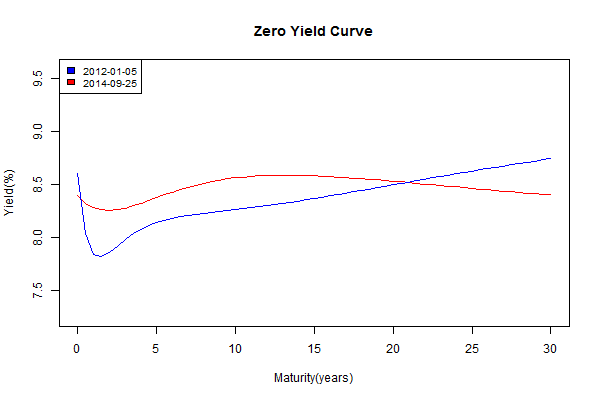

With the consensus on RBI rate cuts beginning next year, investors have been lapping up long-term government bonds (gsecs or gilts, if you wish.) The long-end has been bid so hard that the yield curve is flat as a pancake.

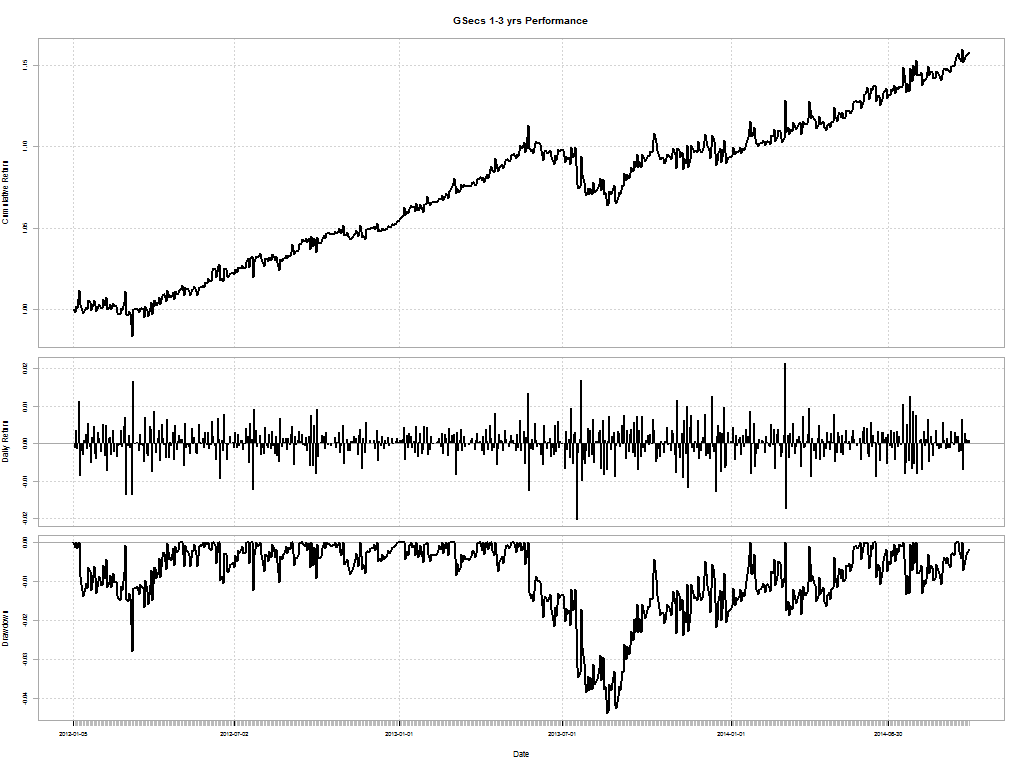

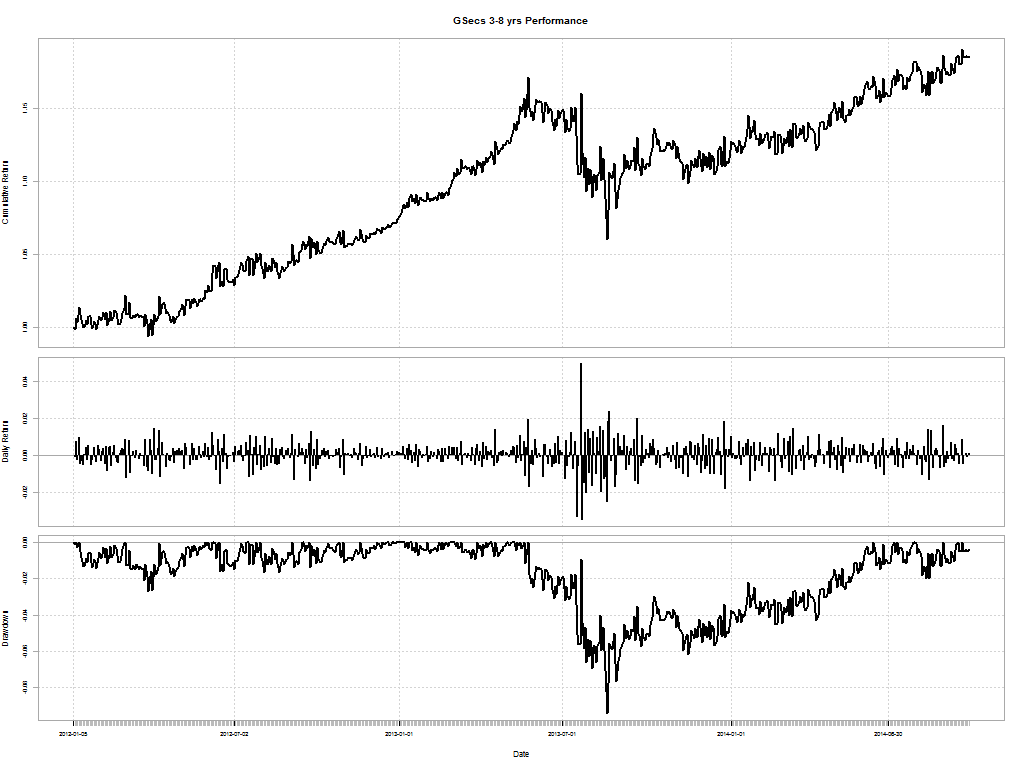

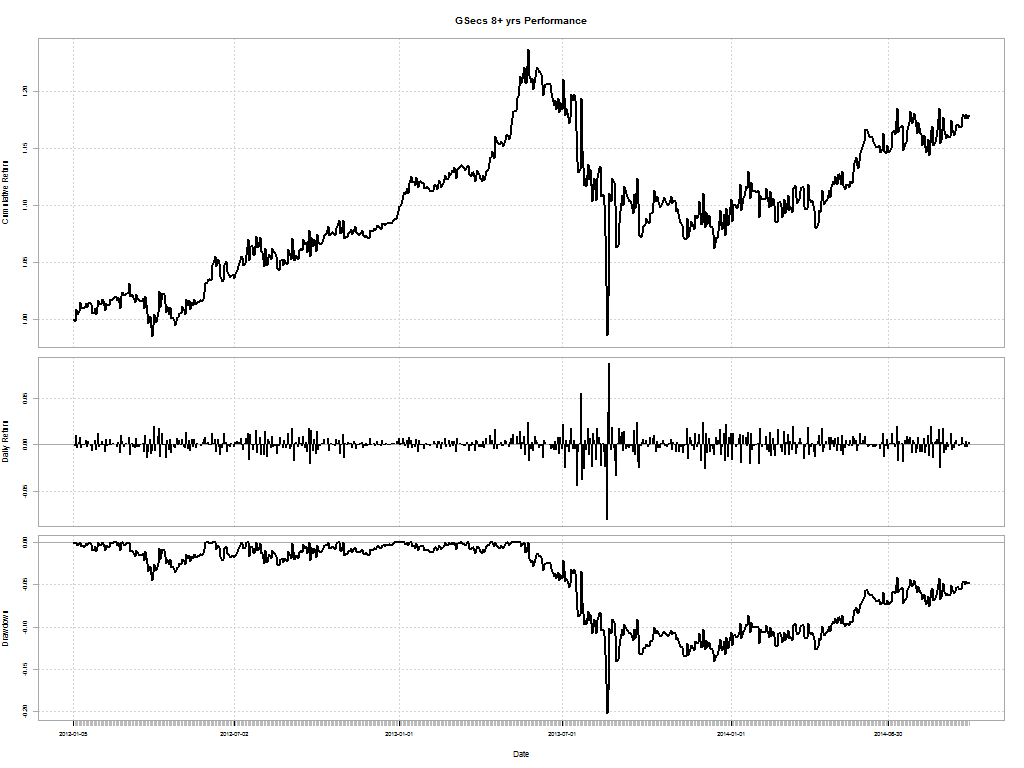

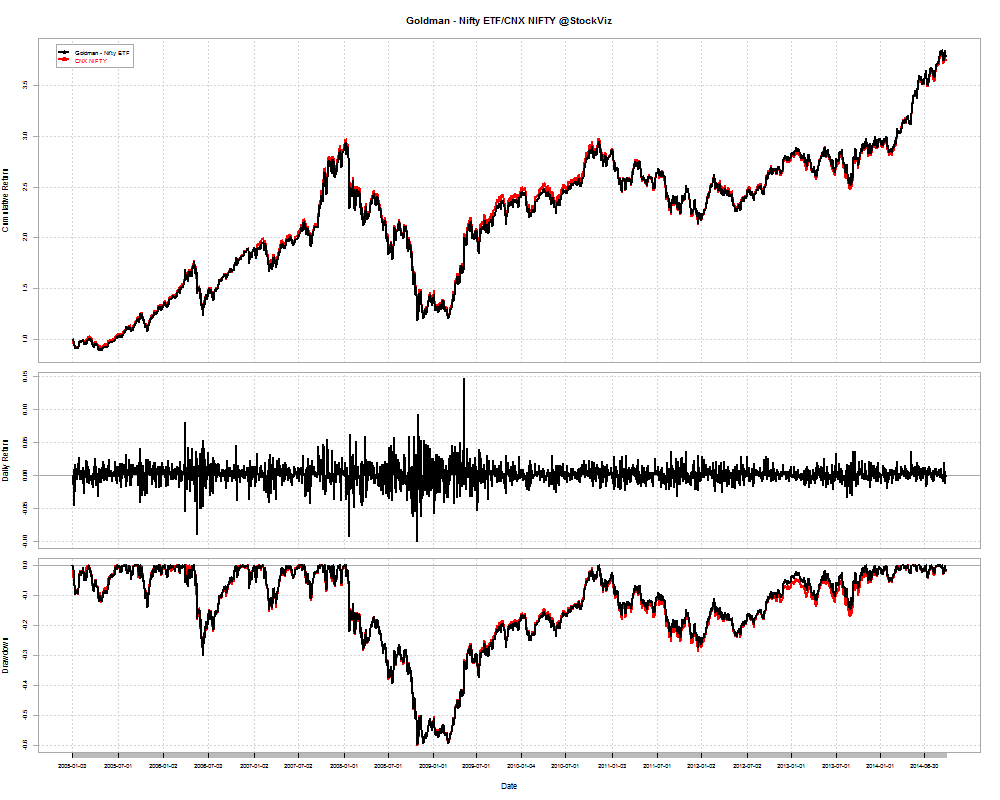

GSec Total Return Indices have tracked this, except for the hiccup back in May last year.

Short-term:

Medium-term:

Long-term:

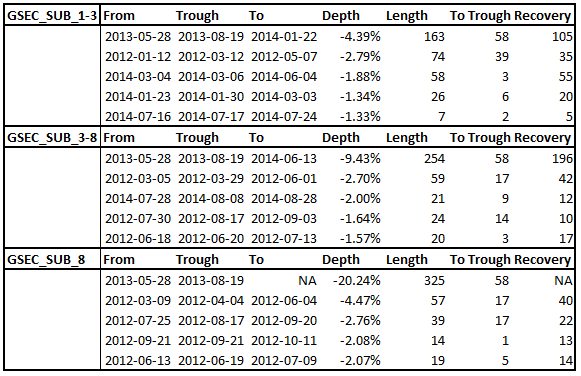

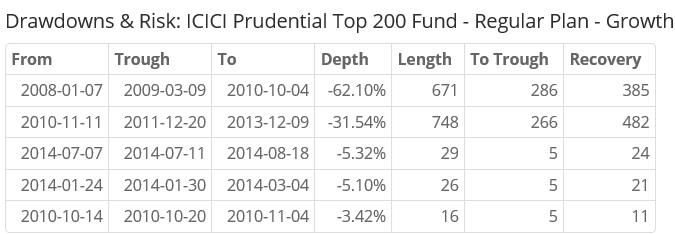

Drawdowns

May’13 was a rude reminder to investors who thought that you cannot lose money investing in government bonds. You can. Investors in the long-end of the curve are yet to recover from the drawdown last year.

Should you expect actively managed gilt funds to do better?

UTI – GILT ADVANTAGE vs. ICICI Prudential Long Term Gilt

UTI’s fund has a much shorter duration compared to ICICI’s (4.1 vs. 7.35 years.) And the returns that the funds have posted exemplify the importance of incorporating the fund portfolio’s duration into your decision making.

Since 2012-01-05, UTI – GILT ADVANTAGE-LONG TERM has returned a cumulative 24.59% vs. ICICI Prudential Long Term Gilt Fund’s cumulative return of 20.16%.

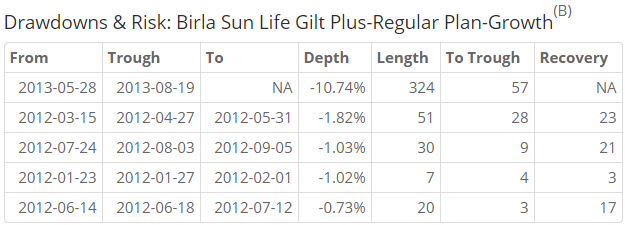

UTI – GILT ADVANTAGE vs. Birla Sun Life Gilt Plus

Since 2012-01-05, UTI – GILT ADVANTAGE has returned a cumulative 24.59% vs. Birla Sun Life Gilt Plus’s cumulative return of 14.79%. And BSL’s fund is yet to recover from the May’13 drawdown.

UTI – GILT ADVANTAGE vs. HDFC Gilt Fund-Long Term

Since 2012-01-05, UTI – GILT ADVANTAGE has returned a cumulative 24.59% vs. HDFC Gilt Fund-Long Term’s cumulative return of 22.01%. Of the three funds we compared, this is the closest any gilt fund has come to matching UTI’s returns.

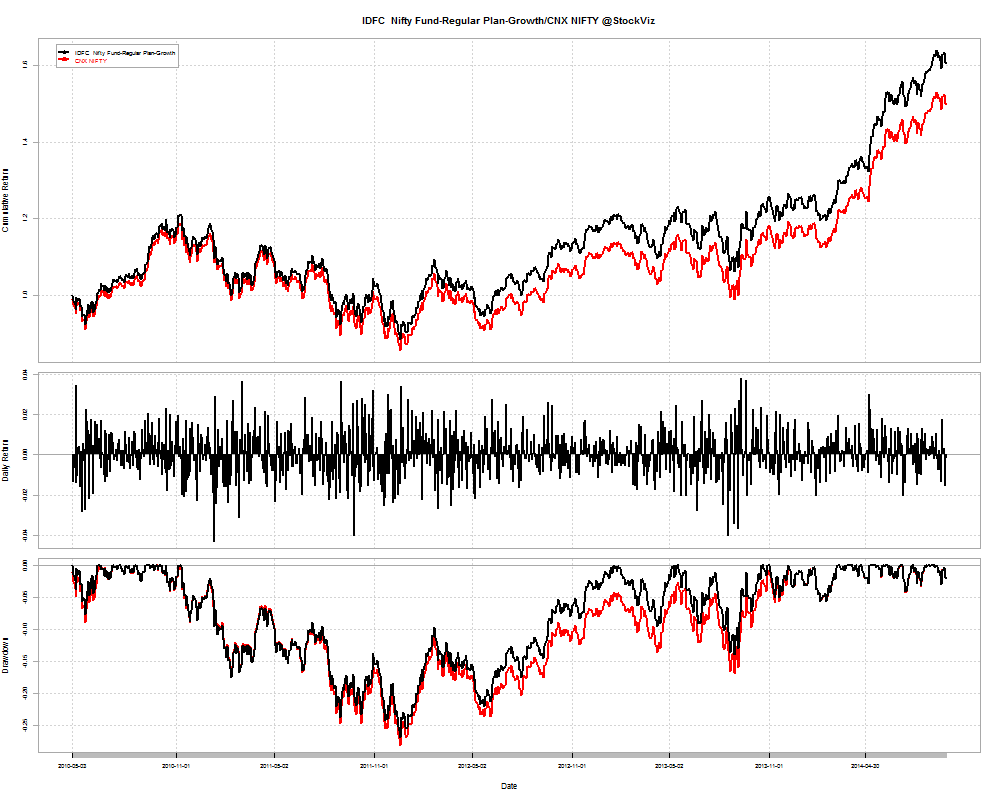

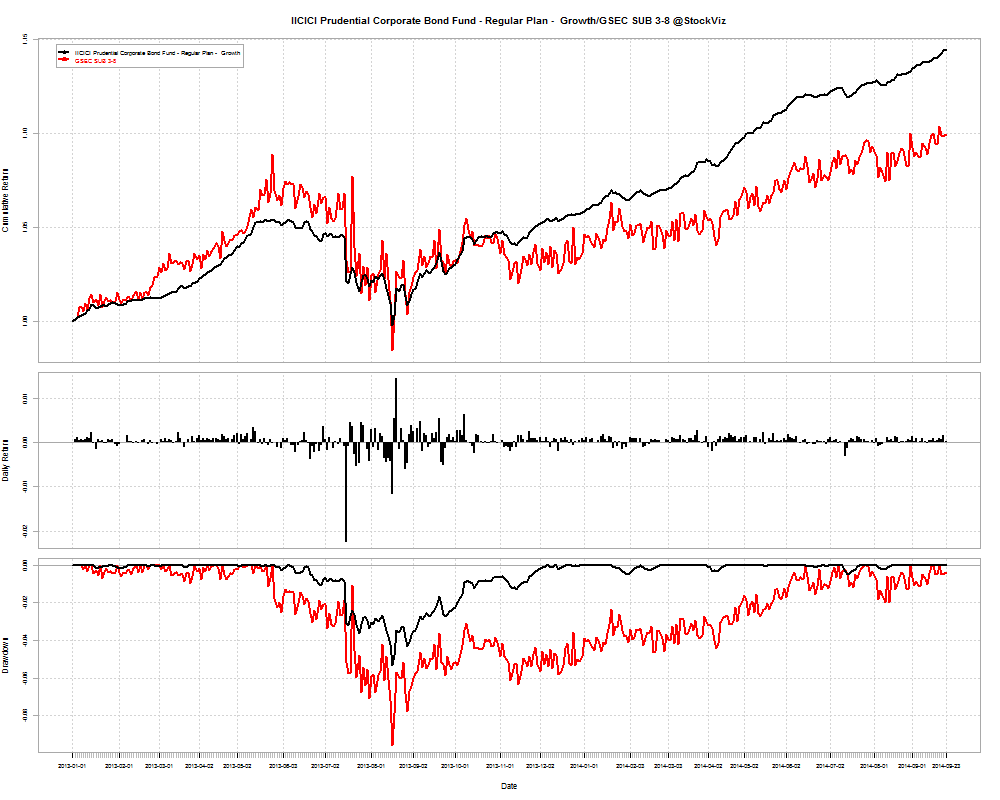

UTI – GILT ADVANTAGE vs. GSEC SUB 3-8 TRI

Since 2012-01-05, UTI – GILT ADVANTAGE-LONG TERM has returned a cumulative 24.59% vs. GSEC SUB 3-8’s cumulative return of 18.55%. The fund beat the sub-index hands-down.

Conclusion

It looks like the UTI Gilt Advantage fund is a well managed fund that has beat its peers and benchmarks. But as the standard disclaimer reads, “past performance does not necessarily predict future results.”

You can run the comparison tool here: FundCompare

If you want advice on investing in mutual funds, please get in touch with Shyam.

You can either WhatsApp him or call him at 080-2665-0232.

He is an AMFI registered IFA who can advice you on HDFC, ICICI Pru, UTI and Birla Sun Life funds.