There is a problem of plenty when it comes to mutual funds – direct growth schemes alone number into the high 200s. Investors have responded to this bewildering array of choices by going in for the ‘unlimited buffet’ option. They end up making small investments into a large number of funds. By doing so, they end up owning the whole market – paying active management fee for a passive investment. There are two things investors should keep in mind before adding a new fund to their investment:

- What is the new fund’s portfolio overlap with the existing investments?

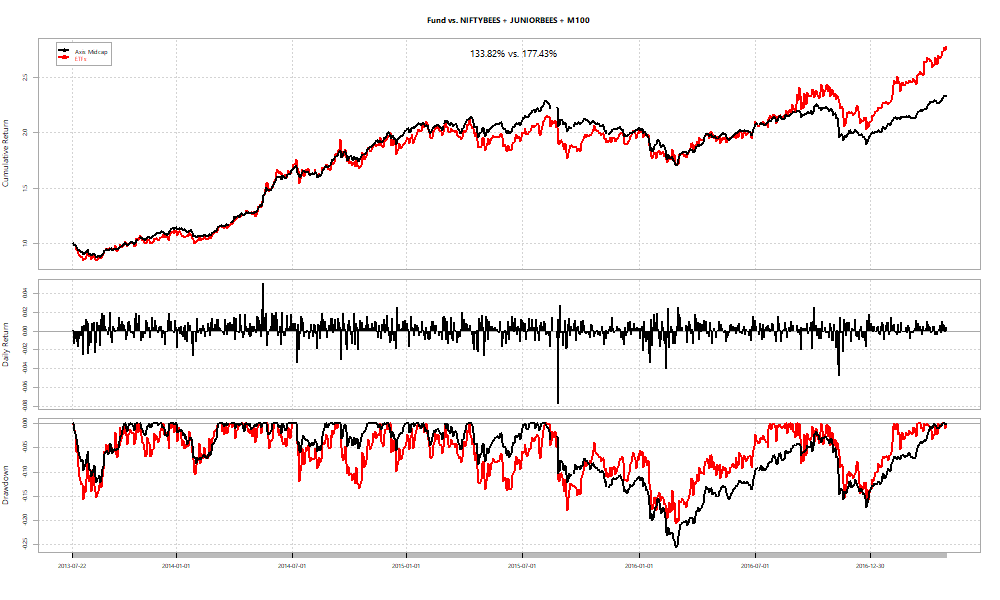

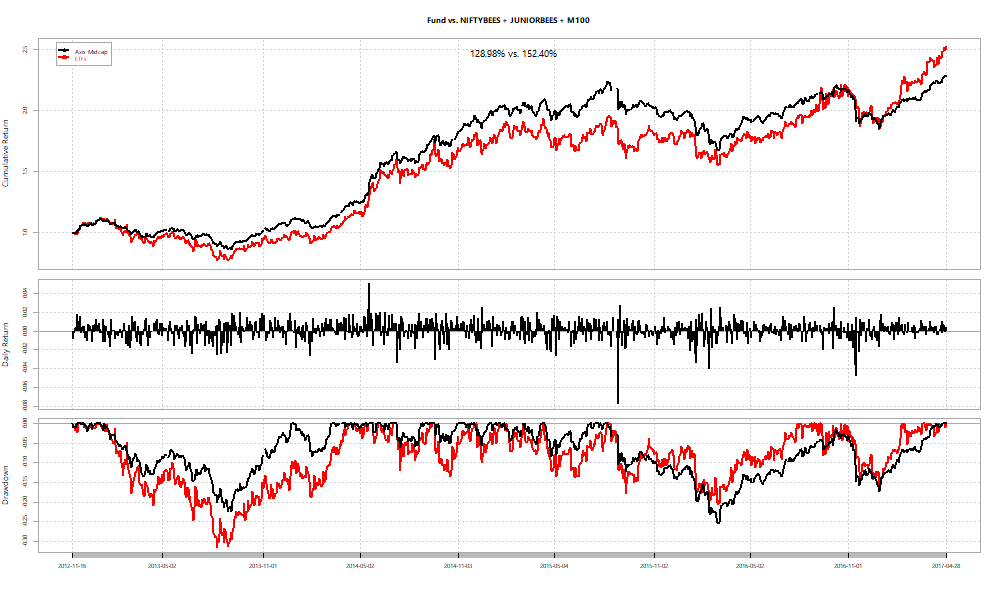

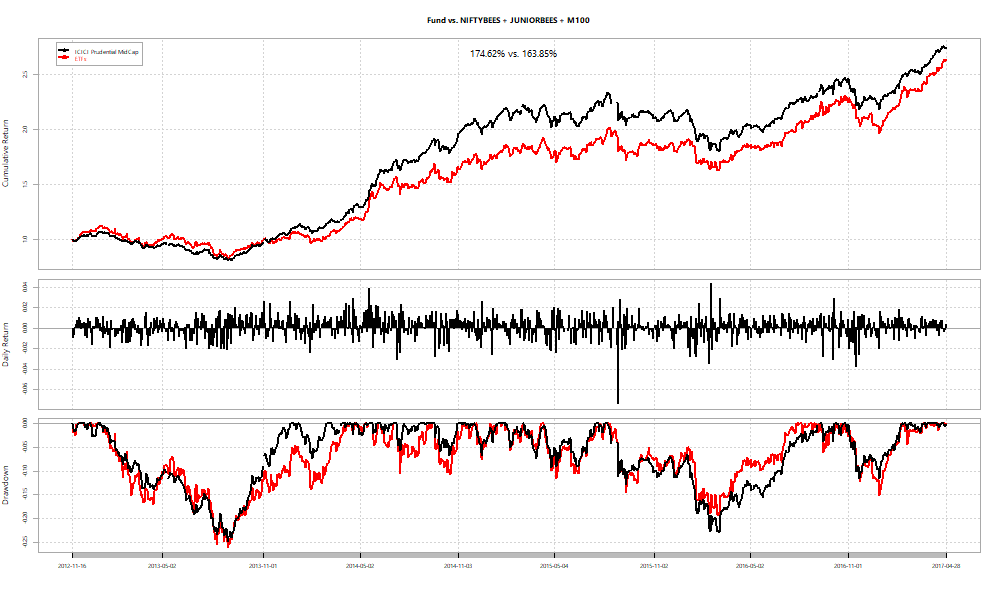

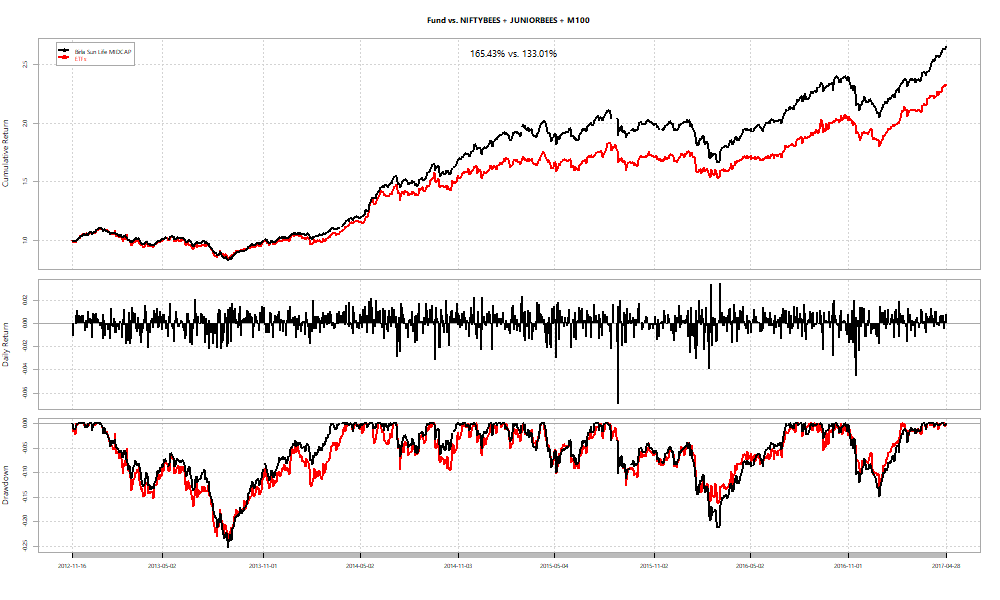

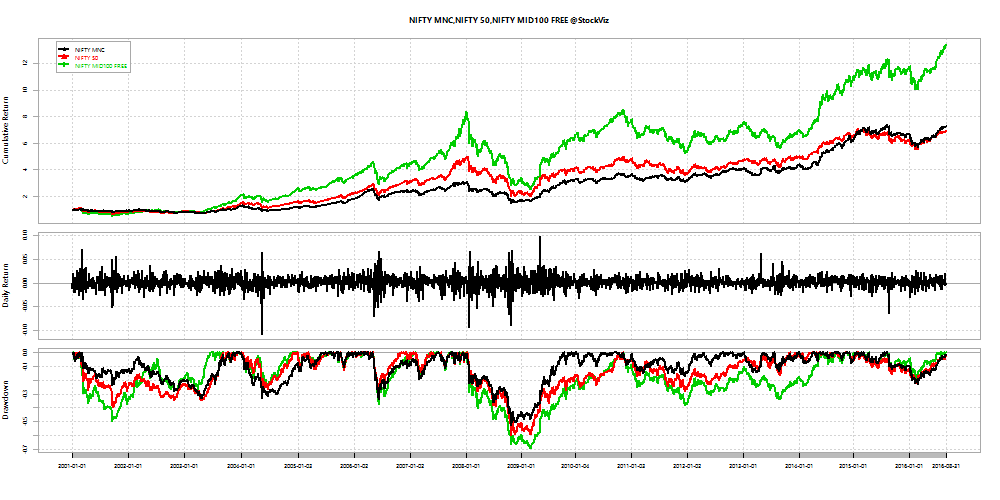

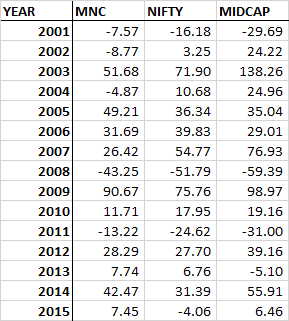

- How different is the new fund’s portfolio from a large-cap and mid-cap index?

The first answer will tell you whether to add the new fund to your portfolio. The second will tell you if you should just replace the fund with an index ETF.

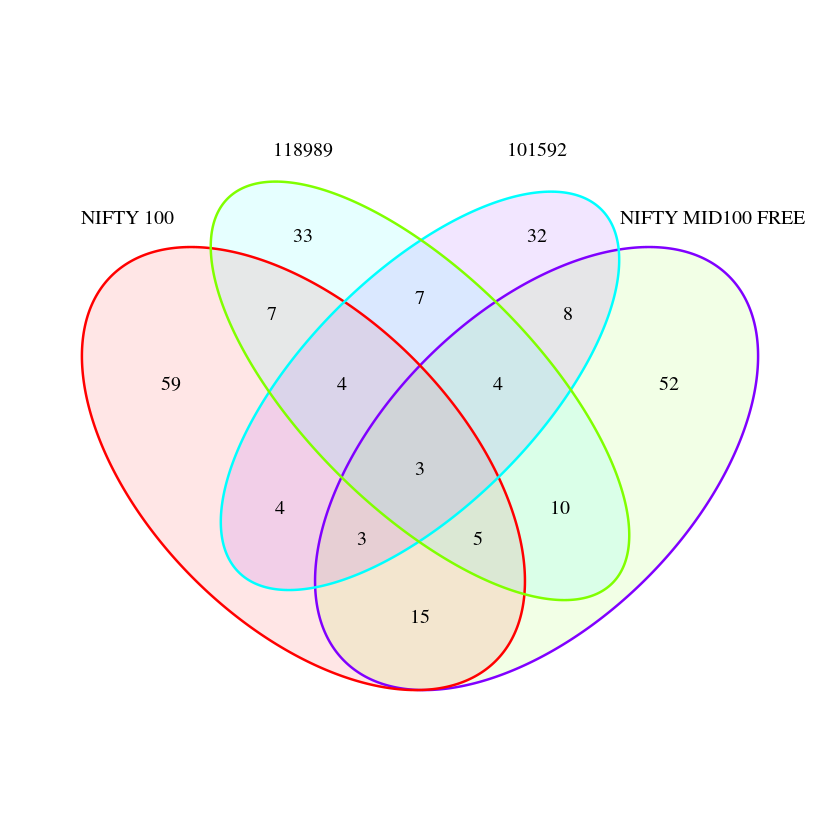

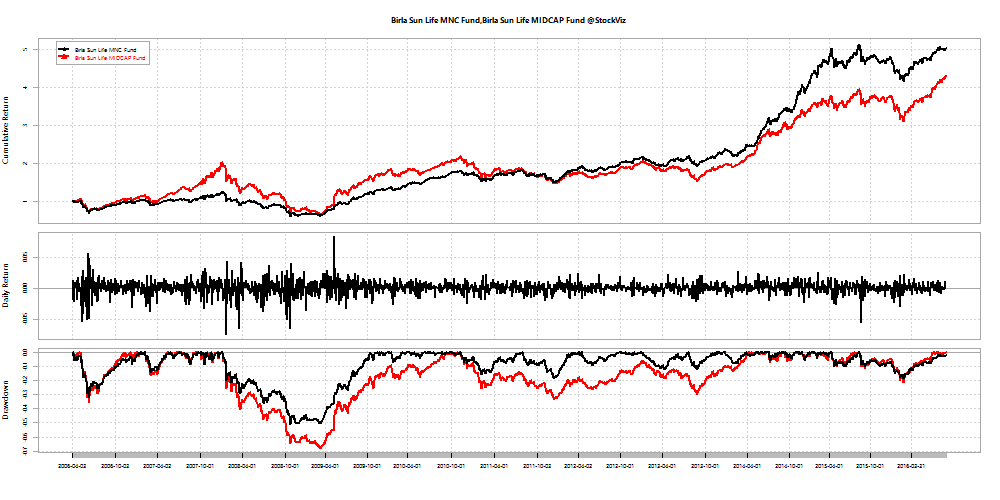

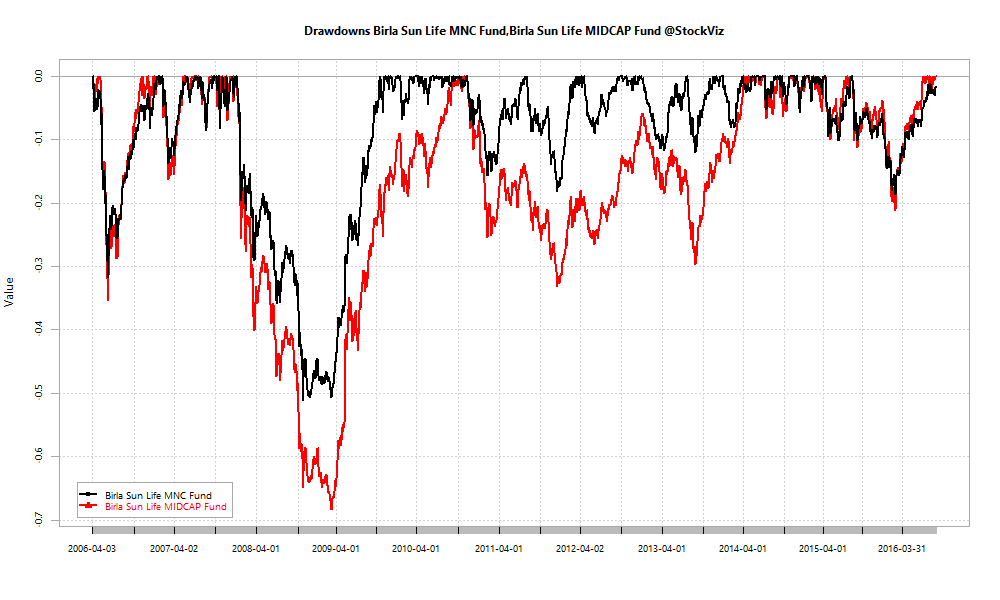

For example, say you own HDFC Mid Cap Opportunities and you are wondering if you should also buy the Birla Sun Life Midcap fund. Here’s how the fund portfolios overlap:

The funds have about 18 stocks in common and a fairly large number of stocks that are not in any of the indices. Given the differing styles, perhaps it makes sense to add the new fund to the portfolio.

The second, also called “Active Share,” shows how different the portfolio is from an index. For example, DSP Blackrock Technology.com Fund has a 26% overlap with NIFTY 100 and a 5% overlap with NIFTY MID100 FREE. Whereas, the HDFC Large cap Fund has a 95% overlap with the NIFTY 100 index. It probably makes sense to replace the latter with an index fund.

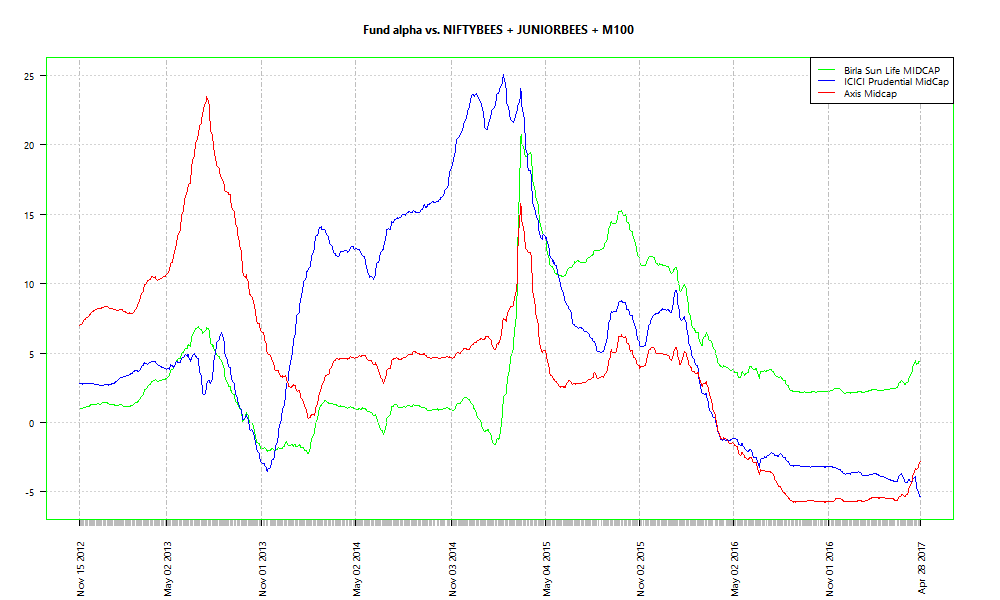

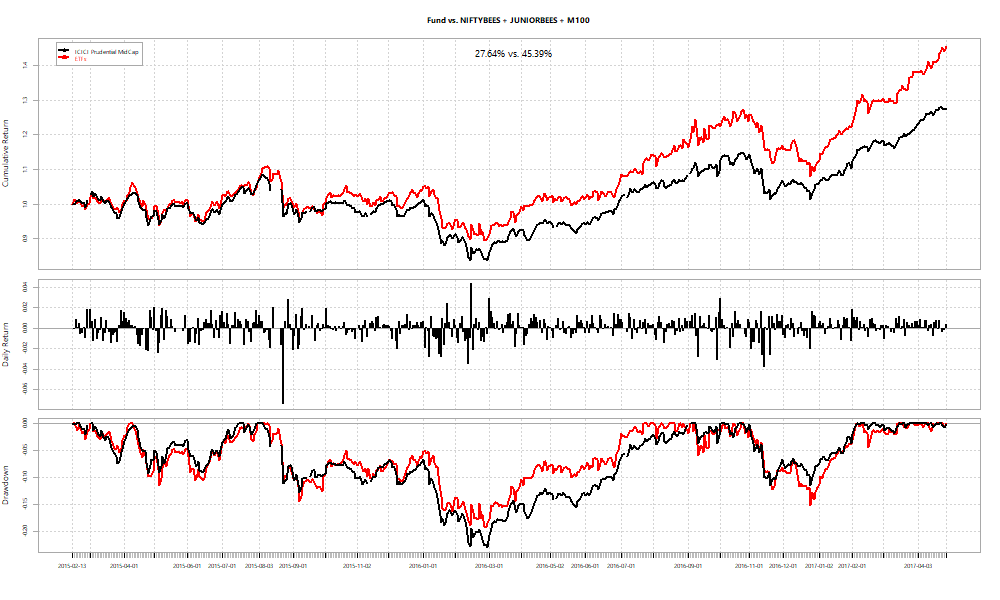

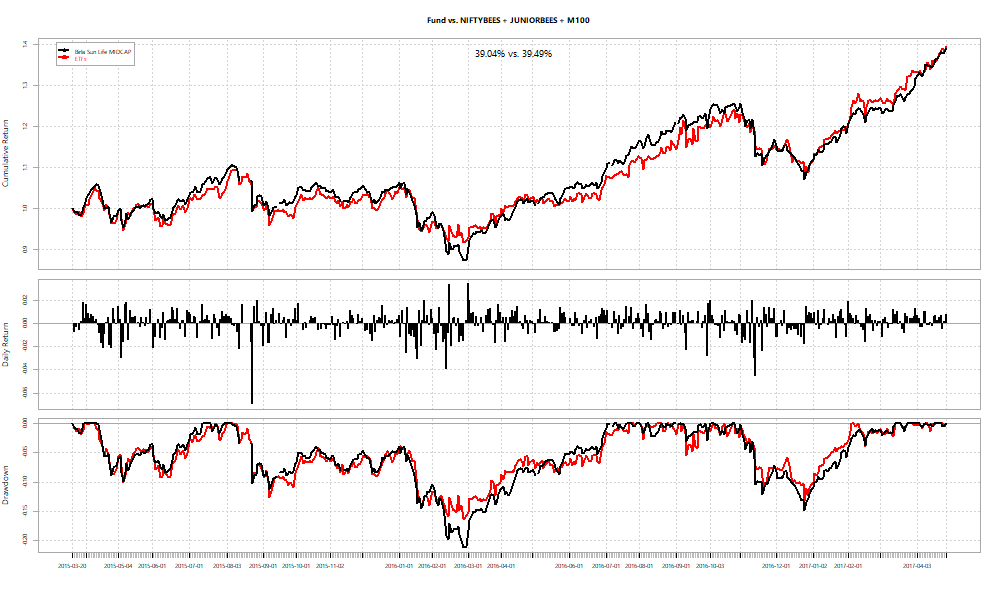

For more details about the analysis and its results, please peruse the notebook on github.