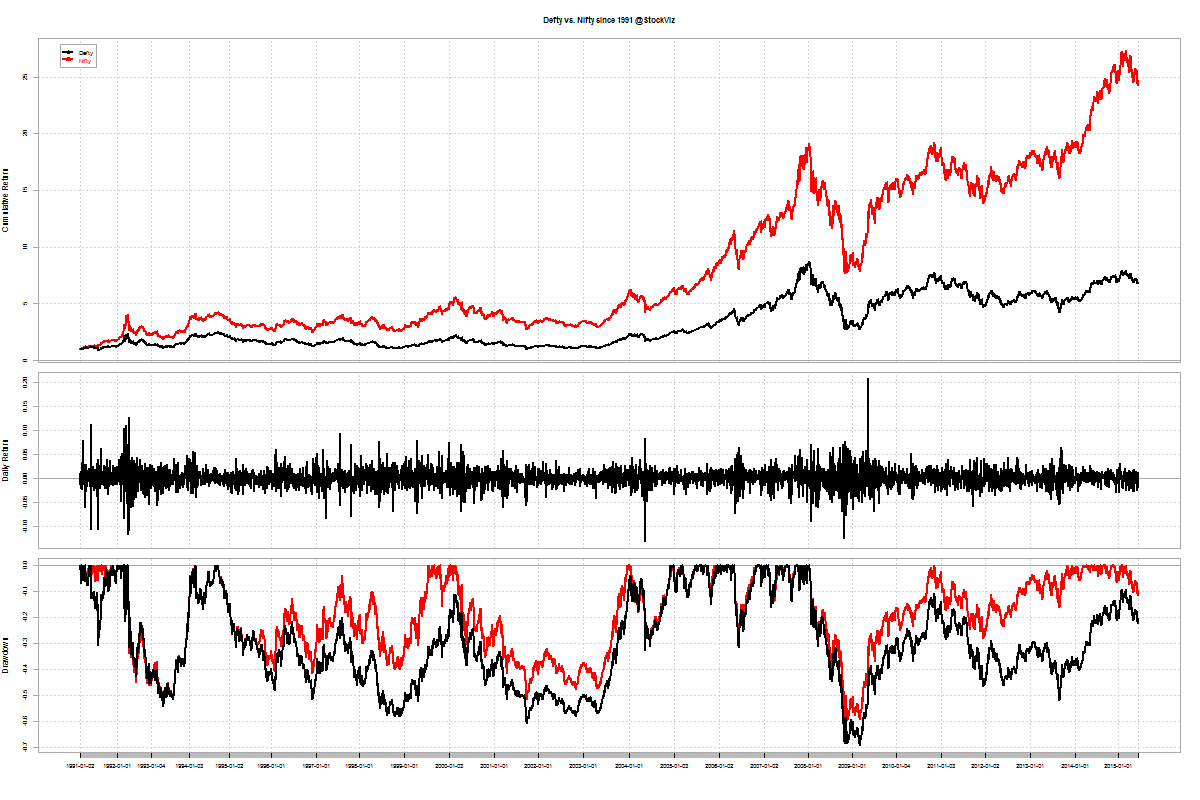

Nifty investors have seen an IRR of 821% since 1991 and today. However, in dollar terms, the IRR is 286%. The difference of 535% is because of rupee depreciation – even if you had held on to a non-productive dollar asset, you would have made that much in rupee terms.

Diversification benefit

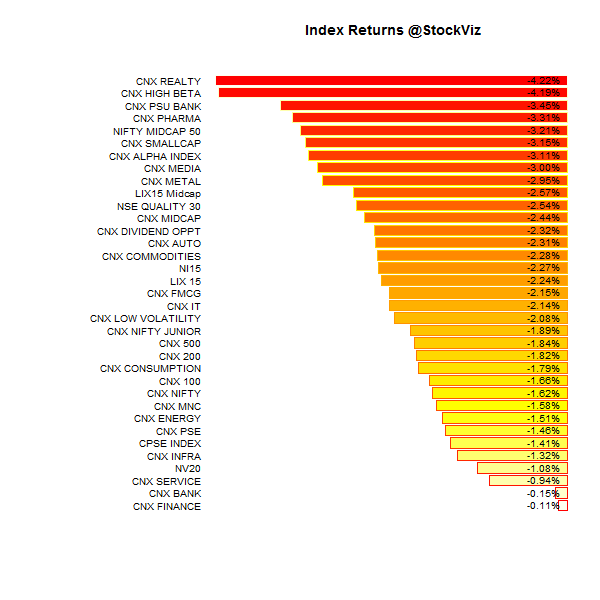

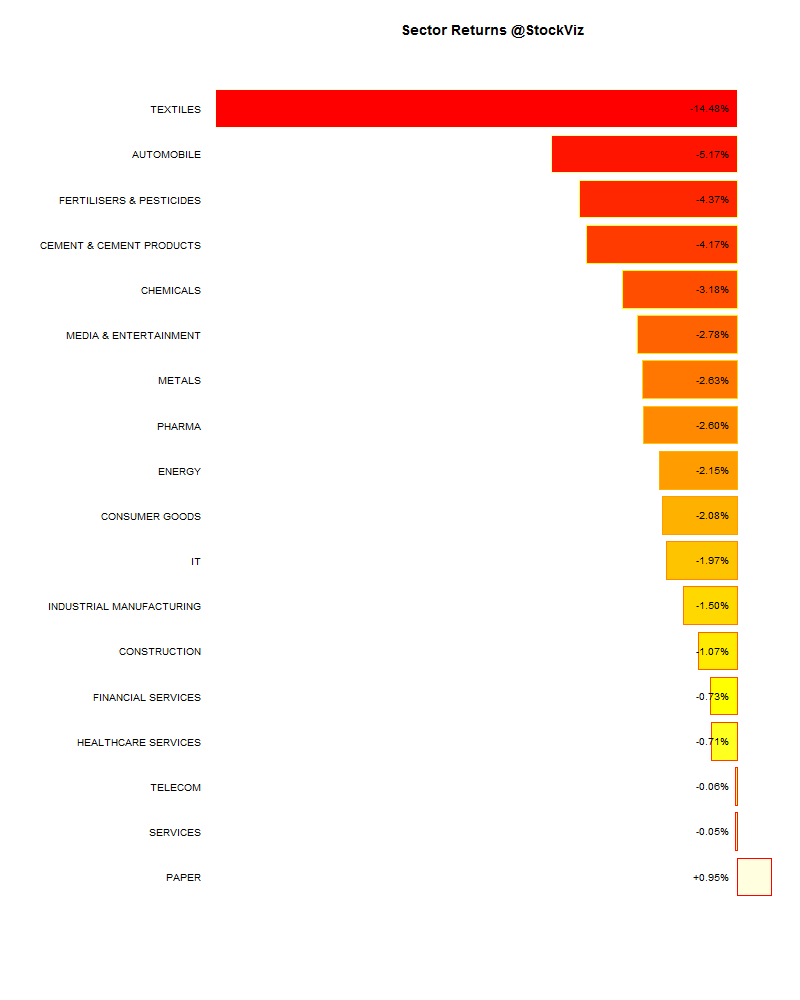

By being long only Indian assets, your fate is tied to the vagaries of the local market participants, regulators and politicians. In a country where most people have dual-SIM phones, it is surprising that most investors are willing to hitch their ride to that pony.

One of the oldest international funds is from Birla Sun Life, let us see how that fared since the financial crisis:

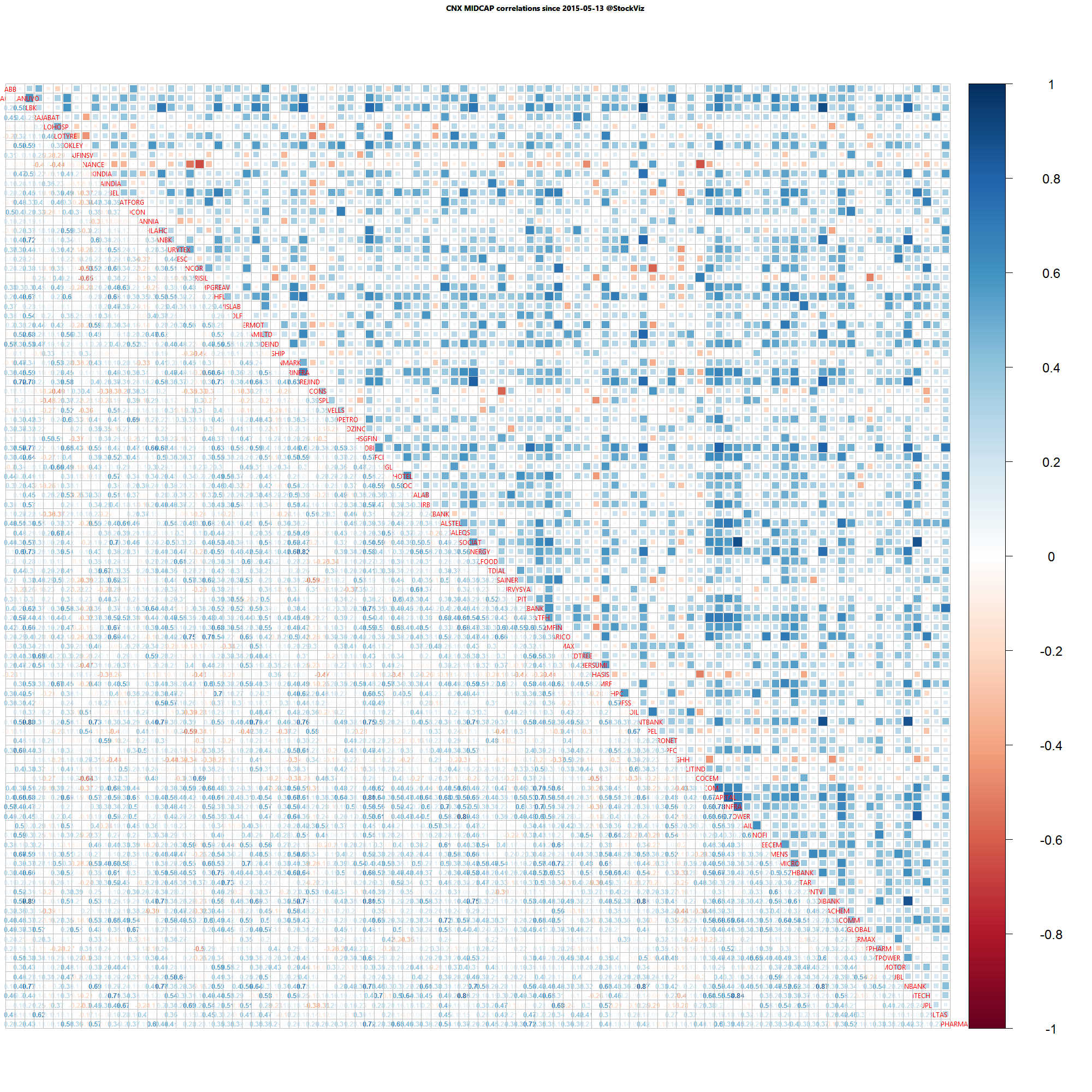

Between 2008-01-01 and 2015-06-15, Birla Sun Life International Equity Fund Plan A- Growth has returned a cumulative 69.99% with an IRR of 7.37% vs. CNX Midcap’s cumulative return of 32.36% and an IRR of 3.83%. It has a beta of only 0.12825 vs. the Midcap index. (MorningStar)

Caveats

The biggest problem with investing in international funds is manager competence. All the reasons we highlighted in our post, Funds that (also) invest in foreign markets, apply. At the end of the day, you are still investing in equities and equity markets are (loosely) correlated. However, investors are better off choosing a pure international equity fund rather than one where the “international” part is a hobby.

The second problem is that there are some funds that invest in emerging Asia or frontier markets. These funds are not really long the dollar. Investors should pay attention to this detail.

Conclusion

Investing in international funds makes sense from a depreciation and diversification point of view. In our Aggressive Fund portfolio, we assign 30% of investor allocation to international funds.