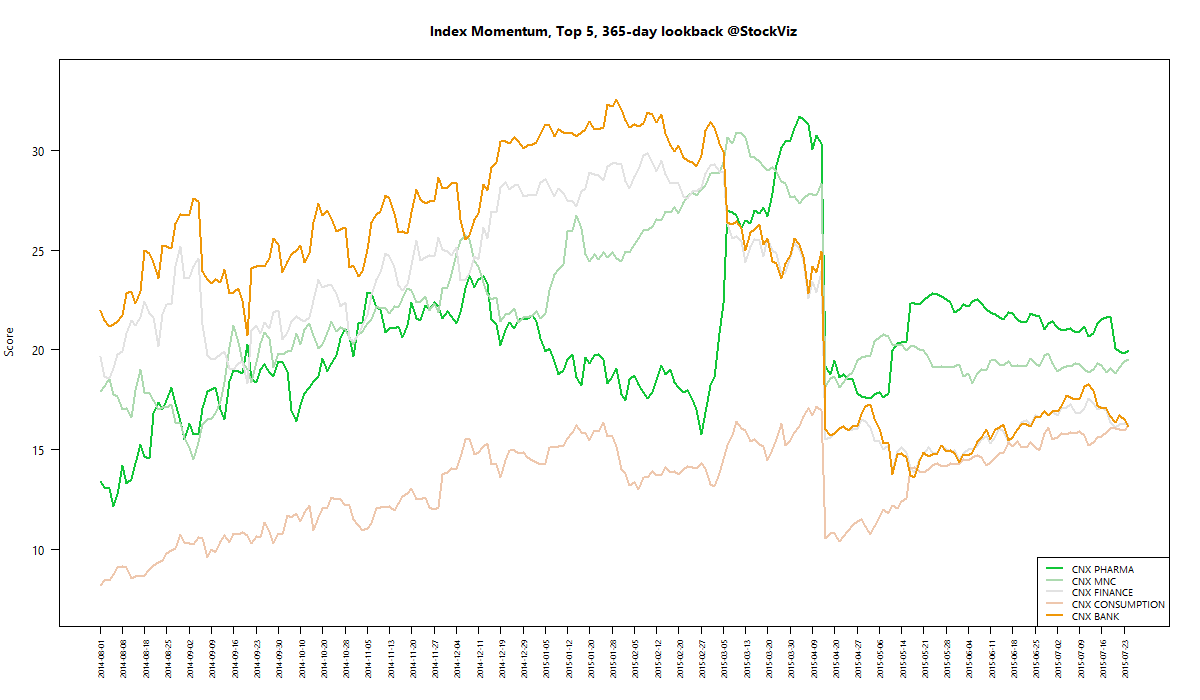

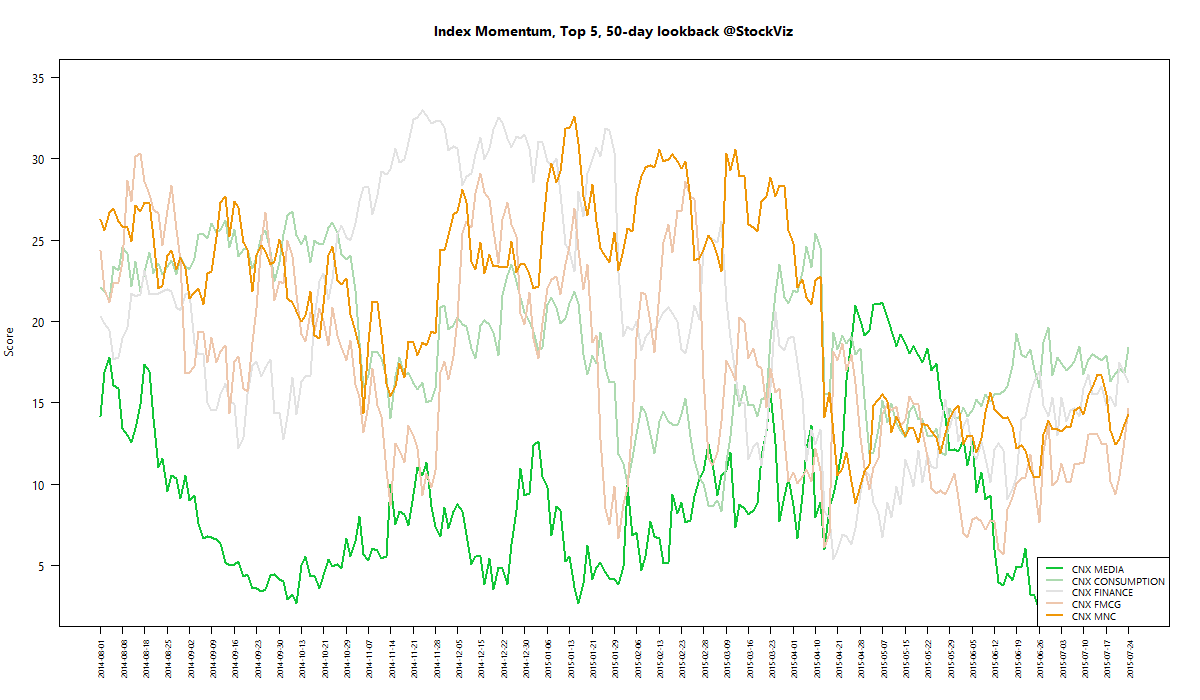

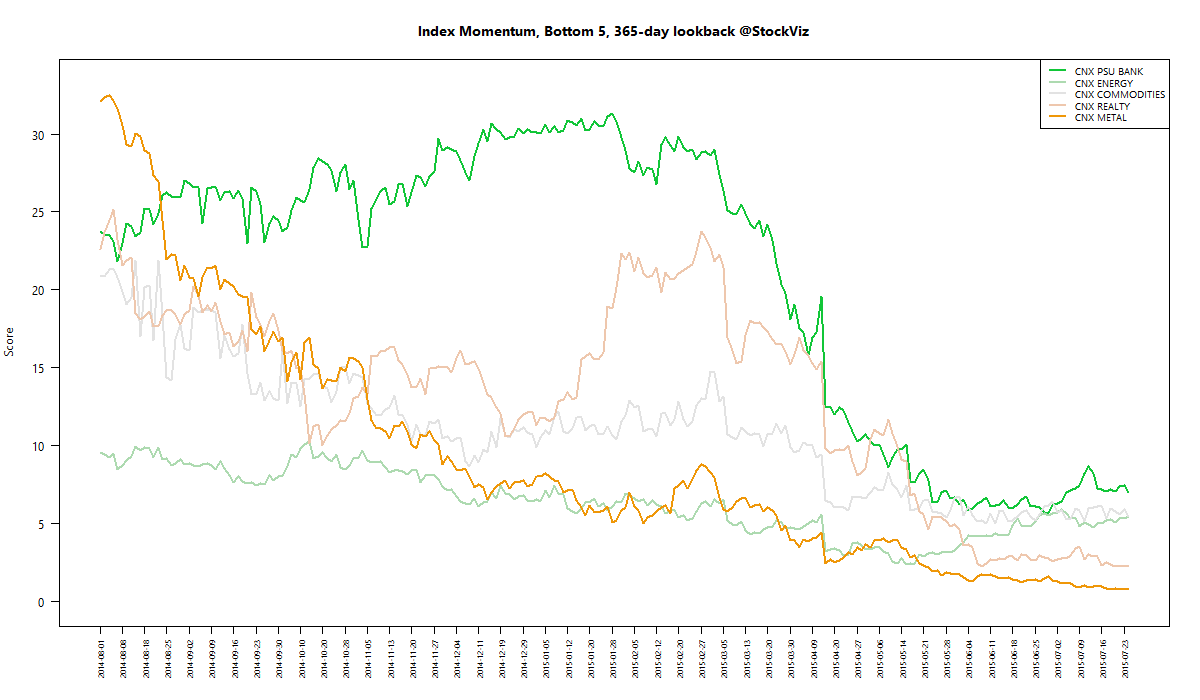

MOMENTUM

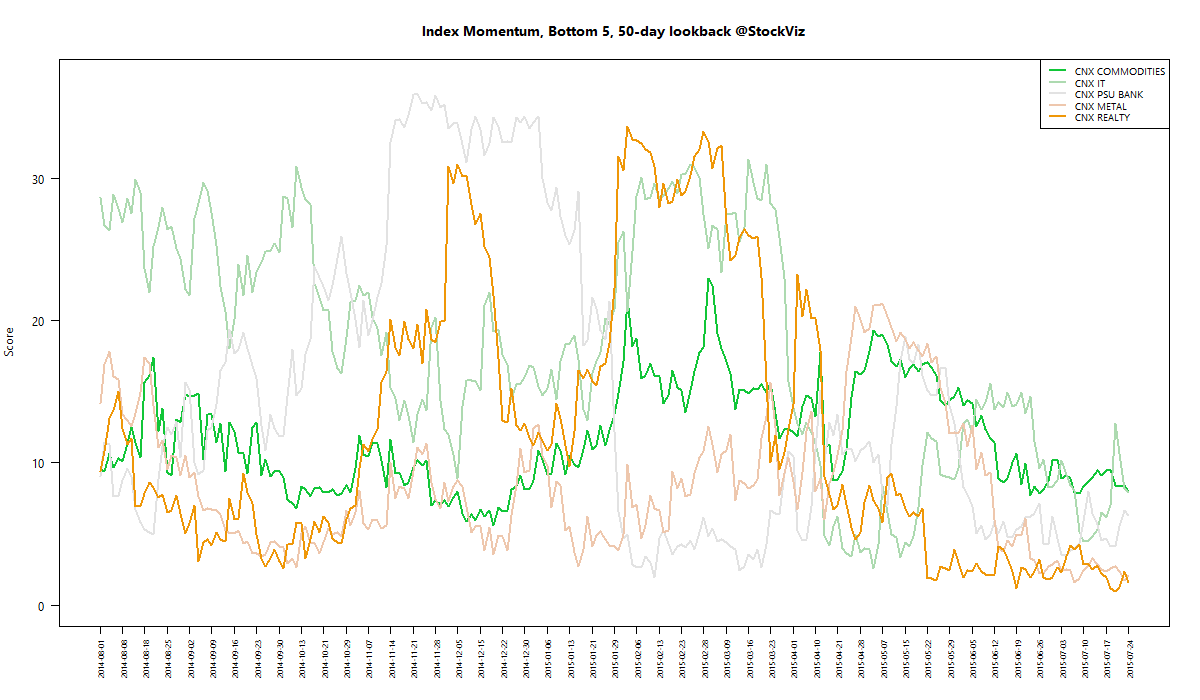

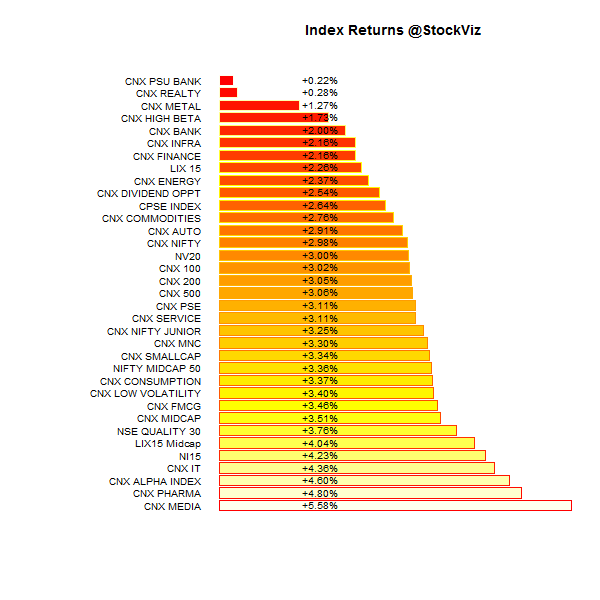

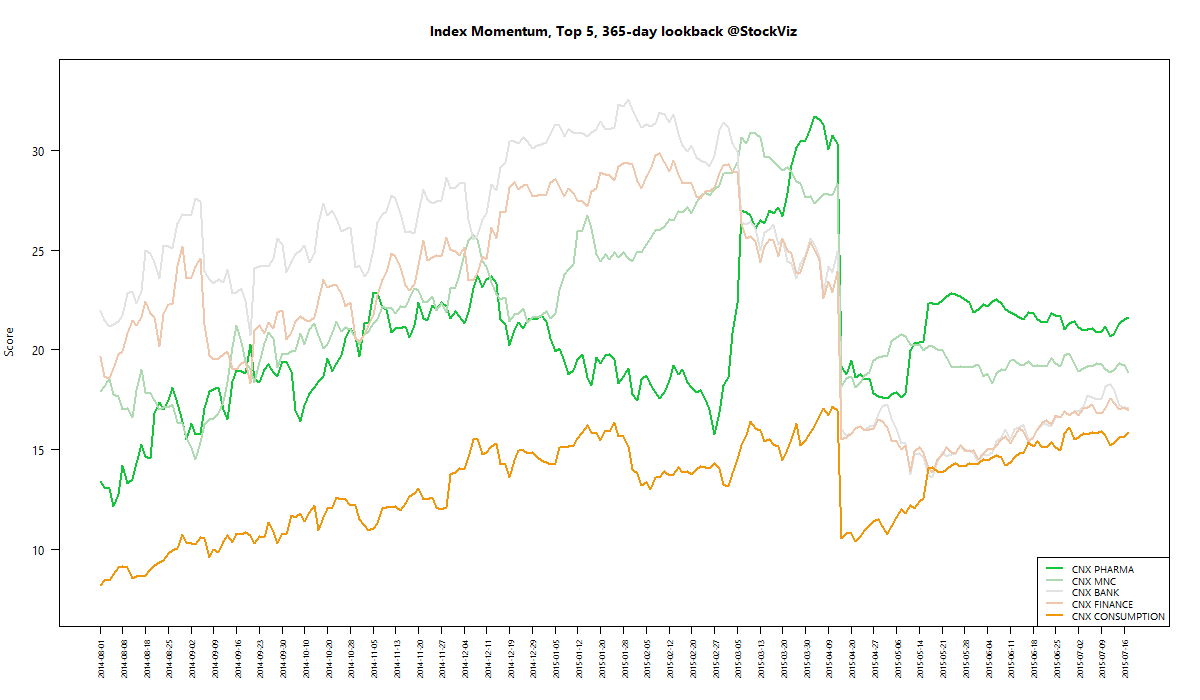

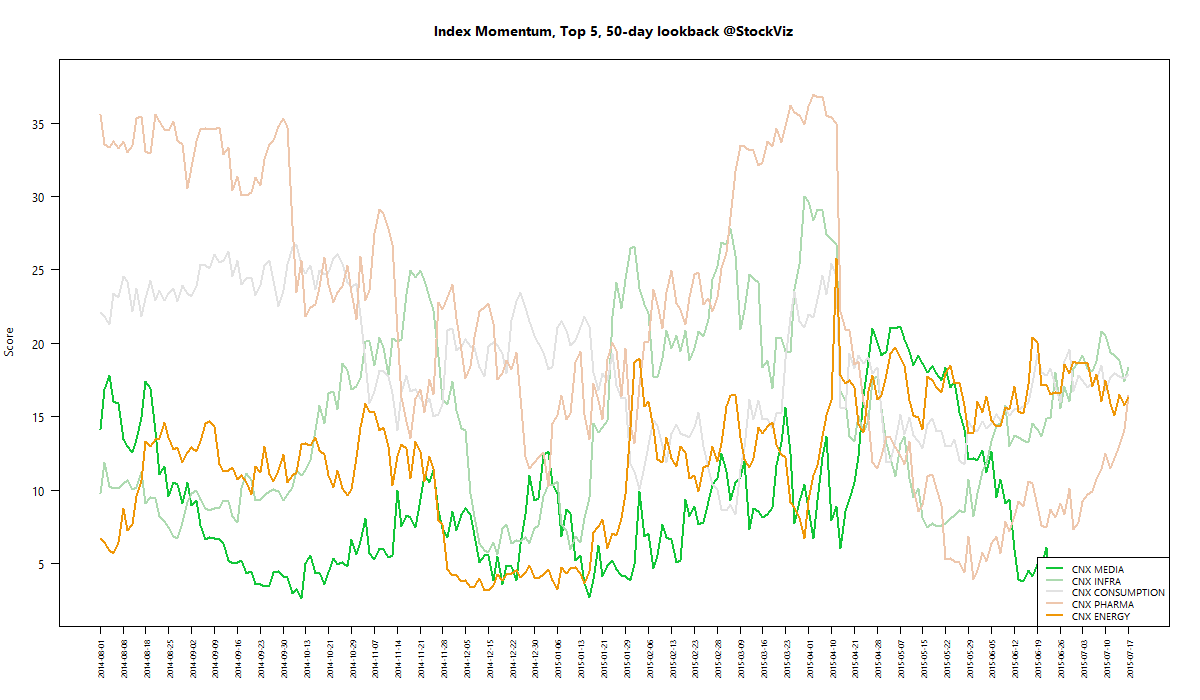

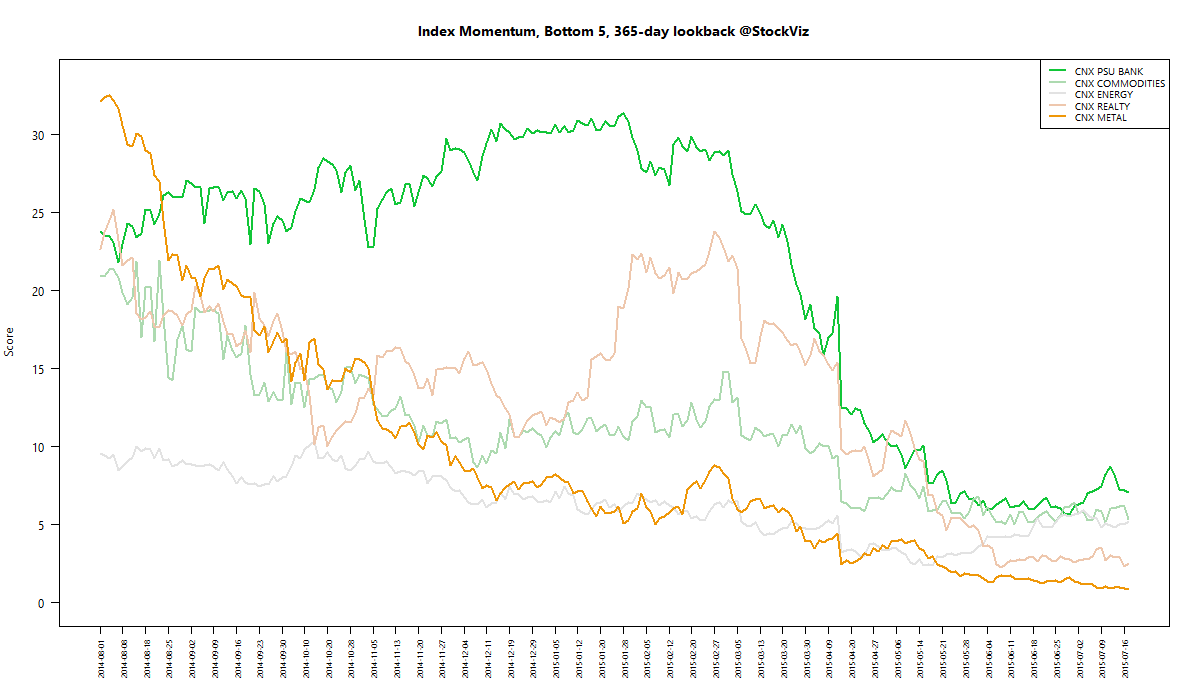

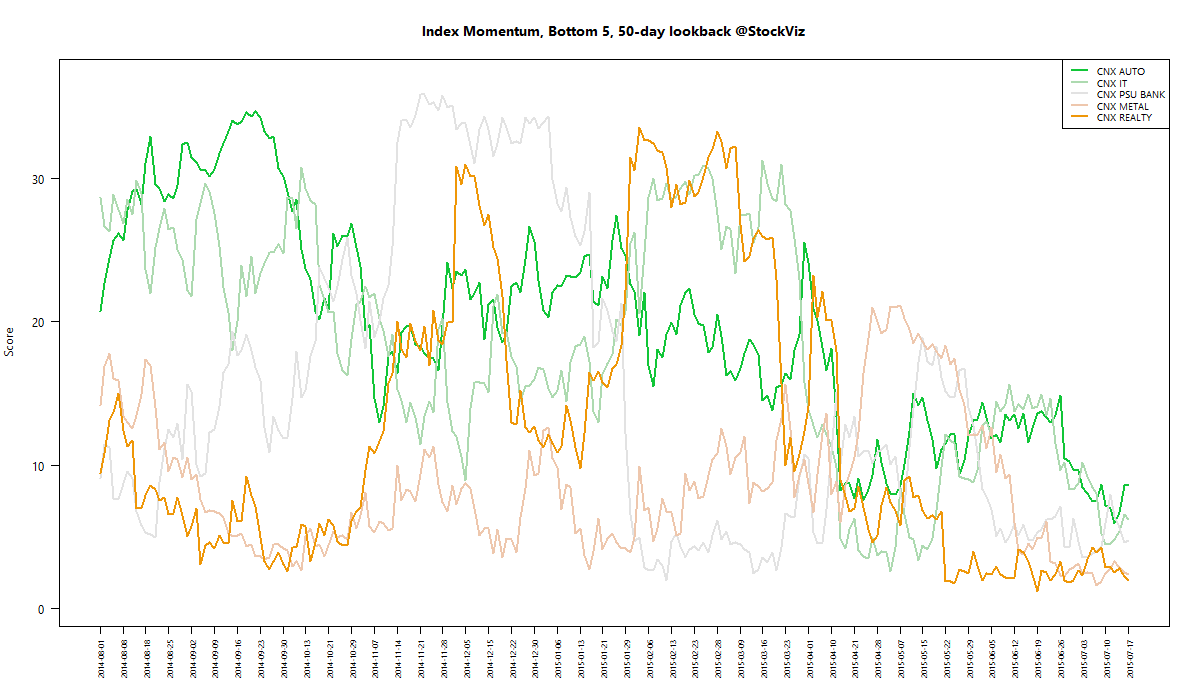

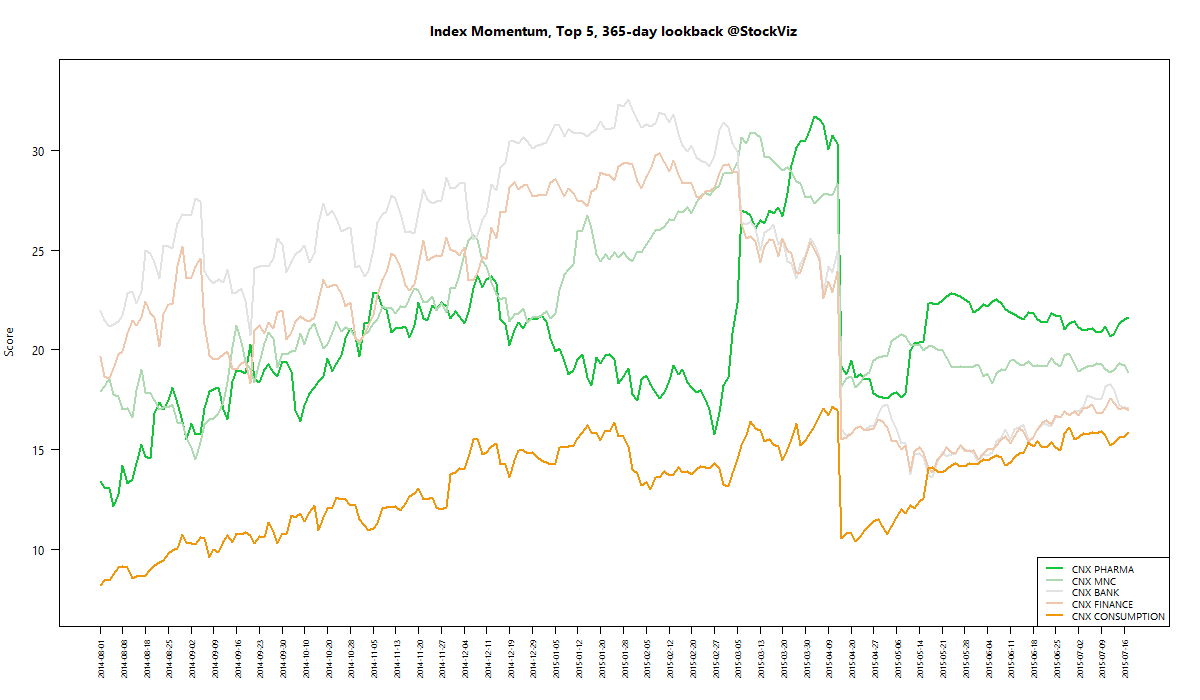

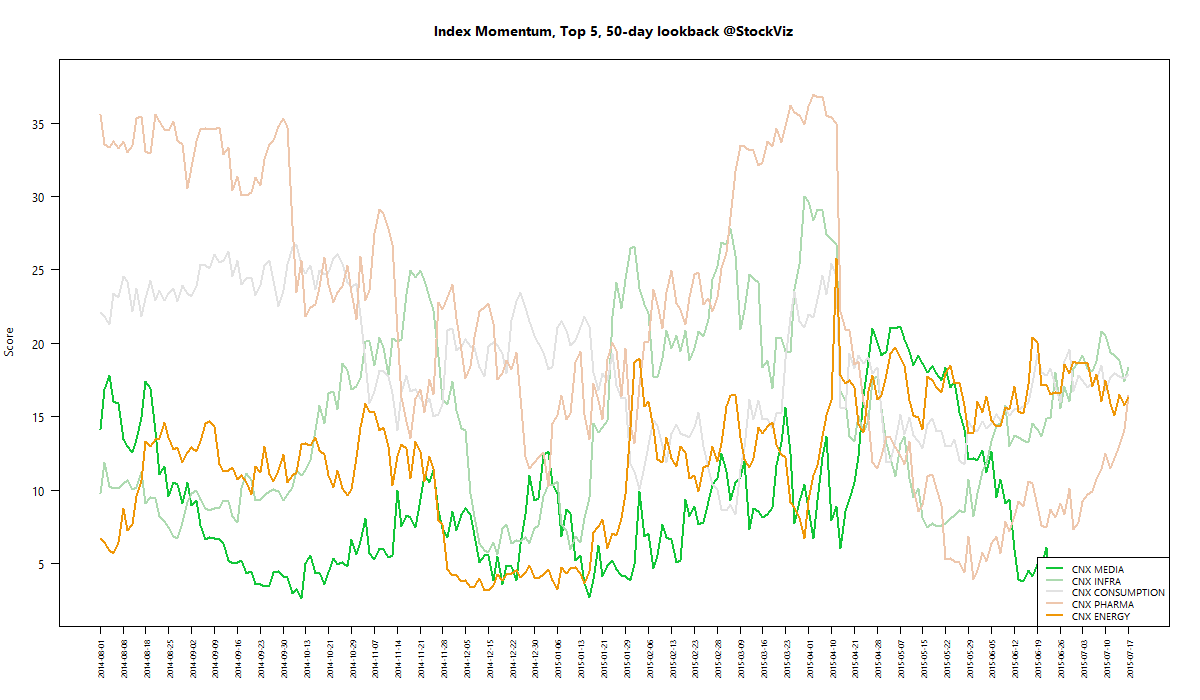

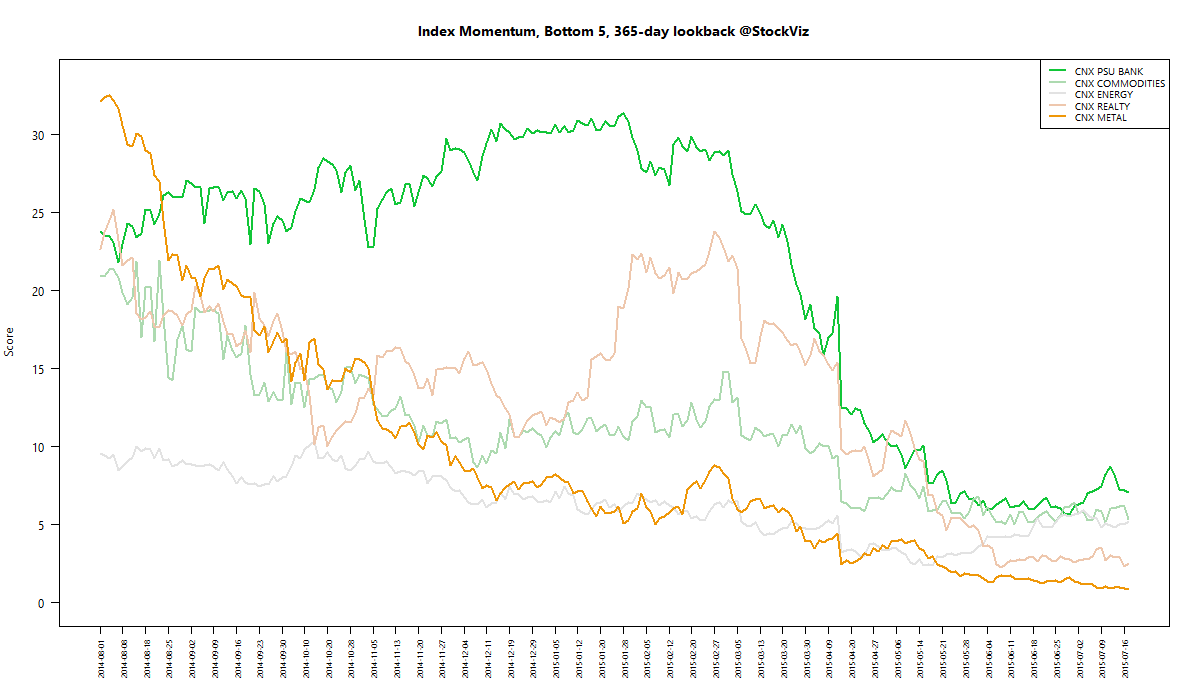

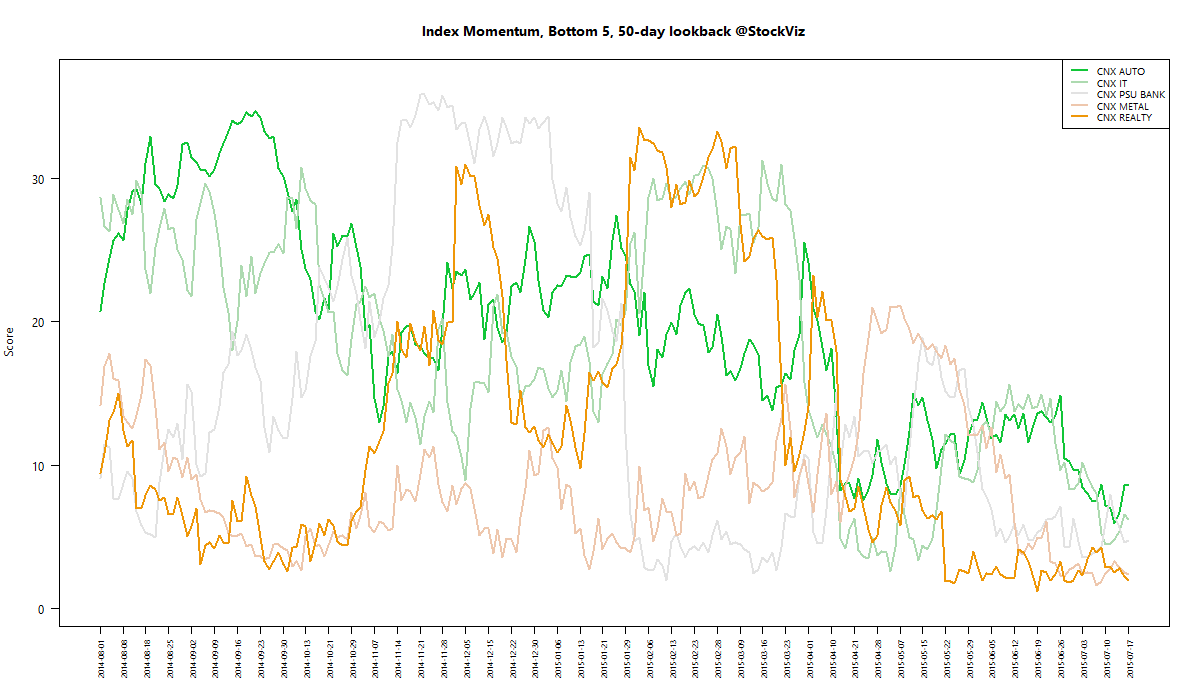

We run our proprietary momentum scoring algorithm on indices just like we do on stocks. You can use the momentum scores of sub-indices to get a sense for which sectors have the wind on their backs and those that are facing headwinds.

Traders can pick their longs in sectors with high short-term momentum and their shorts in sectors with low momentum. Investors can use the longer lookback scores to position themselves using our re-factored index Themes.

You can see how the momentum algorithm has performed on individual stocks here.

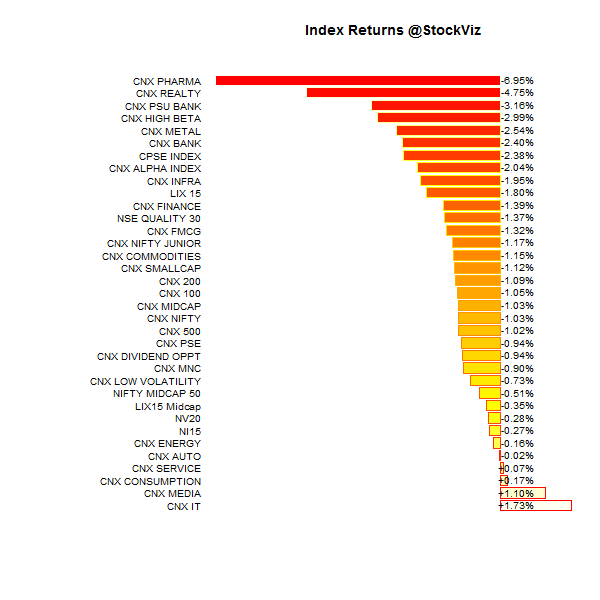

Here are the best and the worst sub-indices:

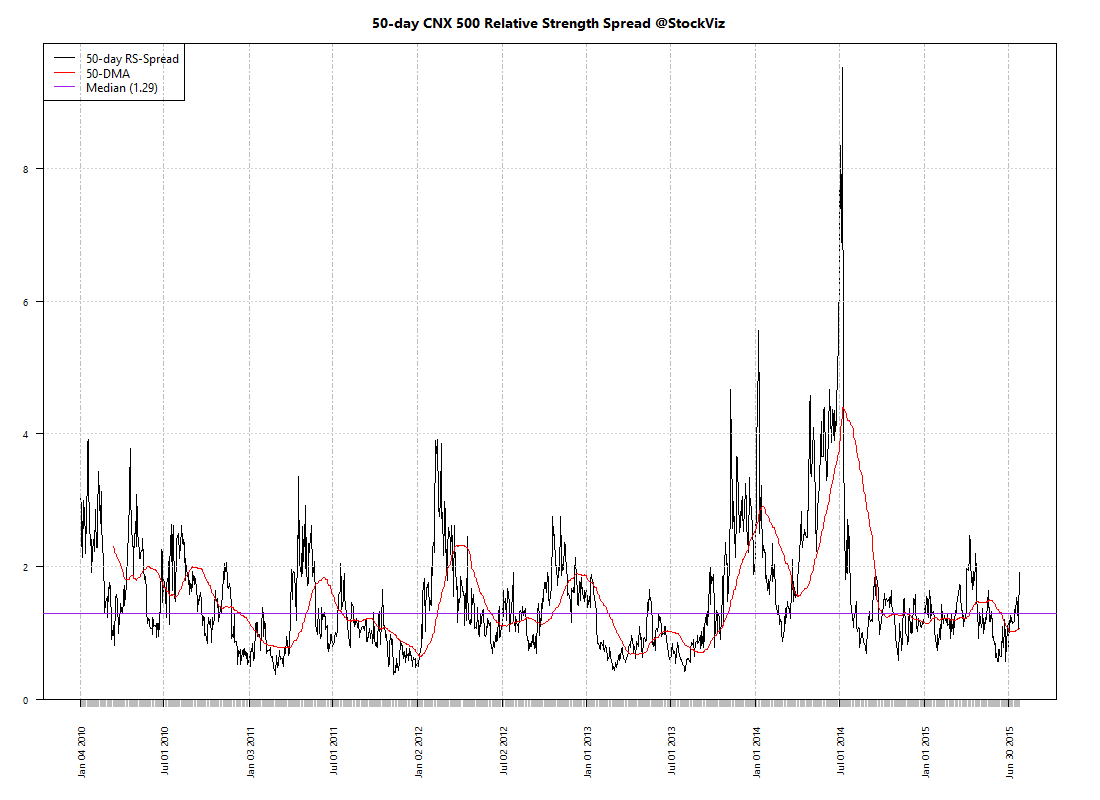

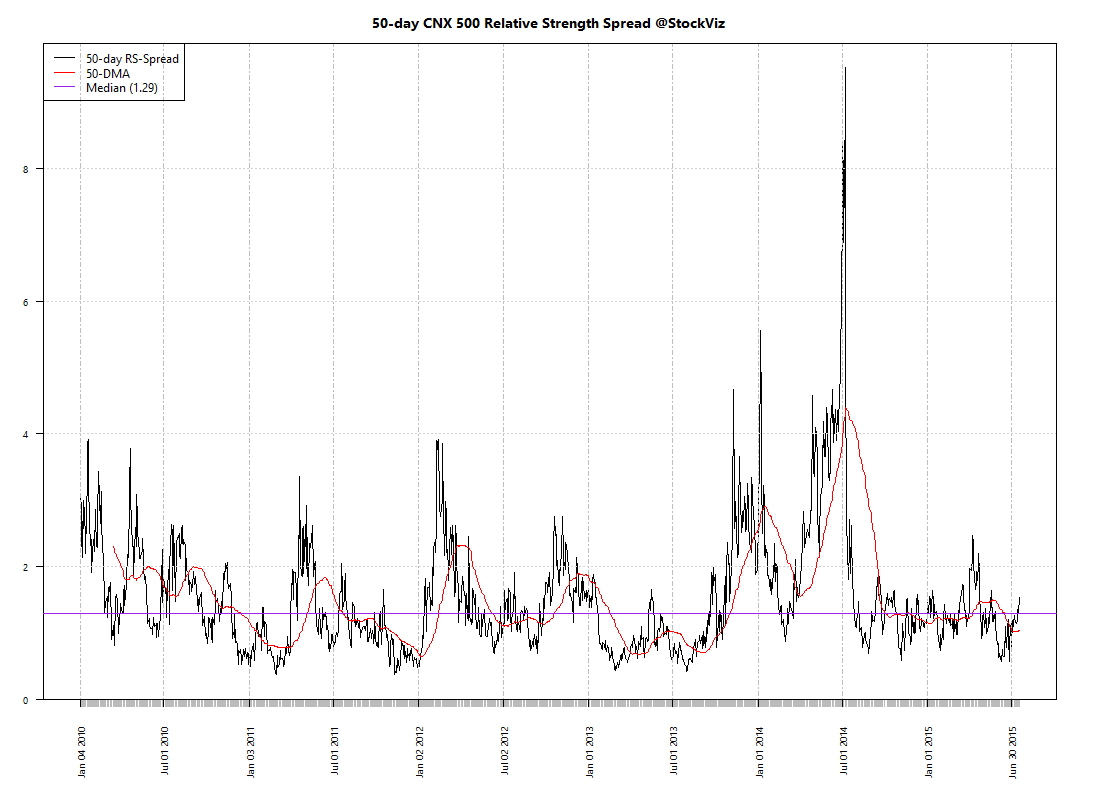

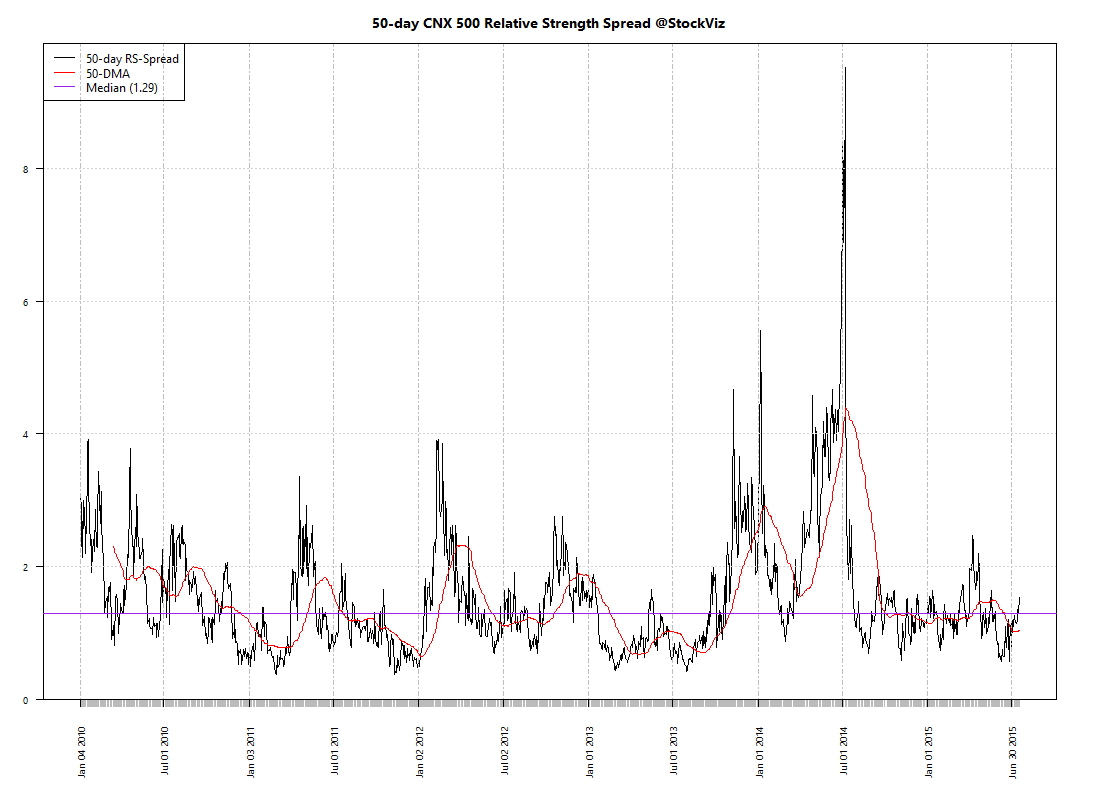

Relative Strength Spread

Refactored Index Performance

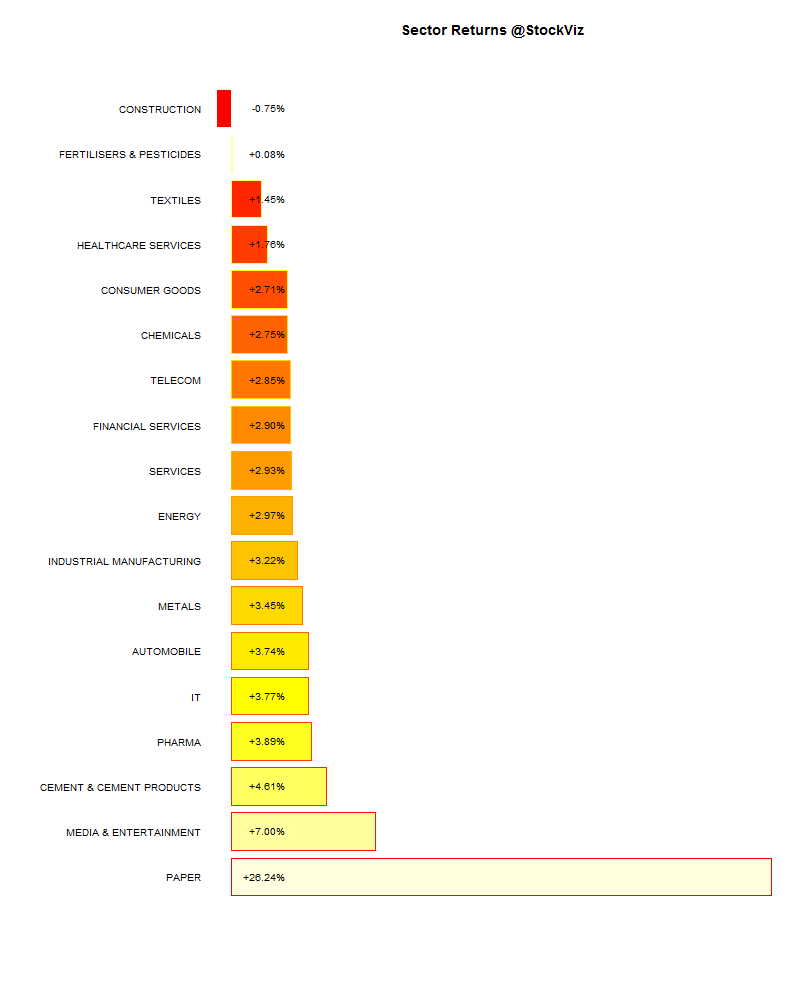

50-day performance, from May 11, 2015 through July 17, 2015:

Trend Model Summary

| Index |

Signal |

% From Peak |

Day of Peak |

| CNX AUTO |

SHORT |

6.88

|

2015-Jan-27

|

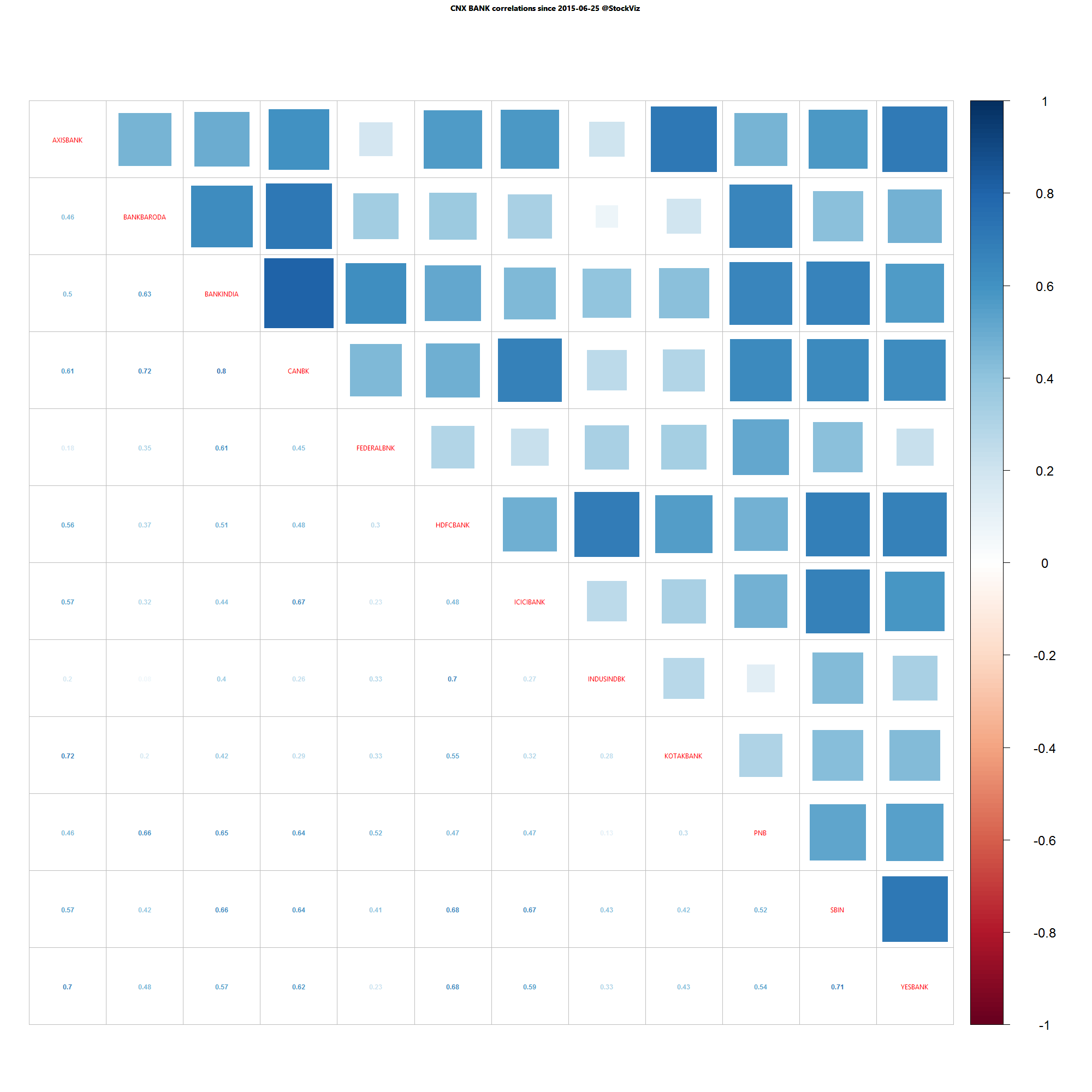

| CNX BANK |

SHORT |

7.11

|

2015-Jan-27

|

| CNX COMMODITIES |

SHORT |

27.00

|

2008-Jan-04

|

| CNX CONSUMPTION |

LONG |

0.00

|

2015-Jul-17

|

| CNX ENERGY |

SHORT |

25.49

|

2008-Jan-14

|

| CNX FMCG |

SHORT |

7.71

|

2015-Feb-25

|

| CNX INFRA |

LONG |

45.57

|

2008-Jan-09

|

| CNX IT |

LONG |

88.20

|

2000-Feb-21

|

| CNX MEDIA |

LONG |

20.59

|

2008-Jan-04

|

| CNX METAL |

LONG |

59.82

|

2008-Jan-04

|

| CNX MNC |

LONG |

0.04

|

2015-Jul-16

|

| CNX PHARMA |

LONG |

5.00

|

2015-Apr-08

|

| CNX PSE |

LONG |

23.04

|

2008-Jan-04

|

| CNX PSU BANK |

SHORT |

37.11

|

2010-Nov-05

|

| CNX REALTY |

SHORT |

90.41

|

2008-Jan-14

|

| CNX SERVICE |

LONG |

6.13

|

2015-Mar-03

|

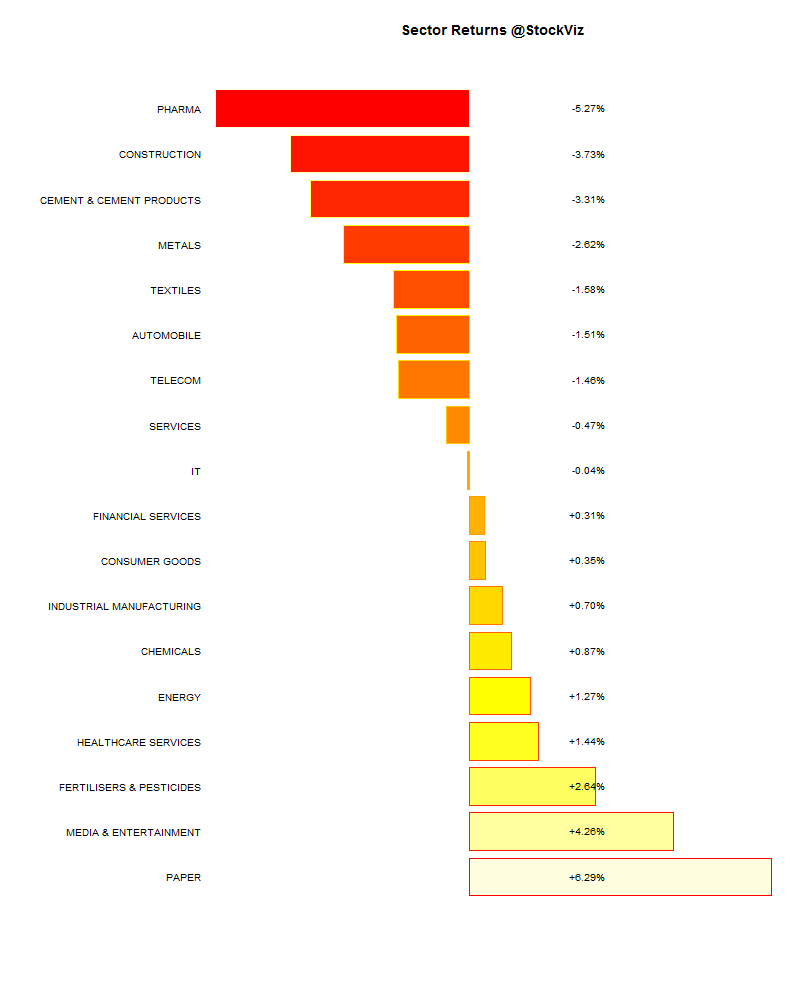

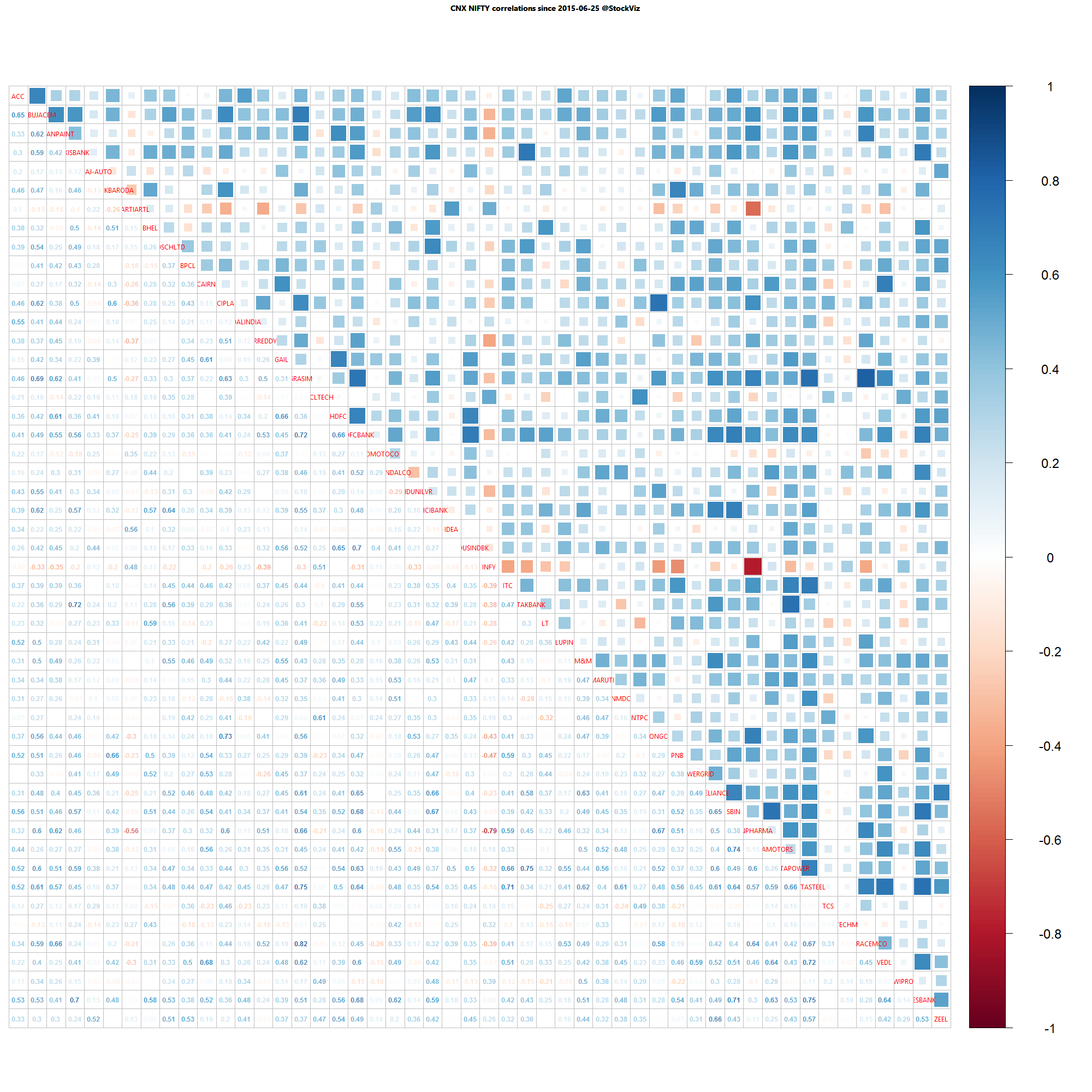

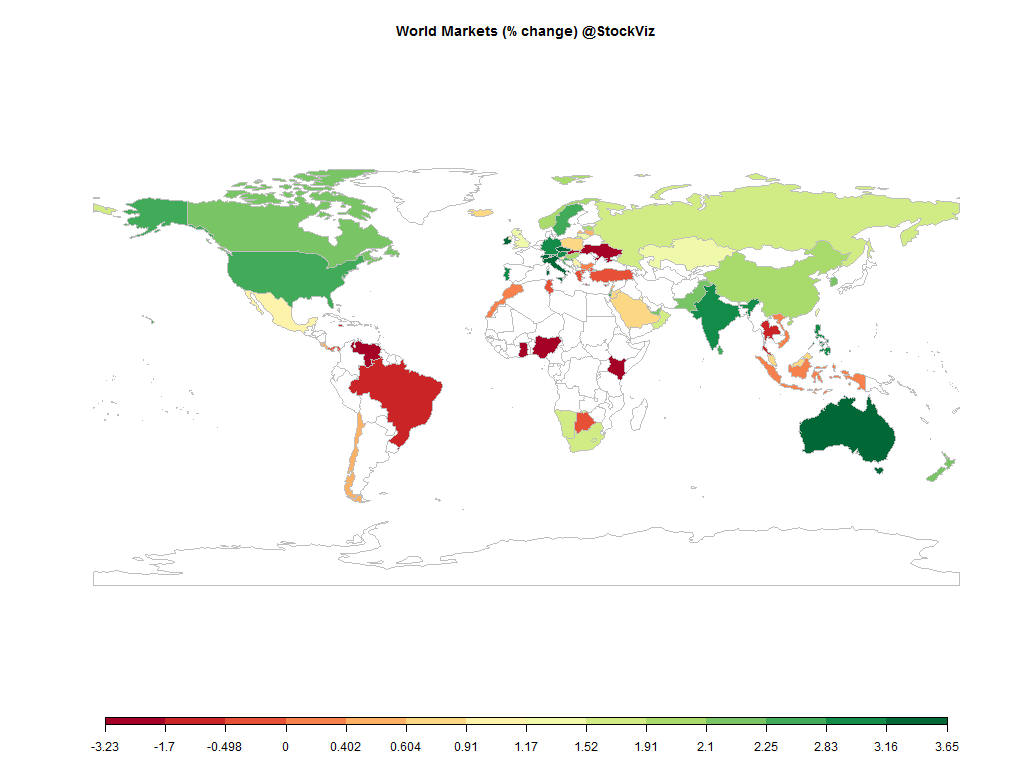

MNCs and FMCGs have recouped their drawdowns. PHARMA is not far behind. Its the old economy stocks that are still trying to digest their “India Shining” debt binge.