MOMENTUM

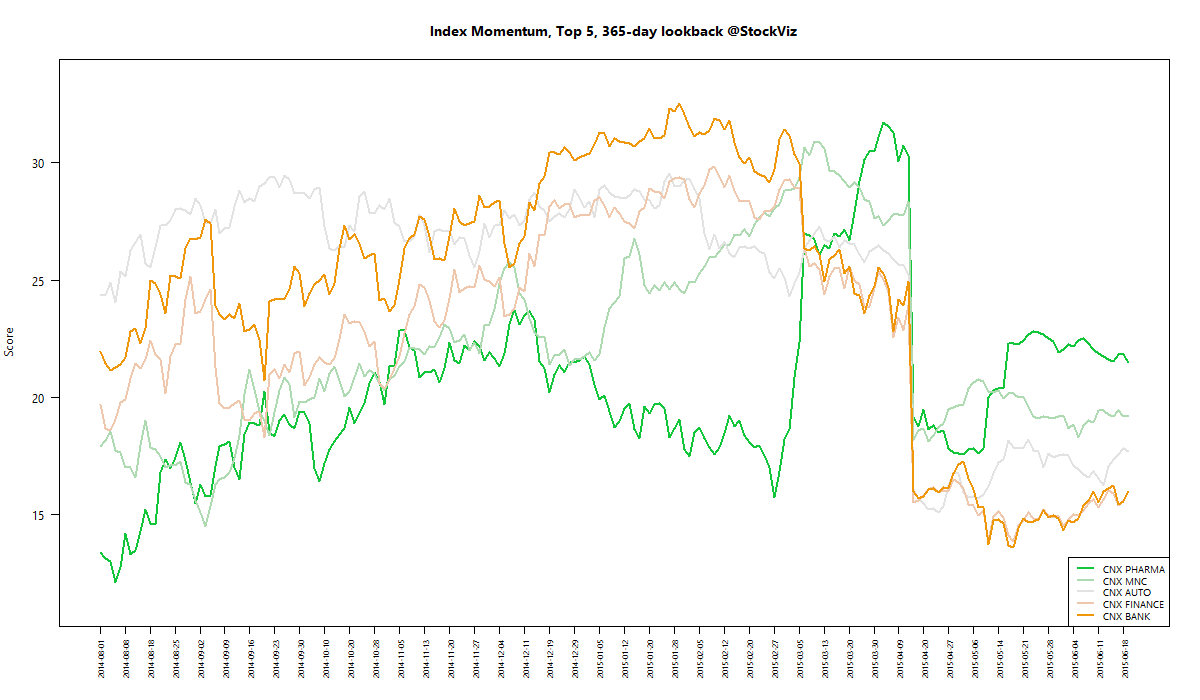

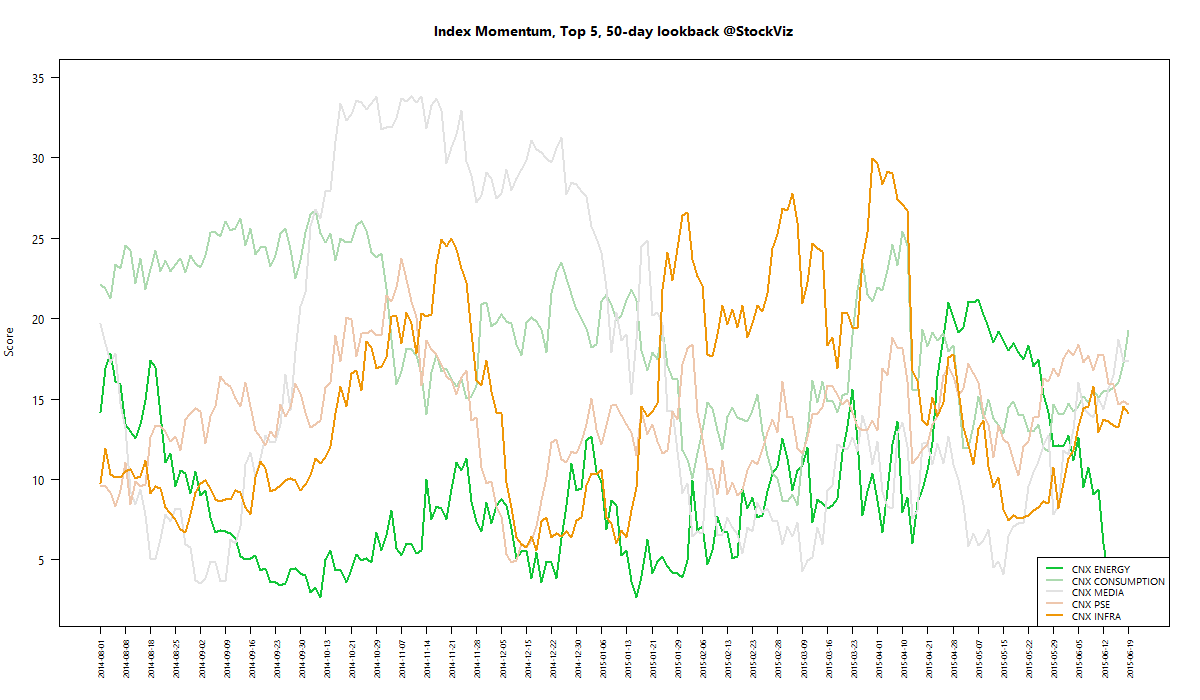

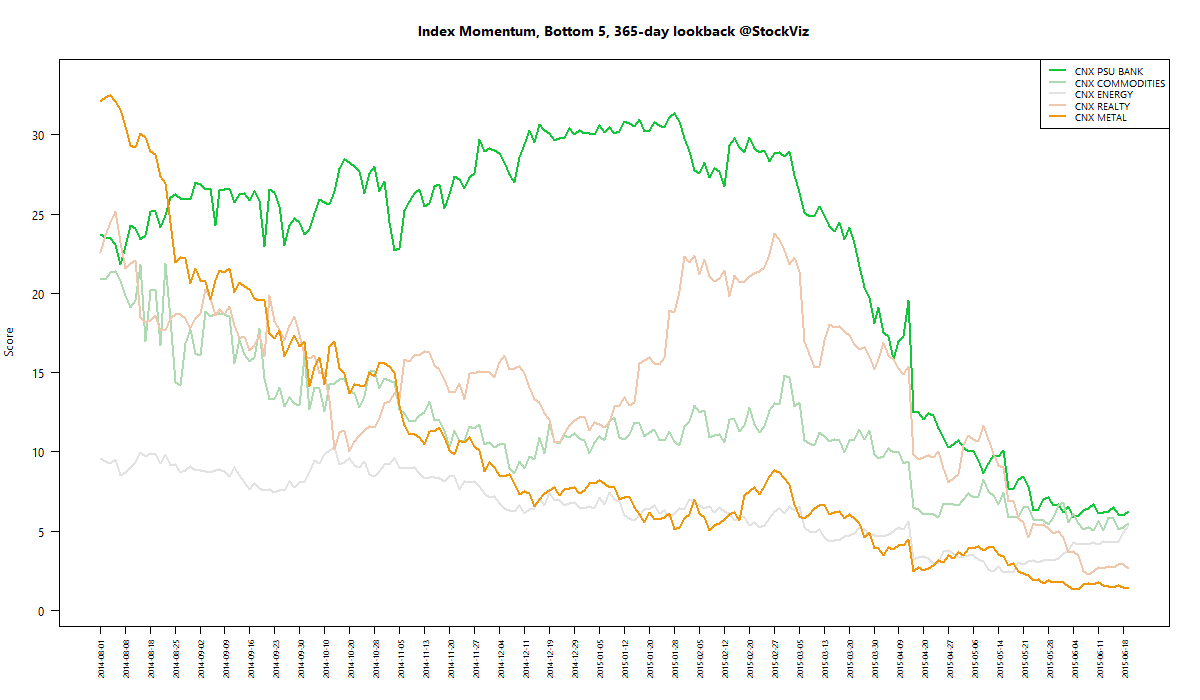

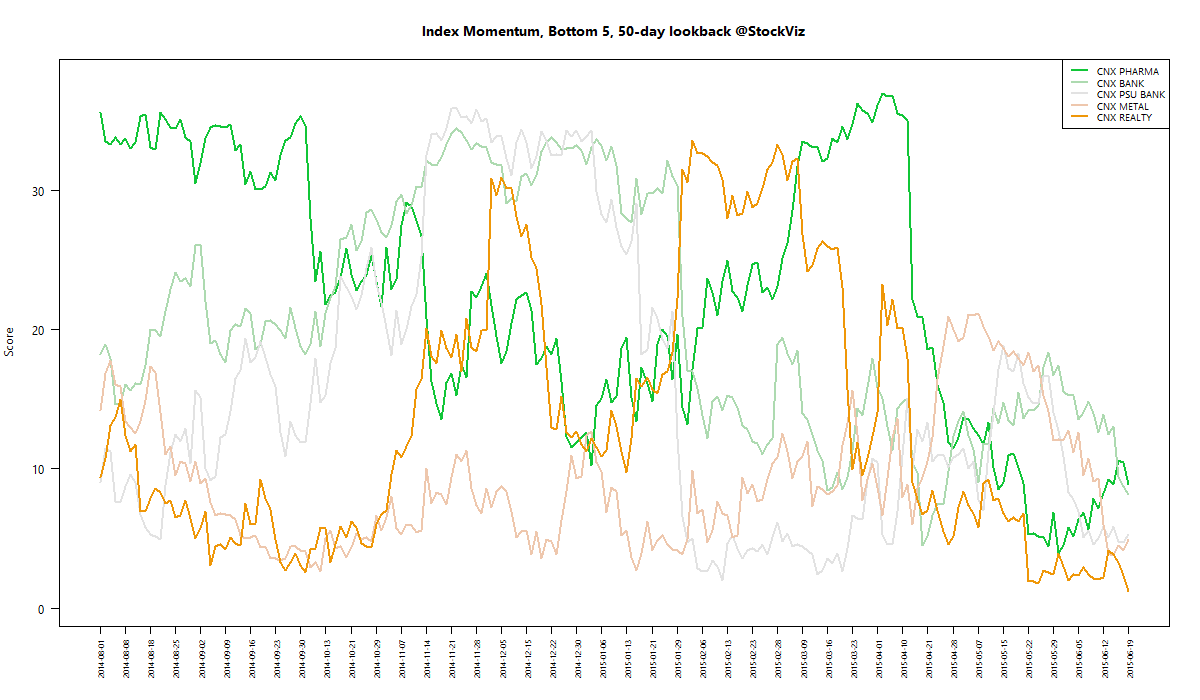

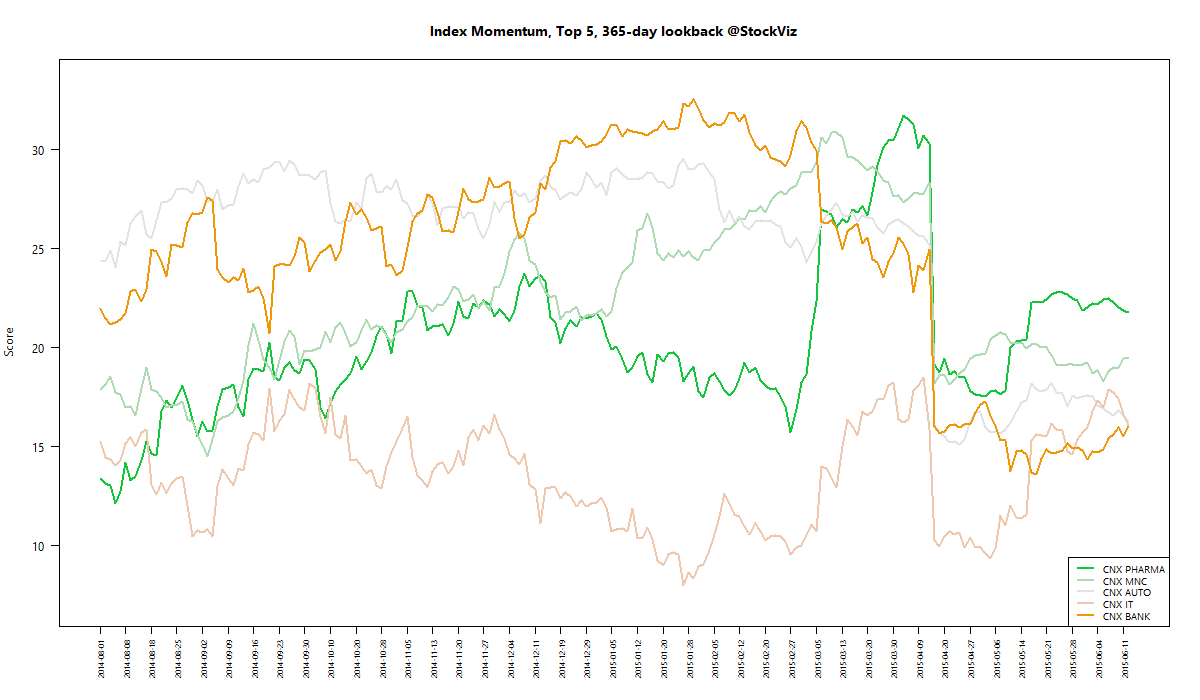

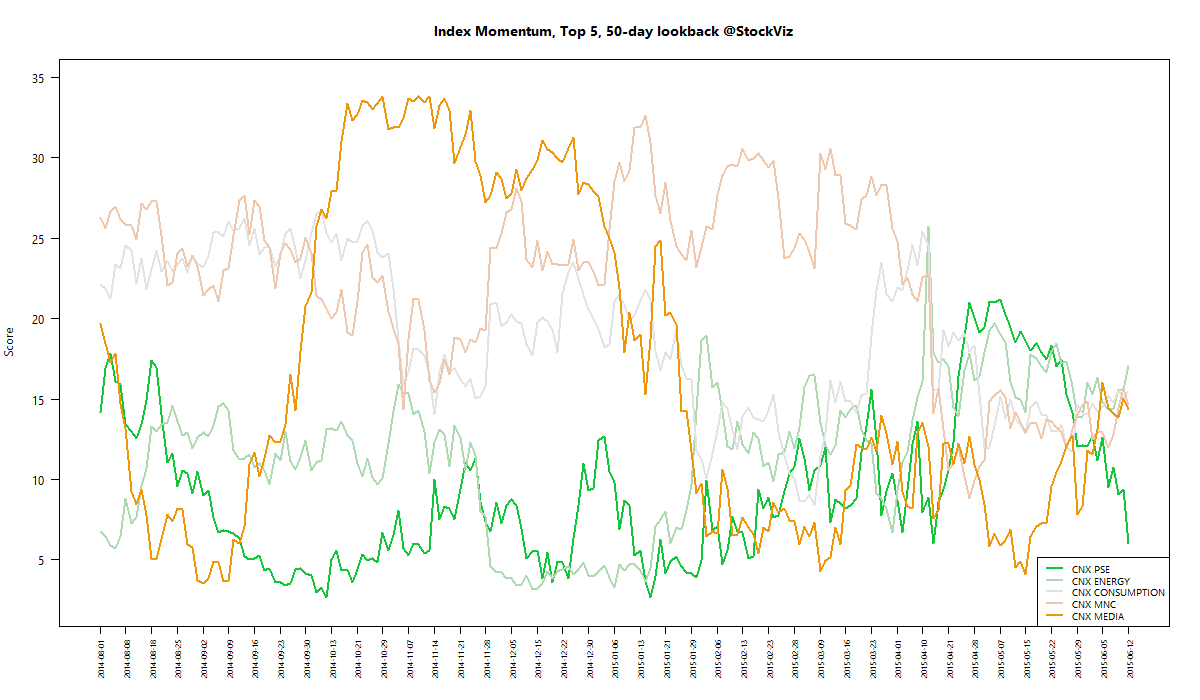

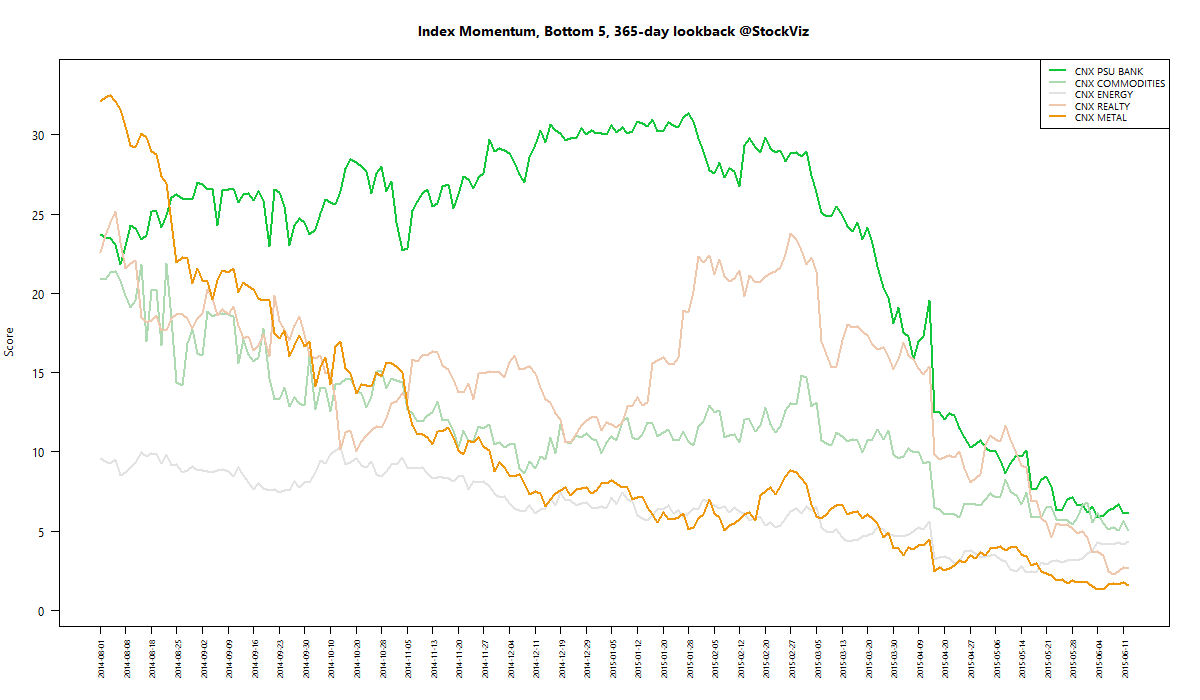

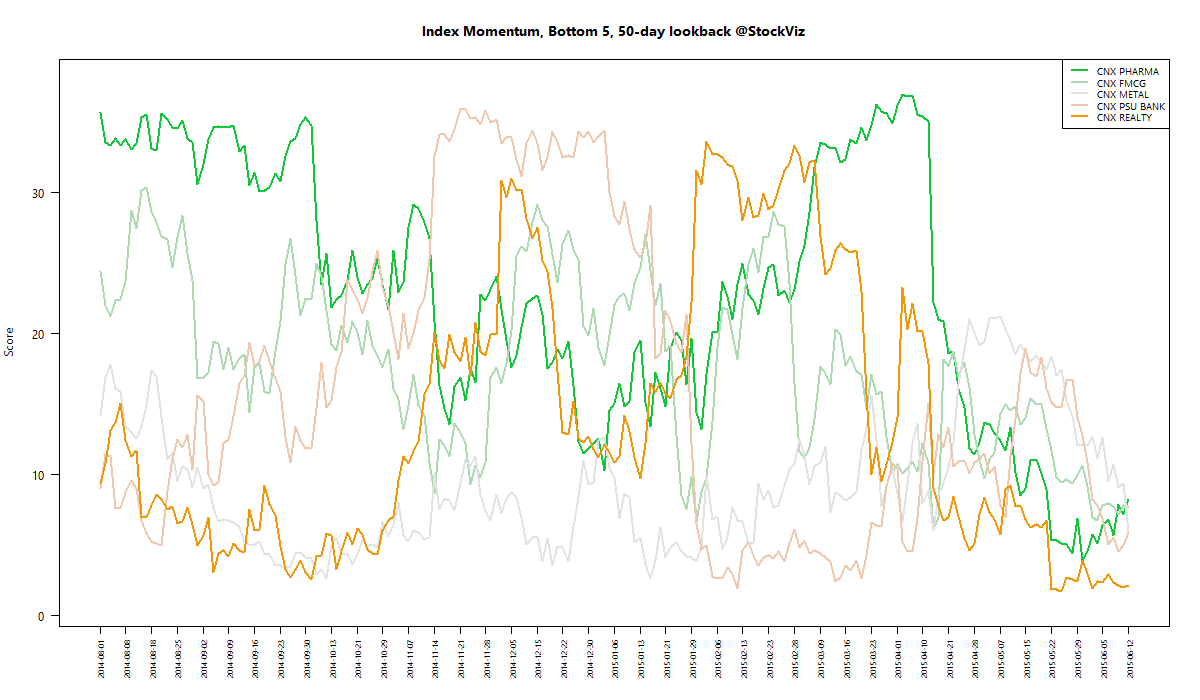

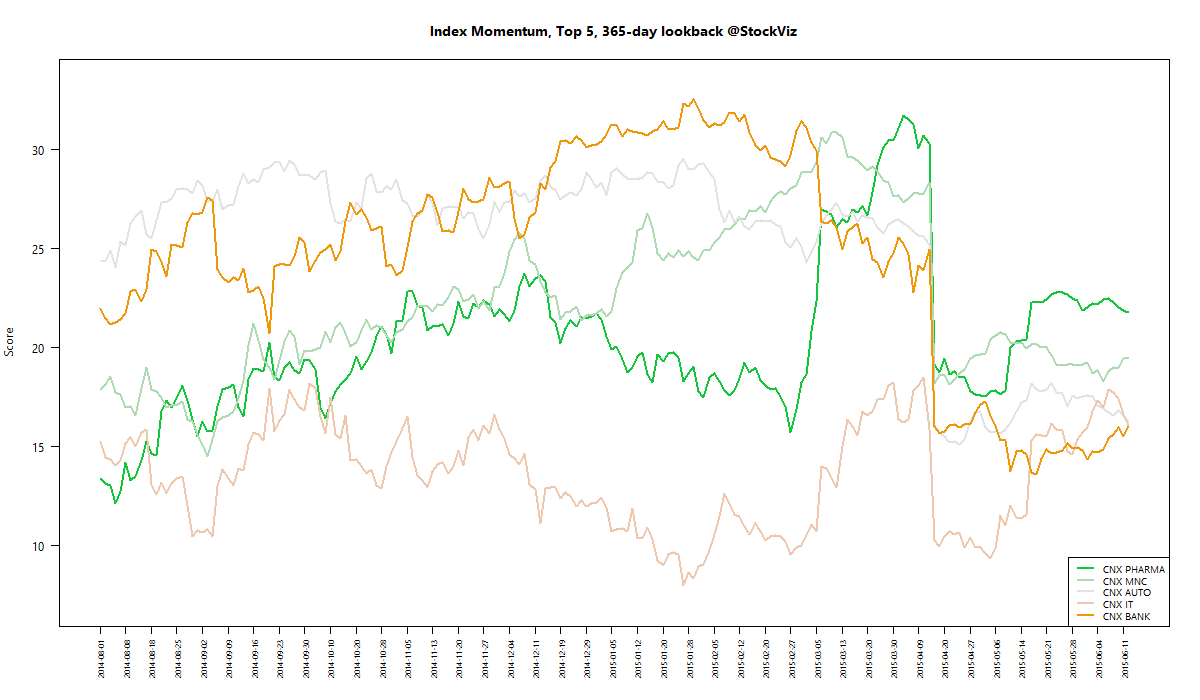

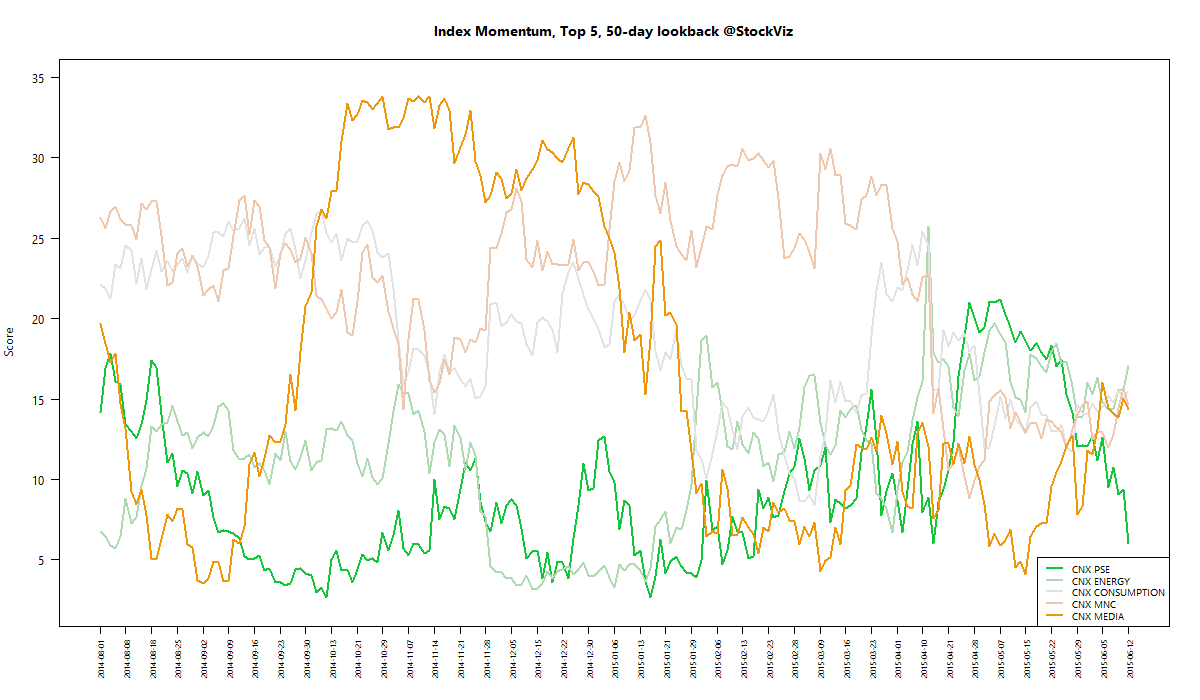

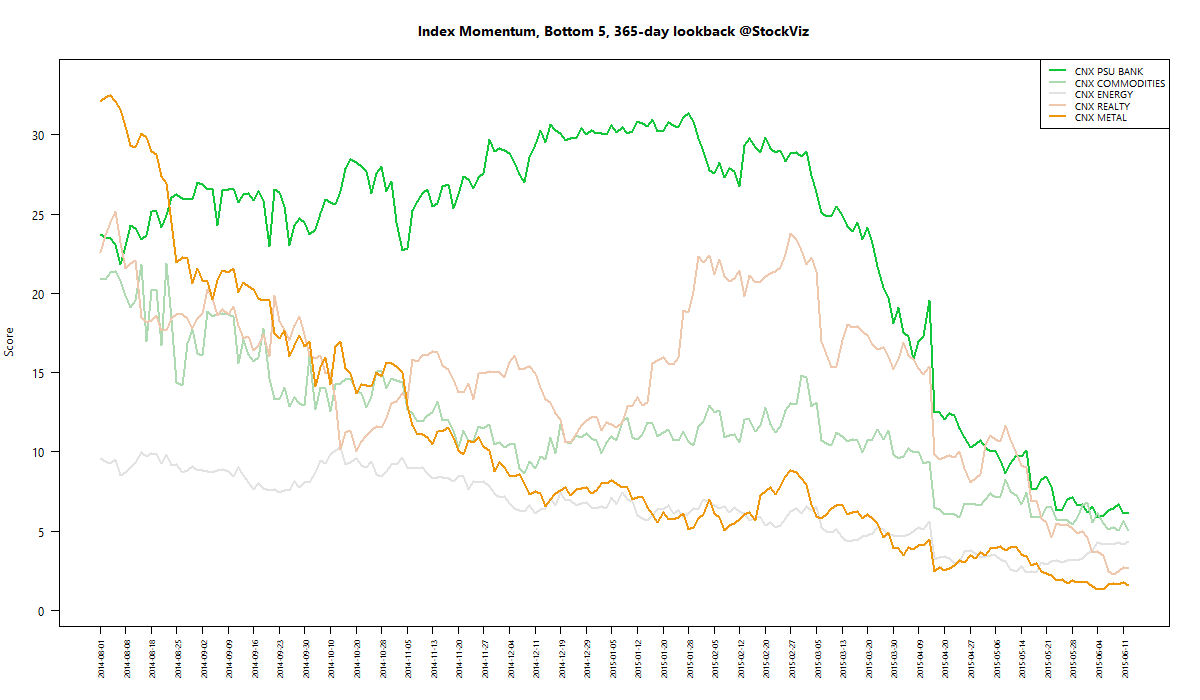

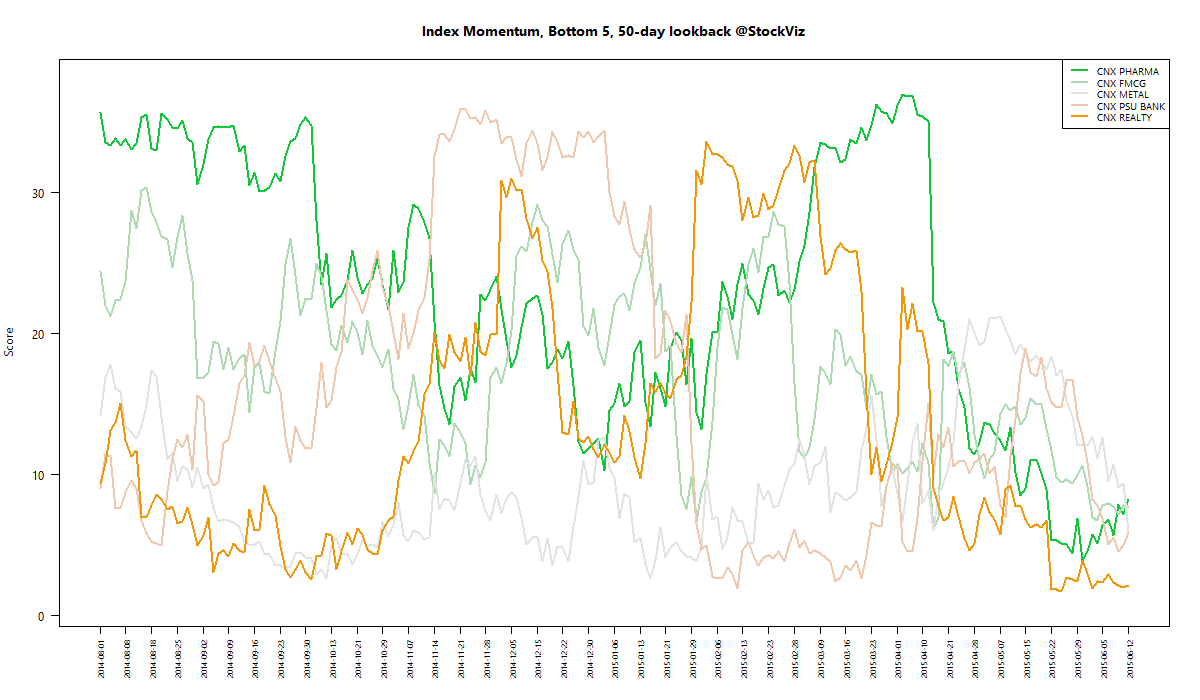

We run our proprietary momentum scoring algorithm on indices just like we do on stocks. You can use the momentum scores of sub-indices to get a sense for which sectors have the wind on their backs and those that are facing headwinds.

Traders can pick their longs in sectors with high short-term momentum and their shorts in sectors with low momentum. Investors can use the longer lookback scores to position themselves using our re-factored index Themes.

You can see how the momentum algorithm has performed on individual stocks here.

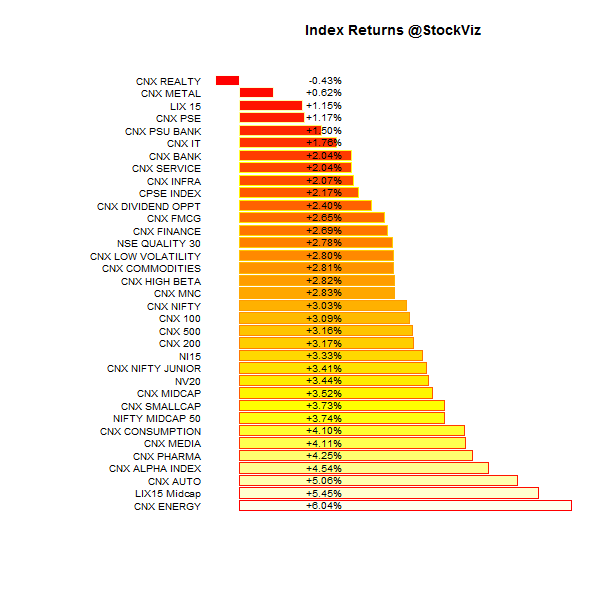

Here are the best and the worst sub-indices:

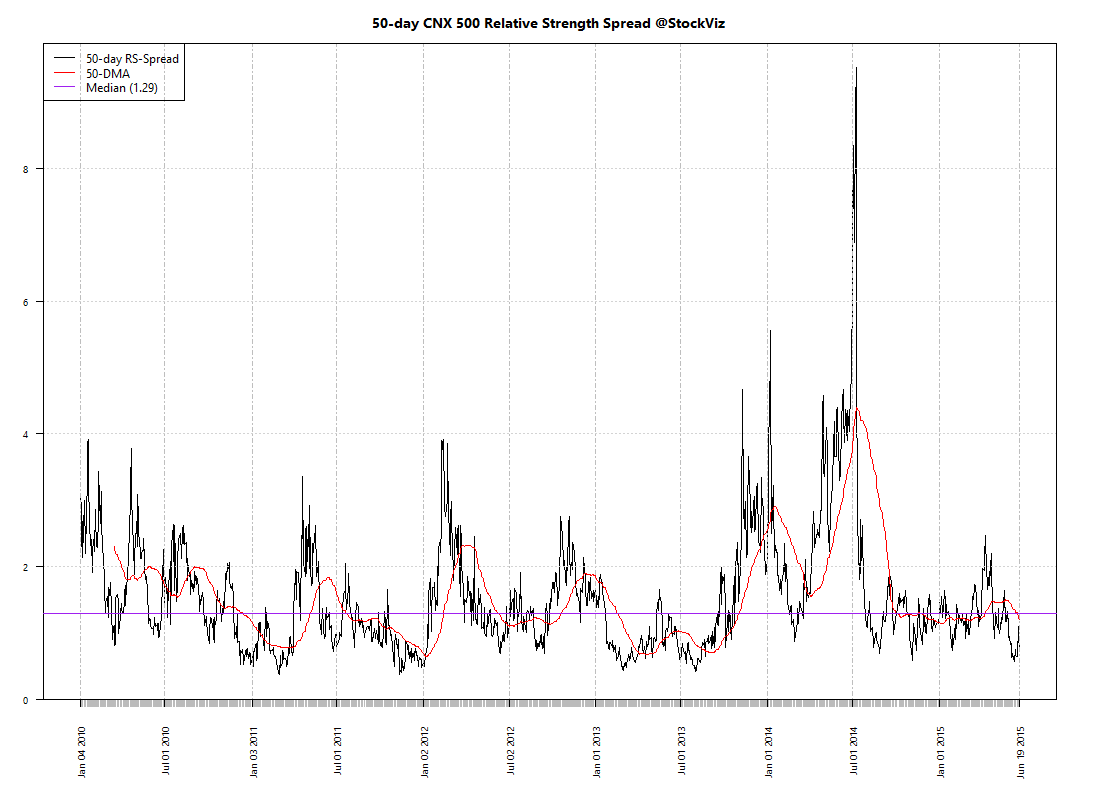

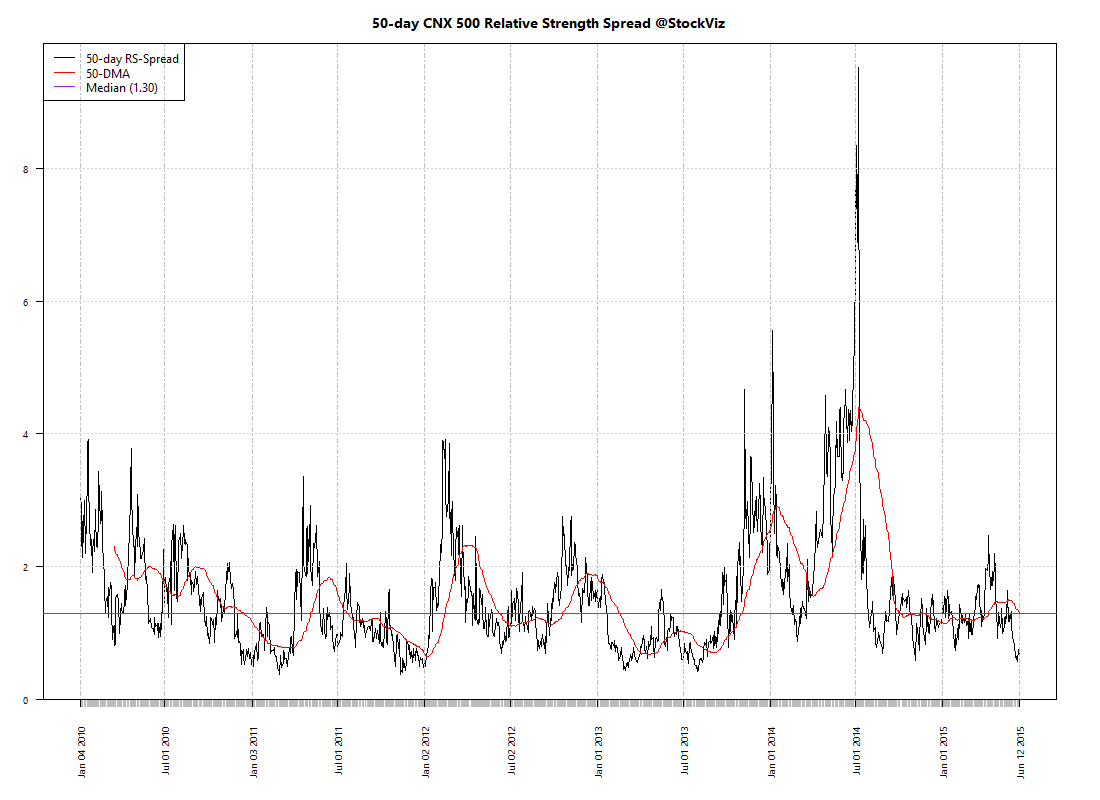

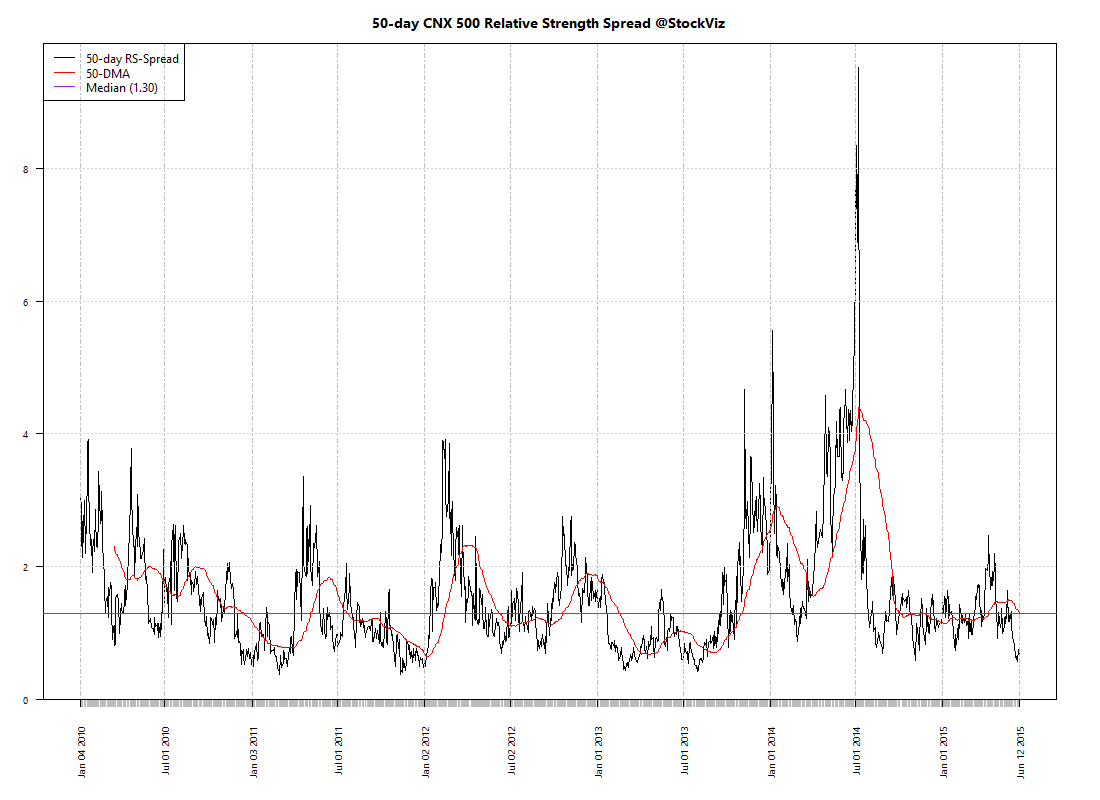

Relative Strength Spread

Refactored Index Performance

50-day performance, from March 31, 2015 through June 12, 2015:

Trend Model Summary

| Index |

Signal |

% From Peak |

Day of Peak |

| CNX AUTO |

LONG |

13.13

|

2015-Jan-27

|

| CNX BANK |

LONG |

14.75

|

2015-Jan-27

|

| CNX ENERGY |

SHORT |

30.29

|

2008-Jan-14

|

| CNX FMCG |

LONG |

15.47

|

2015-Feb-25

|

| CNX INFRA |

SHORT |

49.72

|

2008-Jan-09

|

| CNX IT |

LONG |

88.43

|

2000-Feb-21

|

| CNX MEDIA |

SHORT |

29.56

|

2008-Jan-04

|

| CNX METAL |

LONG |

59.10

|

2008-Jan-04

|

| CNX MNC |

LONG |

8.01

|

2015-Mar-12

|

| CNX NIFTY |

LONG |

11.26

|

2015-Mar-03

|

| CNX PHARMA |

LONG |

18.09

|

2015-Apr-08

|

| CNX PSE |

SHORT |

26.34

|

2008-Jan-04

|

| CNX REALTY |

LONG |

90.71

|

2008-Jan-14

|

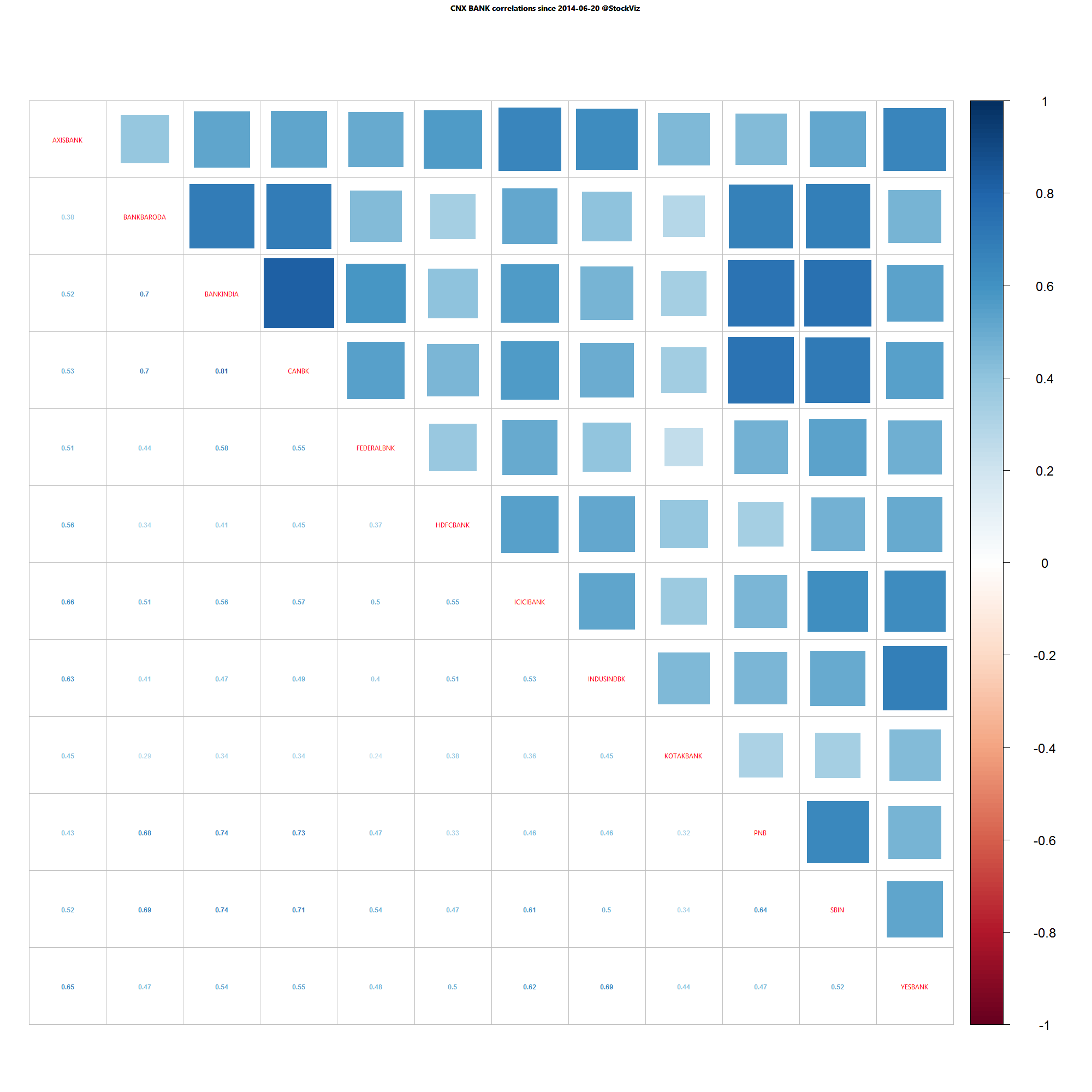

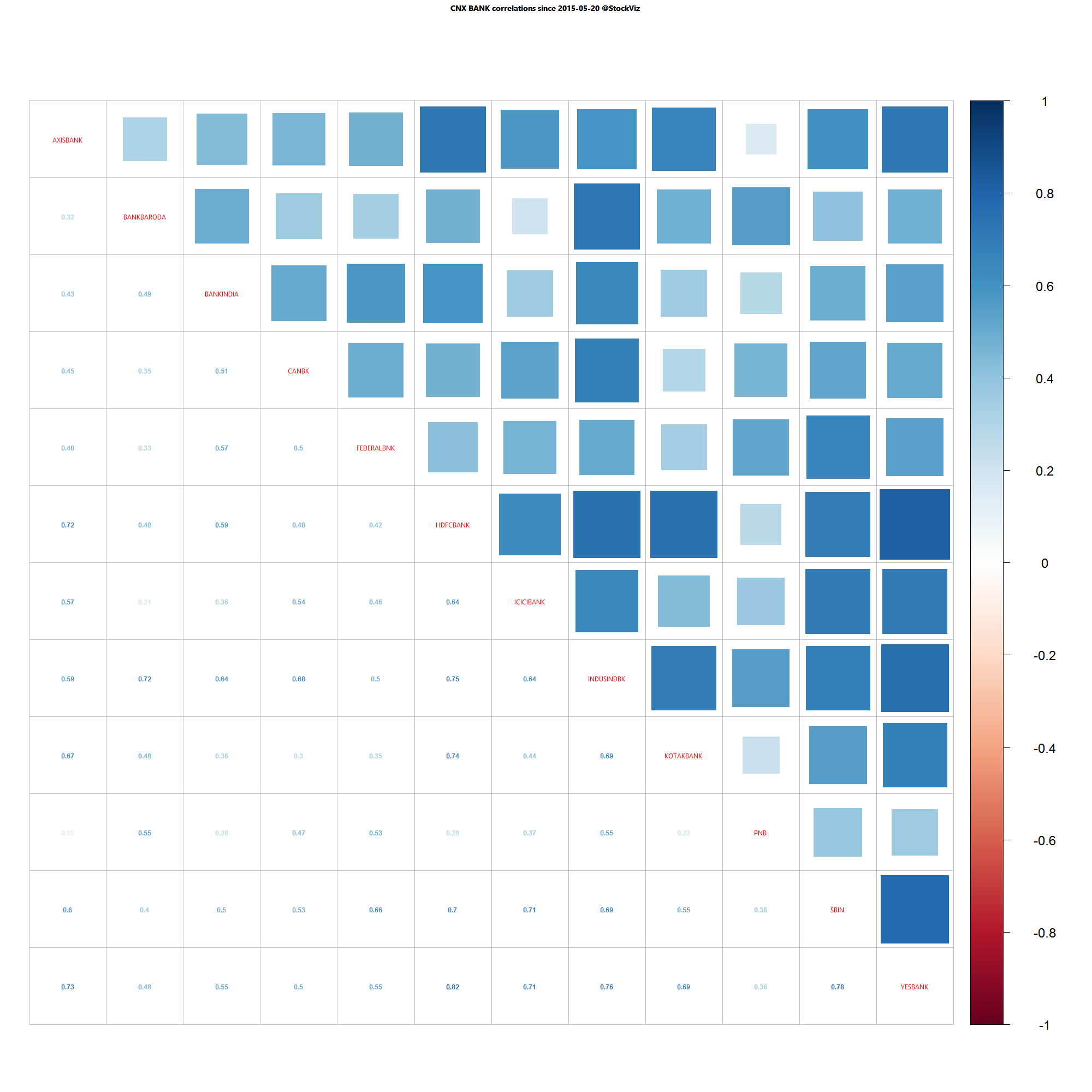

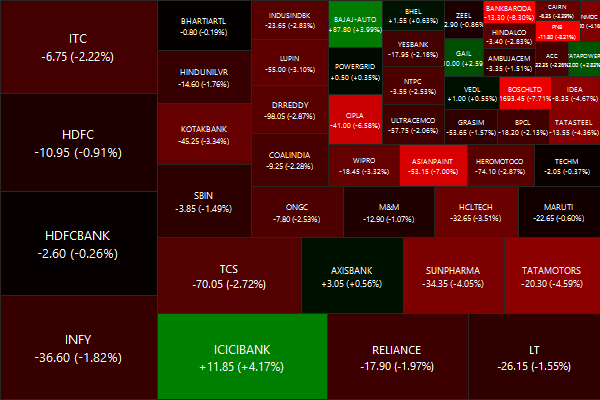

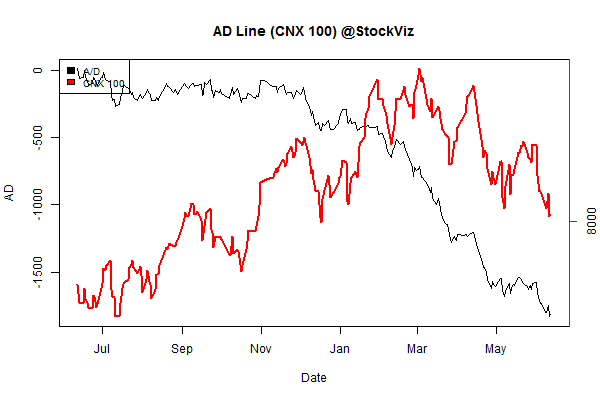

Given the state of the relative strength spread, good luck with trend following strategies! But it looks like there are some sectors where a positive trend is reasserting itself. Are we seeing green shoots in pharma, media and banks?