Equities

Commodities

| Energy |

| Brent Crude Oil |

-10.09% |

| WTI Crude Oil |

+1.01% |

| Heating Oil |

-23.24% |

| Ethanol |

+9.68% |

| Natural Gas |

-0.59% |

| RBOB Gasoline |

-0.11% |

| Metals |

| Palladium |

-8.72% |

| Silver 5000oz |

+0.60% |

| Platinum |

-2.66% |

| Gold 100oz |

-1.21% |

| Copper |

+1.48% |

| Agricultural |

| Corn |

+0.39% |

| Cotton |

-0.53% |

| Sugar #11 |

-8.55% |

| Wheat |

+3.22% |

| Coffee (Arabica) |

+2.84% |

| Coffee (Robusta) |

-5.17% |

| White Sugar |

-1.21% |

| Cattle |

+1.89% |

| Cocoa |

-4.76% |

| Lean Hogs |

-6.81% |

| Lumber |

-6.01% |

| Soybeans |

-4.13% |

| Feeder Cattle |

+9.48% |

| Orange Juice |

+2.60% |

| Soybean Meal |

-7.10% |

Credit Indices

| Index |

Change |

| Markit CDX EM |

-0.40% |

| Markit CDX NA IG |

+2.83% |

| Markit iTraxx Asia ex-Japan IG |

+1.68% |

| Markit iTraxx Australia |

-3.30% |

| Markit iTraxx Europe |

+1.27% |

| Markit iTraxx Europe Crossover |

+3.62% |

| Markit iTraxx Japan |

-7.25% |

| Markit iTraxx SovX Western Europe |

-0.63% |

| Markit LCDX (Loan CDS) |

-0.10% |

| Markit MCDX (Municipal CDS) |

+3.28% |

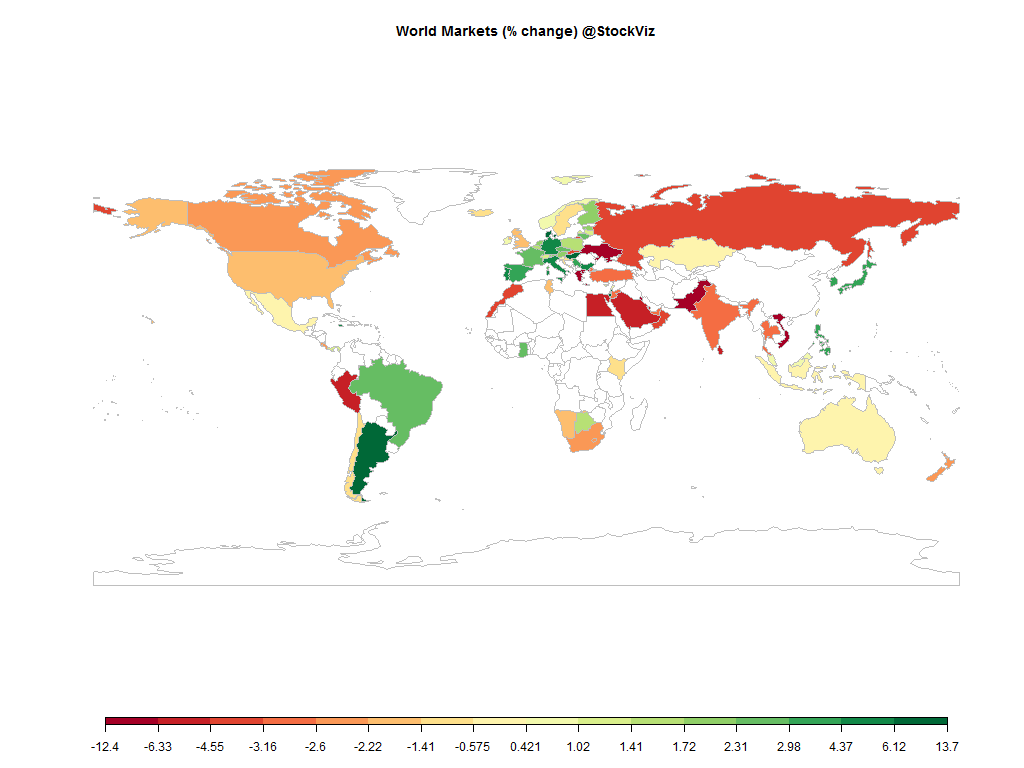

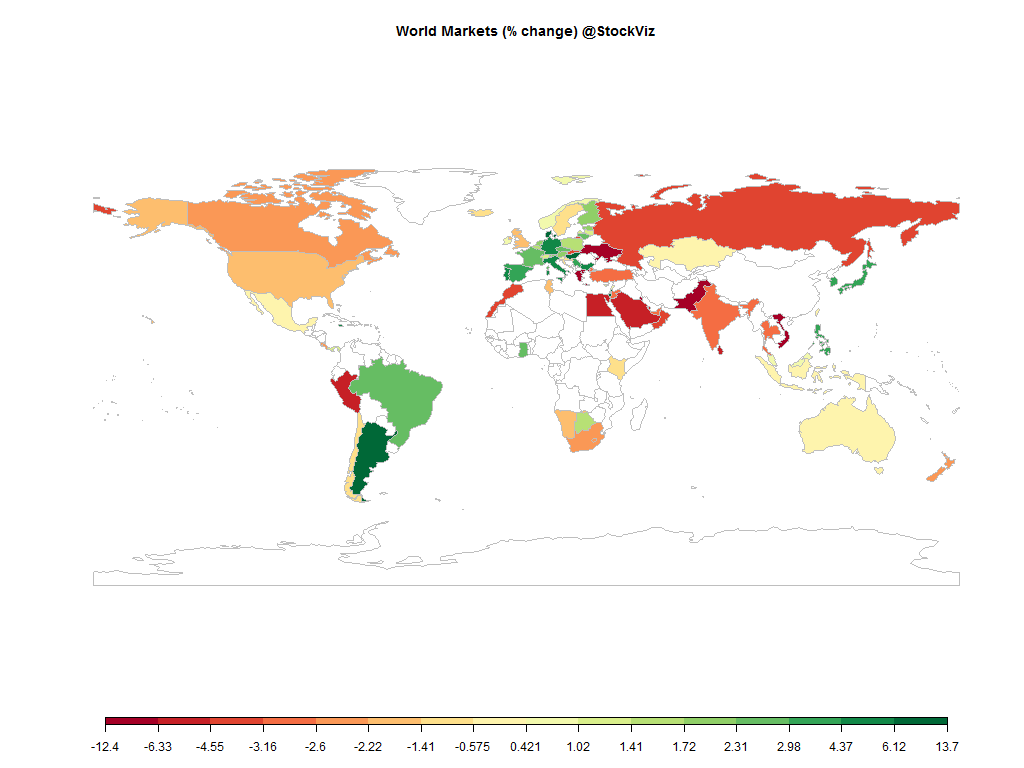

The Shanghai stock market was on fire this month while Europe was enjoying QE sugar highs. Nifty got dinged early on but recovered towards the end of the month.

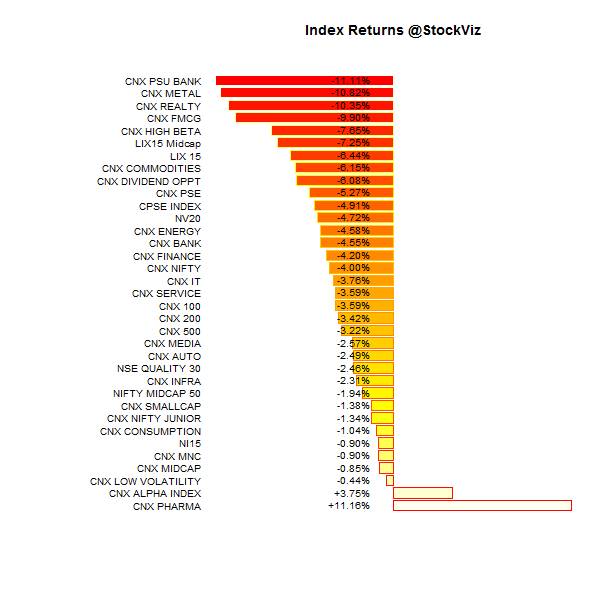

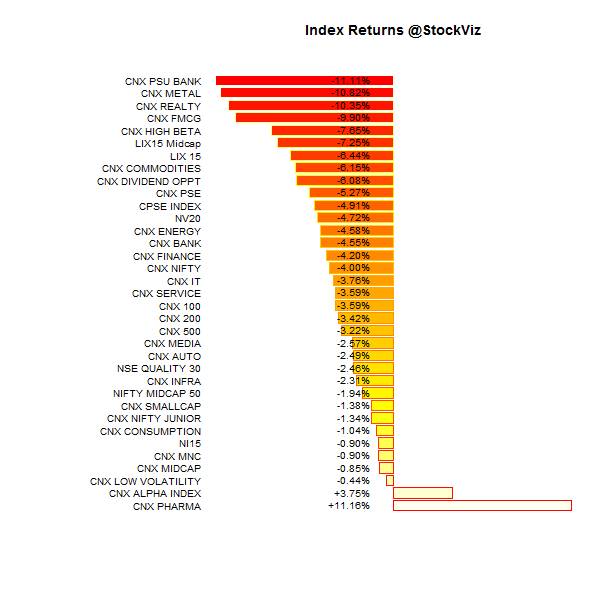

Index Returns

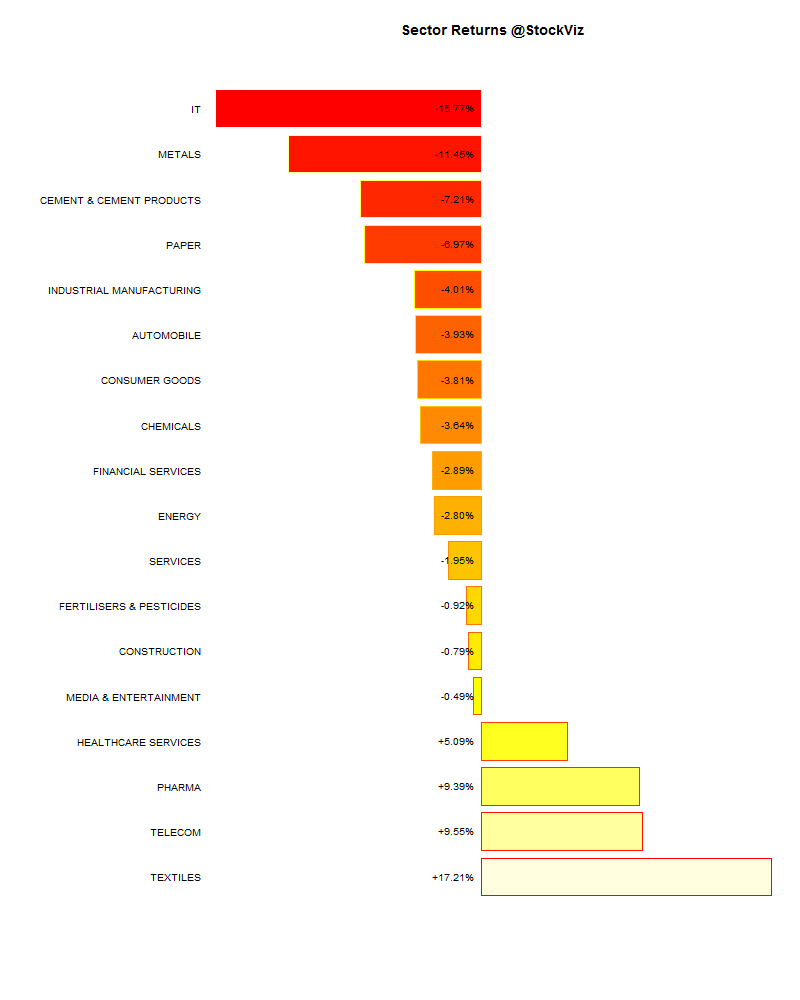

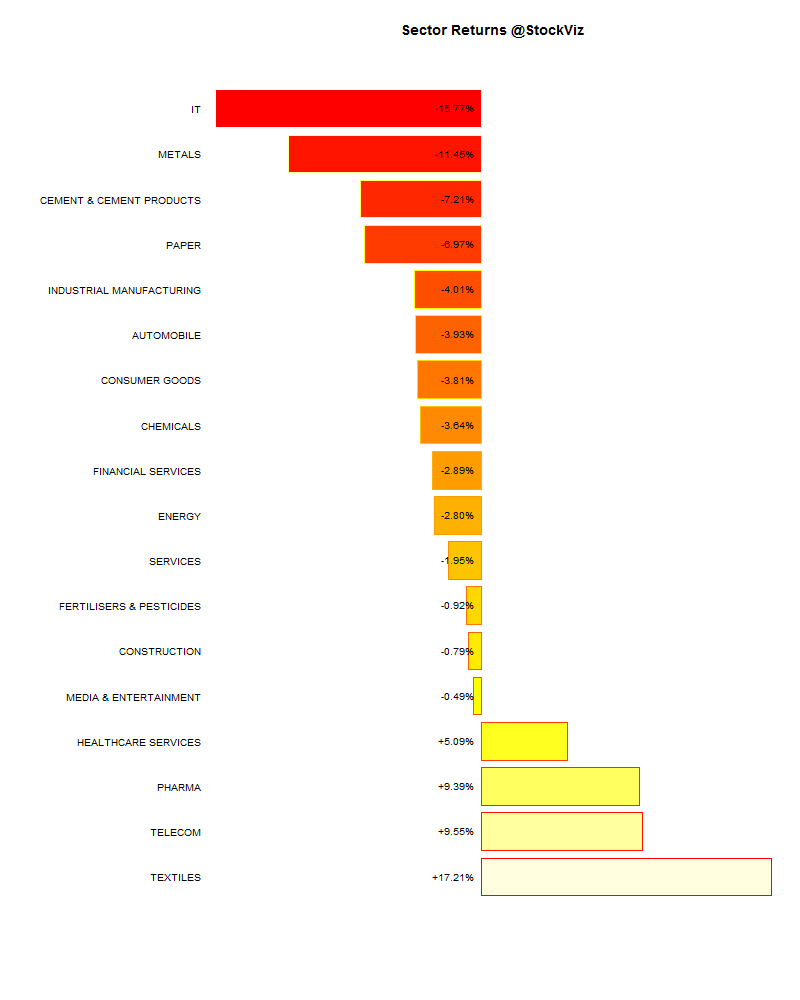

Sector Performance

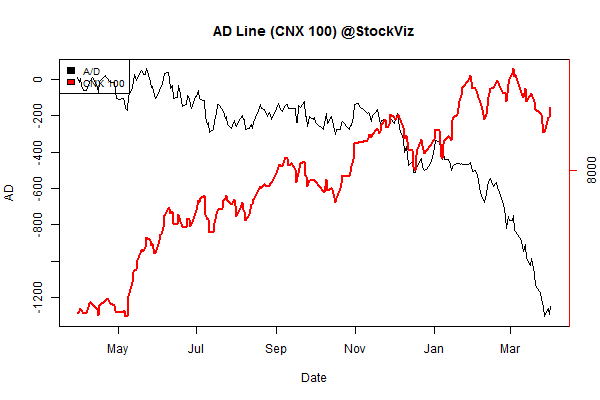

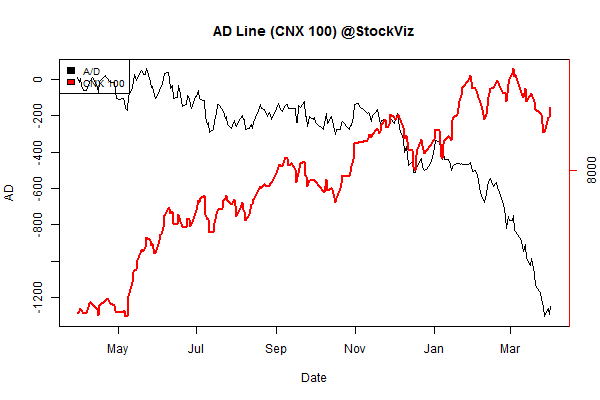

Advance Decline

Market Cap Decile Performance

| Decile |

Mkt. Cap. |

Adv/Decl |

| 1 (micro) |

-13.05% |

64/69 |

| 2 |

-11.54% |

52/81 |

| 3 |

-10.26% |

47/86 |

| 4 |

-5.80% |

62/71 |

| 5 |

-6.35% |

57/75 |

| 6 |

-4.82% |

55/78 |

| 7 |

-2.37% |

66/67 |

| 8 |

-0.22% |

76/57 |

| 9 |

+0.71% |

67/66 |

| 10 (mega) |

-1.25% |

68/65 |

Red ink across the board with small caps hit exceptionally hard…

Top Winners and Losers

Pharma broadly out-performed the rest…

ETF Performance

PSU banks – have they finally found a bottom?

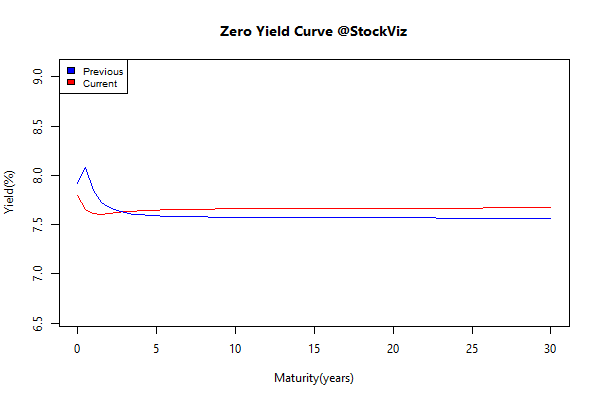

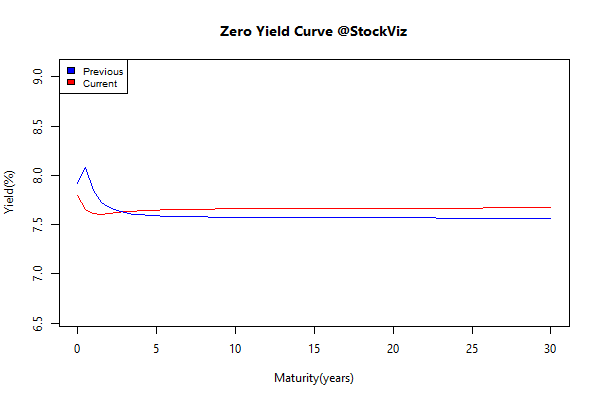

Yield Curve

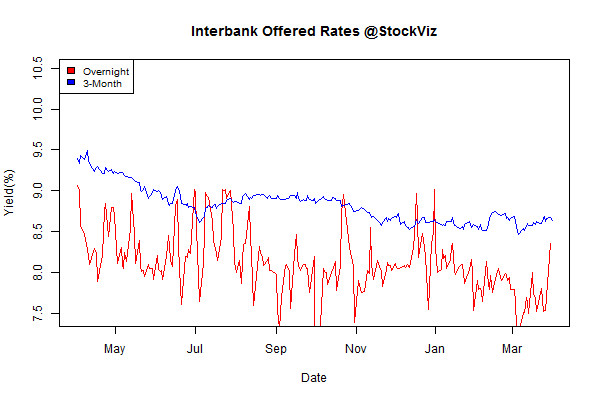

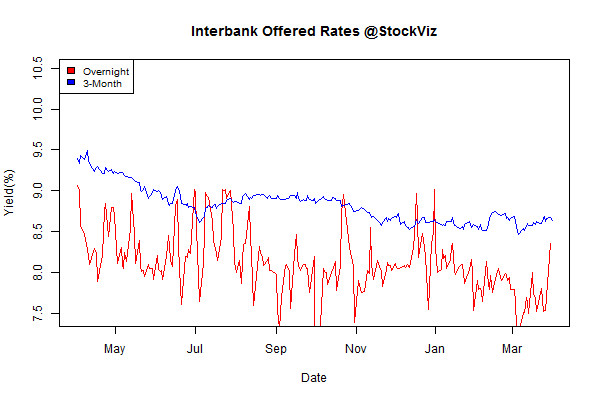

Interbank lending rates

Bond Indices

| Sub Index |

Change in YTM |

Total Return(%) |

| GSEC TB |

-0.16 |

+0.73% |

| GSEC SUB 1-3 |

+0.05 |

+0.47% |

| GSEC SUB 3-8 |

+0.00 |

+0.87% |

| GSEC SUB 8 |

-0.01 |

+0.29% |

Almost motionless…

Investment Theme Performance

Equity Mutual Funds

Bond Mutual Funds

Something to think about

China is letting low-cost production shift out of the country and is focusing instead on capital-intensive industries. Chinese labor costs have soared, undermining the calculus that brought all those jobs to China in the first place, and new robot technology is cheaper and easier to deploy than ever before.

But, if everybody has access to the same technology, why manufacture in China and pay shipping?

Source: WSJ

Comments are closed, but trackbacks and pingbacks are open.