The proposal

The Securities and Exchange Board of India (Sebi) is checking if ecommerce portals can be used to sell mutual funds. (ET)

Let’s see what the pros and cons are.

Pro #1: Increased Reach

Do you know what the fastest growing region for ecommerce sales are? Tier 2 and Tier 3 cities. (DNA)

The biggest problem with the distributor (IFA) driven model is that it has high fixed costs. IFAs rather have a small number of big clients than a large number of small clients. By pushing funds through ecommerce portals, which have typically traded negative margins for increased market share in the past, the number of small-ticket mutual fund investors could potentially explode.

Pro #2: Lower costs for AMCs

In the distributor driven model, the producer (asset management companies) bear a large portion of the marketing costs. For example, if HDFC is coming out with a new fund, they will take out newspaper and TV ads, send out fliers, etc. But ecommerce portals pay for their own marketing. Smaller brands (AMCs,) who cannot match the big guys in their marketing budgets might benefit disproportionately. I recently went shopping for some RAM for the laptop. I ended up buying ‘Dolgix’, a brand that I had never hear of before from some vendor in Nehru Place, because the specs matched and there’s a 7-day return policy in case it turned out to be a turd. Expect similar buying patterns to emerge when people go fund shopping.

Pro #3: More business to advisers

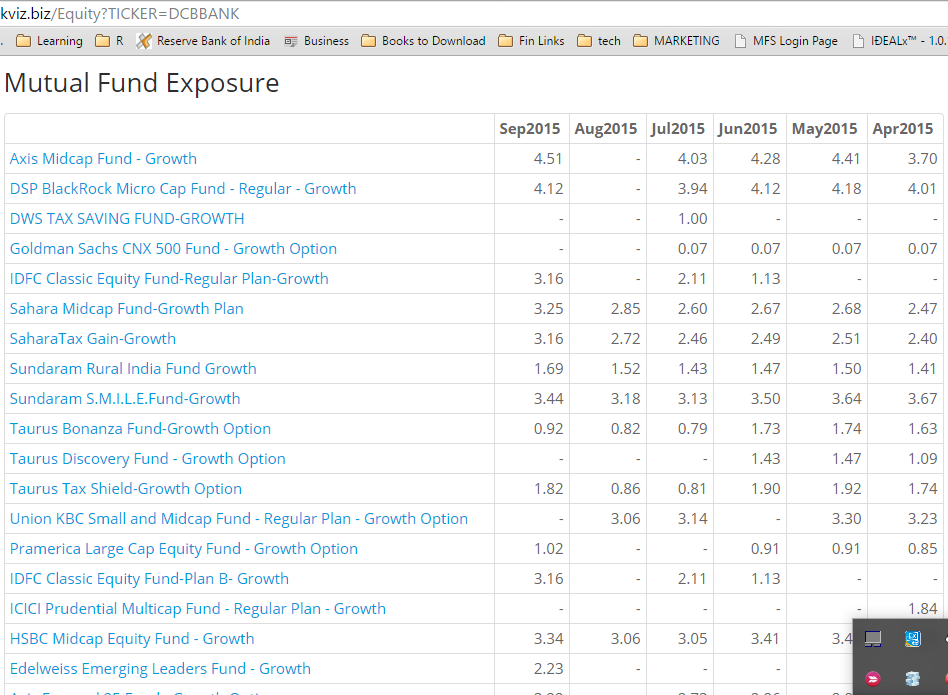

There are 42 AMCs in India with a mind-boggling number of schemes that have their own toggles and switches. There is a huge overlap between funds and schemes, mostly because of marketing reasons. With more investors being made aware of these choices, a significant portion of them will look for advice. If not on the first buy, then definitely on their next. Tech savvy IFAs/IAs will benefit for the increased mind-share.

Pro #4: Online-only Funds

We are yet to see a “direct-only” AMC. But if the digital channel finds wide adoption, then it is not a stretch to see a whole crop of online-only AMCs with a significant cost advantage over traditional AMCs spring up.

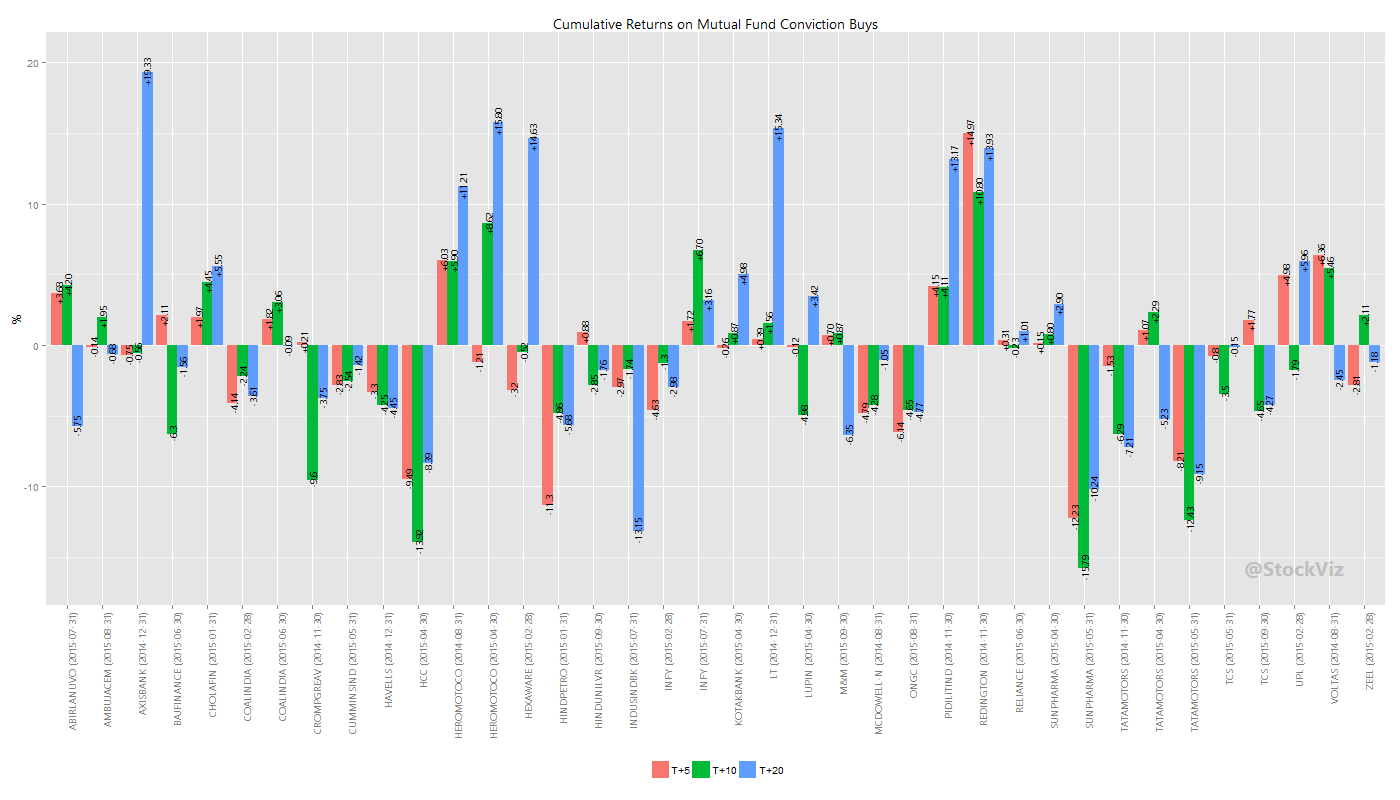

Cons #1: Herding

Unsophisticated investors herd into investments that have strong recent performance. Self-directed first-time investors might end up with lower long-term returns because of this. Which could lead them to abandon mutual funds subsequently. Also, AMCs might experience higher volatility in fund-flows as investors switch to “hot” funds.

Conclusion

Allowing ecommerce portals to distribute funds makes sense. The pros outweigh the cons.