MOMENTUM

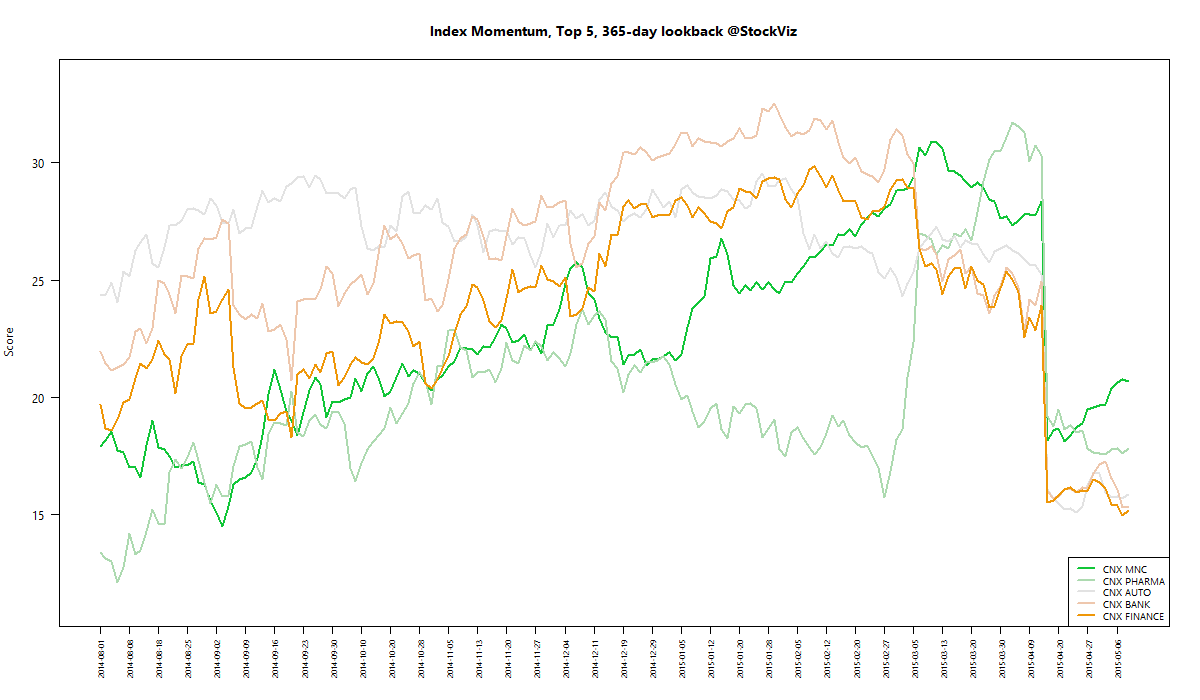

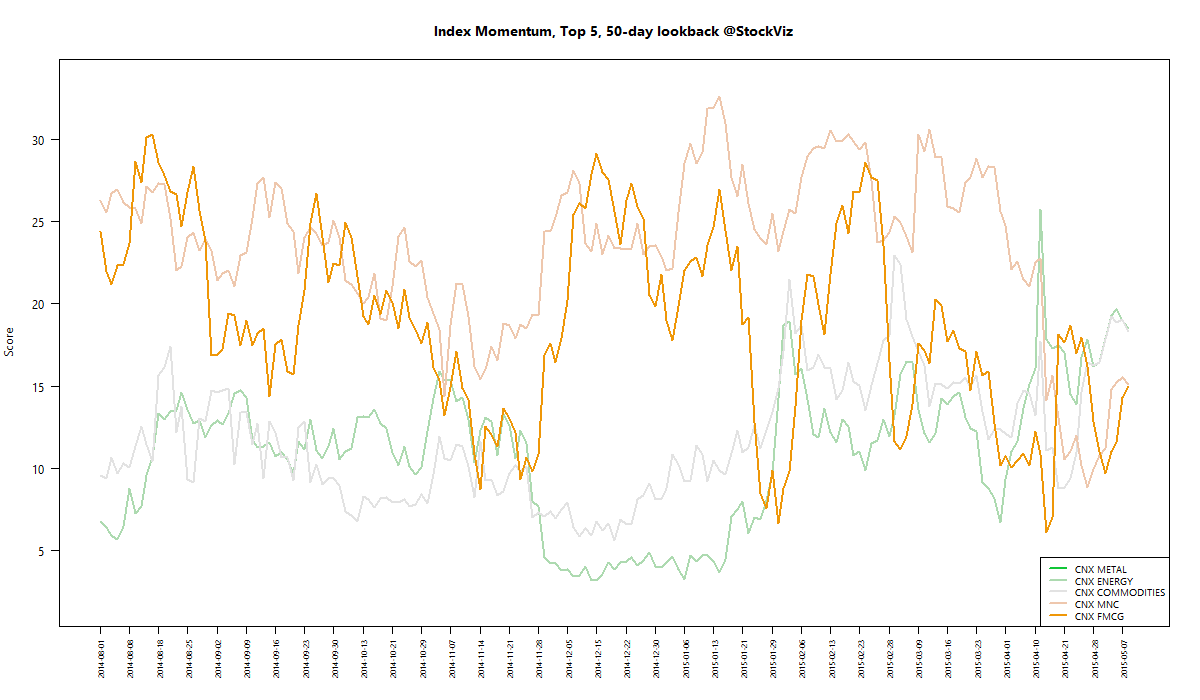

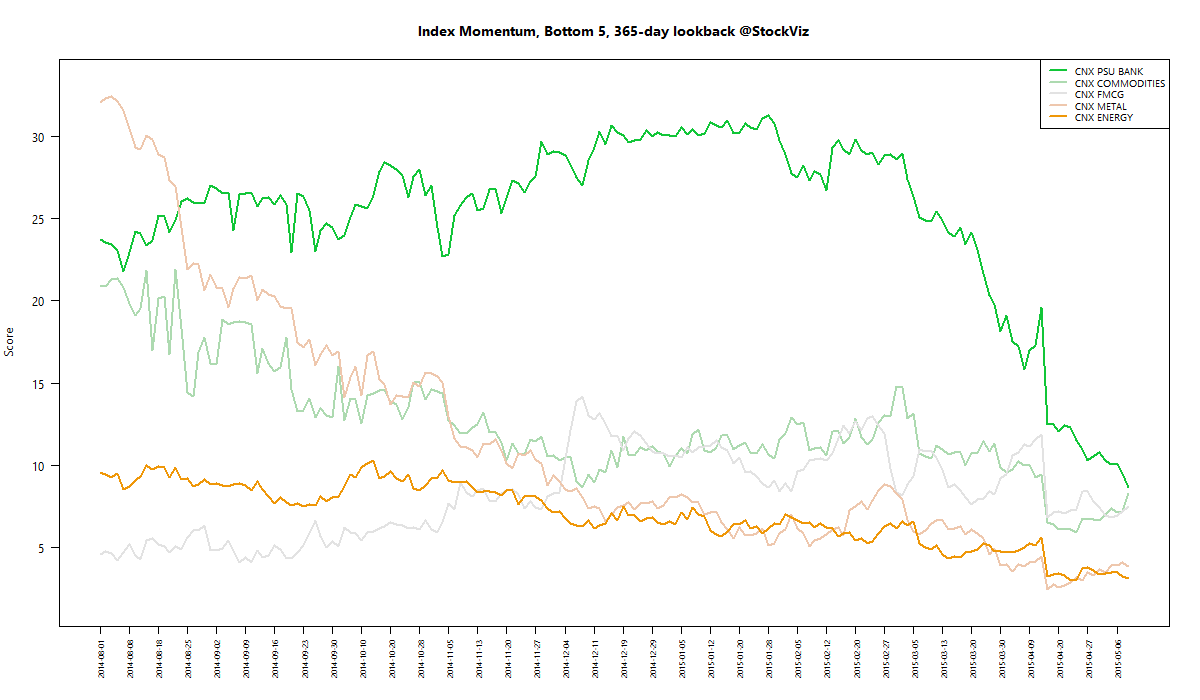

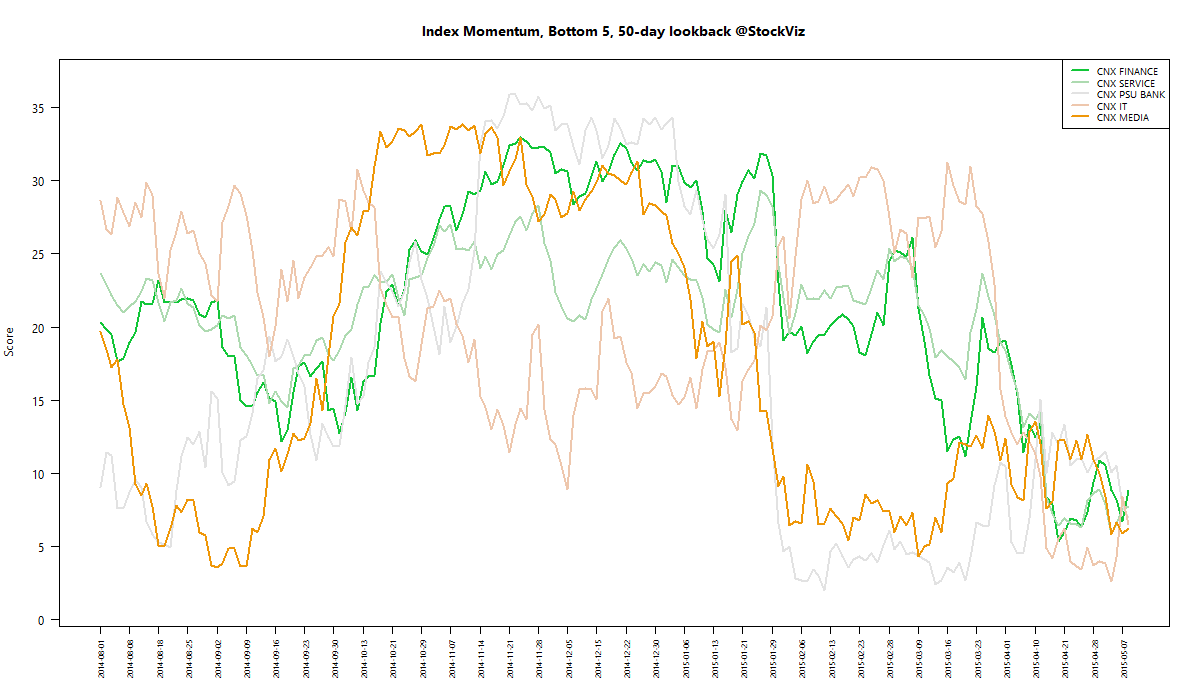

We run our proprietary momentum scoring algorithm on indices just like we do on stocks. You can use the momentum scores of sub-indices to get a sense for which sectors have the wind on their backs and those that are facing headwinds.

Traders can pick their longs in sectors with high short-term momentum and their shorts in sectors with low momentum. Investors can use the longer lookback scores to position themselves using our re-factored index Themes.

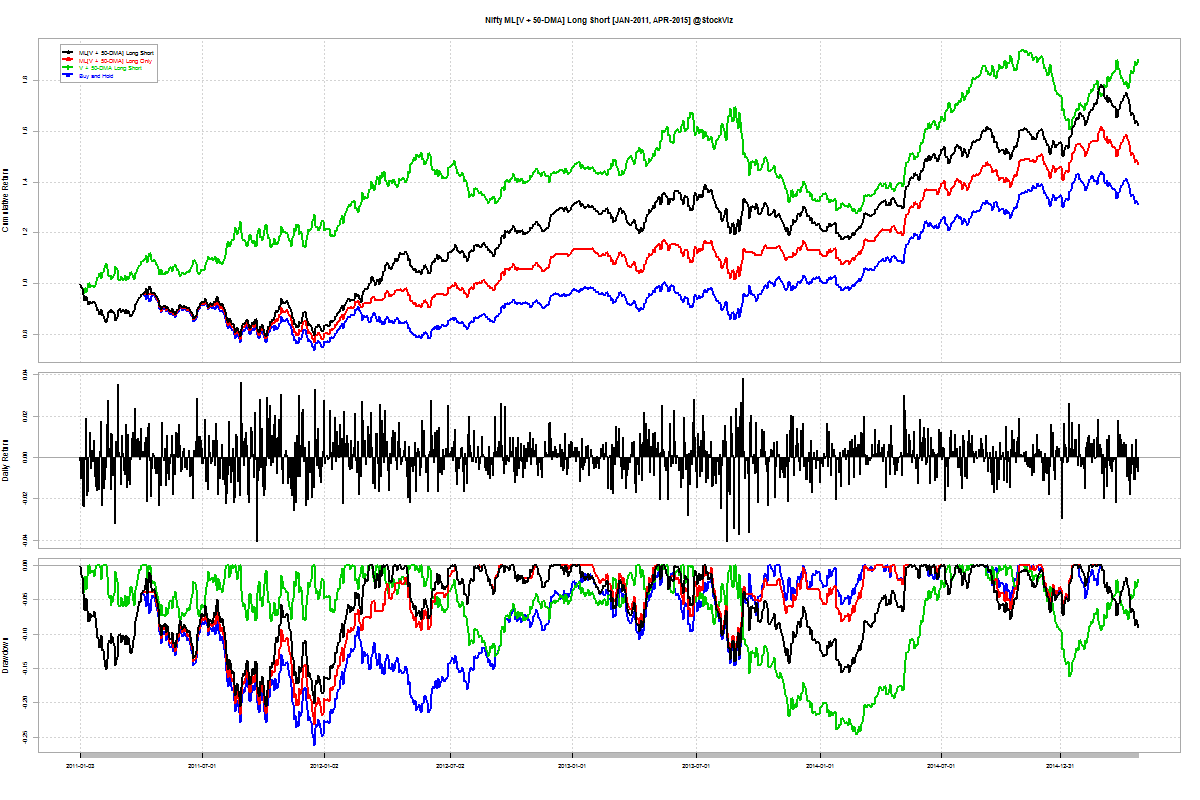

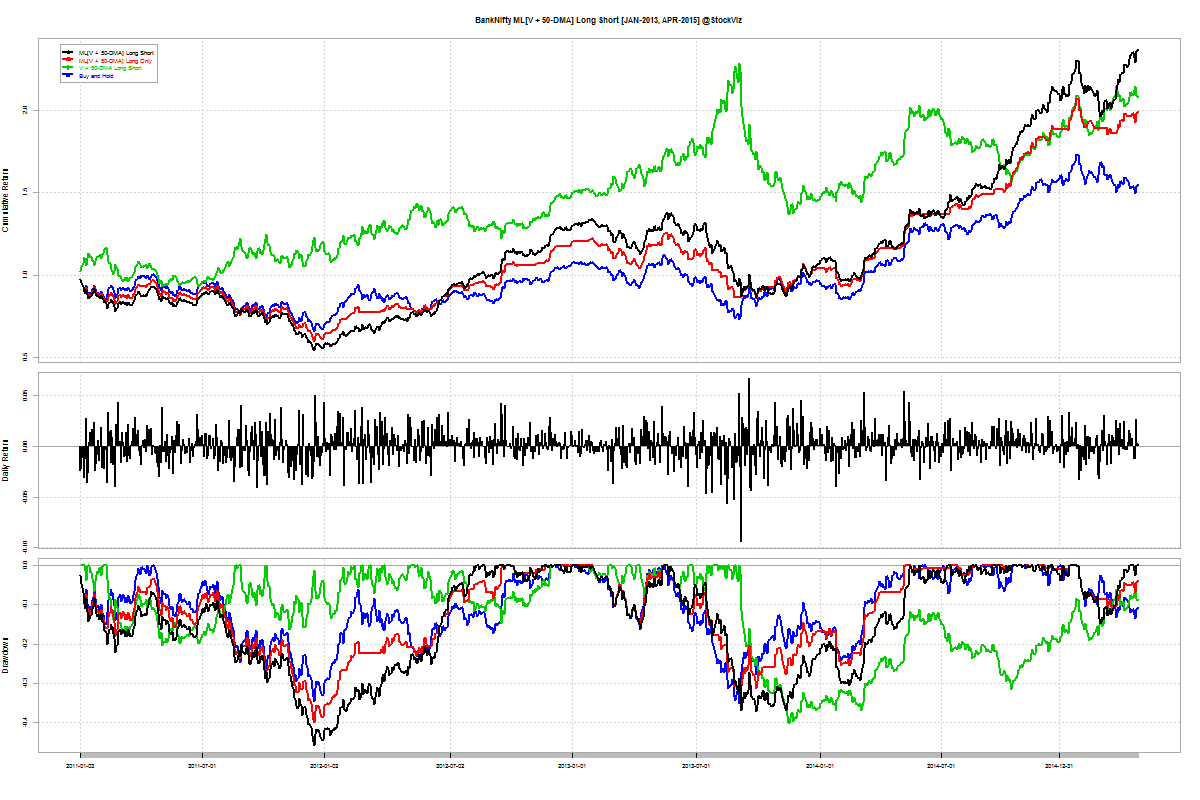

You can see how the momentum algorithm has performed on individual stocks here.

Here are the best and the worst sub-indices:

Refactored Index Performance

50-day performance, from February 24, 2015 through May 08, 2015:

Trend Model Summary

| Index | Signal | % From Peak | Day of Peak |

|---|---|---|---|

| CNX AUTO | SHORT |

9.89

|

2015-Jan-27

|

| CNX BANK | SHORT |

13.42

|

2015-Jan-27

|

| CNX ENERGY | SHORT |

30.10

|

2008-Jan-14

|

| CNX FMCG | SHORT |

10.93

|

2015-Feb-25

|

| CNX INFRA | SHORT |

50.20

|

2008-Jan-09

|

| CNX IT | SHORT |

88.30

|

2000-Feb-21

|

| CNX MEDIA | SHORT |

30.20

|

2008-Jan-04

|

| CNX METAL | SHORT |

55.67

|

2008-Jan-04

|

| CNX MNC | SHORT |

5.36

|

2015-Mar-12

|

| CNX NIFTY | SHORT |

8.95

|

2015-Mar-03

|

| CNX PHARMA | SHORT |

12.48

|

2015-Apr-08

|

| CNX PSE | SHORT |

27.69

|

2008-Jan-04

|

| CNX REALTY | SHORT |

88.96

|

2008-Jan-14

|