Our recent series on asset allocation walked through how different investment decisions affect portfolio returns and risk.

- Number of assets: Three is better than two and four.

- Rebalance threshold: Allowing a single asset to drift upto 80% reduces transaction costs and taxes.

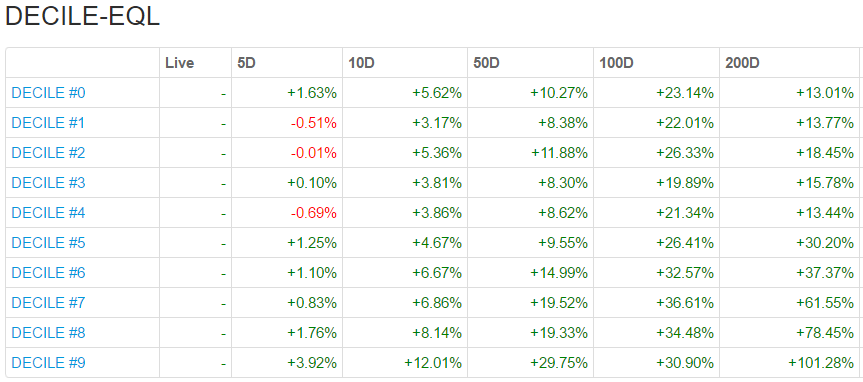

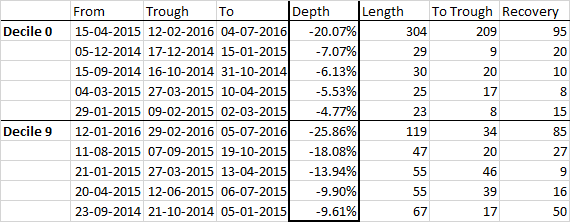

- Weighing scheme: Equal weight is better than portfolio optimization methods.

You can read through the posts and the various factors that went into the analysis in order:

- Allocating a Two-Asset Portfolio

- Allocating a Three-Asset Portfolio, Equal Weighted

- Allocating a Three-Asset Portfolio, Optimized

- Allocating a Four-Asset Portfolio

For investors looking to gain from such a portfolio, we have setup a ready-to-invest Theme, the EQUAL-III, that takes care of keeping track of everything. It maintains an equal-weight portfolio of the M100 (Midcap-100 ETF,) N100 (Nasdaq-100 ETF) and the RRSLGETF (Long Term Gilt ETF.)

Questions? WhatsApp us +91-80-2665-0232