Indian retail contributes 11% of our country’s GDP. In the last few years, organized retail stores have come up in cities and towns in a big way. The trend has been triggered by the change in the Indian consumer in terms of purchasing power, choice preferences, demand for quality control, and value for money. Organized retail creates better opportunities and profit for the end-suppliers such as farmers, spinners, rural craftsmen, etc. It also creates price competition that works for the consumers’ good.

The growth of organized retail stores like Big Bazaar, Shopper’s Stop, Lifestyle Retail and Spencer’s Retail is already derailing small mom-and-pop stores, with or without FDI. On the other hand, organized retail employs 40 million Indians, offers organized shifts and salaries, fair work policies and generates $450 million revenue. Most importantly, organized retail creates direct relationships with suppliers, cutting out the middle man’s cut which can be exorbitant. While the sale of a kilogram of potatoes will get a farmer only Rs.3-4, it is sold in the market for Rs.25. Organized retail ensures farmers get a better deal.

Organized retail also supports agricultural workers with infrastructure to reduce food spoilage – cold storage for perishables like fruits and vegetables, hygienic transport, etc. Currently, food wastage leads to 30% losses that contribute to our current inflation rate. The sad state of backend infrastructure in India may get addressed with FDI support as the government needs both funds and expertise in this area.

In September 2012, the government sanctioned FDI in single-brand retail – allowing 100% ownership on the condition that 30 percent of goods be sourced from Indian small and medium suppliers. FDI in multi-brand retail was also allowed subject to state government sanctions, with 51% ownership and a minimum of $100 million initial investment spread over 3 years. The government has also advised foreign parties to invest 50 percent in backend infrastructure development.

Though many heated arguments have prevailed in the political arena over FDI, it is supported by organized retailers in India and rural farmer associations such as Consortium of Indian Farmers Associations (CIFA). However, the restrictive regulations, state-level uncertainties, bad infrastructure, and high investment stake will limit the entry of foreign investors. Walmart, Tesco, and Carrefour are still testing the waters in wholesale markets though they were expected to launch retail stores soon.

supported by organized retailers in India and rural farmer associations such as Consortium of Indian Farmers Associations (CIFA). However, the restrictive regulations, state-level uncertainties, bad infrastructure, and high investment stake will limit the entry of foreign investors. Walmart, Tesco, and Carrefour are still testing the waters in wholesale markets though they were expected to launch retail stores soon.

Organized retail in India faces other challenges too such as:

- Wide geographical spread

- Varying customer preferences across states and regions

- Limited access to retail markets because of FDI opposition in some states

- Complex distribution network

- Taxation laws that favor small retailers

- Cumbersome real estate procurement and local laws

- Resistance in some local areas (political and coercive)

- Limited use of IT systems for analysis, supply chain management, etc.

- Small ticket size

- Lack of retail management education

- Lack of retail workforce trainings

Organized retail (with FDI support) has helped economies like China, Japan, and Malaysia increase local employment, competition and product quality. There is no reason why the same can’t happen in India over time. Joint ventures with foreign players, multi-format and single-brand stores will bring down prices, create wider choice of quality goods, and drive more profits to the supplier’s end. However, political tussles and unfavorable conditions may deter many foreign retailers from investing in India.

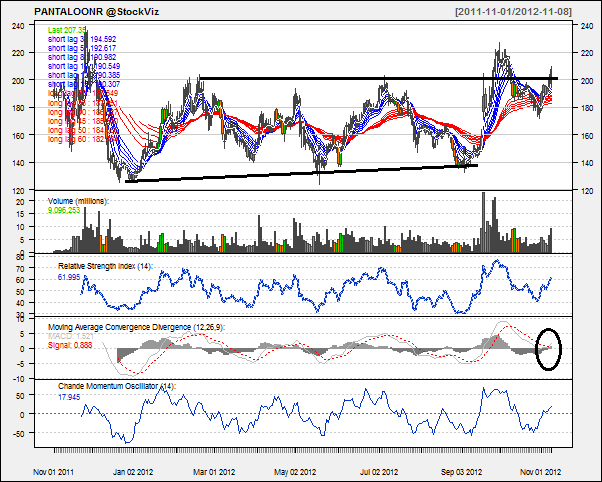

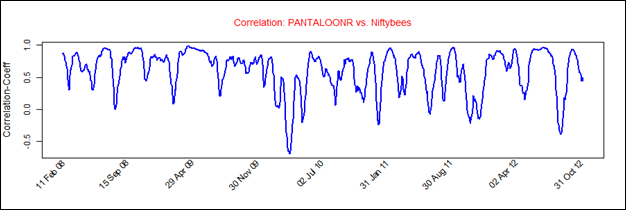

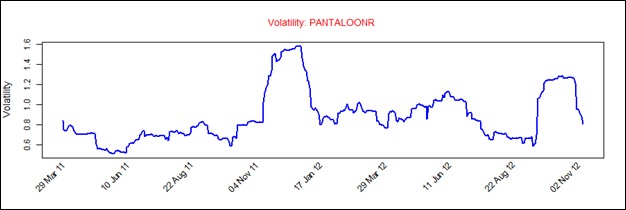

[stockquote]PANTALOONR[/stockquote] [stockquote]TRENT[/stockquote] [stockquote]SHOPERSTOP[/stockquote] [stockquote]FUTUREVENT[/stockquote]