The NIFTY ended tepid, moving just +0.12% for the week.

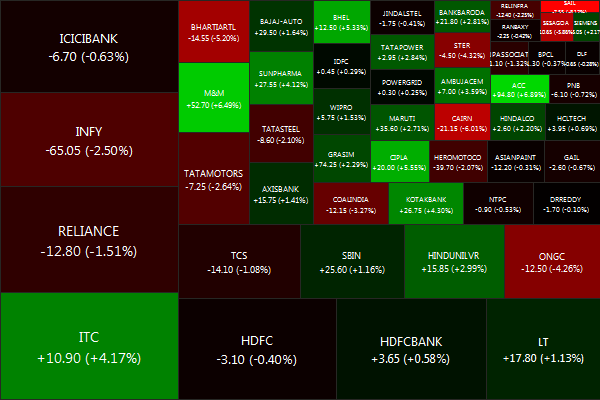

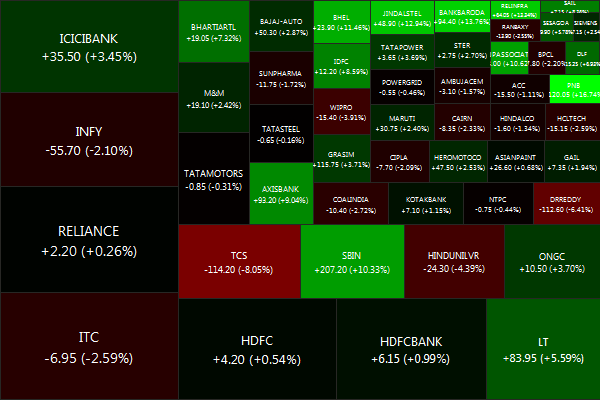

Biggest losers were SAIL (-7.77%), SESAGOA (-5.49%) and CAIRN (-5.32%).

And the biggest winners were M&M (+6.90%), ACC (+6.56%) and BHEL (+6.26%).

Advancers lead decliners 28 vs 22

Gold: -1.10%, Banks: -1.19%. Infrastructure: +6.03%,

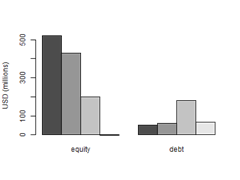

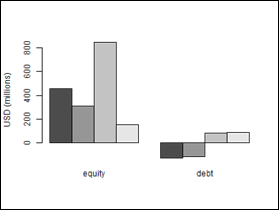

Net FII flows for the week: $1,769.89 mm (Equity) and -$73.68 mm (Debt)

The Economist has an awesome summary of the Indian political scene: Are we going through an American-style robber-baron phase or are we creating a Russian-style kleptocracy?

India’s politicians are not, by instinct, reformers. They act when pushed. Besides, the public is so angry that even honest decisions are sometimes construed as favoring special interests, so babus consider it safest to do nothing.

Daily news summaries are here.