You can now get a live snapshot of the biggest movers within an index. Head over to the “Indices”  page and click on “Movers.” The page is automatically refreshed every minute.

page and click on “Movers.” The page is automatically refreshed every minute.

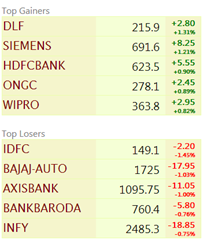

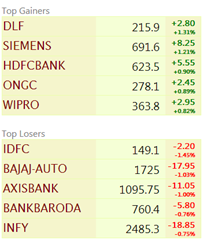

You an also track the top gainers and losers while you are at it 🙂

Invest Without Emotions

You can now get a live snapshot of the biggest movers within an index. Head over to the “Indices”  page and click on “Movers.” The page is automatically refreshed every minute.

page and click on “Movers.” The page is automatically refreshed every minute.

You an also track the top gainers and losers while you are at it 🙂

This week’s pick is [stockquote]ITC[/stockquote]. Trading at 52 week high of Rs. 280, the stock has a return of close to 40% over the last 12 month period. The stock has been in a consistent uptrend for the last year, a small correction happened close to Rs. 250, but a pullback was seen from the Rs. 227 levels with affirming volumes.

Oscillators like RSI and CMO are at currently at the levels of 66 and 60. At this high level, there surely can be a correction in the short term. Although looking at the previous highs of RSI, the stock can see an up move till RSI reaches 80. MACD line and signal line are drifting apart from each other and histogram levels are on a rise. Not suggesting any corrections.

Looking at GMMA for a medium to long term outlook is not giving a lot of indication. The long term lines are moving away from each other (signaling a continuation of the previous trend). The increasing separation in the short term lines also suggests a positive outlook for the near term. The stock seems to be on a roll. It is a long term green flag for this stock.

ITC’s average correlation of 0.49 with the [stockquote]NIFTYBEES[/stockquote] suggests that the correlation is strong and positive, Although the movements will not be of the same magnitude as Niftybees.

ITC has volatility in the range of 0.4 to 0.6 for the most part (except for the high regions during 2010) which is not a very big range. The volatility is currently at 0.70, higher compared to the recent past. A constant eye is required on the scrip in case it makes a sudden move.

The up-trend is quite prominent. For a short term until the RSI levels start to decrease it is suggested to hold the scrip. And for the long term we do not have any standard to measure if it has any resistance at any levels. This stock can just be another example to prove the proverb “the trend is your friend” true.

Using a Trailing Stop Loss (TSL) is one of the best ways to limit your downside and protect your winning trades. Instead of relying on your gut, here’s a straight-forward way to derive the appropriate TSL percentage for your trades.

ATR stands for Average True Range. It provides a measure of volatility that incorporates gap/limit moves. The range of a day’s trading is simply high – low. The true range extends it to yesterday’s closing price if it was outside of today’s range.1

To set a TSL percentage, just multiply the latest daily ATR value by 2 and divide by the previous close.

What you are doing here is simply attaching a risk tolerance level (2) based on the stock’s intra-day moves averaged over a period of time.

For example, if you were trading [stockquote]COLPAL[/stockquote] today, you would set the TSL to

2 * 30.5/1,250.65 = 4.88%

You can use StockViz to set a TSL alerts for your trades. Read this to see how.

The NIFTY ended on a positive note, drifting up +0.87% for the week.

Biggest losers were LUPIN (-4.66%), BAJAJ-AUTO (-4.32%) and CIPLA (-4.17%).

And the biggest winners were JPASSOCIAT (+7.84%), AMBUJACEM (+7.08%) and BHEL (+6.86%).

Advancers lead decliners 30 vs 20

Gold: -1.04%, Banks: +0.64%. Infrastructure: -0.70%,

Net FII flows for the short week: $457.62 mm (Equity) and $193.11 mm (Debt)

The biggest data point that investors will ponder over the weekend is the US unemployment rate hitting 7.8% for September (8.1% previous).

Erroneous orders placed by Emkay sends Nifty crashing by 16%, to 4880.20 on Friday morning. Emkay has been temporarily barred from trading. Fat fingers indeed. (WSJ) [stockquote]EMKAY[/stockquote]

Daily news summaries are here.

Setting a stop loss can often times be an emotional decision. When you buy a stock, you expect it to go up; setting a stop loss at that point in time makes you play the devil’s advocate with yourself. Its not a nice feeling. However, setting a trailing stop loss, takes some of the pain away.

Quite simply, a trailing stop is not a fixed price at which you exit a loss making investment – it is a percentage below the most recent high set after you have made the buy.

For example, lets assume that you bought a stock at Rs. 100. It then proceeds to move in this fashion:

Watch how the trailing base, hugs the highs made by the stock after you bought it.

The stop loss is then triggered when the price falls x % below the trailing base.

In this example, if you set the trailing stop loss % as 5, the stop loss is triggered at point (7) highlighted in the chart.

The positives are many:

StockViz is proud to announce the availability of Trailing Stop Loss Alerts for our users. Start using them now!