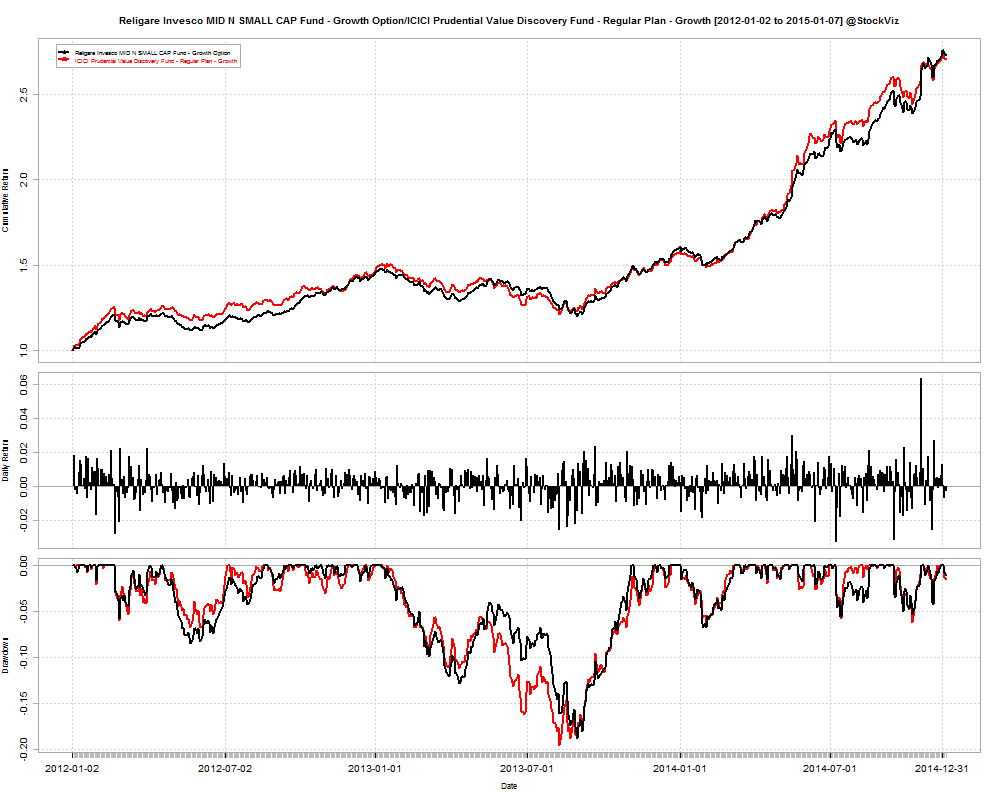

Sometimes, when you are comparing funds from different AMCs, you stumble across a pair of them that are so similar that it becomes a tough call choosing between them. For example, Religare Invesco MID N SMALL CAP Fund and ICICI Prudential Value Discovery Fund are right on top of each other. Try to spot the difference here (Jan-2012 through Jan-2015):

Between 2012-01-02 and 2015-01-07, Religare Invesco MID N SMALL CAP Fund has returned a cumulative 172.88% with an IRR of 39.49% vs. ICICI Prudential Value Discovery Fund’s cumulative return of 170.32% and an IRR of 39.05%.

Their drawdowns are similar as well. And since the NAV is quoted after all expenses, Religare’s expense ratio of 2.97% vs. ICICI’s 2.34% is factored into the returns.

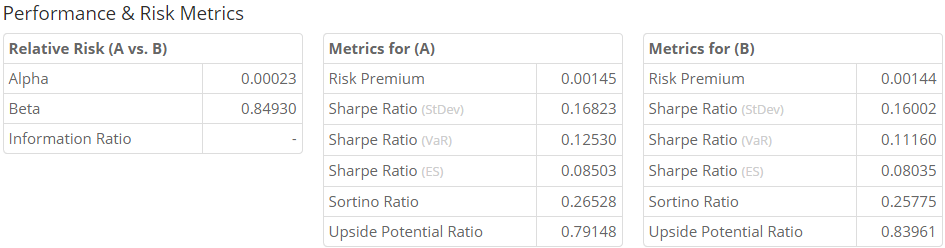

In terms of metrics, Religare is marginally better than ICICI. However, there is nothing there to swing the decision one way or the other.

Run the FundCompare tool and have a look for yourself.