The Two Anomalies in Finance

Momentum and Value remain the two “anomalies” in finance. The Efficient Market Hypothesis cannot explain why value investing, where investors pick up “under-priced” stocks, and momentum investing, where investors bet on stocks that have already run up, give out-sized returns compared to the rest of the market. After all, aren’t markets supposed to discover the “right” price and negate these effects?

Investing in Momentum

Value investors get a lot of face-time in media – people like to hear about stocks that are “hidden gems” that can suddenly come alive and give out-sized returns. However, very little is spoken about momentum investing. This results in investment portfolios that are underweight momentum.

The problem with momentum investing are the large draw-downs. When momentum stocks tank, they do so spectacularly. The draw-down keeps away most mutual funds from seriously pursuing this strategy: a) they can’t get out easily, and b) if they show too much volatility, investors will revolt.

But individual investors don’t have these constraints if they learn to embrace volatility.

Comparing Momentum Returns

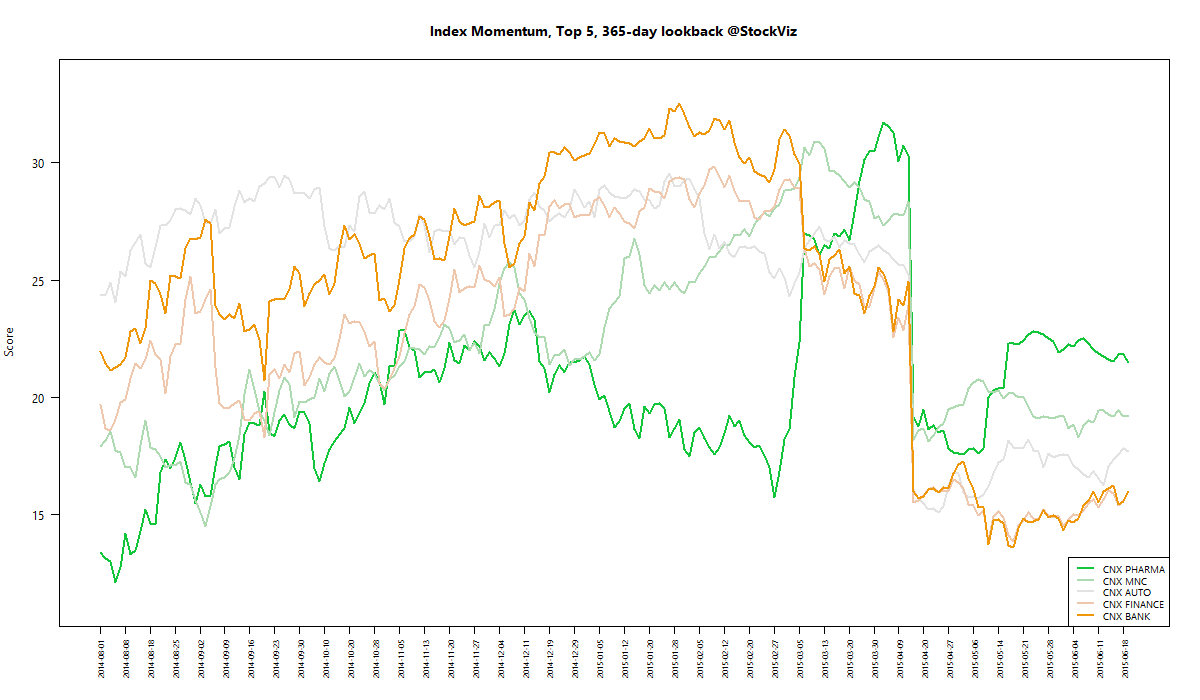

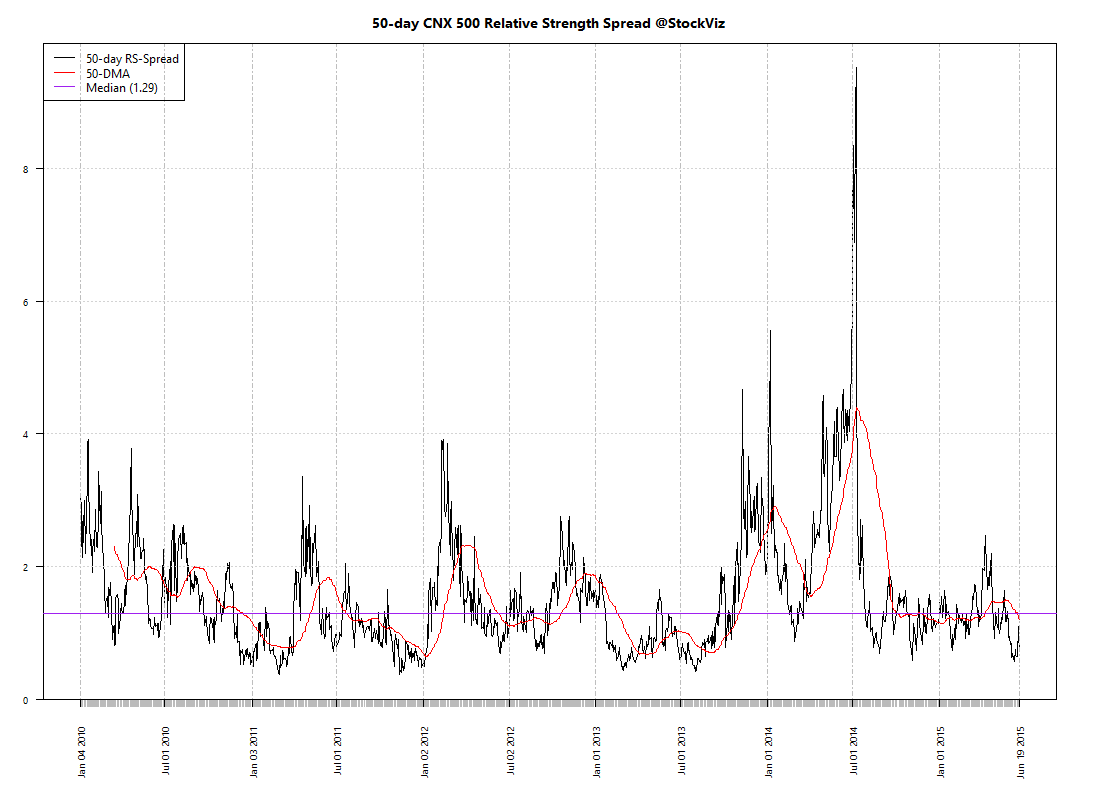

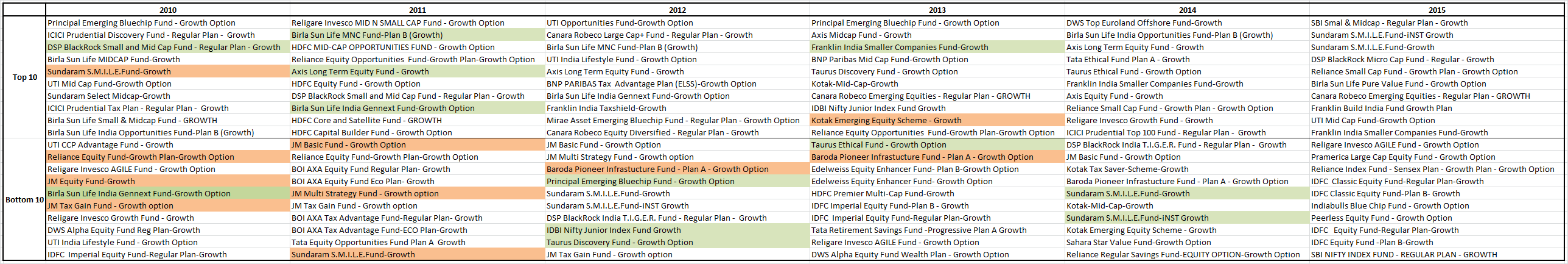

Our FundCompare tool allows you to see how momentum investing has fared over different time-frames and compare their returns to whatever mutual fund you own. For example, if you compare Momentum with the ICICI Value Discovery Fund, here’s how the monthly returns compare:

Between 2014-01-01 and 2015-06-18, Momentum has had an IRR of 70.16% vs. ICICI Prudential Value Discovery Fund’s IRR of 50.05%![]()

How much should you invest?

Risk, at the end of the day, is whatever allows you to sleep at night. You could start with a 10% allocation and scale till you reach your limit. Whichever way you choose to go bout it, our Momentum Theme will be ready for you.