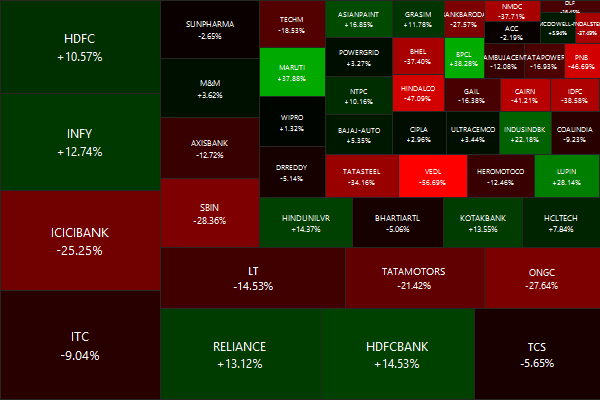

| held since | returns (%) | |

|---|---|---|

| EVERESTIND |

2014-Jul-07

|

+16.77

|

| GEOMETRIC |

2014-Mar-13

|

+54.95

|

| HITECHPLAS |

2014-Jul-07

|

+175.89

|

| INFINITE |

2014-Oct-07

|

+23.97

|

| MASTEK |

2013-Aug-28

|

+19.14

|

| MBECL |

2014-Mar-13

|

+55.23

|

| OMAXAUTO |

2015-Jan-19

|

+57.58

|

| SUNCLAYLTD |

2015-Jan-19

|

+18.68

|

| TRIDENT |

2014-Oct-07

|

+97.03

|

| UFLEX |

2014-Jul-07

|

+41.59

|

| WSTCSTPAPR |

2014-Jul-07

|

+19.07

|

| LUMAXIND |

2015-Jul-07

|

+50.39

|

| SUNDRMBRAK |

2015-Jul-07

|

+11.55

|

| GARWALLROP |

2015-Jul-07

|

+71.68

|

| HARITASEAT |

2015-Jul-07

|

+146.41

|

| ORIENTBELL |

2015-Jul-07

|

+18.60

|

| SURYAROSNI |

2015-Jul-07

|

+8.86

|

| AGCNET |

2015-Jul-07

|

-12.67

|

| UCALFUEL |

2015-Jul-07

|

+29.00

|

| CANTABIL |

2015-Jul-07

|

+5.85

|

Since the last rebalance on 2015-Jul-07 till 2016-Jan-01, this strategy has returned +37.90%

You can find more details about the Quality to Price Theme here.