MOMENTUM

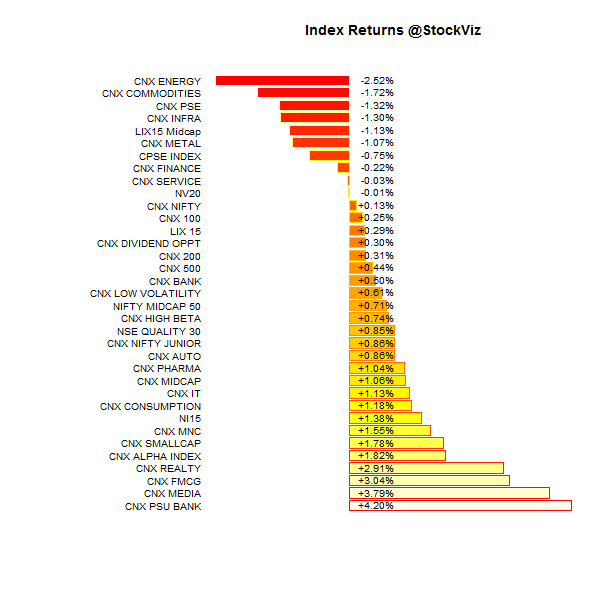

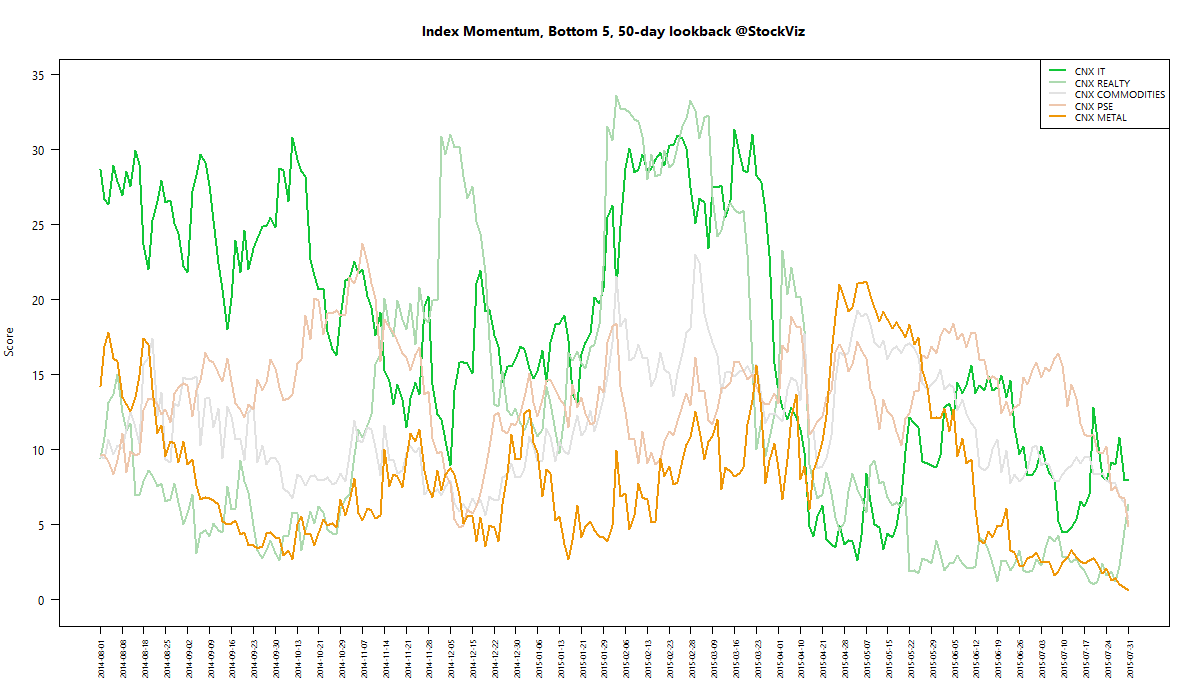

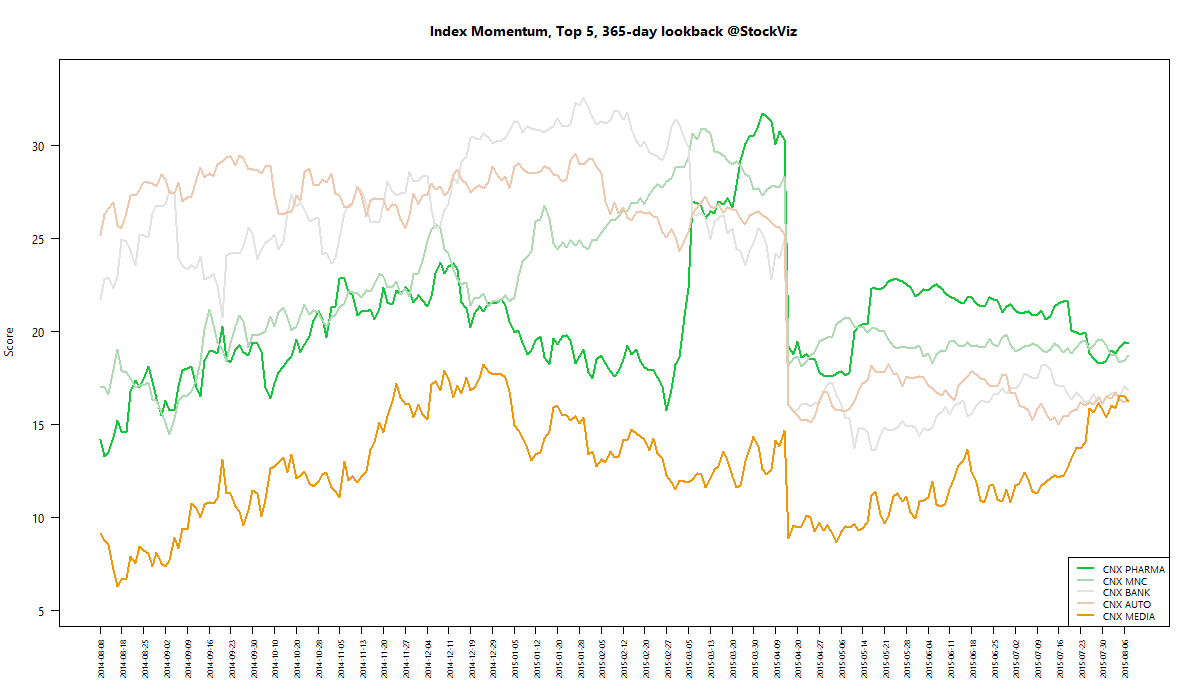

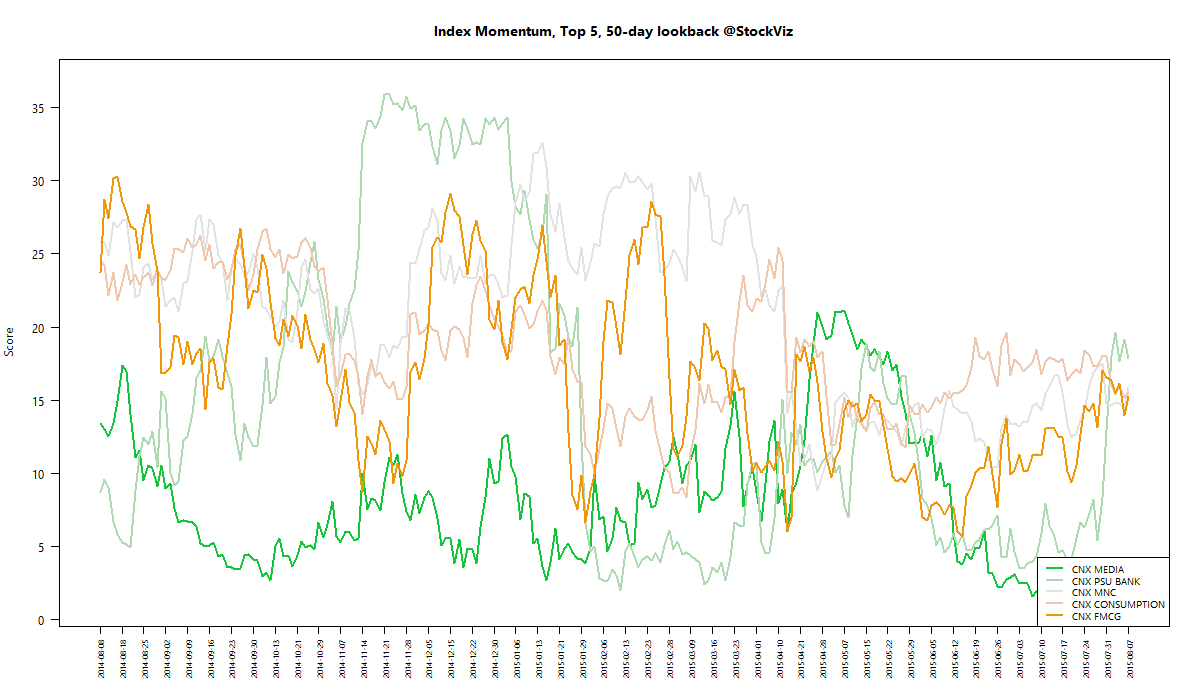

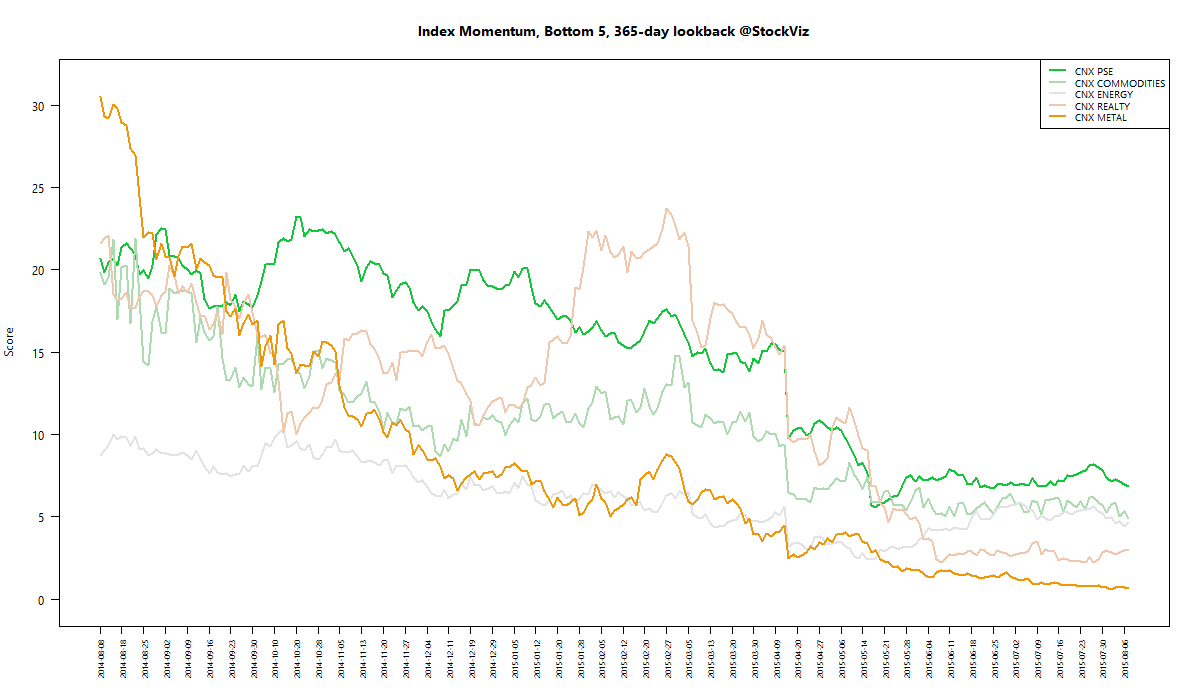

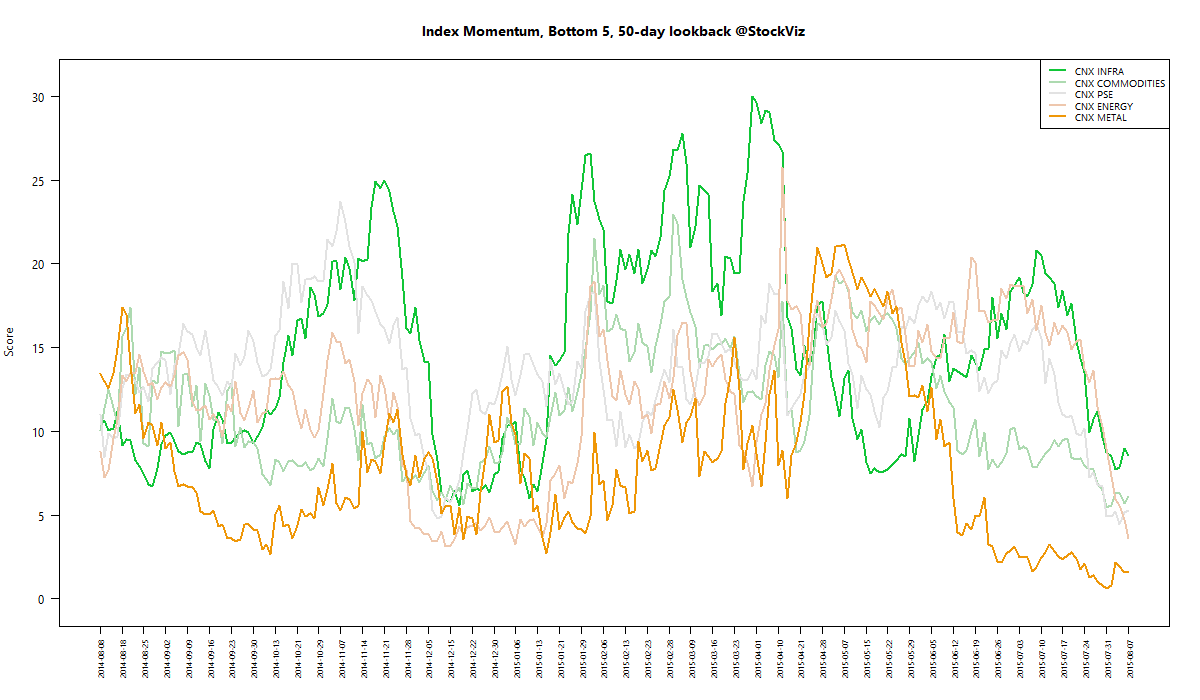

We run our proprietary momentum scoring algorithm on indices just like we do on stocks. You can use the momentum scores of sub-indices to get a sense for which sectors have the wind on their backs and those that are facing headwinds.

Traders can pick their longs in sectors with high short-term momentum and their shorts in sectors with low momentum. Investors can use the longer lookback scores to position themselves using our re-factored index Themes.

You can see how the momentum algorithm has performed on individual stocks here.

Here are the best and the worst sub-indices:

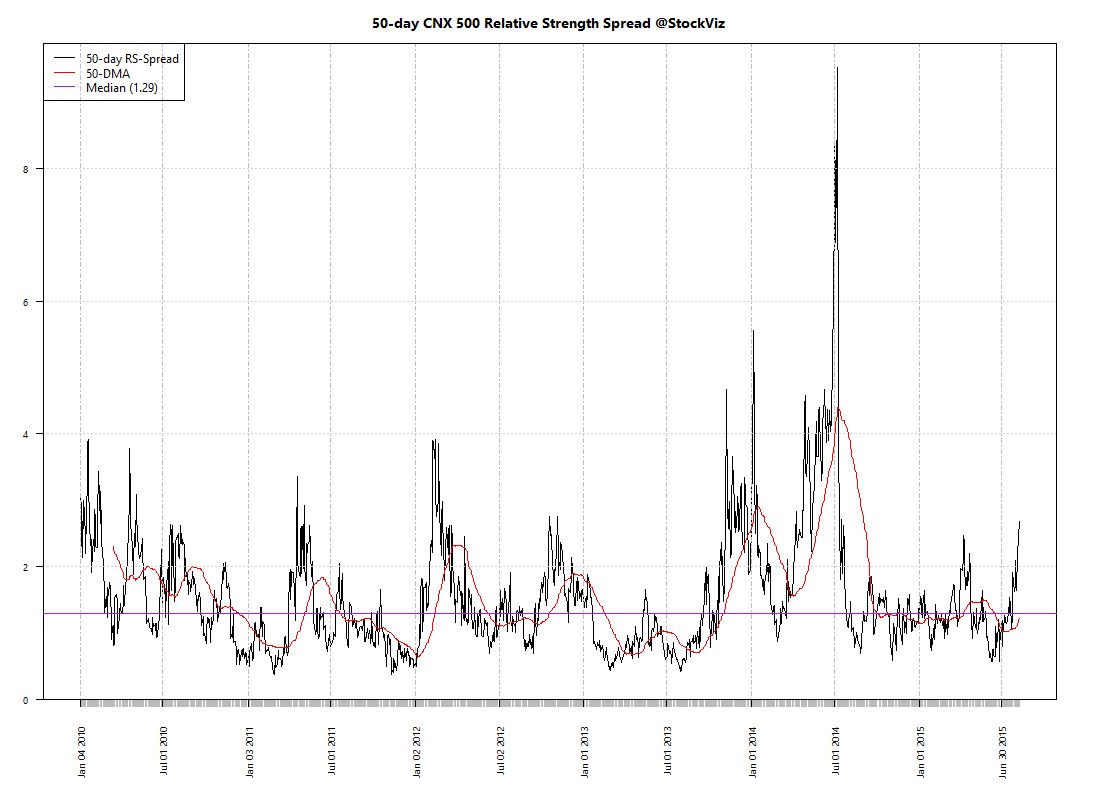

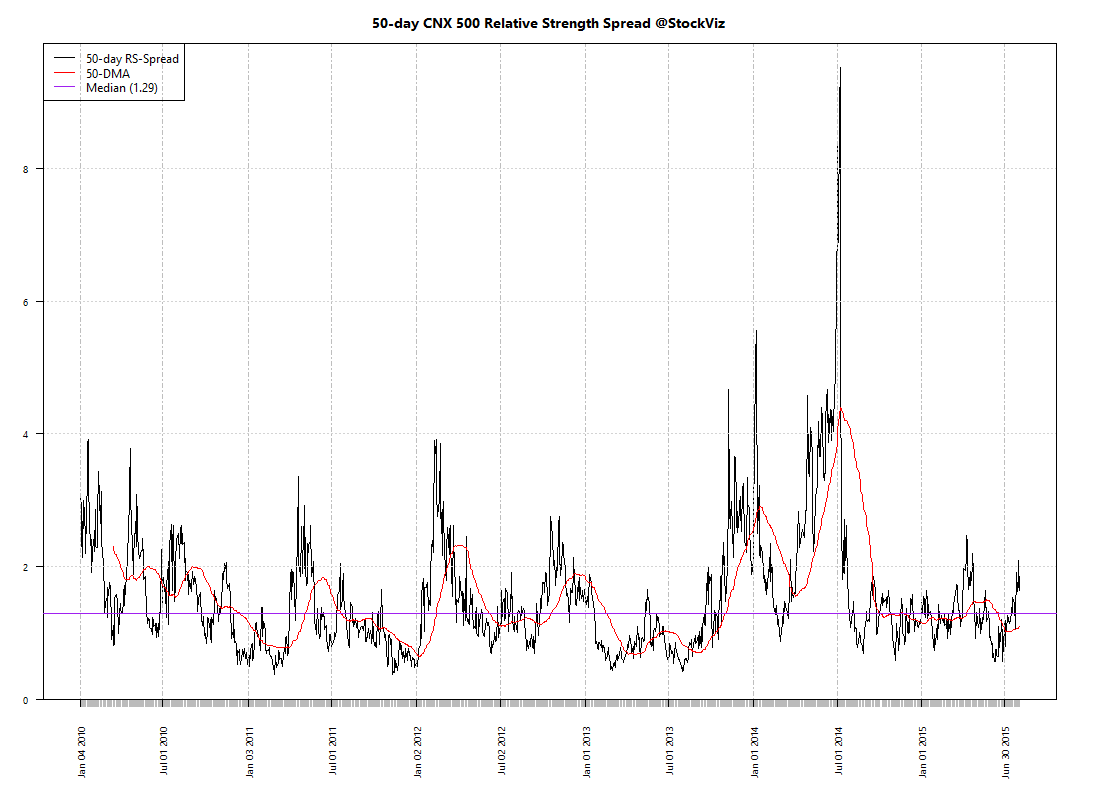

Relative Strength Spread

Refactored Index Performance

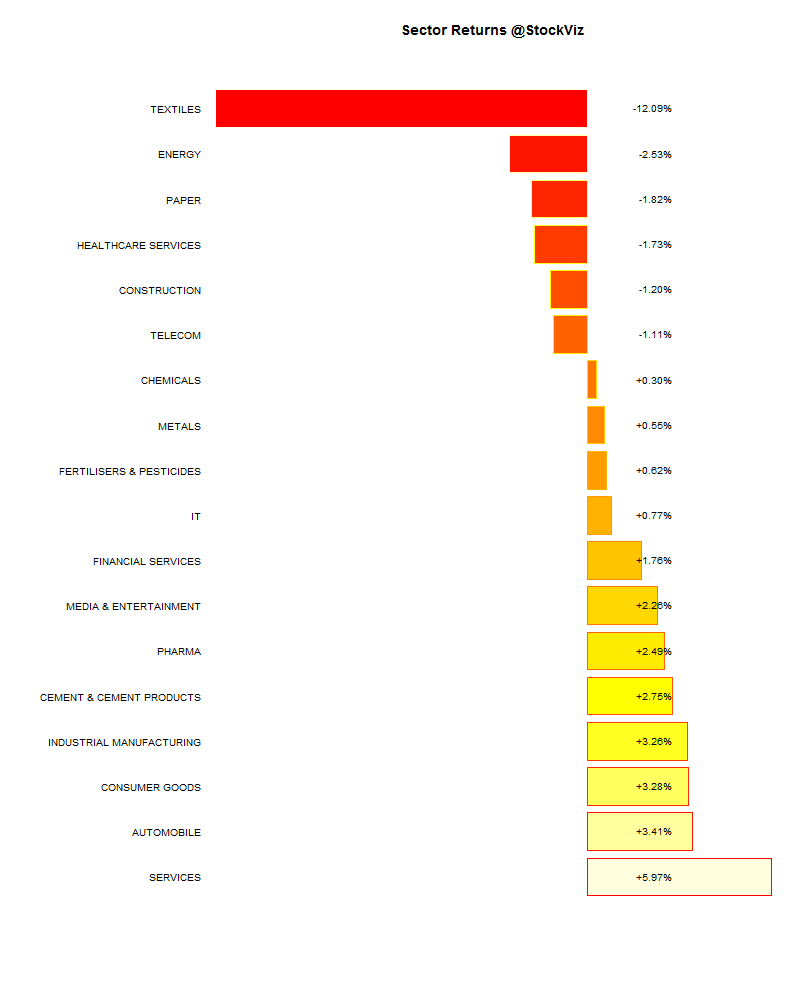

50-day performance, from June 01, 2015 through August 07, 2015:

Trend Model Summary

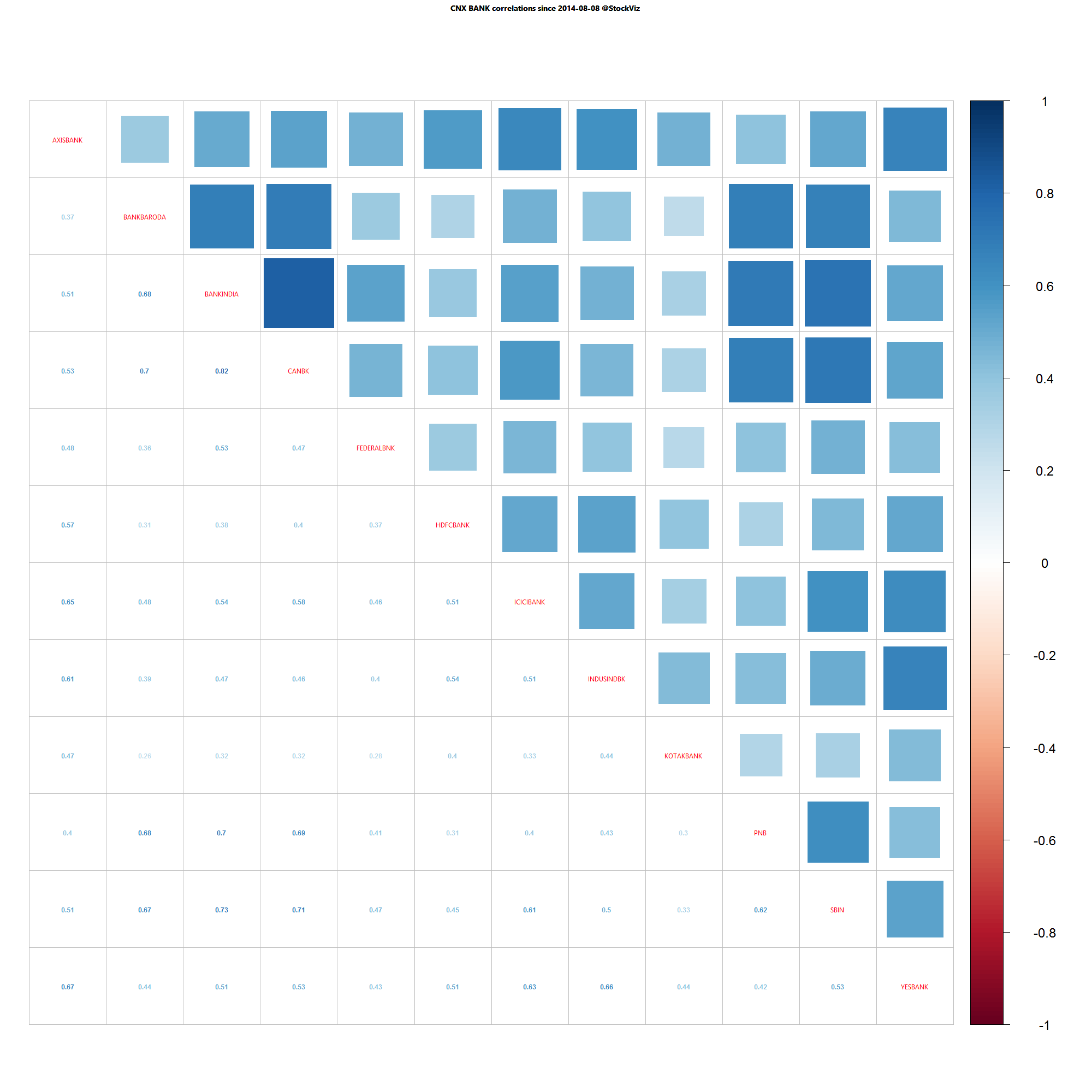

| Index | Signal | % From Peak | Day of Peak |

|---|---|---|---|

| CNX AUTO | LONG |

3.26

|

2015-Jan-27

|

| CNX BANK | LONG |

8.08

|

2015-Jan-27

|

| CNX COMMODITIES | SHORT |

28.46

|

2008-Jan-04

|

| CNX CONSUMPTION | LONG |

0.52

|

2015-Aug-05

|

| CNX ENERGY | LONG |

27.88

|

2008-Jan-14

|

| CNX FMCG | LONG |

6.25

|

2015-Feb-25

|

| CNX INFRA | SHORT |

47.01

|

2008-Jan-09

|

| CNX IT | SHORT |

87.86

|

2000-Feb-21

|

| CNX MEDIA | LONG |

15.34

|

2008-Jan-04

|

| CNX METAL | LONG |

61.19

|

2008-Jan-04

|

| CNX MNC | LONG |

0.00

|

2015-Aug-07

|

| CNX NIFTY | LONG |

4.80

|

2015-Mar-03

|

| CNX PHARMA | LONG |

8.60

|

2015-Apr-08

|

| CNX PSE | SHORT |

25.11

|

2008-Jan-04

|

| CNX PSU BANK | LONG |

33.42

|

2010-Nov-05

|

| CNX REALTY | LONG |

90.27

|

2008-Jan-14

|

| CNX SERVICE | SHORT |

6.02

|

2015-Mar-03

|