There used to be a time when getting your kids through college was the final act before kicking them out of the house. But kids these days want their parents to fund their US education as well. And how about a gap year to travel through Europe? You can roll your eyes all that you want but 15-20 years from now, this will be the new normal for middle-class Indians. What can we do? We have always been an aspirational lot and it is bound to rub off on our kids. As much as we like our kids to be financially independent when they grow up, we also don’t want them to start their lives with a ton of student loans. However, given the potentially large dollar liabilities in the future, most Indian investors continue to keep all their eggs in the Indian rupee basket. If you think your Indian mid-cap mutual fund alone is going to fund your kid’s grad school, think again.

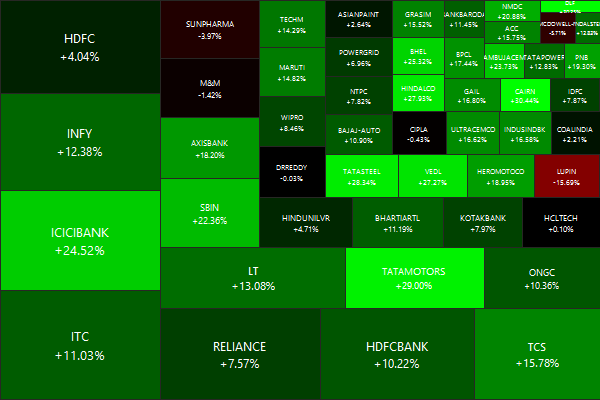

Not only have Indian Mid-caps trailed US Mid-caps over the last 25 years, they have done so with steeper and longer drawdowns.

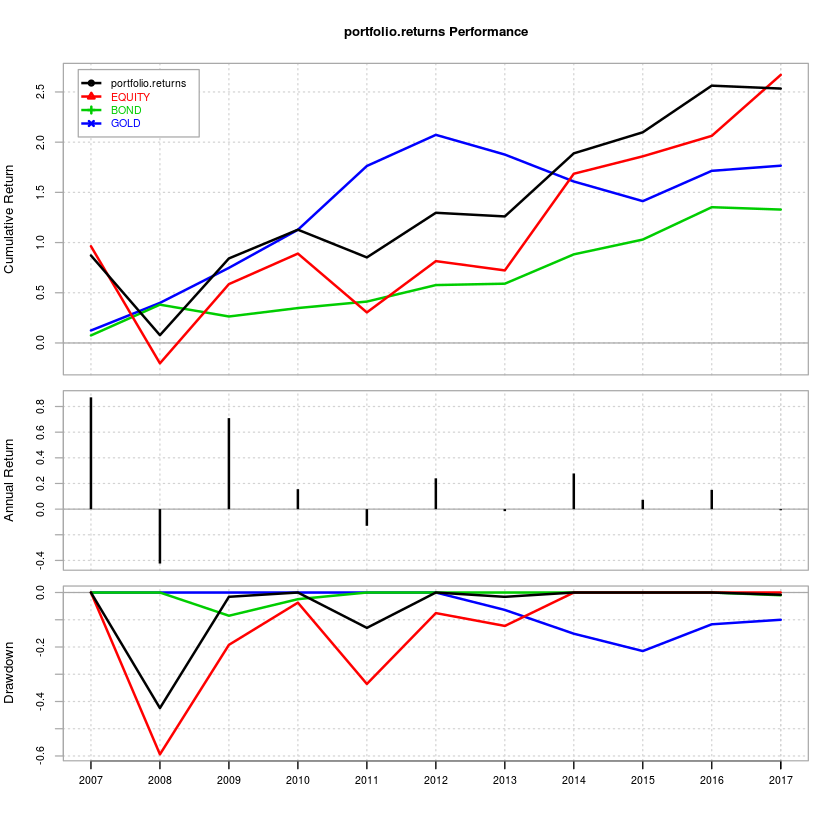

Over the last 25 years or so, US mid-caps have out-performed Indian mid-caps. Indian asset managers would have you believe that “east or west, India is the best” but that is not what the numbers say. Here are the cumulative and annual returns of the MSCI India MC and MSCI USA MC indices:

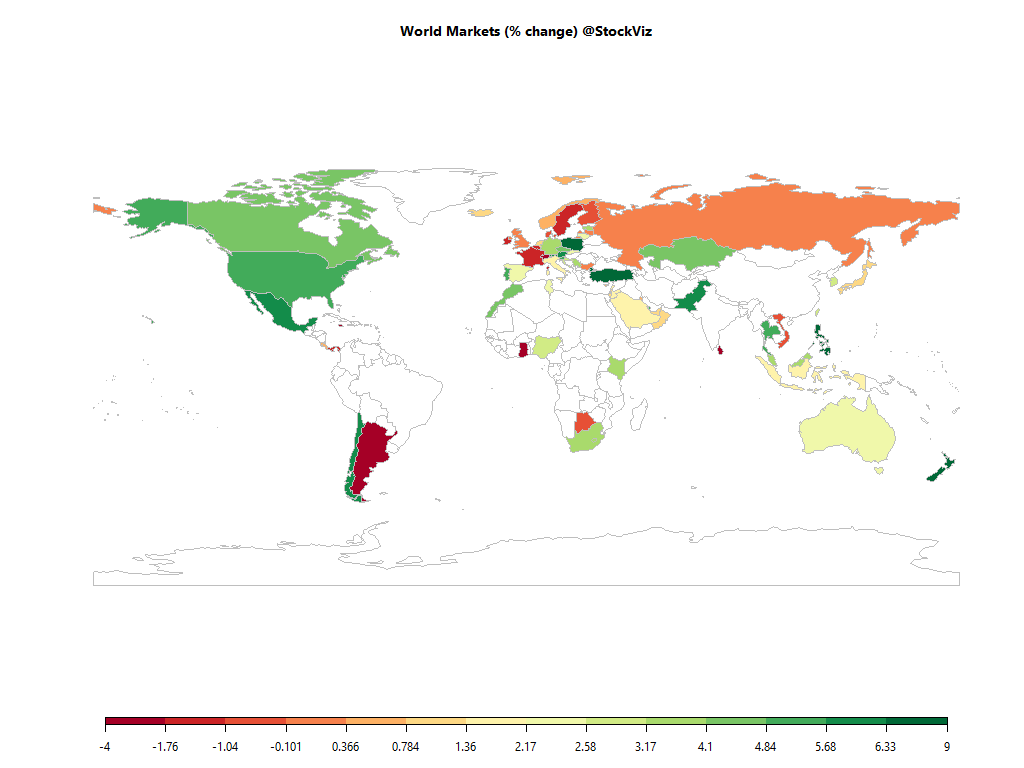

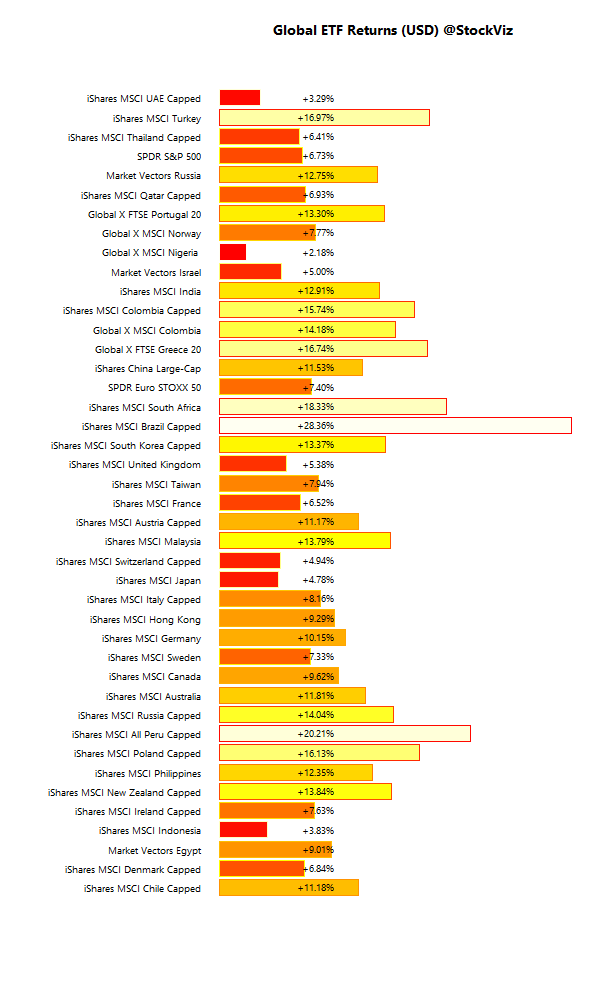

Living in India, it is easy to get carried away with stories about how Indian equities present big opportunities. However, historical returns show that investors were not compensated for the additional risk that they took by investing in India. Also, the US equity market cap is 50% of the total world equity market cap. So even if you have bonds, gold etc in your portfolio, being 100% invested in India is not true diversification. Besides, the Indian rupee keeps depreciating, making your future dollar liabilities that much larger when priced in local assets.

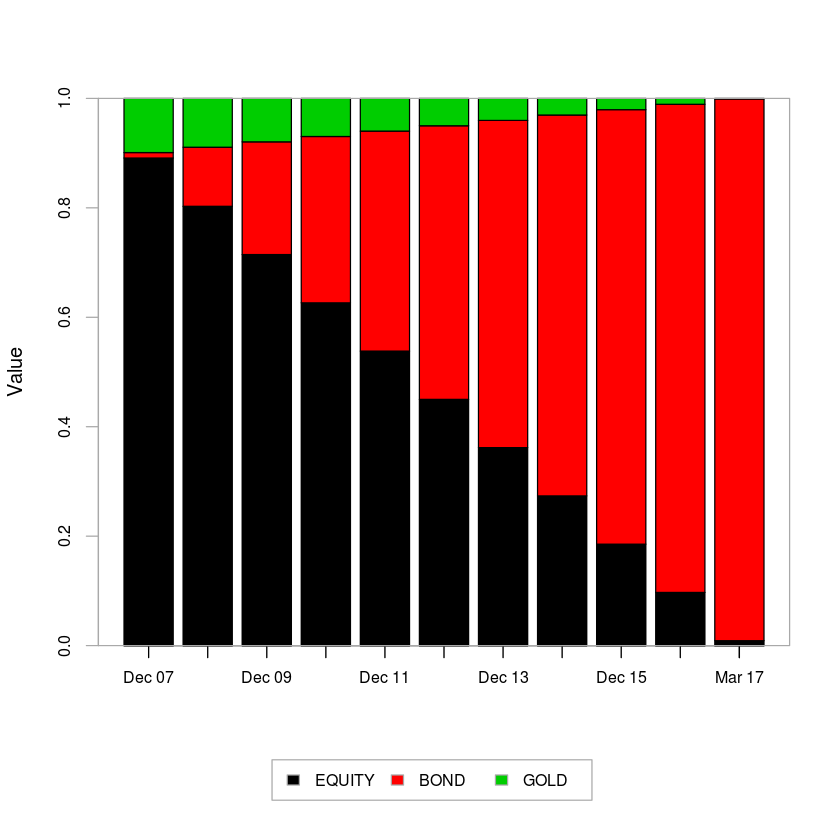

We ran through different allocations between Indian and US mid-caps to get an idea of what the potential returns could look like:

Assuming a monthly rebalance, the 50/50 portfolio beats the “all in” 100/0 and 0/100 portfolios. And it does so with shallower drawdowns. So both from a diversification and returns point of view, it makes sense to allocate towards US mid-caps.

It is time to have a chat about your portfolio. Get in touch with us now!

Further reading: Funding Your Dollar Dreams