Introduction

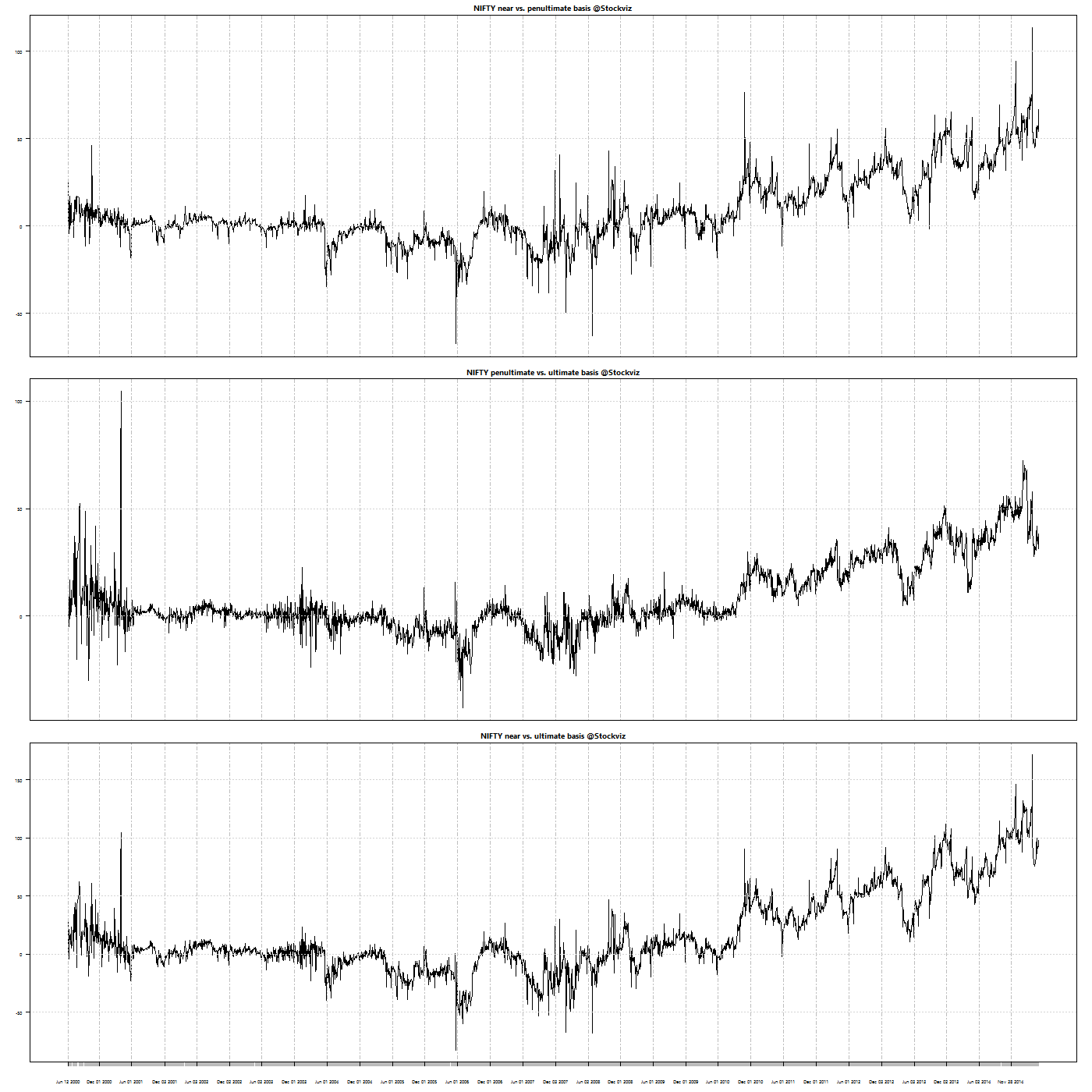

When we discussed cash-futures basis, it was pointed out that the fair value of a futures contract is a function of the underlying price, interest rates, dividends and time to expiration. The same logic applies to the fair value of contracts across expiration dates. For example, as of close on April 30, 2015, NIFTY futures contracts had the following values: 8177.35 (April), 8244.05 (May), 8275.30 (June).

Some of our clients wanted us to check if this basis can be traded. Is it possible to profit from going long the near contract and short the far contract on a consistent basis? Before we look at profitability, lets chart the basis.

The basis

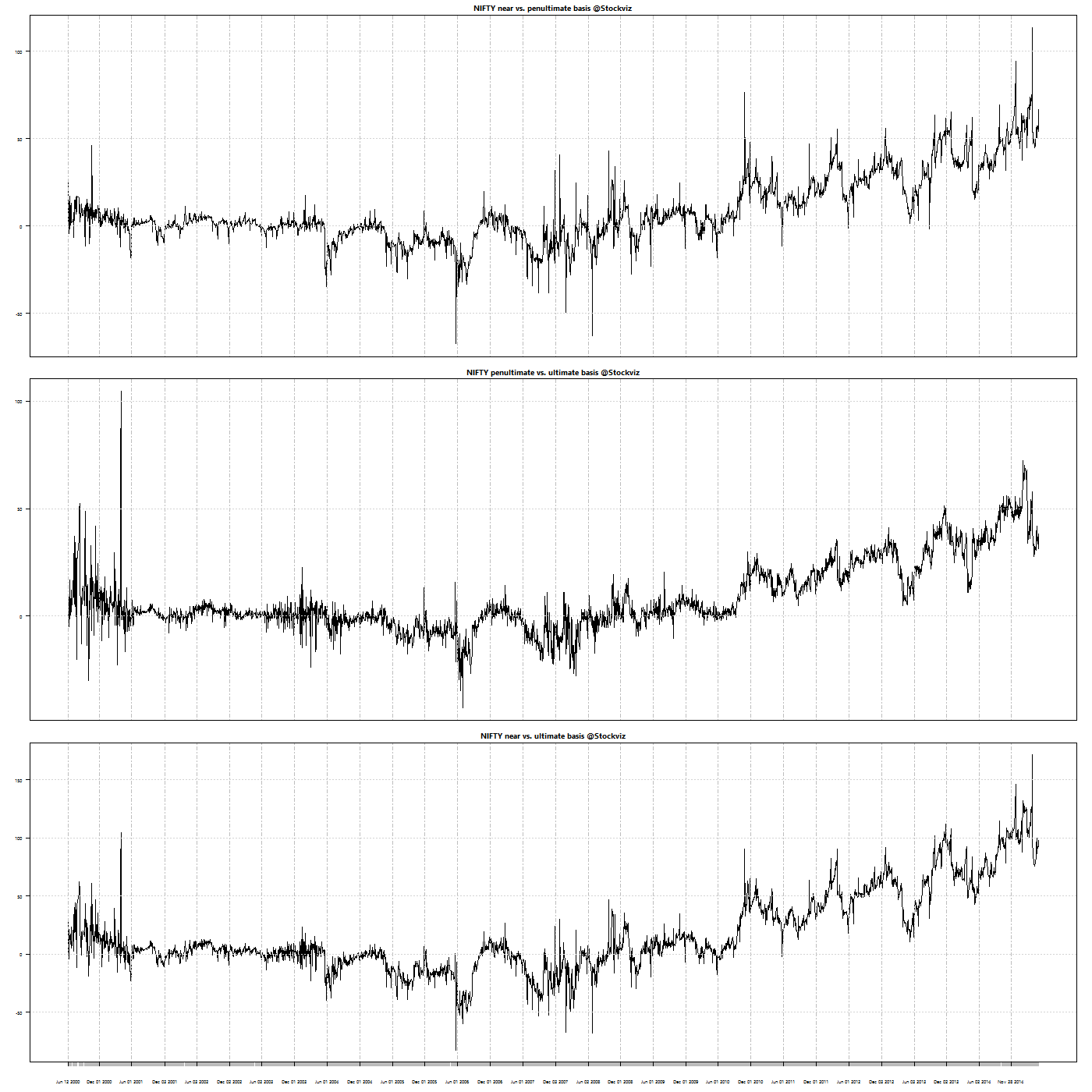

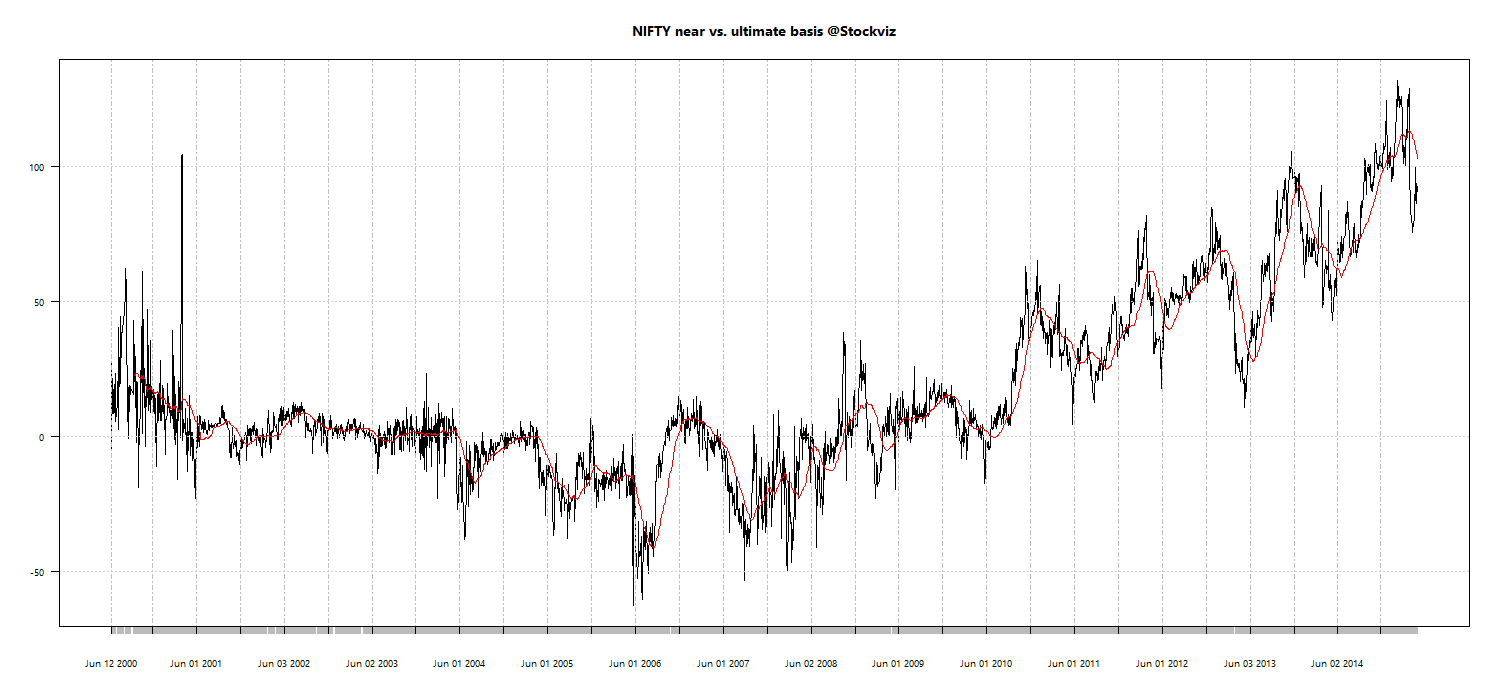

Here is how the basis between different contracts look (2000 through now):

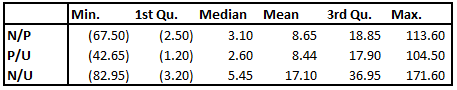

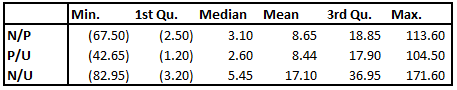

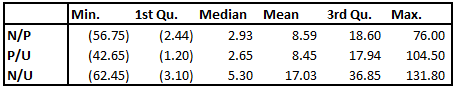

Here is the summary statistic of the basis:

Here is the same data with futures expiry dates removed:

With the extreme values removed, we can now check if we can trade the nearest expiry contract with the farthest.

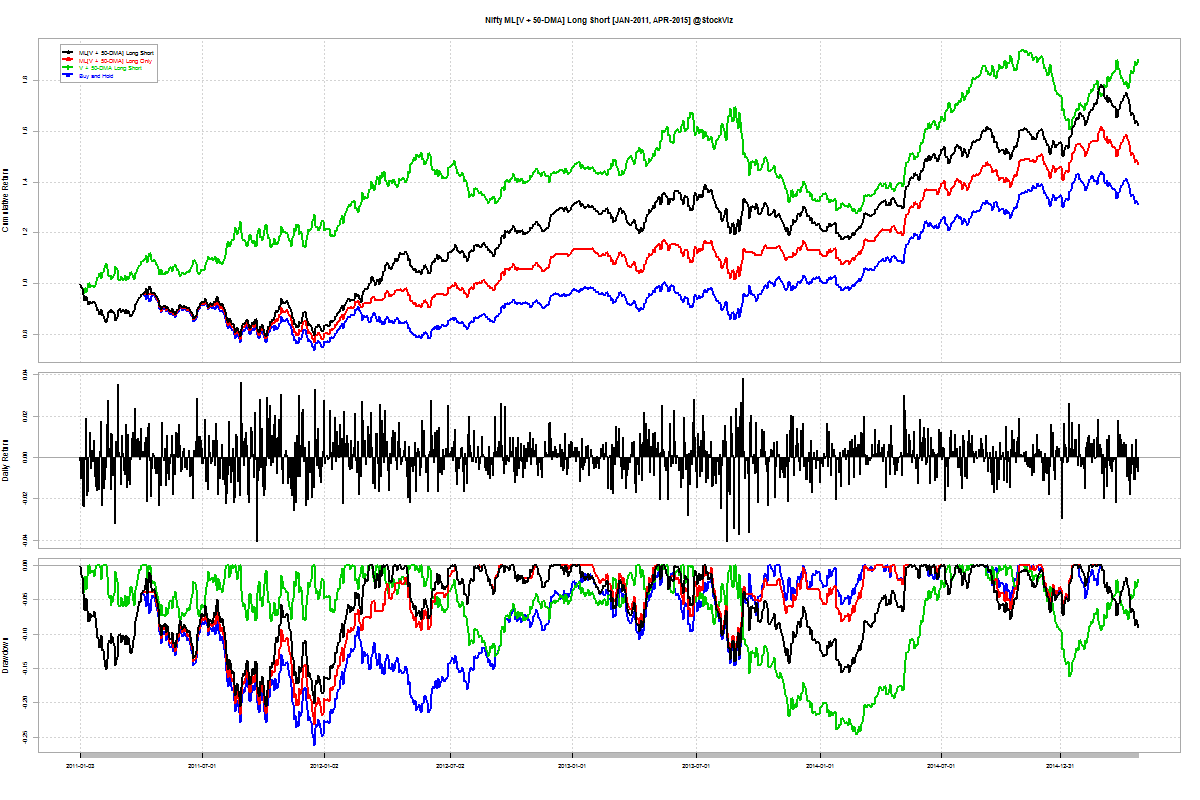

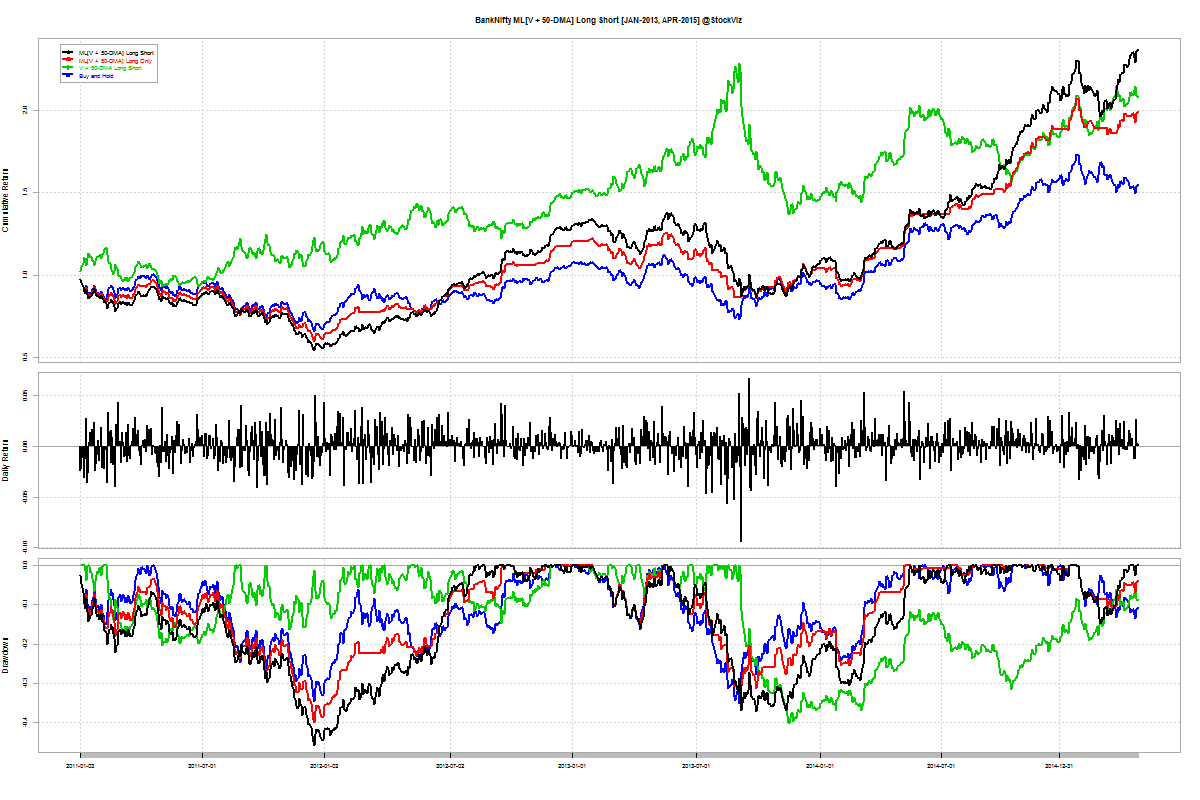

50-day Average Basis Trade Back-Test

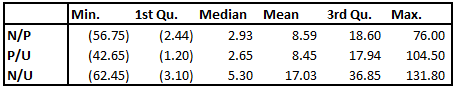

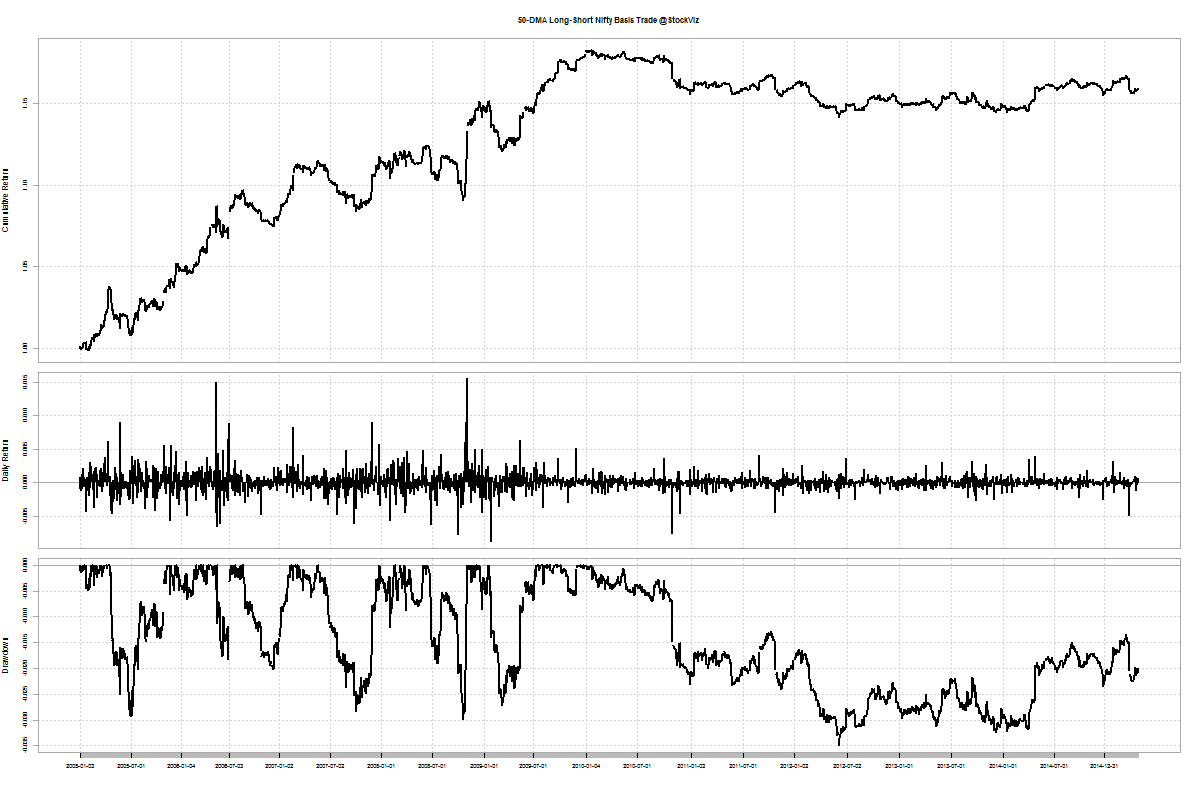

Lets take a look at the Near vs. Farthest basis and draw a 50-dma through it:

The basis is not stable and what’s worse, it appears to be trending. Lets try our simple trading rule: go long the basis if it is above 50-dma and short if otherwise.

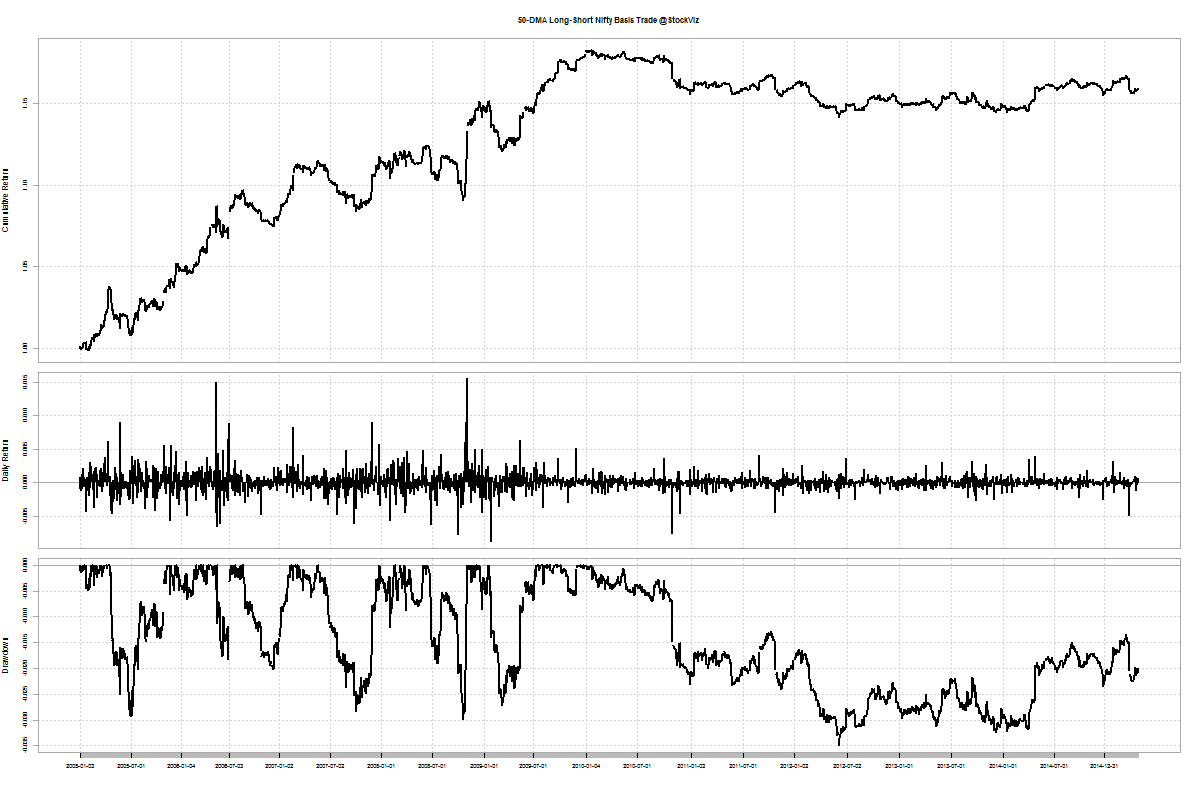

Here’s how the back-test works out (2005 through now):

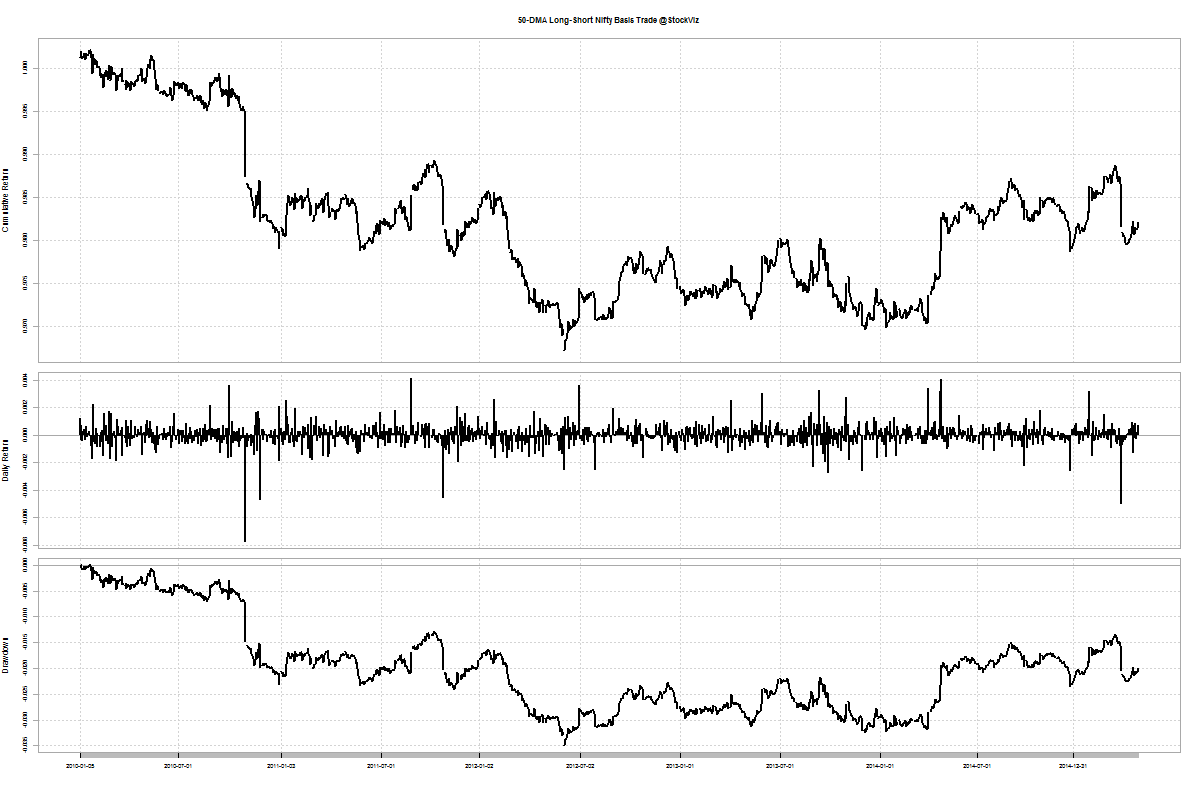

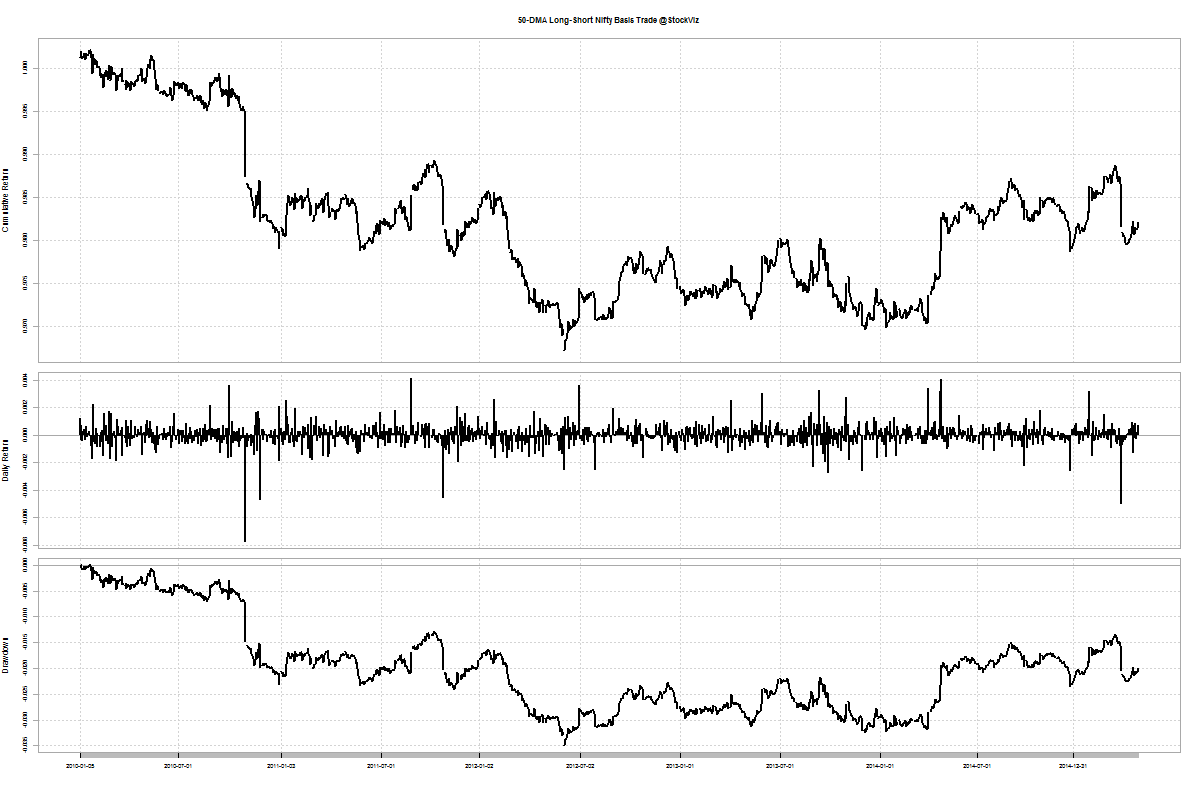

Lets check the back-test on a smaller subset (2010 through now):

A ~20% profit in a 10 year time-frame is barely enough to cover transaction costs. Besides, it looks like the strategy hit a wall in 2010.

Conclusion

It appears that the basis trade described above is not profitable enough after considering transaction costs and taxes. Also, whatever meager profits were there seem to have been arbitraged away lately.