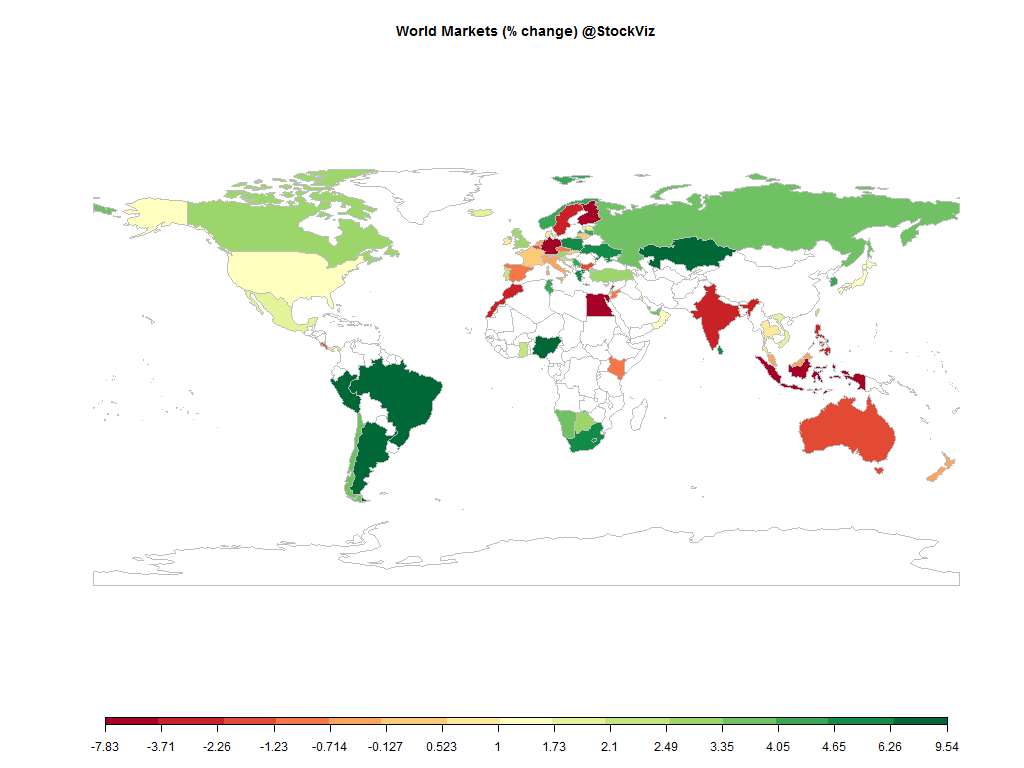

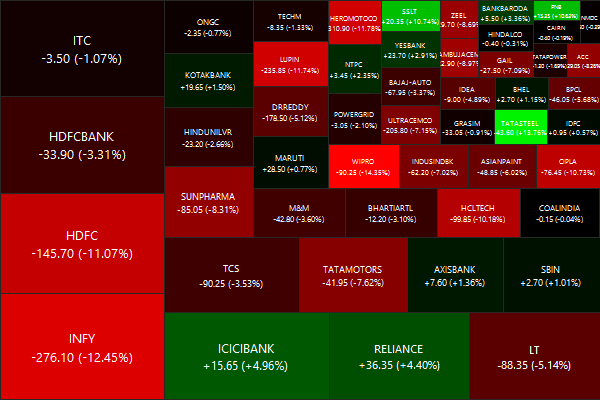

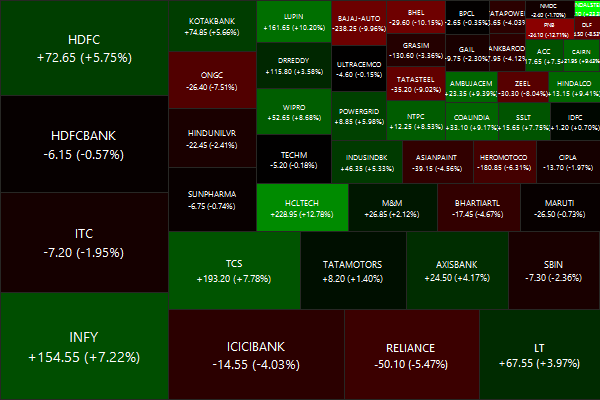

Equities

Commodities

| Energy |

| Brent Crude Oil |

-4.12% |

| WTI Crude Oil |

-2.96% |

| Heating Oil |

-3.91% |

| Ethanol |

+4.61% |

| Natural Gas |

+7.28% |

| RBOB Gasoline |

-2.67% |

| Metals |

| Palladium |

-12.83% |

| Platinum |

-2.52% |

| Copper |

-5.07% |

| Gold 100oz |

-1.45% |

| Silver 5000oz |

-6.59% |

| Agricultural |

| Corn |

+17.28% |

| Soybeans |

+12.15% |

| White Sugar |

+5.92% |

| Cattle |

-2.87% |

| Cocoa |

+1.42% |

| Coffee (Arabica) |

+3.44% |

| Feeder Cattle |

-3.67% |

| Lumber |

+5.57% |

| Soybean Meal |

+16.68% |

| Sugar #11 |

+4.00% |

| Wheat |

+27.02% |

| Coffee (Robusta) |

+15.36% |

| Cotton |

+4.09% |

| Lean Hogs |

-9.18% |

| Orange Juice |

+0.57% |

Credit Indices

| Index |

Change |

| Markit CDX EM |

-0.46% |

| Markit CDX NA HY |

-0.63% |

| Markit CDX NA IG |

+3.48% |

| Markit iTraxx Asia ex-Japan IG |

+1.61% |

| Markit iTraxx Australia |

+1.97% |

| Markit iTraxx Europe |

+3.03% |

| Markit iTraxx Europe Crossover |

+10.35% |

| Markit iTraxx Japan |

+4.34% |

| Markit iTraxx SovX Western Europe |

-0.80% |

| Markit LCDX (Loan CDS) |

-0.04% |

| Markit MCDX (Municipal CDS) |

-1.32% |

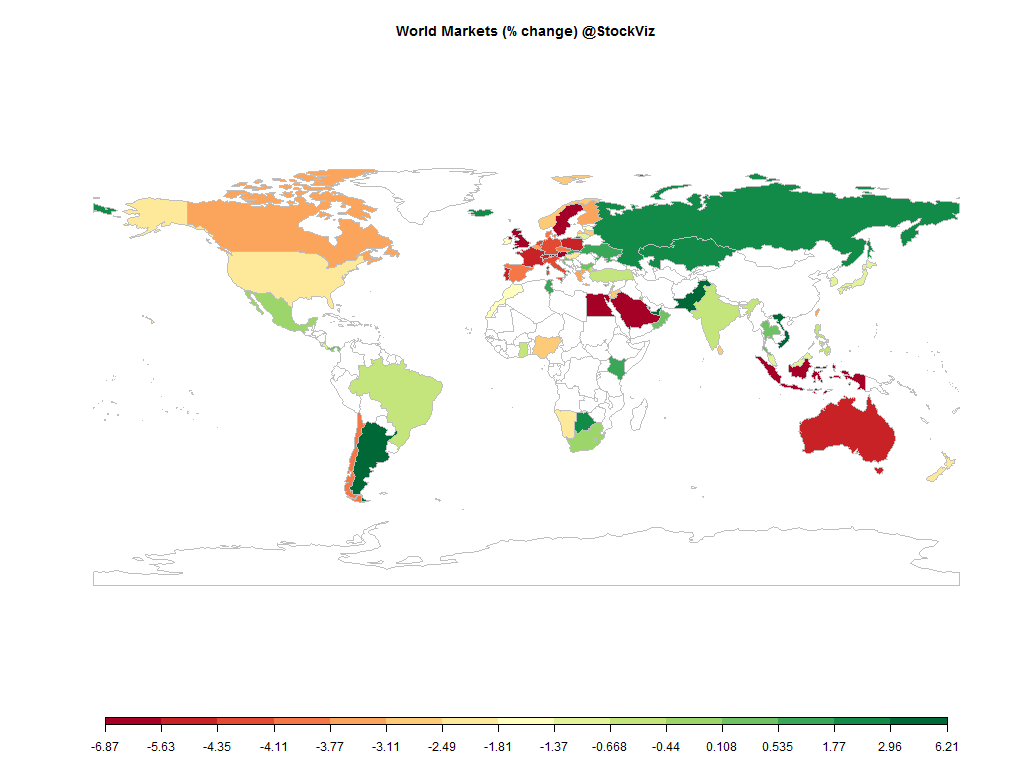

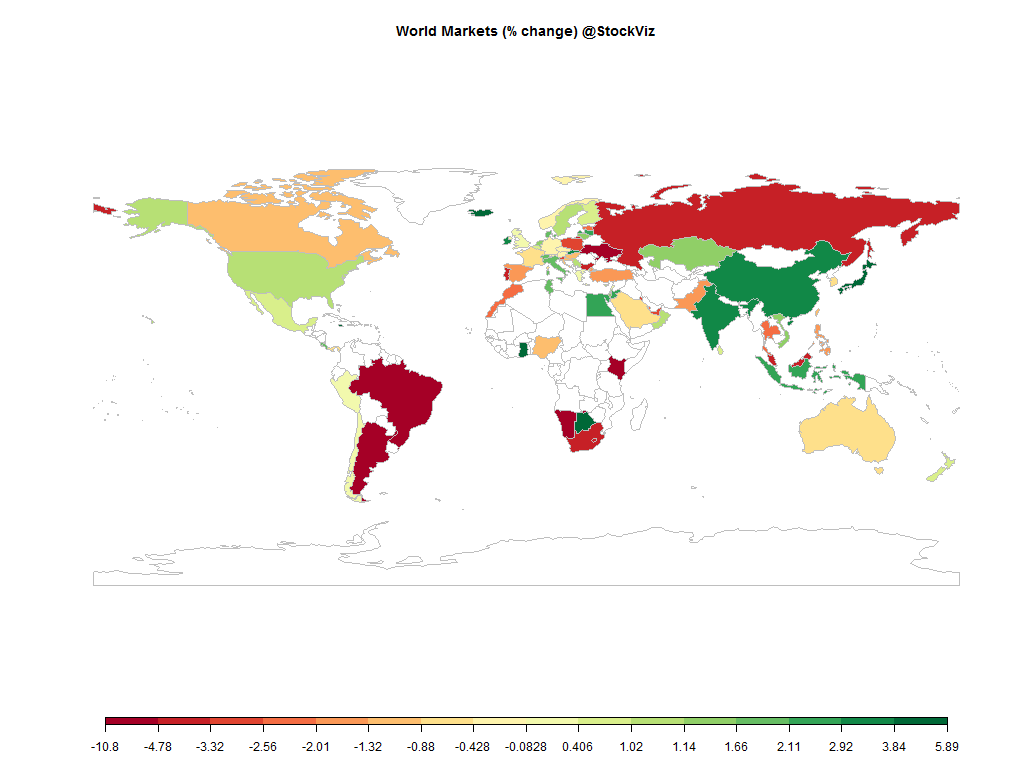

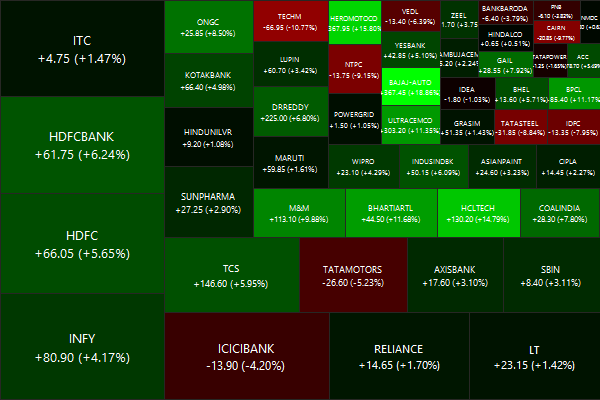

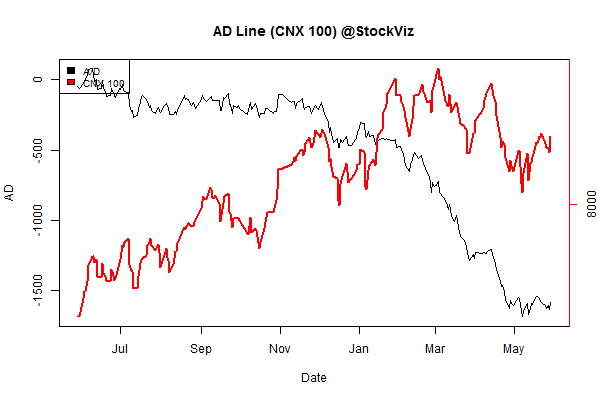

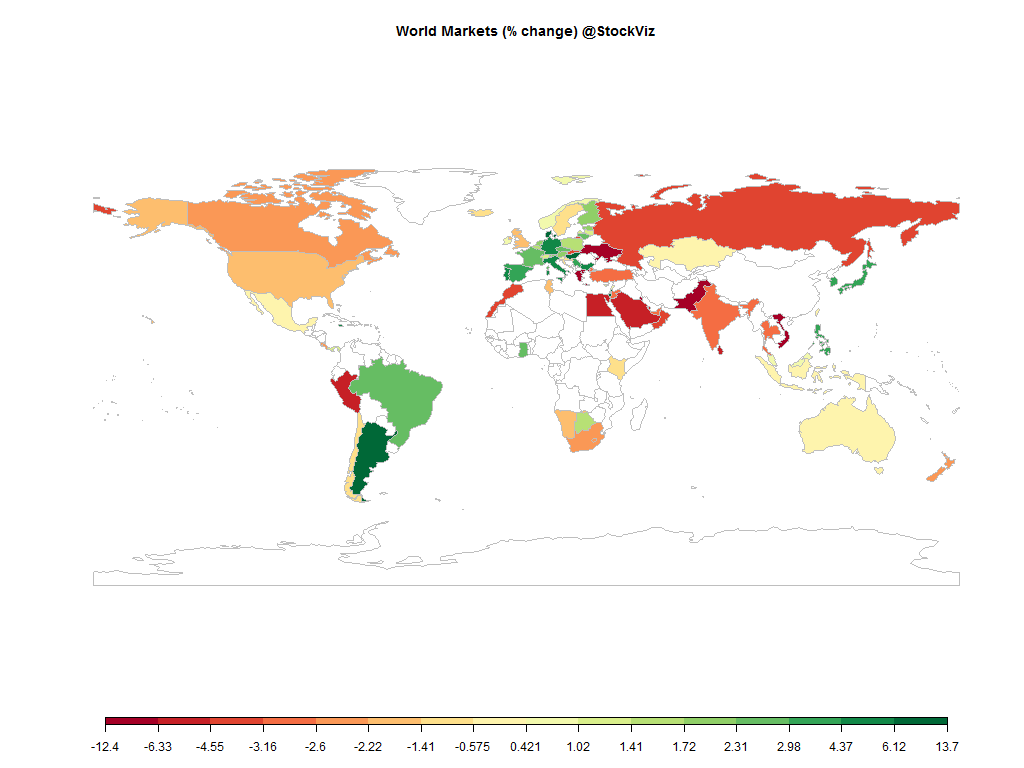

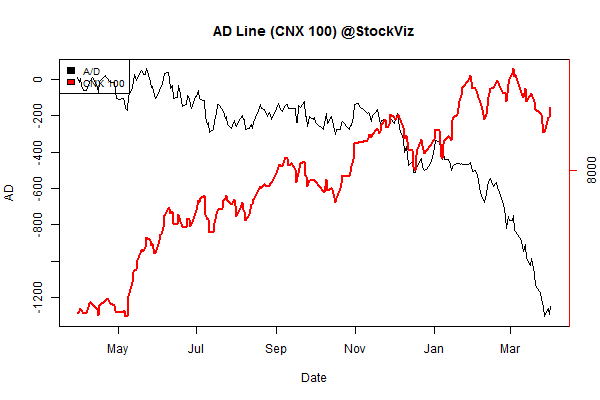

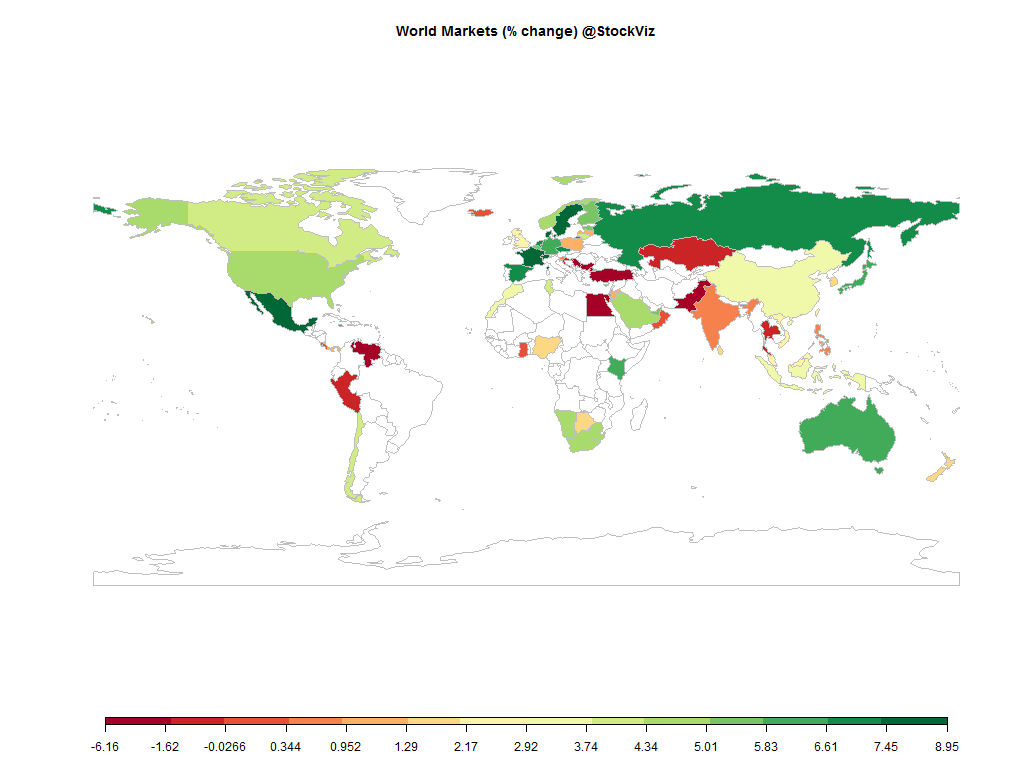

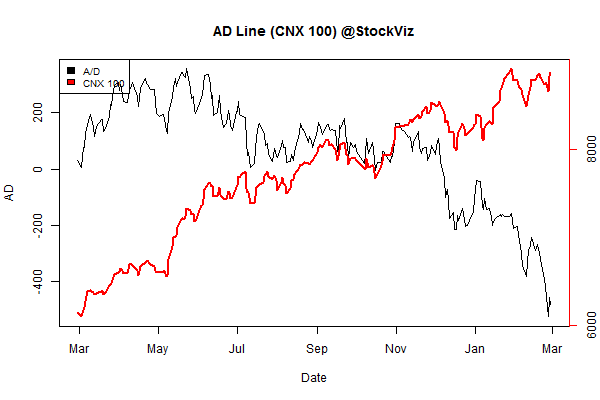

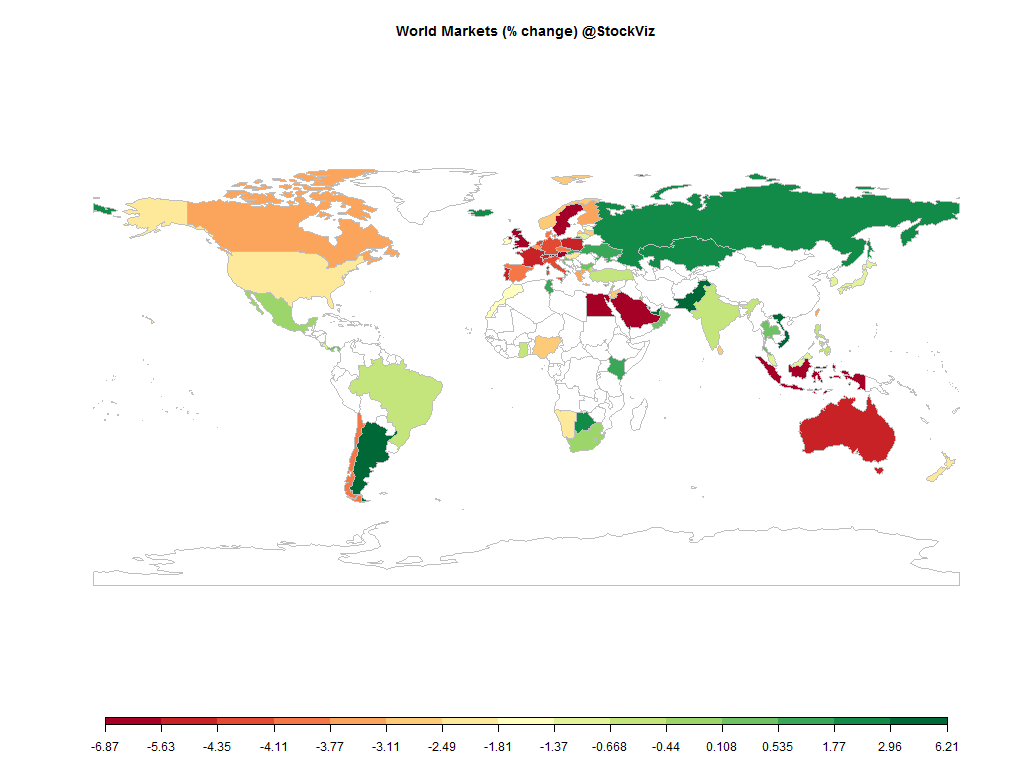

An eventful month comes to an end. The Chinese bubble popped, the Greek drama is playing out, people stopped obsessing about the Fed raising rates and monsoons went from being a headwind to a tailwind.

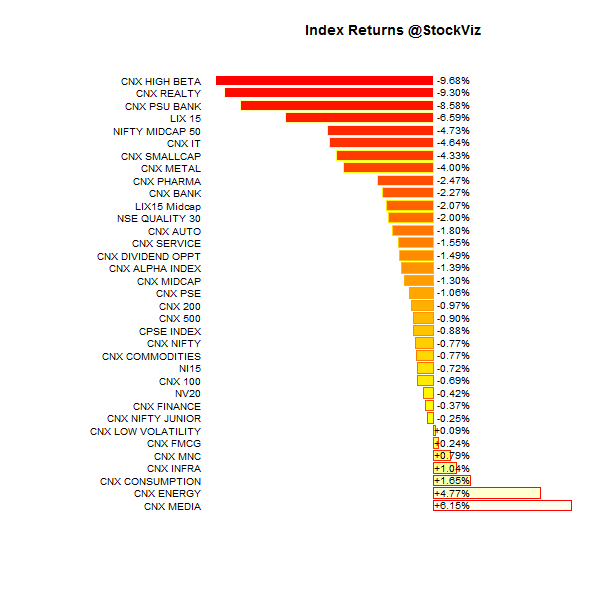

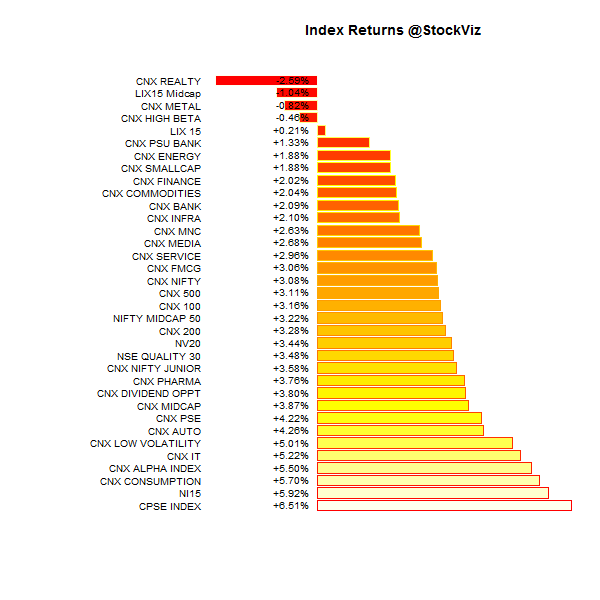

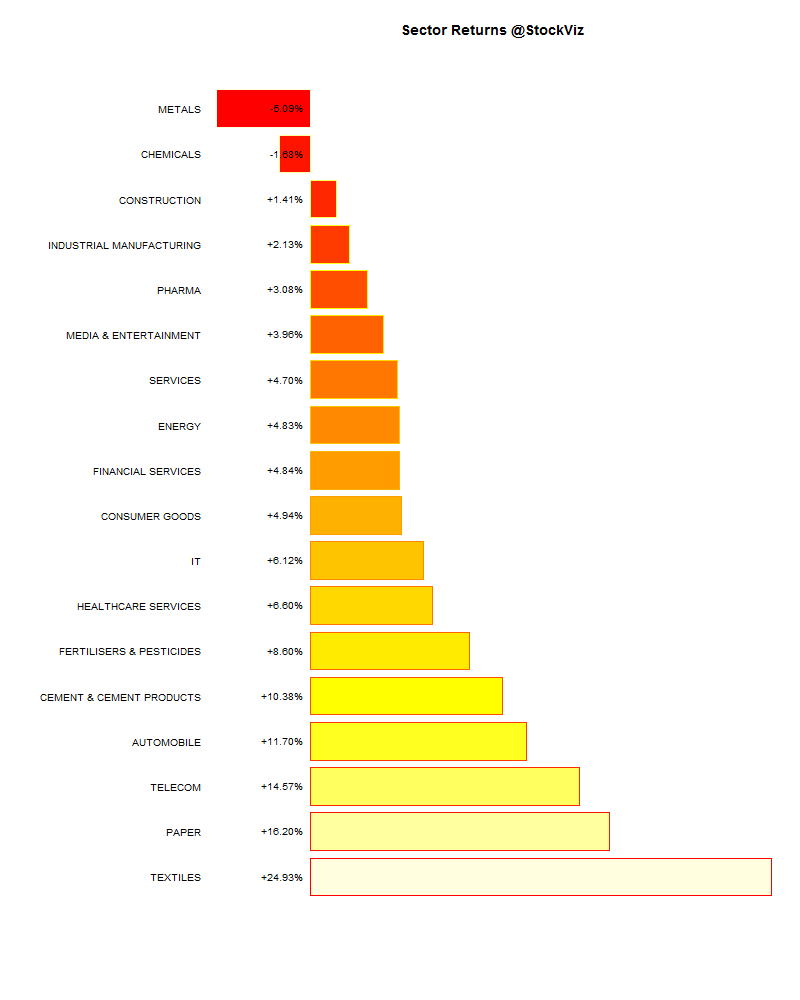

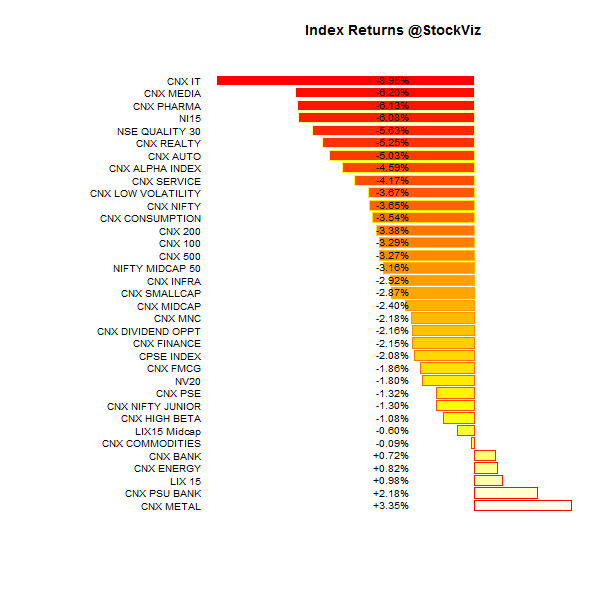

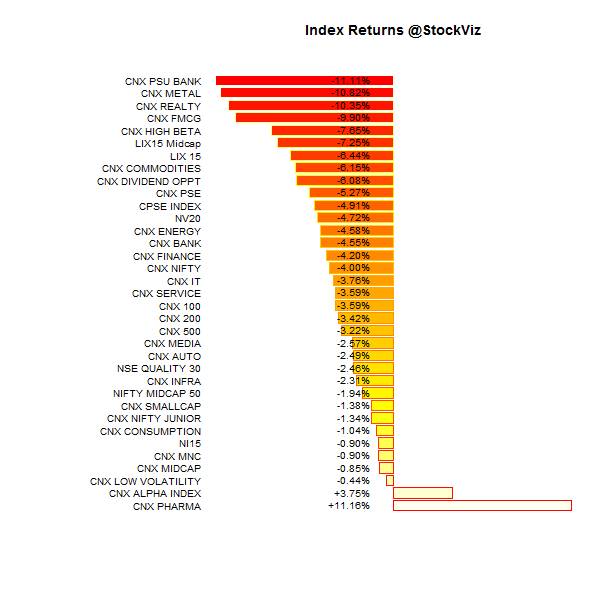

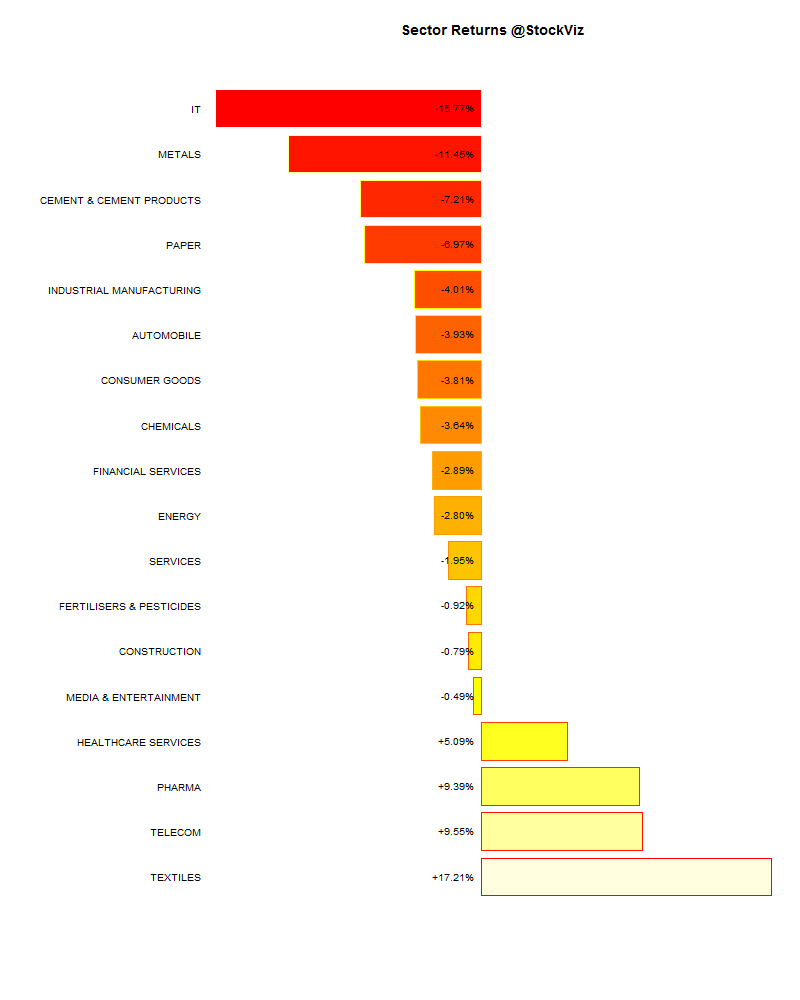

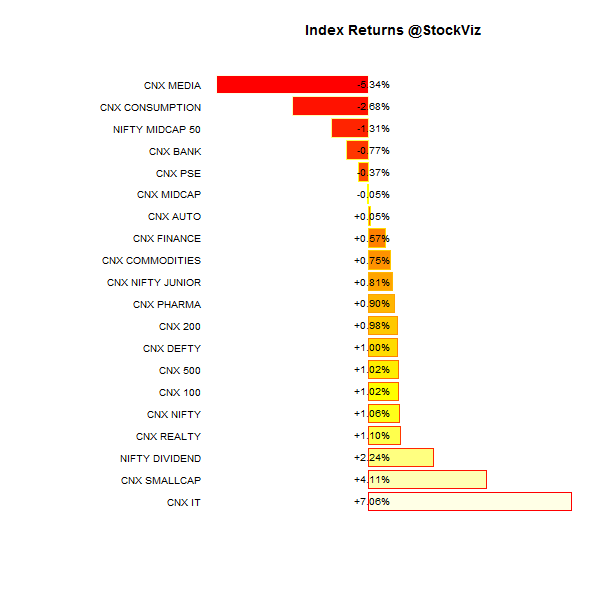

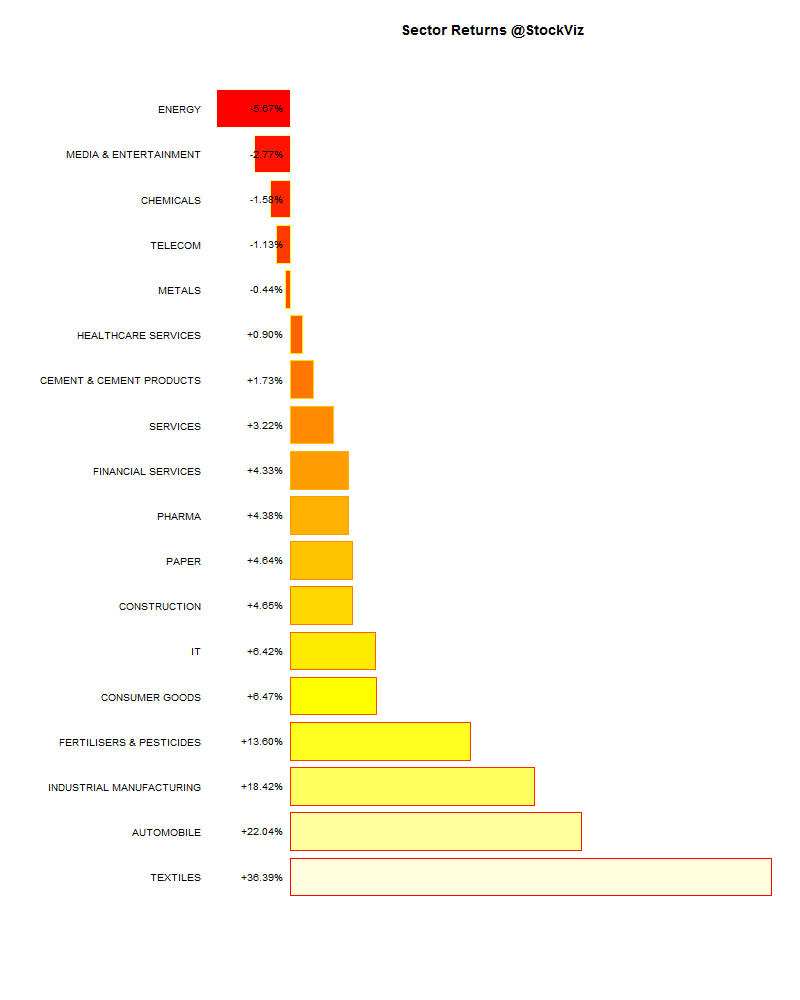

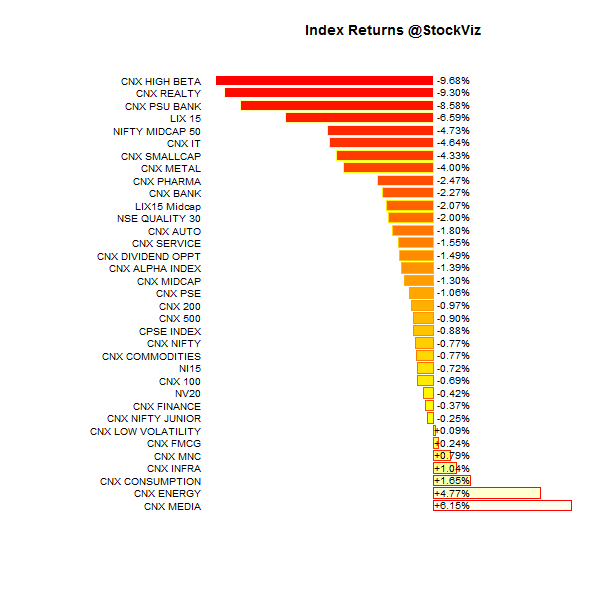

Index Returns

Market Cap Decile Performance

| Decile |

Mkt. Cap. |

Adv/Decl |

| 1 (micro) |

-5.56% |

59/70 |

| 2 |

-2.35% |

56/73 |

| 3 |

-2.72% |

58/71 |

| 4 |

-2.32% |

58/71 |

| 5 |

-0.54% |

62/67 |

| 6 |

-4.34% |

59/70 |

| 7 |

-1.46% |

64/65 |

| 8 |

-2.39% |

53/76 |

| 9 |

-2.65% |

57/72 |

| 10 (mega) |

-0.34% |

64/65 |

Midcaps got totally hammered with the Midcap Index down 4.73%.

Top Winners and Losers

Media companies as a whole did well. The CNX Media Index was the best performing index in June…

ETF Performance

Most PSU banks are just zombies at this point – the walking dead…

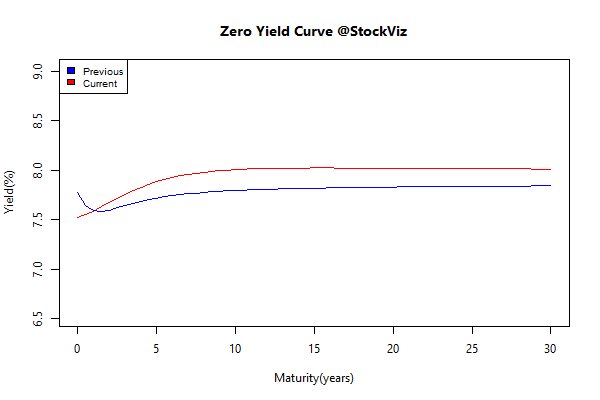

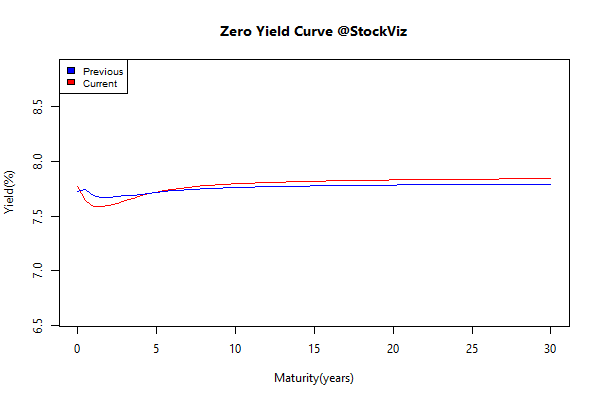

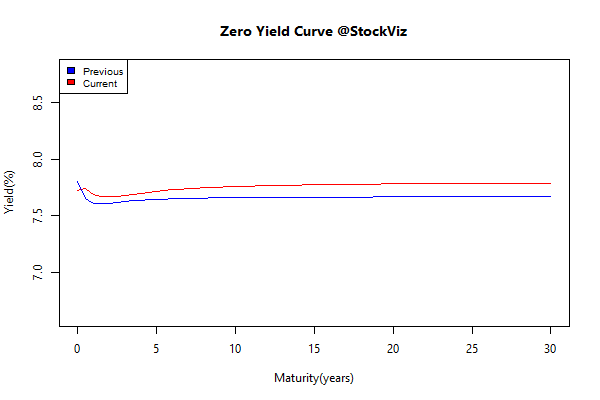

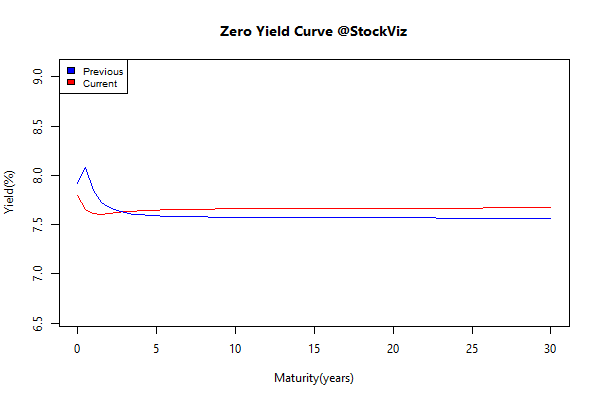

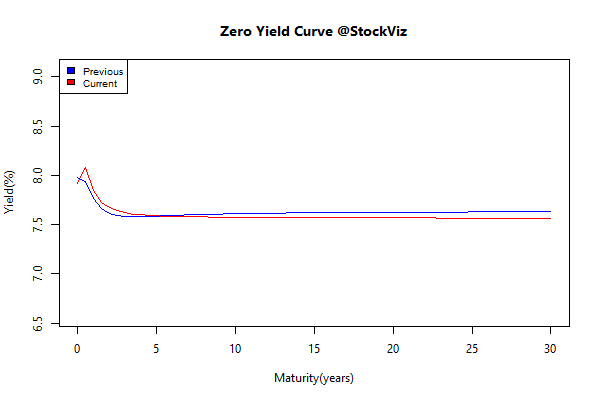

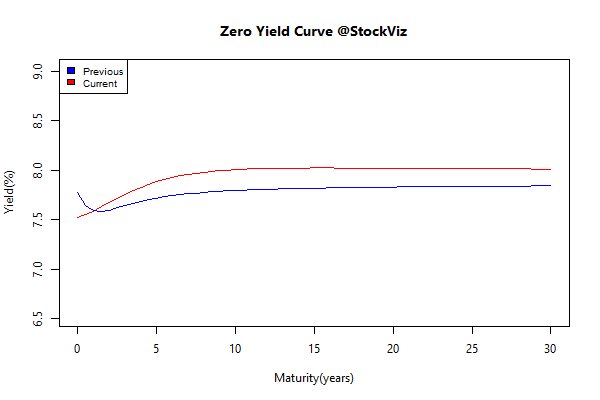

Yield Curve

Bond Indices

| Sub Index |

Change in YTM |

Total Return(%) |

| GSEC TB |

-0.51 |

+0.82% |

| GSEC SUB 1-3 |

+0.15 |

+1.17% |

| GSEC SUB 3-8 |

+0.08 |

+0.17% |

| GSEC SUB 8 |

+0.14 |

-0.97% |

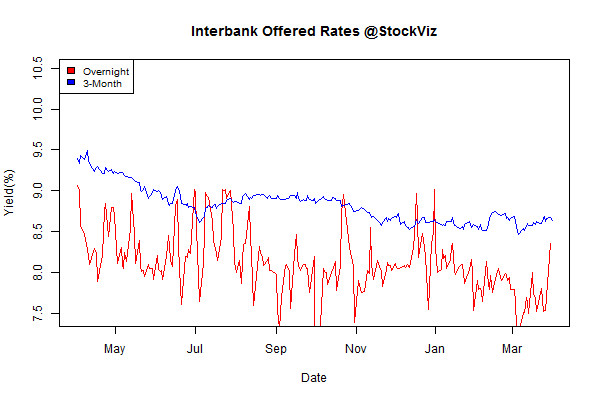

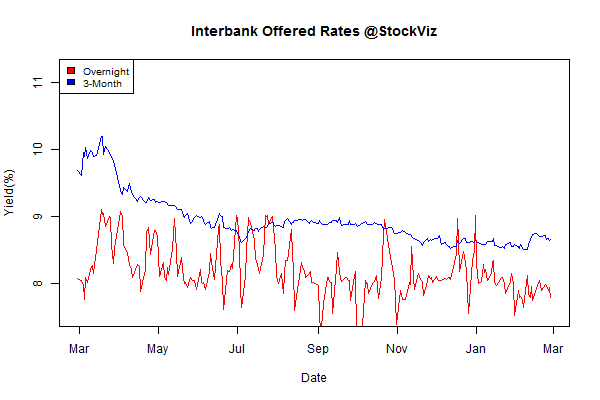

Bonds were buffeted by gyrations in international bond markets and currency volatility…

Investment Theme Performance

Most investment strategies took it on the chin…

Equity Mutual Funds

Bond Mutual Funds

Thought to sum up the month

When you’re constantly looking for a catalyst to explain every single move in the markets you start to see signals and correlations that just don’t exist. Most of the time we won’t know exactly why the markets moved a certain way until much later. Sometimes even with the benefit of perfect hindsight, investors still can’t agree on the specifics of the cause and effect. But to some the ‘why’ in the markets will always seem easy after the fact, so they keep searching for the answers.

Source: Letting Go of the Why