Churn and Burn

When retail investors trade stocks, the market impact of trading decisions are de minimis. However, when a fund trades its portfolio, it has a noticeable market impact. According to a study quoted here in the Economist article, when academics compared the returns of the funds with their estimated trading costs, the funds with the highest costs had the lowest returns.

For contrast, lets compare the DWS Tax Saving Fund with Templeton India Growth Fund.

DWS Tax Saving Fund

First, investors would have been better off buying a CNX Midcap index fund. Between 2006-06-01 and 2015-02-19, DWS TAX SAVING FUND has returned a cumulative 143.52% with an IRR of 10.74% vs. CNX Midcap’s cumulative return of 209.71% and an IRR of 13.83%. (http://svz.bz/1EHGTxu)

Second, the fund looks like a fun trading vehicle for the manager rather than something that is meant to build wealth over the long term. Here’s how the manager has churned his portfolio:

Not only should you stay away from this fund, but you should use it in informational videos on how not to churn your portfolio.

Templeton India Growth Fund

First, even though returns are not the absolute best that it could have been, between 2006-06-01 and 2015-02-19, Templeton India Growth Fund has returned a cumulative 267.72% with an IRR of 16.09%.(http://svz.bz/1EHIljm)

Second, the portfolio doesn’t look like a mad scramble like the one above. Markedly fewer holdings for longer:

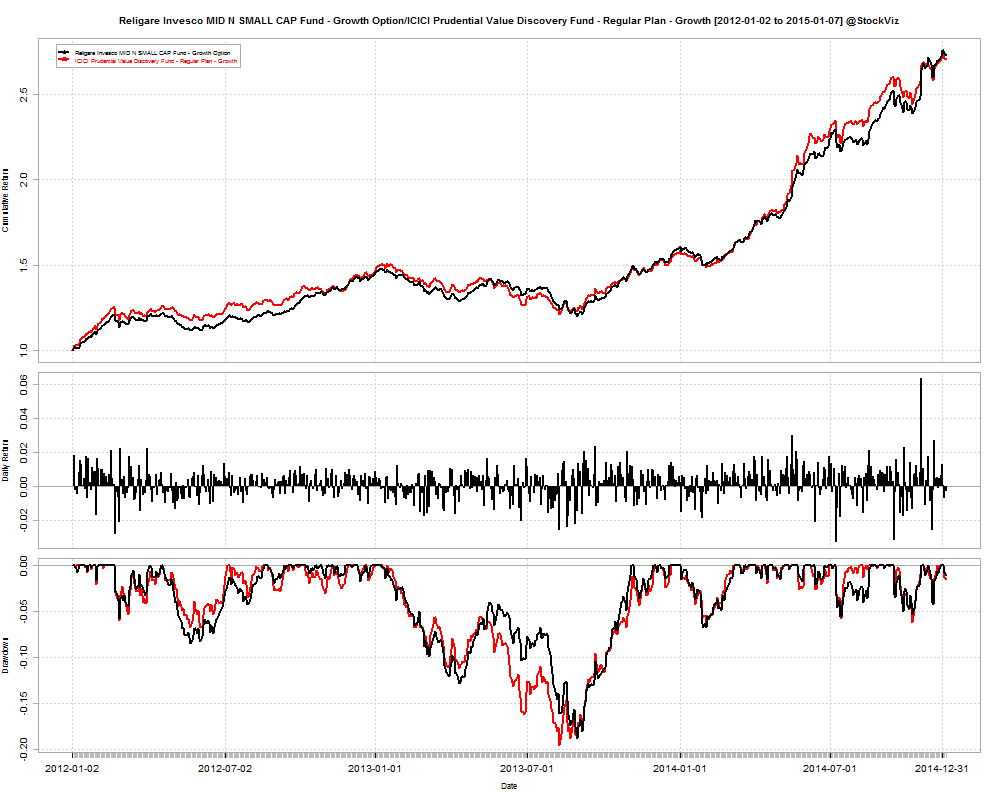

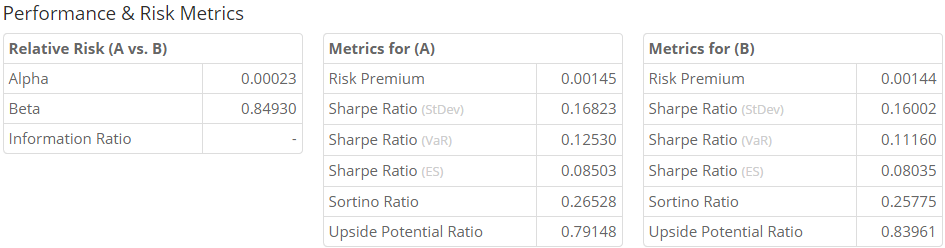

When you compare the two funds with each other, you can see who is doing a better job (http://svz.bz/1EHJCa2):

Conclusion

Beware of funds that churn their portfolios frequently. It might be a reflection of shoddy research, poor conviction or immaturity that you end up paying for.