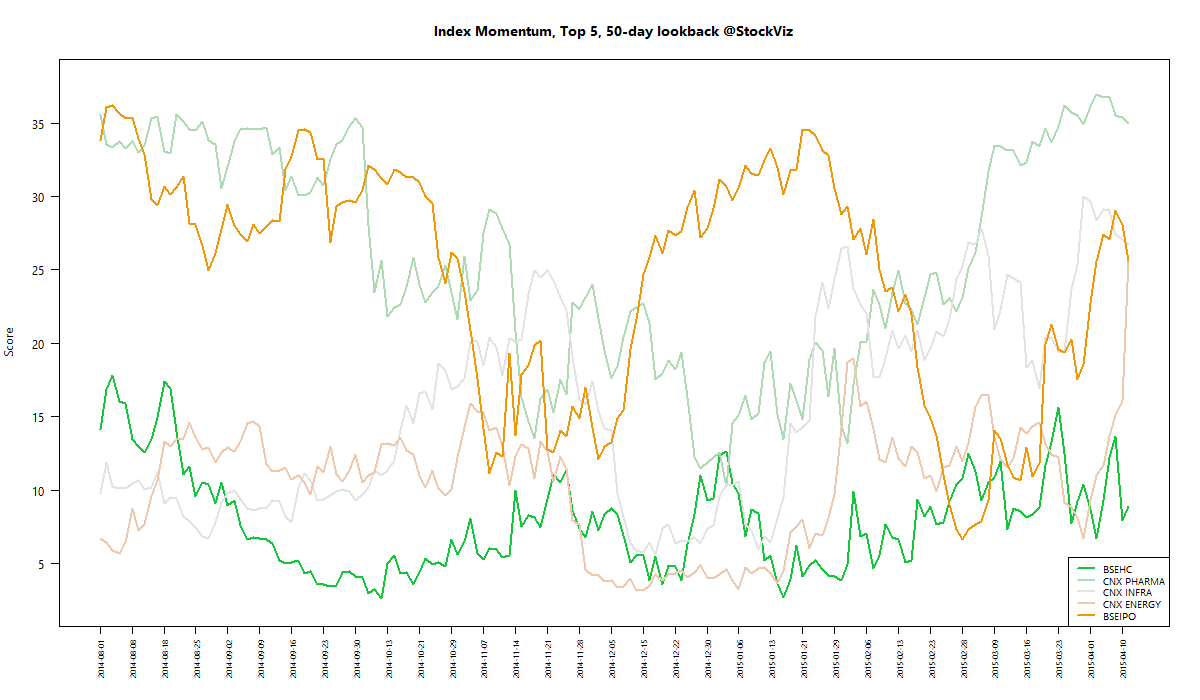

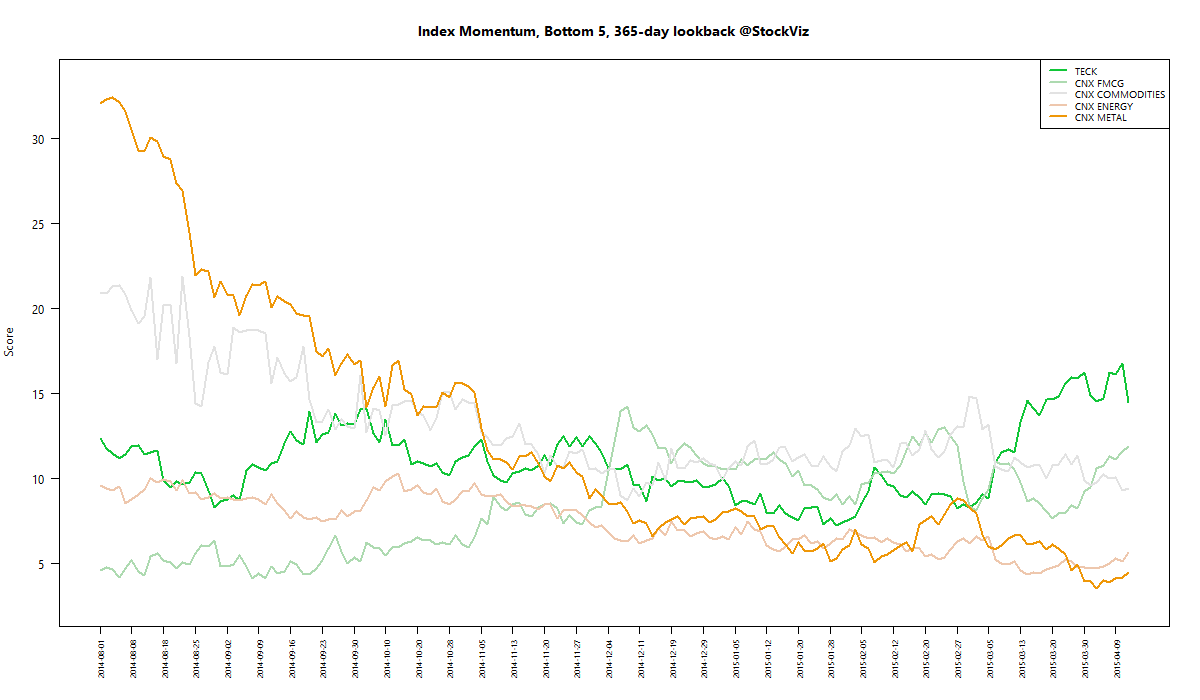

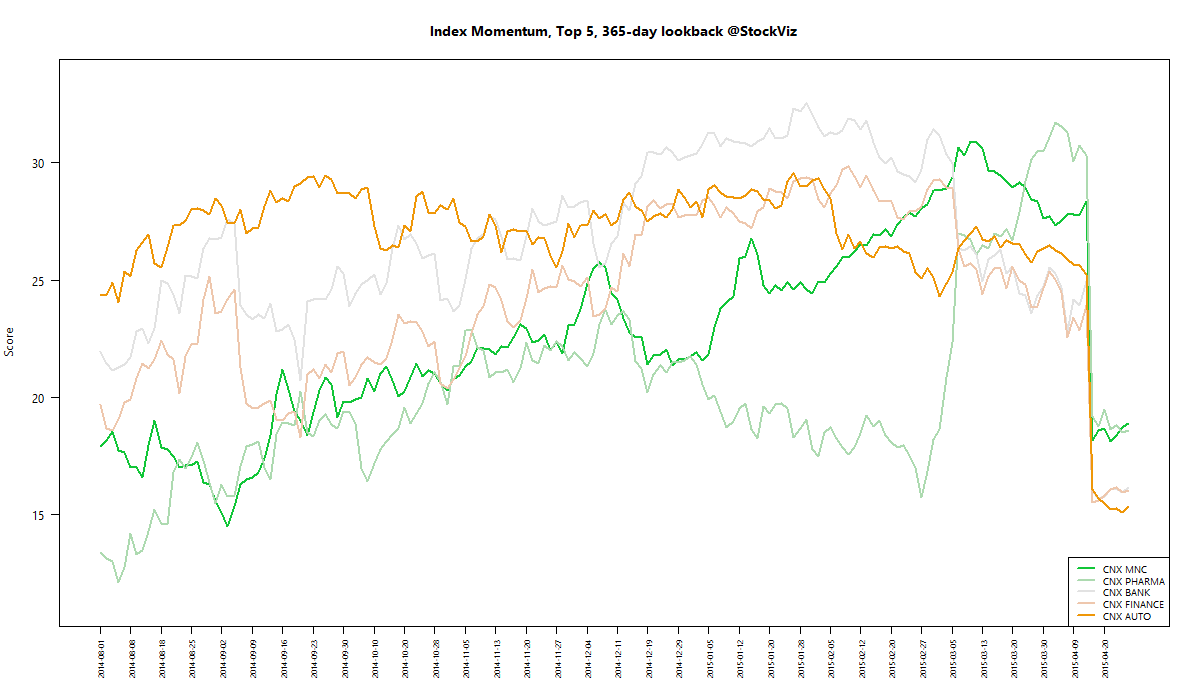

MOMENTUM

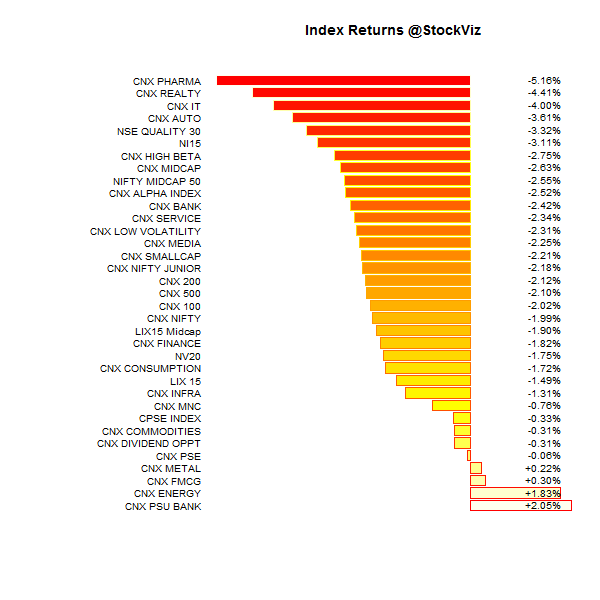

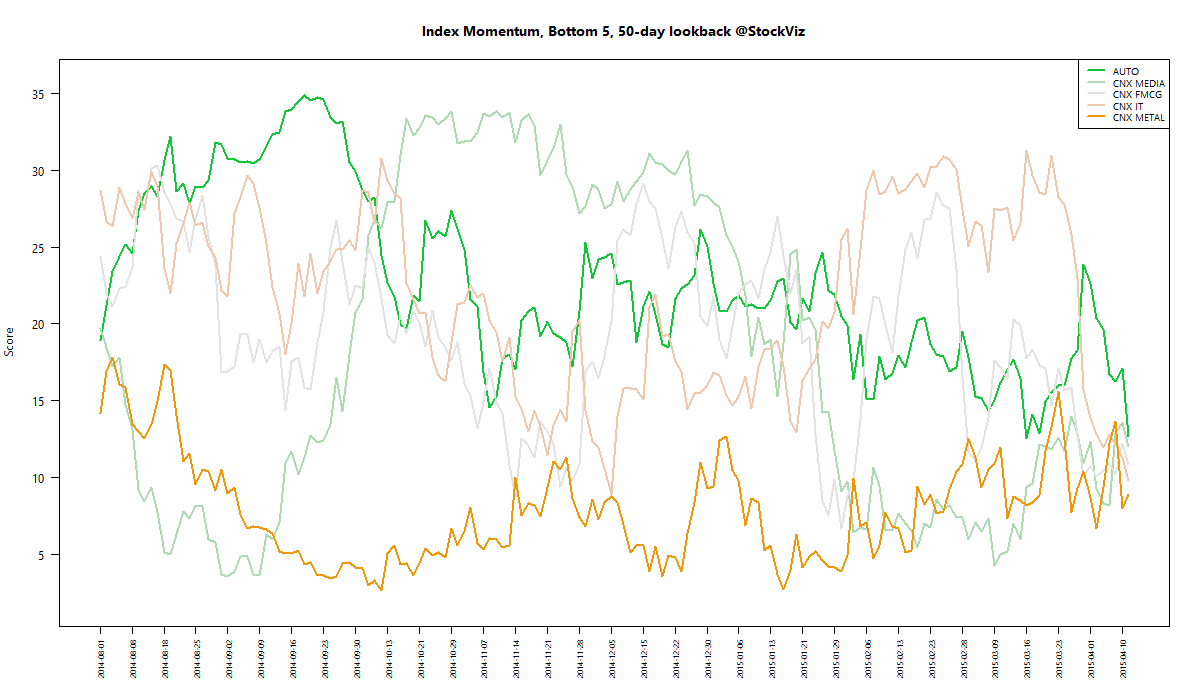

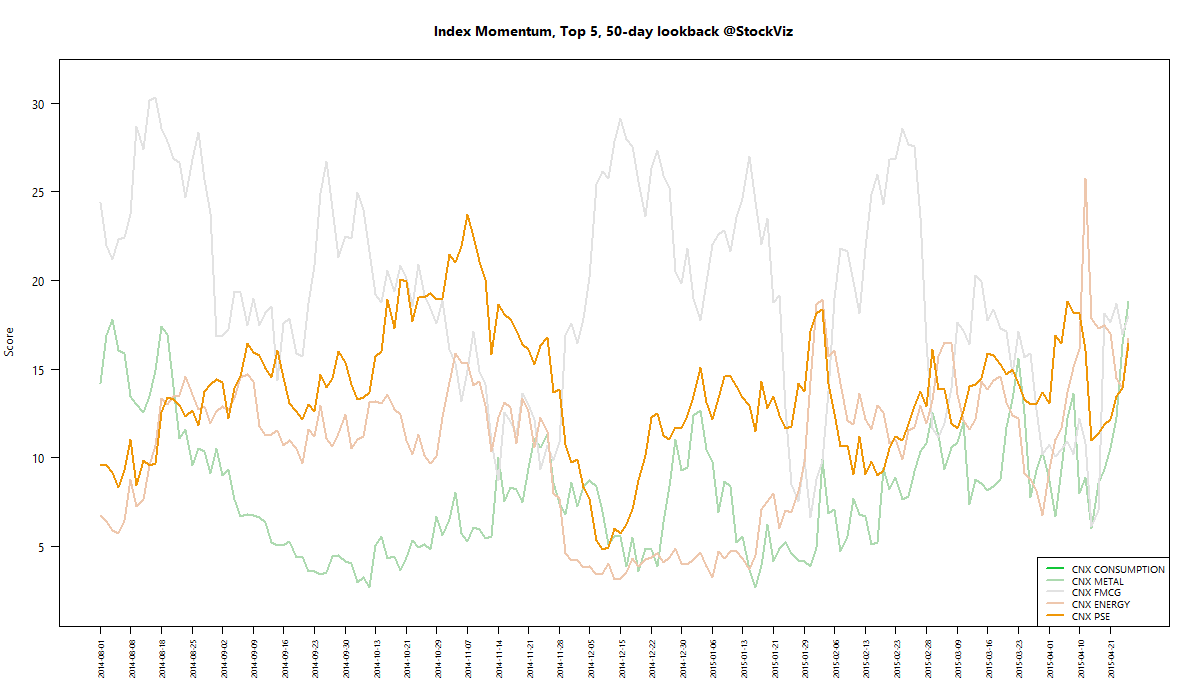

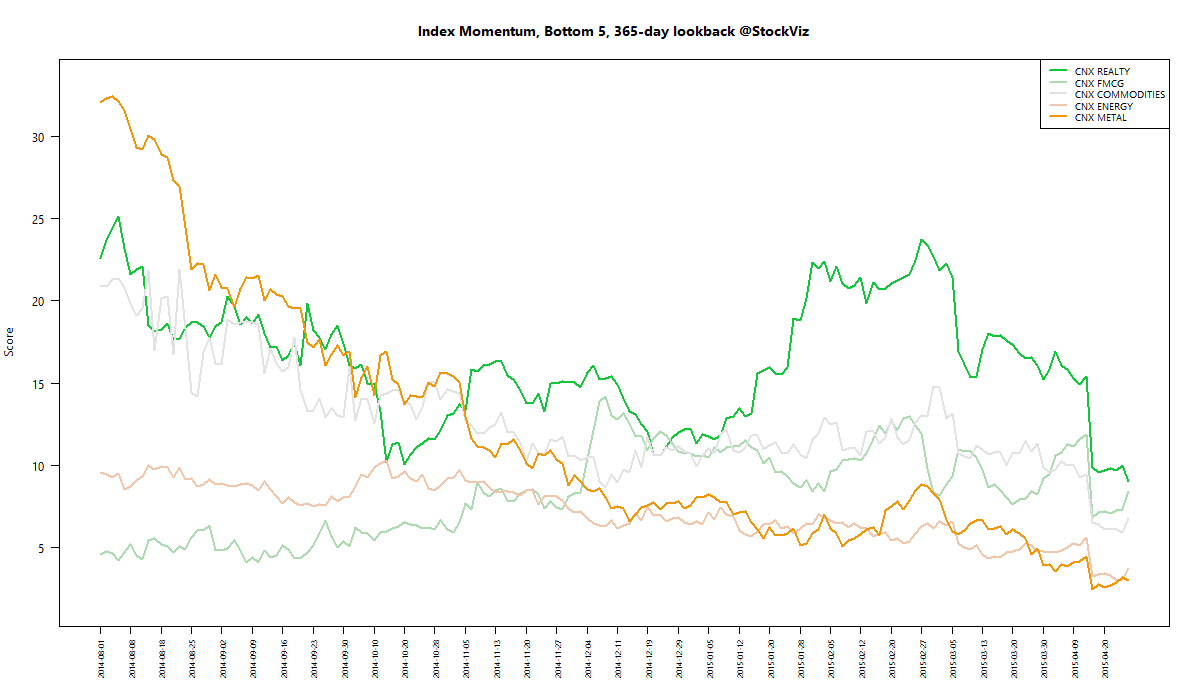

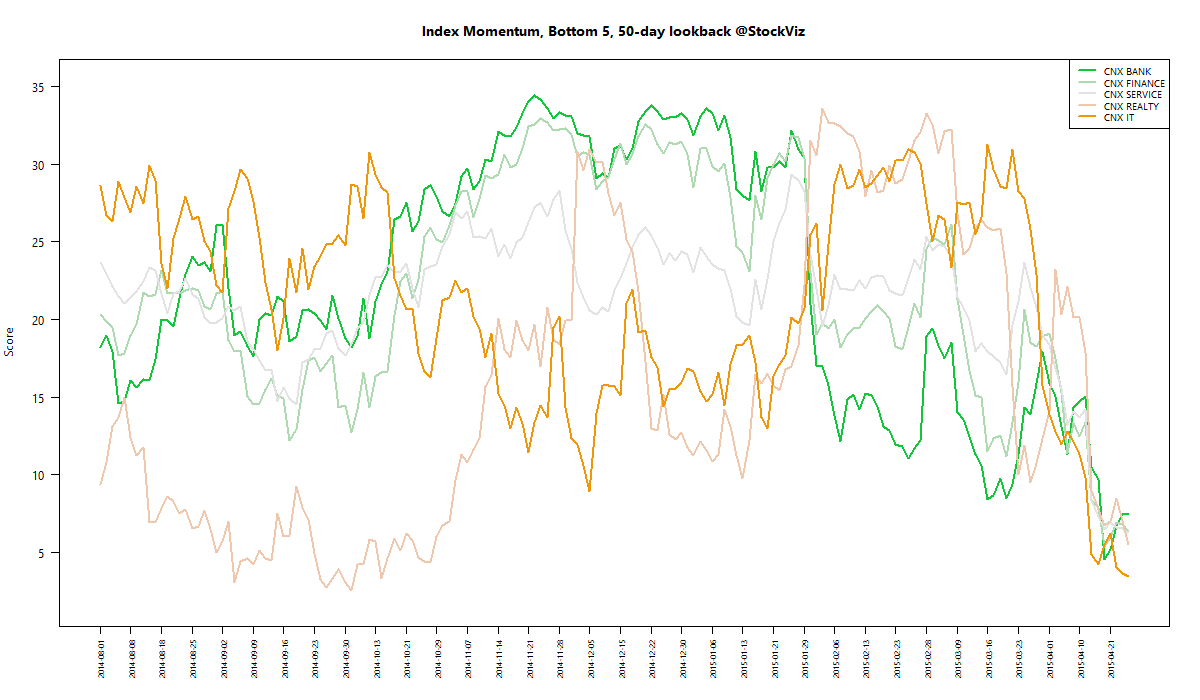

We run our proprietary momentum scoring algorithm on indices just like we do on stocks. You can use the momentum scores of sub-indices to get a sense for which sectors have the wind on their backs and those that are facing headwinds.

Traders can pick their longs in sectors with high short-term momentum and their shorts in sectors with low momentum. Investors can use the longer lookback scores to position themselves using our re-factored index Themes.

You can see how the momentum algorithm has performed on individual stocks here.

Here are the best and the worst sub-indices:

Refactored Index Performance

50-day performance, from February 10, 2015 through April 24, 2015:

Trend Model Summary

| Index | Signal | % From Peak | Day of Peak |

|---|---|---|---|

| CNX AUTO | SHORT |

10.28

|

2015-Jan-27

|

| CNX BANK | SHORT |

12.42

|

2015-Jan-27

|

| CNX ENERGY | SHORT |

29.16

|

2008-Jan-14

|

| CNX FMCG | SHORT |

7.58

|

2015-Feb-25

|

| CNX INFRA | SHORT |

48.62

|

2008-Jan-09

|

| CNX MEDIA | SHORT |

28.84

|

2008-Jan-04

|

| CNX METAL | SHORT |

55.32

|

2008-Jan-04

|

| CNX MNC | SHORT |

6.69

|

2015-Mar-12

|

| CNX NIFTY | SHORT |

7.68

|

2015-Mar-03

|

| CNX PHARMA | SHORT |

11.72

|

2015-Apr-08

|

| CNX PSE | SHORT |

25.79

|

2008-Jan-04

|

Our trend model is short on all indices right now, probably indicating that the market is over-sold…