We ran the Fund Comparison tool to get an idea of how the ICICI Corporate Bond fund stood relative to its peers. Here are some quick takes.

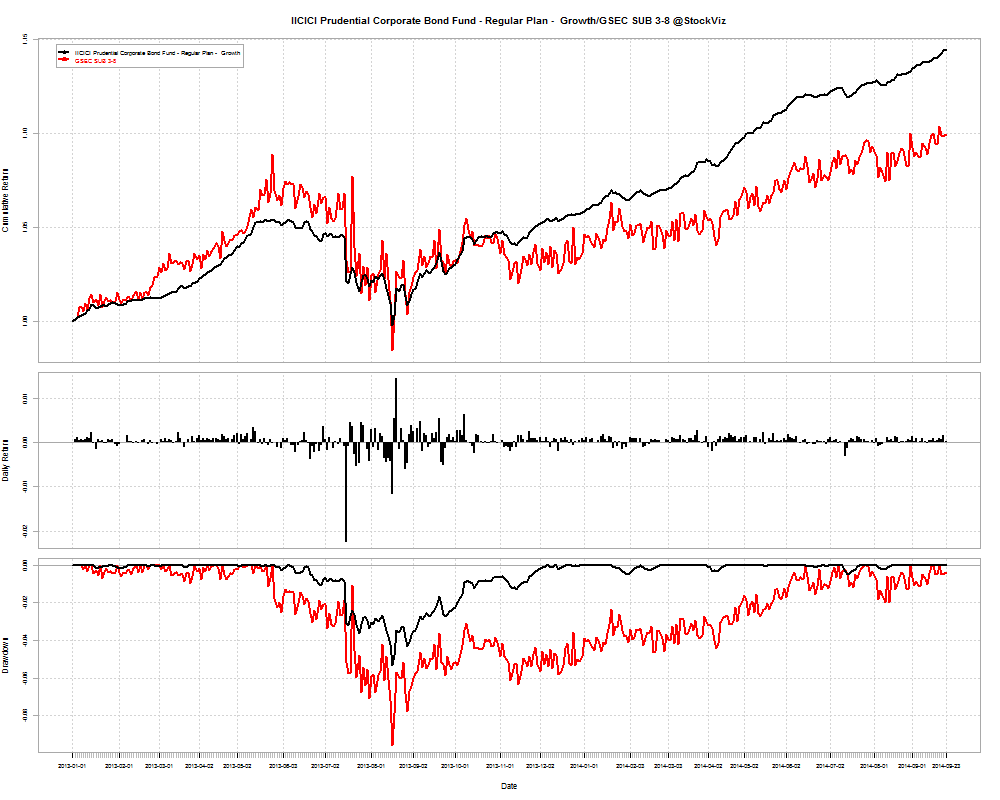

Outperformed GSecs

Since 2013-01-01, IICICI Prudential Corporate Bond Fund has returned a cumulative 14.51% vs. GSEC SUB 3-8’s cumulative return of 10.21%.

Outperformed Principal Debt Opportunities Fund

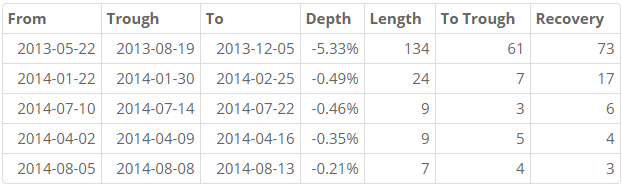

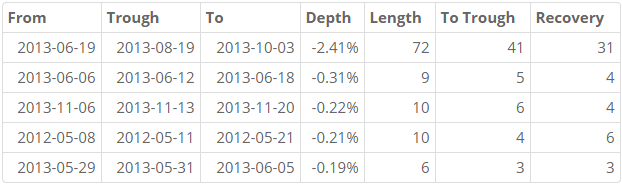

Since 2012-01-02, ICICI Prudential Corporate Bond Fund has returned a cumulative 25.68% vs. Principal Debt Opportunities Fund’s cumulative return of 24.74%. But ICICI had a deeper drawdown in 2013.

ICICI Prudential Corporate Bond Fund Drawdowns:

Principal Debt Opportunities Fund Drawdowns:

Outperformed UTI Gilt Advantage Fund

Since 2013-01-01, ICICI Prudential Corporate Bond Fund has returned a cumulative 14.51% vs. UTI – GILT ADVANTAGE-LONG TERM’s cumulative return of 12.88% while having a shallower drawdown in 2013: -5.33% vs. -8.18%

Conclusion

The ICICI Prudential Corporate Bond Fund could be attractive to investors looking to benefit from corporate credit improving on the back of a recovering economy and riding the RBI’s expected rate cuts coming down the pike.

You can run the comparison tool here: FundCompare

However, if you want advice on investing in mutual funds, please get in touch with Shyam.

You can either WhatsApp him or call him at 080-2665-0232.

He is an AMFI registered IFA who can advice you on ICICI Pru, UTI and Birla Sun Life funds.

Comments are closed, but trackbacks and pingbacks are open.