Recommendations on Media

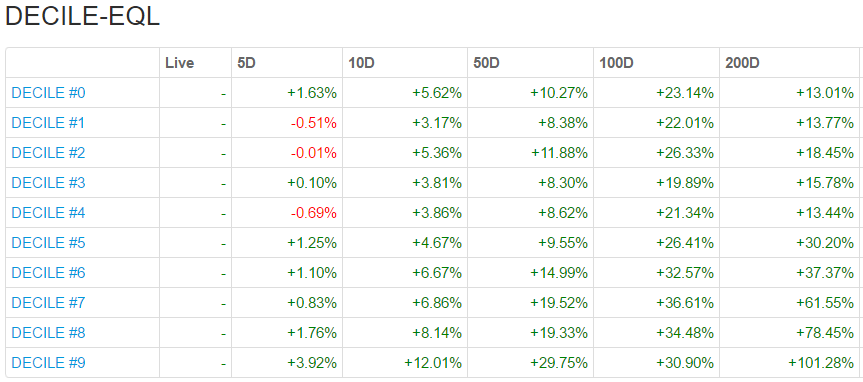

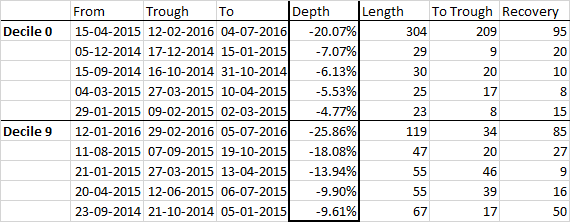

Analysts, brokers and pundits often appear on financial media with a ready list of stocks that investors should buy. Some of them are collated into lists by the Economic Times, Money Control, etc. We turn these lists into equally weighted portfolios and track them. We call them Doodh Ka Doodh Pani ka Pani.

Doodh ya Pani?

We look at 260 trading days worth of returns of these portfolios and compare them with NIFTY and MIDCAP 100 FREE returns during the same time period. 260 trading days approximates to one calendar year — a tax-free holding period and an upper limit of an average retail investor’s patience with investment tips.

Observations

Of the 47 lists we analyzed, the average out-performance was about +1.5% (vs. the MidCap index.)

We created two Themes out of the stocks in ‘Religare Retail Lucky 13 mid-cap redux.’ One was a minimum variance portfolio and the other one was an equal-weighted portfolio. The minimum variance portfolio out-performed the equal-weighted one. Food for thought.

Morgan Stanley had come out with two lists before the General Elections – one was supposed to do very well if Modi got elected and the other if he didn’t. Ironically, ‘Morgan Stanley Fragmented Election 2013-12’ out-performed ‘Morgan Stanley Strong Election 2013-12’ but both under-performed the Midcap Index.

Espirito Santos Silver bullets turned out to be blanks.

Kotak should do a better job with their Diwali picks.

What next?

We hope that these guys continue to put out lists so that we can track them. We admit that 47 is too small a sample to draw any conclusions. If you come across any such lists that are ‘subscription only’, i.e., not available on the ET or MC websites, please send them to info@stockviz.biz. We would love to track them all.