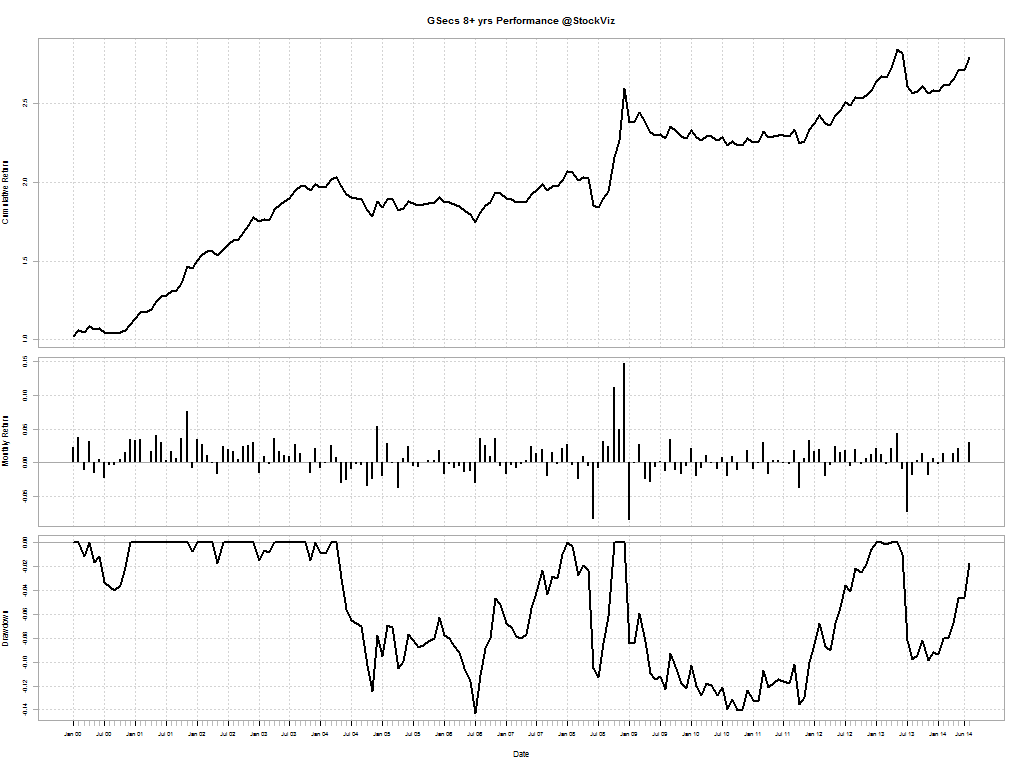

One of the main benefits of diversification is that if you invest in a group of assets with low correlations to one another, then you are likely to get the highest return for a given level of risk. But has it really worked that way for Indian investors? Here’s what we found while we crunched some numbers using CNX 100 and GSec 8+ year total return index since 2003.

Correlation

Yes, correlations are low: 0.0624. And we have a scatter-plot to prove it:

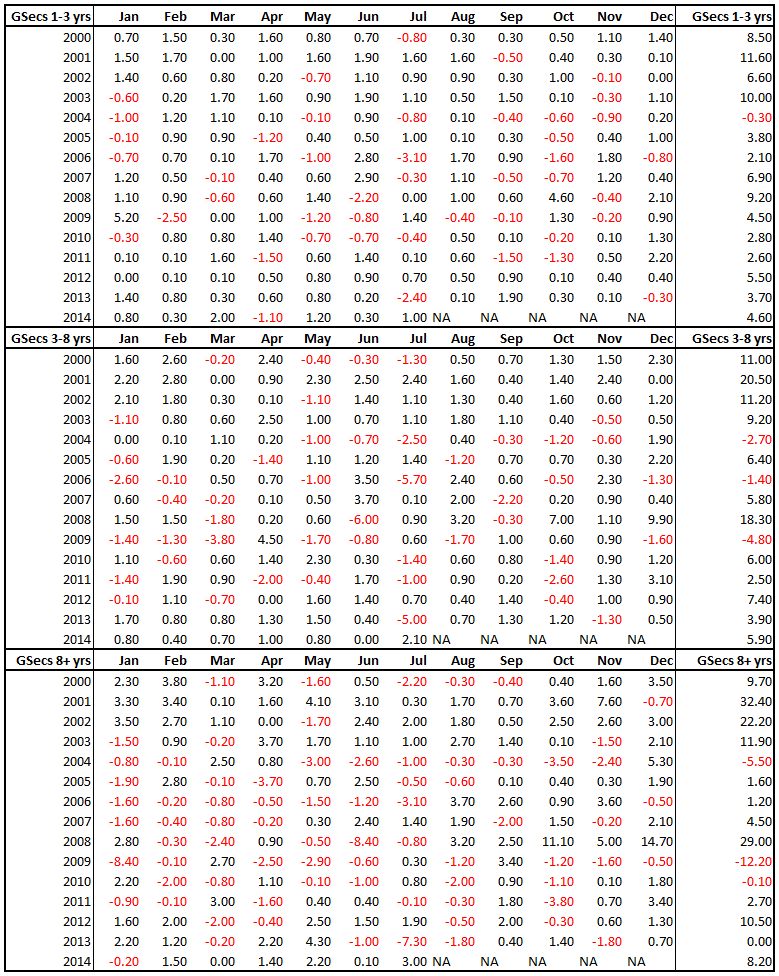

Returns

Here’s how the yearly returns look like (%):

An 80:20 stocks:bonds portfolio would have had an average return of 21.43% vs 25.81% of a stock-only portfolio – a give up of 4.38% in returns – with lower volatility.

The question is, is it worth the trade off if you can stomach the volatility?

Related: BOND ≠ BORING