WHAT IS A “THEME”?

A StockViz Investment Theme is a portfolio of stocks that follows a particular strategy. It is a convenient way for you to:

- stick to a strategy

- follow a preset rebalancing schedule

- think in terms of your portfolio strategy rather than individual stocks

- avoid common behavioral pitfalls

- systematically track your P&L and strategy performance

WHAT IS AN INVESTMENT STRATEGY?

An investment strategy is a specific way of going about the process of investing. It identifies specific variables that define a stock. Variables can be anything: risk, style, sector, balance-sheet items, etc..

By mapping specific Themes to your account, you ensure that you stay pure to your strategy allocation. And that there is no “flying by the seat of your pants” investing.

HOW HAVE YOUR THEMES PERFORMED?

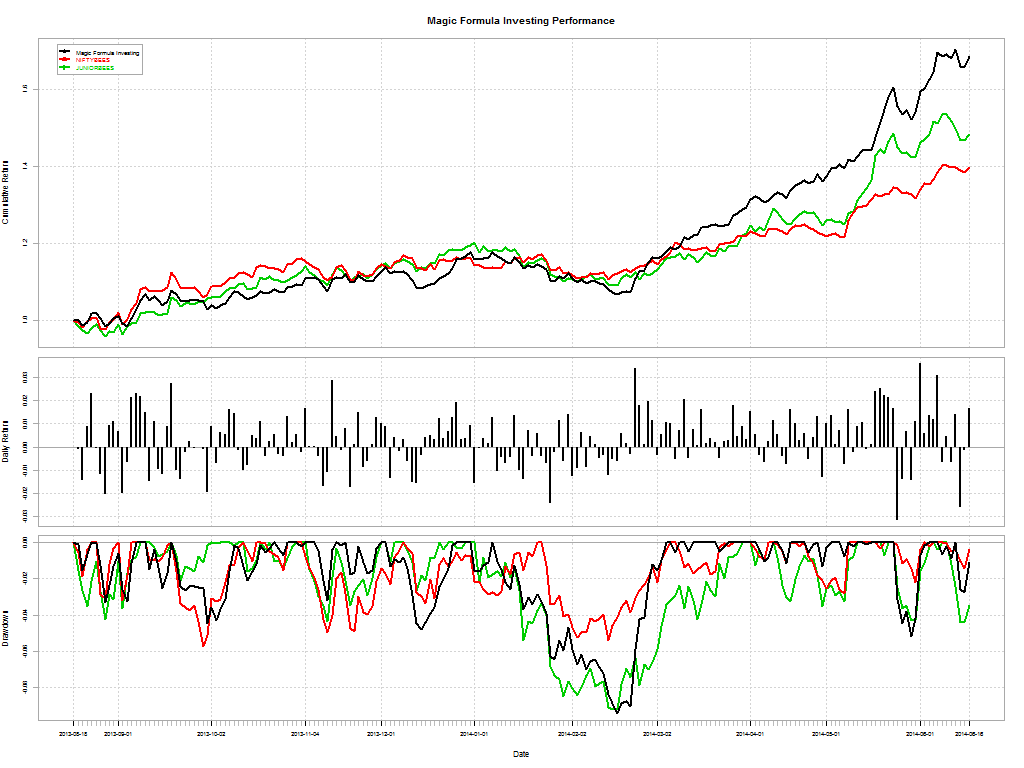

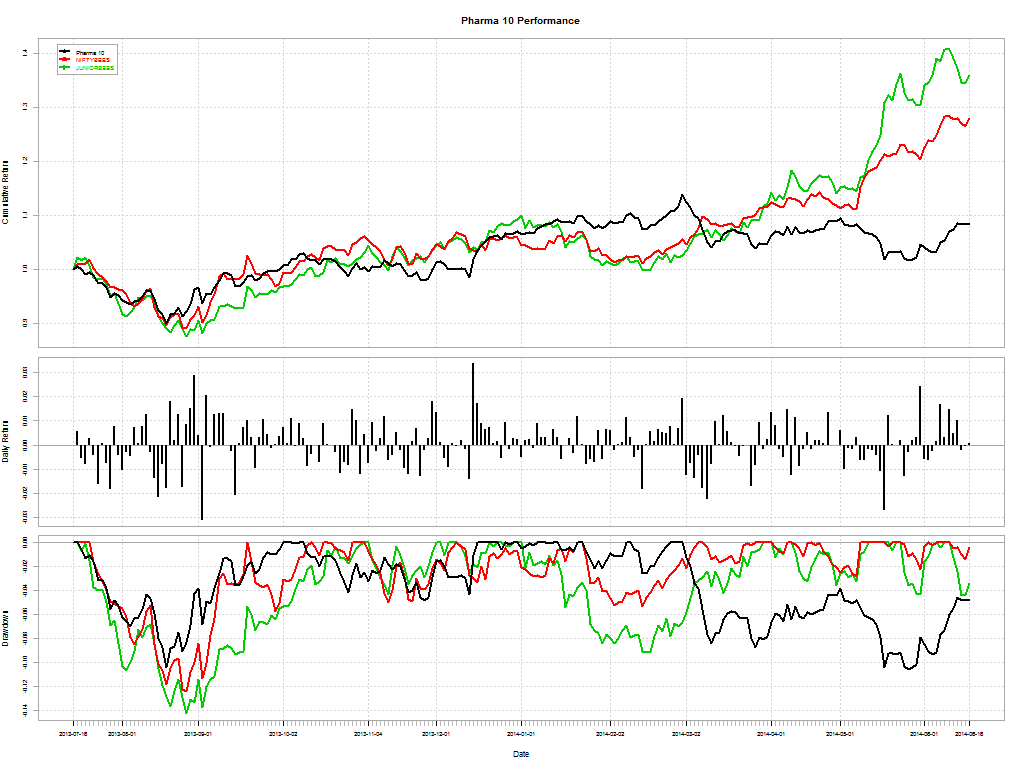

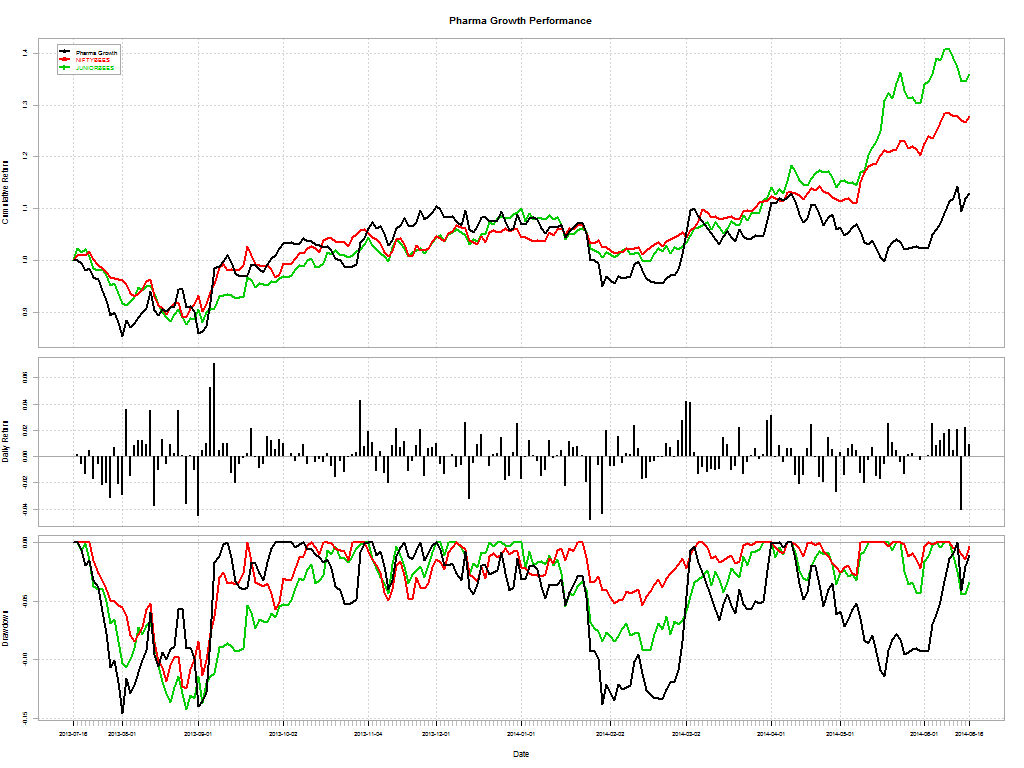

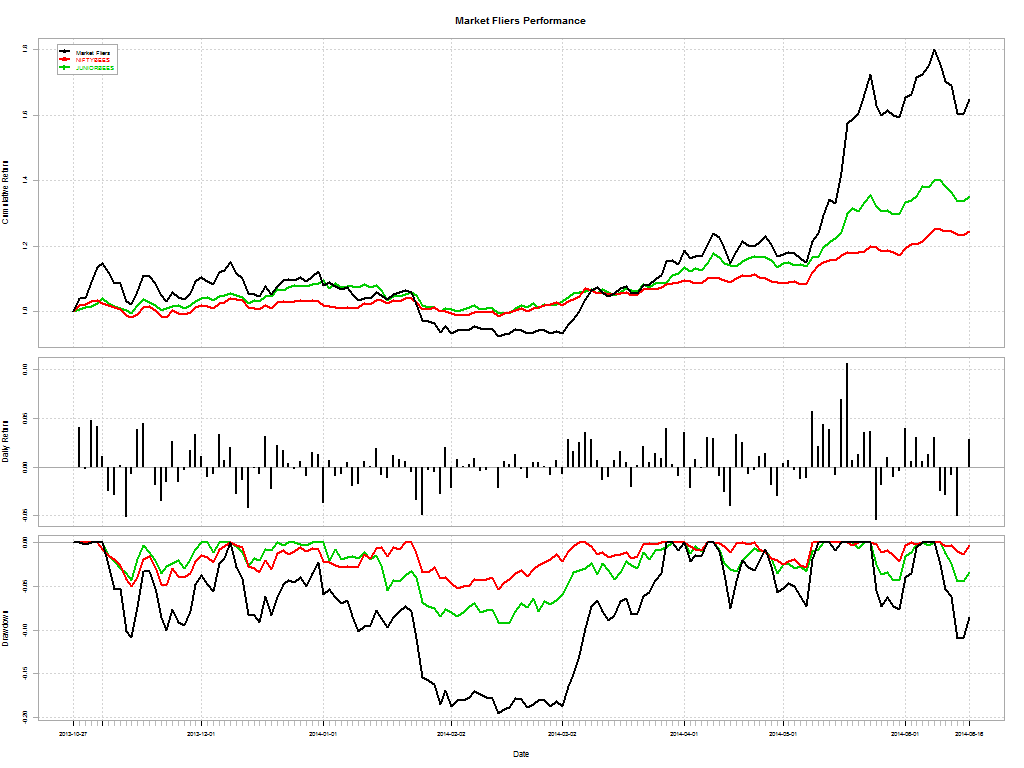

| Theme | Commencement | Performance | NIFTYBEES Performance | JUNIORBEES Performance |

|---|---|---|---|---|

| Market Fliers |

2013-Oct-28

|

64.79%

|

24.5%

|

35.1%

|

| Magic Formula Investing |

2013-Aug-19

|

68.67%

|

39.89%

|

48.38%

|

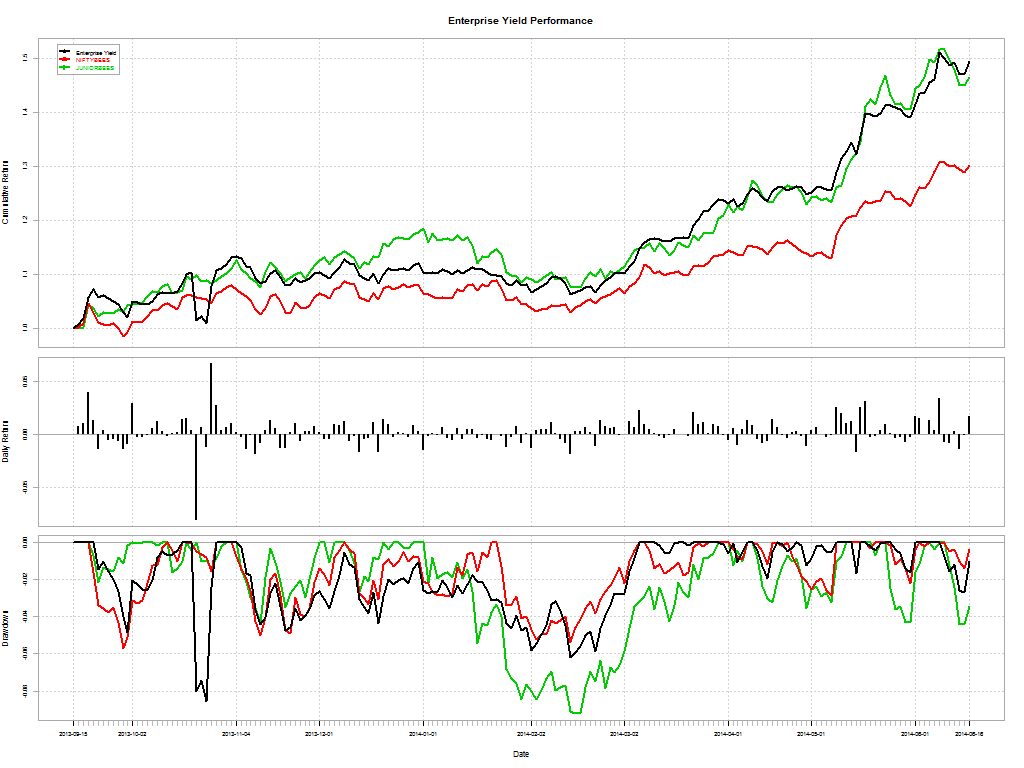

| Enterprise Yield |

2013-Sep-16

|

49.51%

|

30.24%

|

46.46%

|

| Pharma 10 |

2013-Jul-17

|

8.36%

|

27.88%

|

35.85%

|

| Pharma Growth |

2013-Jul-17

|

13.01%

|

27.88%

|

35.85%

|

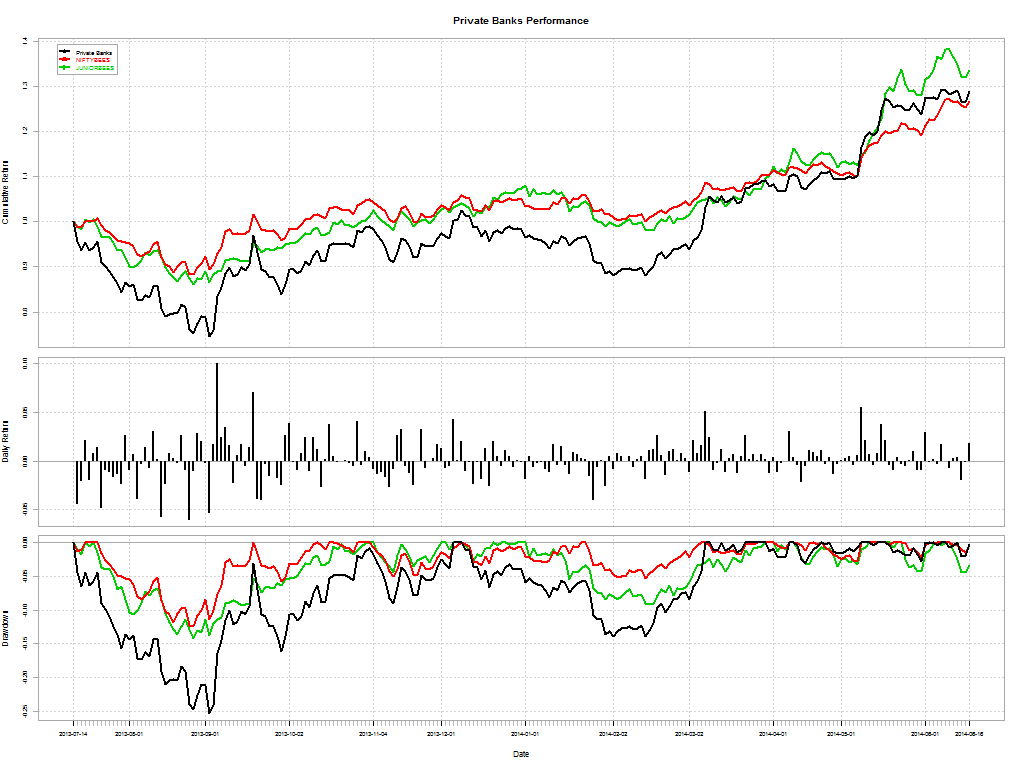

| Private Banks |

2013-Jul-15

|

28.82%

|

26.61%

|

33.45%

|

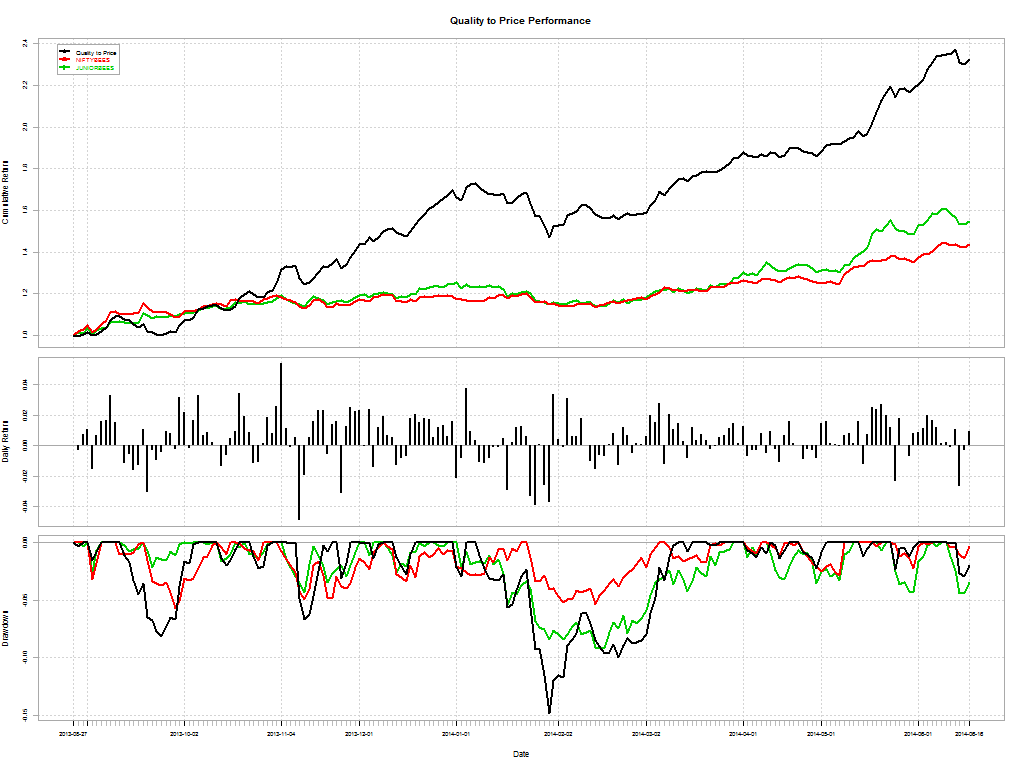

| Quality to Price |

2013-Aug-28

|

132.47%

|

43.5%

|

54.91%

|

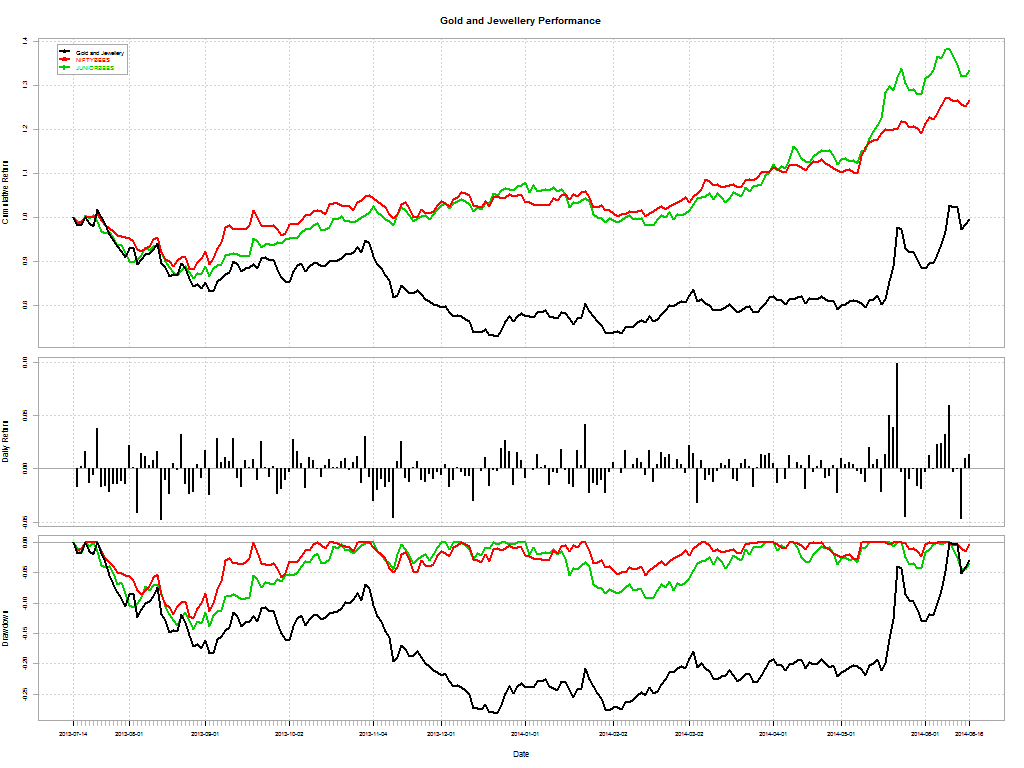

| Gold and Jewellery |

2013-Jul-15

|

-0.34%

|

26.61%

|

33.45%

|

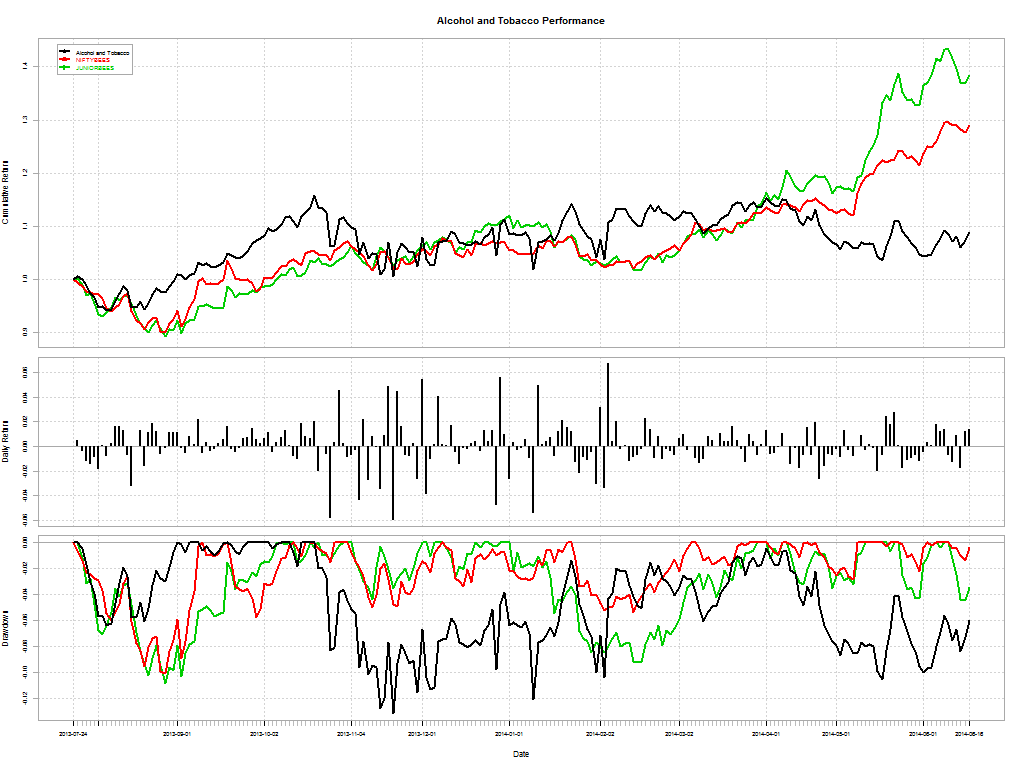

| Alcohol and Tobacco |

2013-Jul-25

|

8.84%

|

29.05%

|

38.35%

|

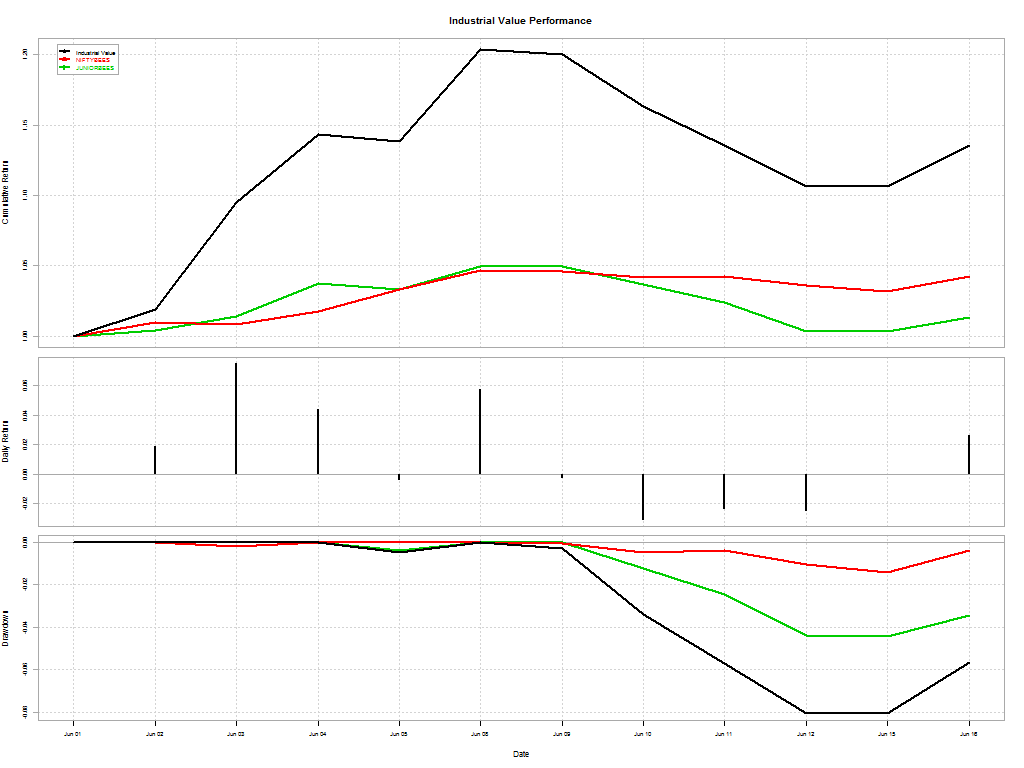

| Industrial Value |

2014-Jun-02

|

13.57%

|

4.27%

|

1.36%

|

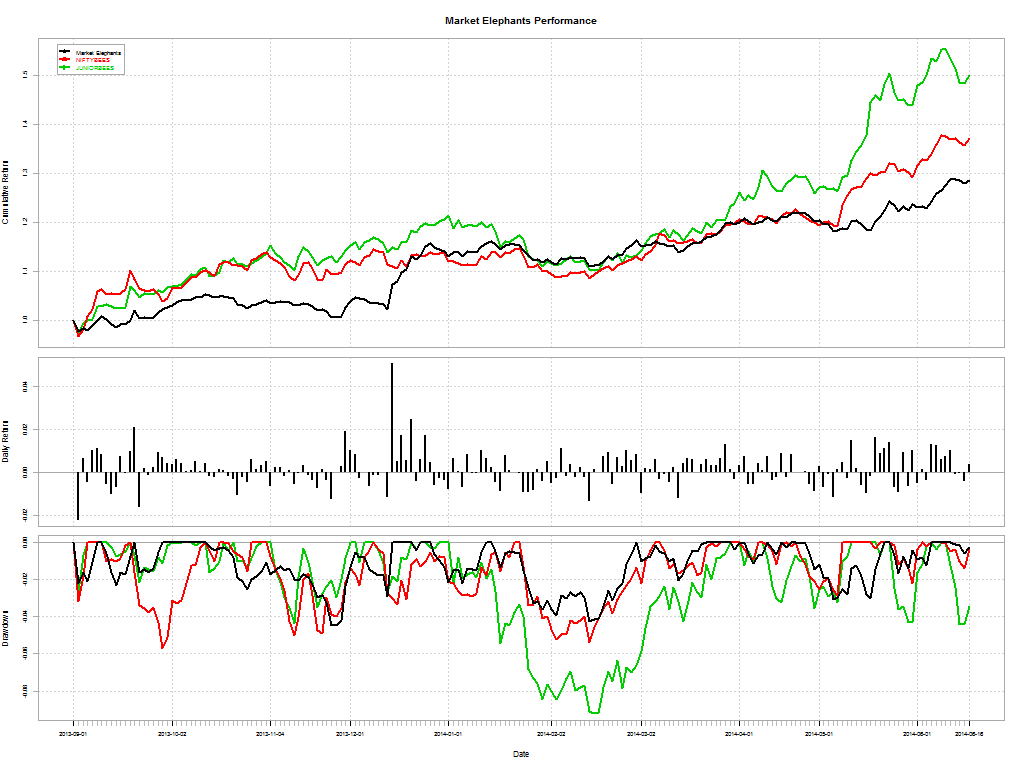

| Market Elephants |

2013-Sep-02

|

28.51%

|

37.15%

|

49.96%

|

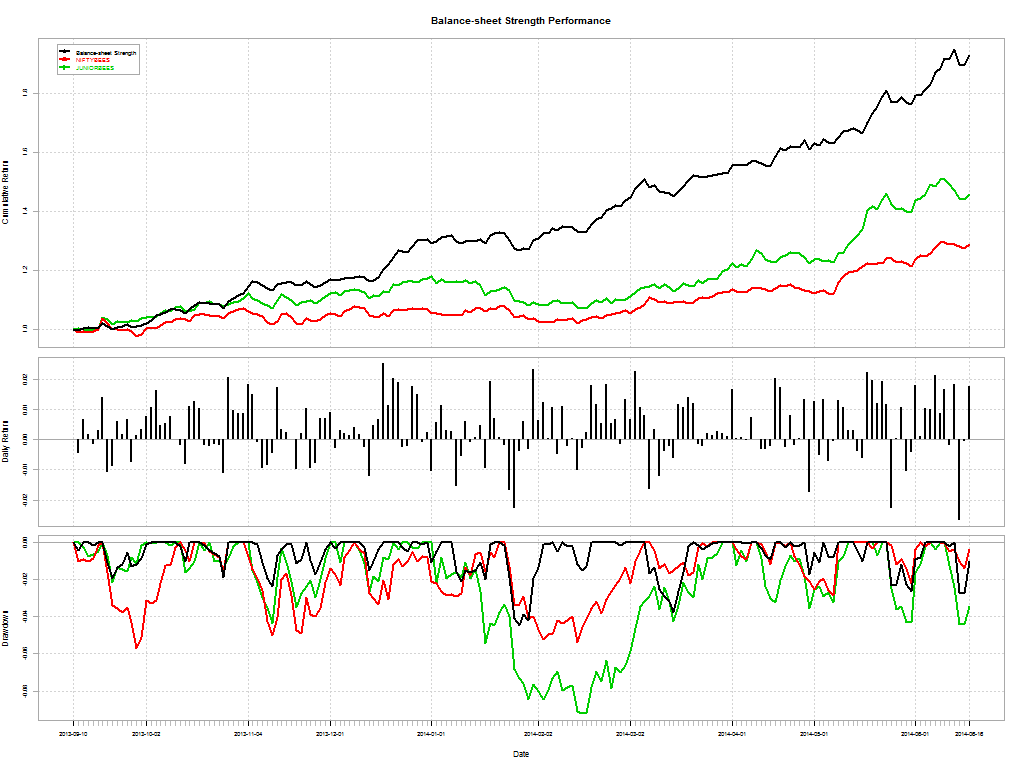

| Balance-sheet Strength |

2013-Sep-11

|

93%

|

28.88%

|

45.66%

|

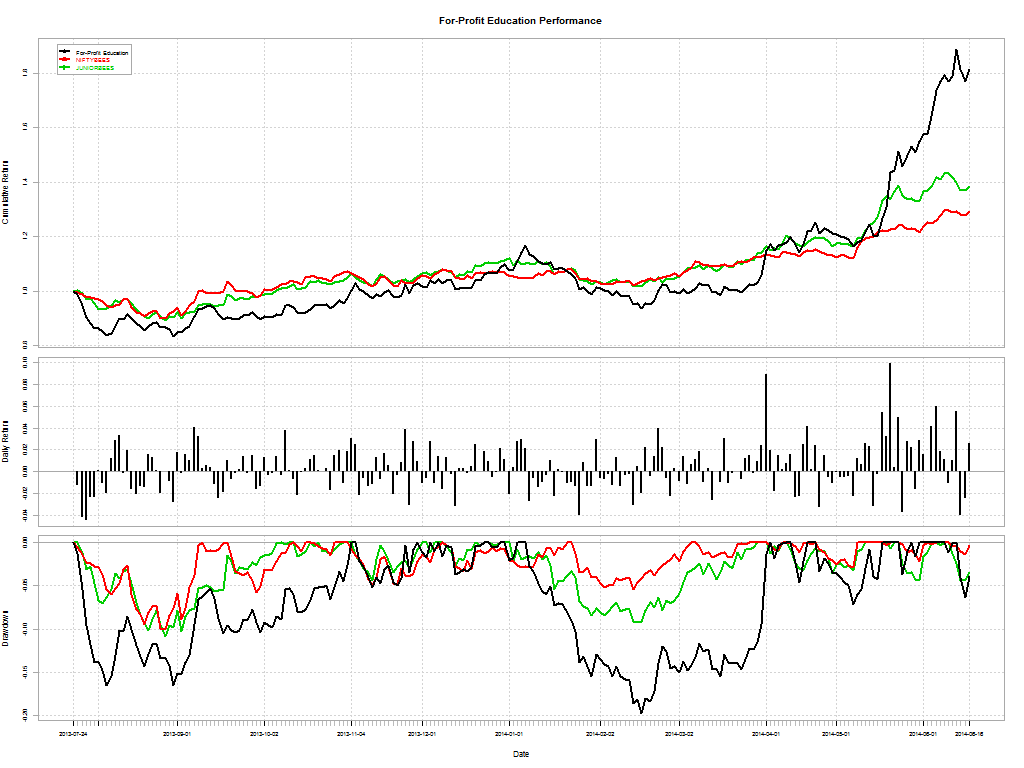

| For-Profit Education |

2013-Jul-25

|

81.33%

|

29.05%

|

38.35%

|

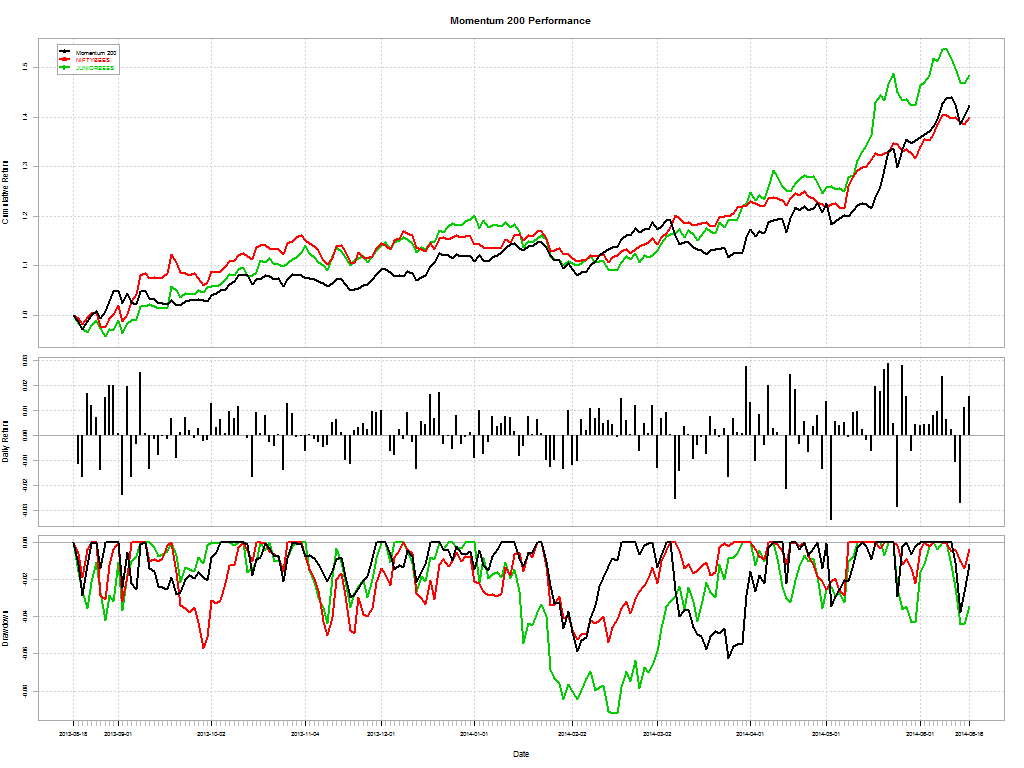

| Momentum 200 |

2013-Aug-19

|

42.34%

|

39.89%

|

48.38%

|

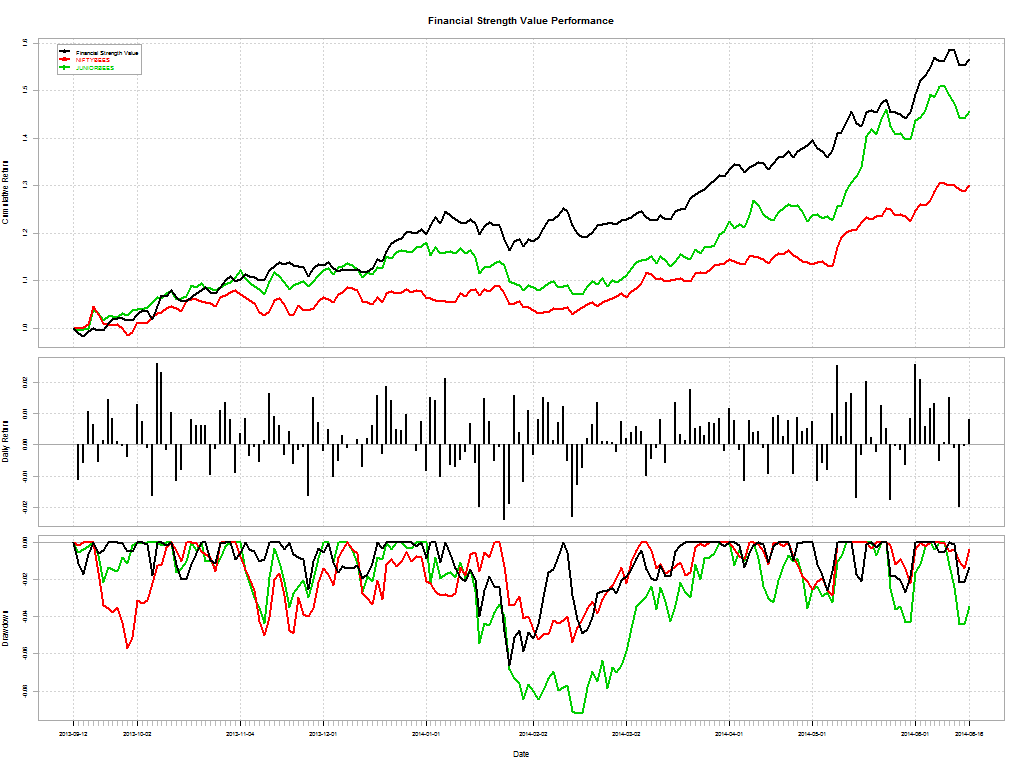

| Financial Strength Value |

2013-Sep-13

|

56.54%

|

30.06%

|

45.69%

|

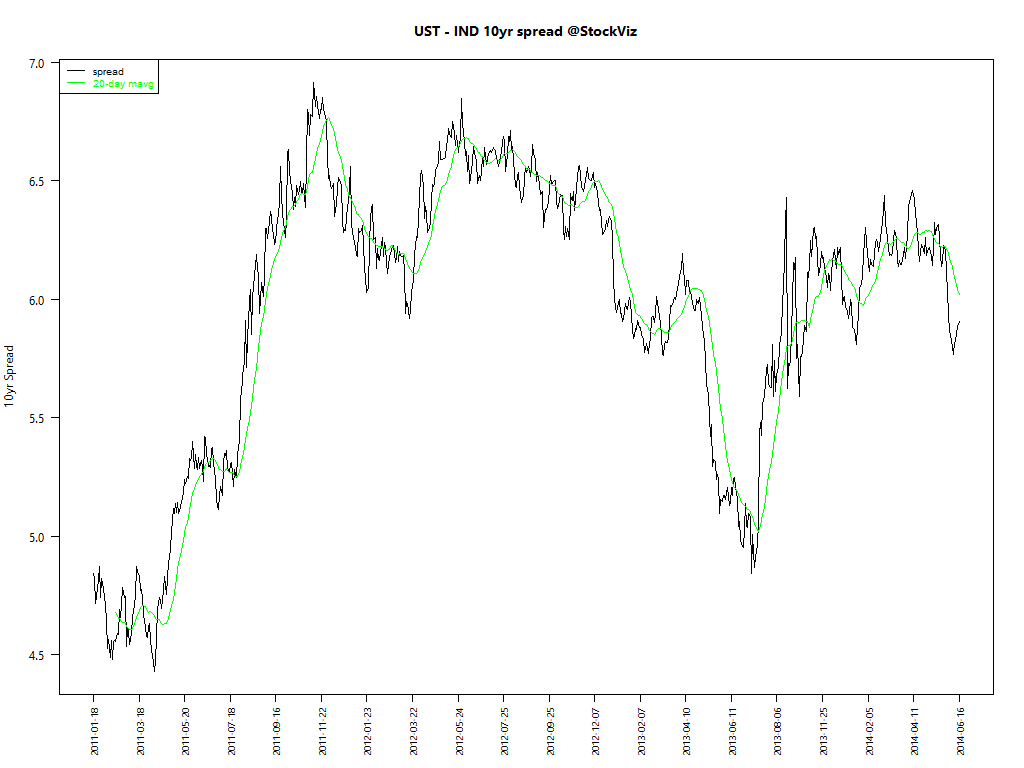

Detail of draw-downs can be found here.

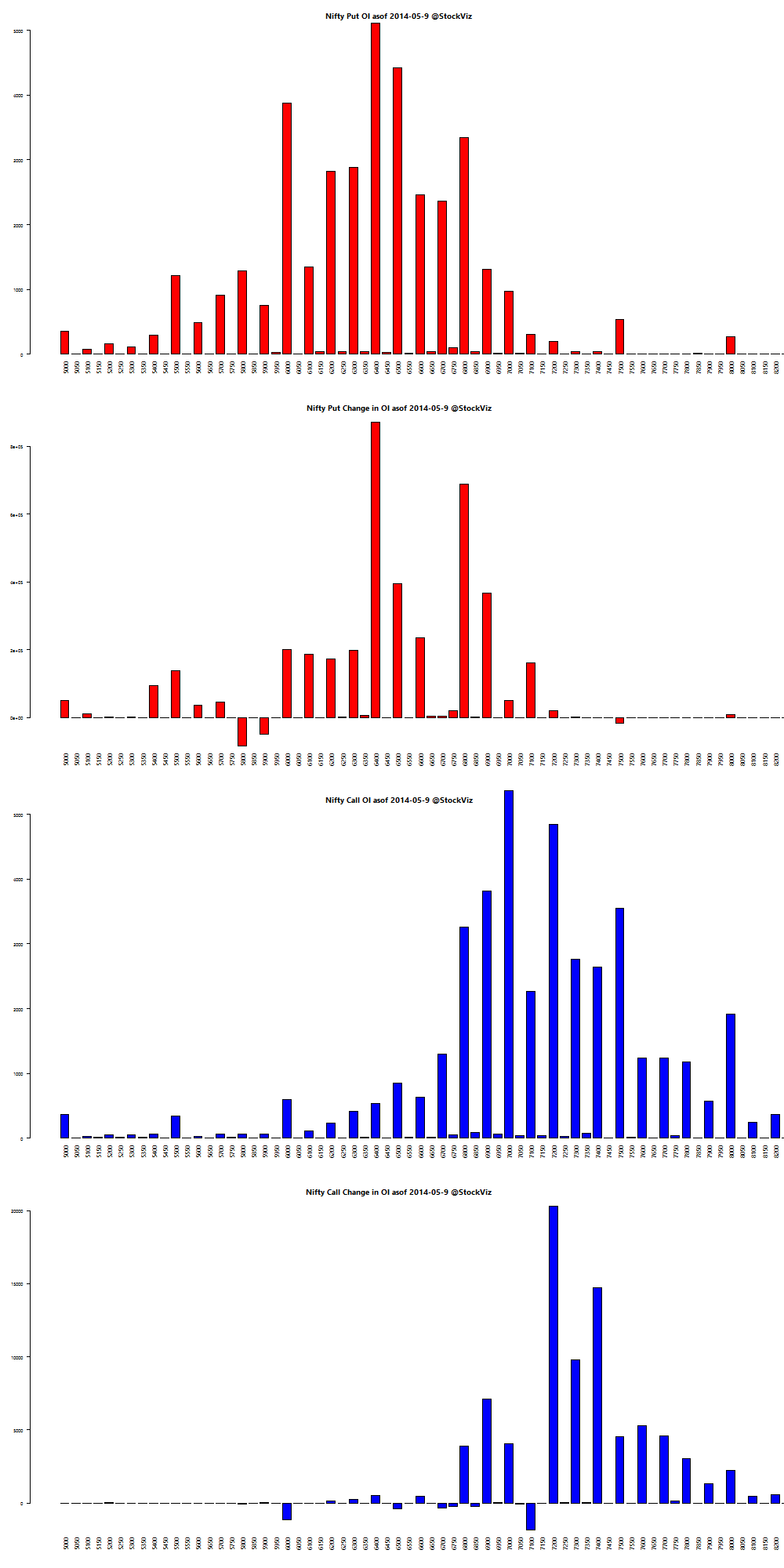

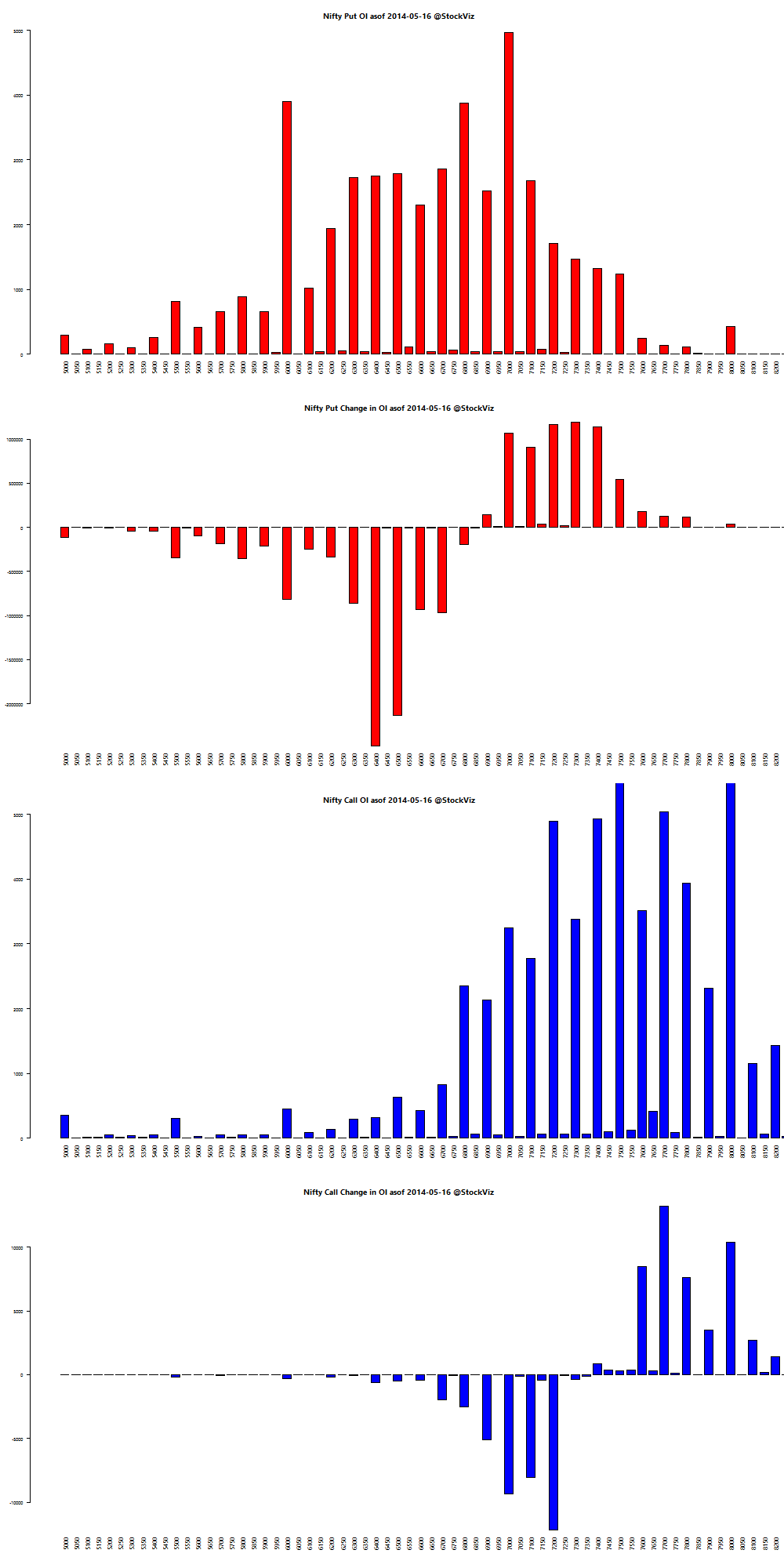

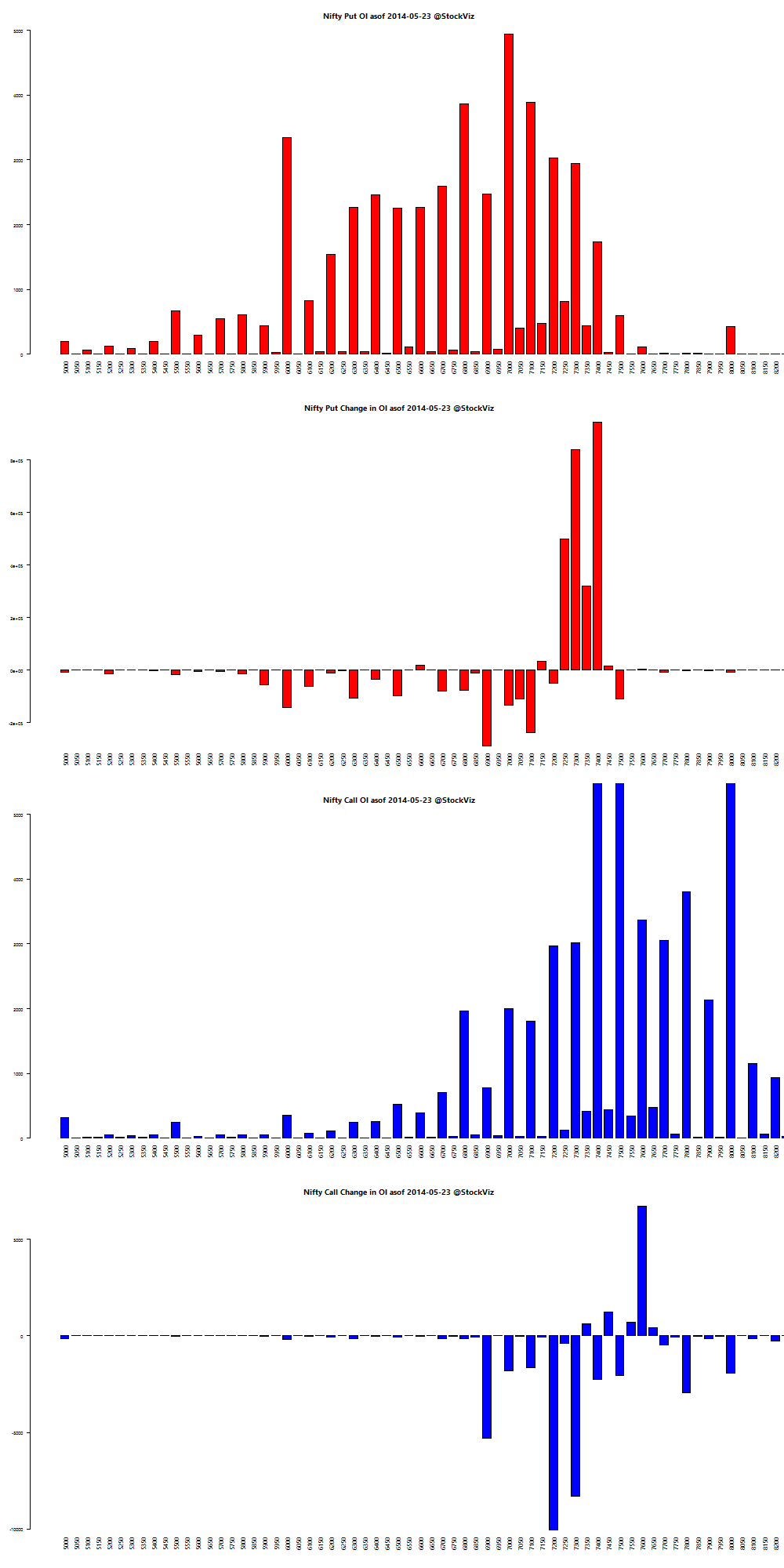

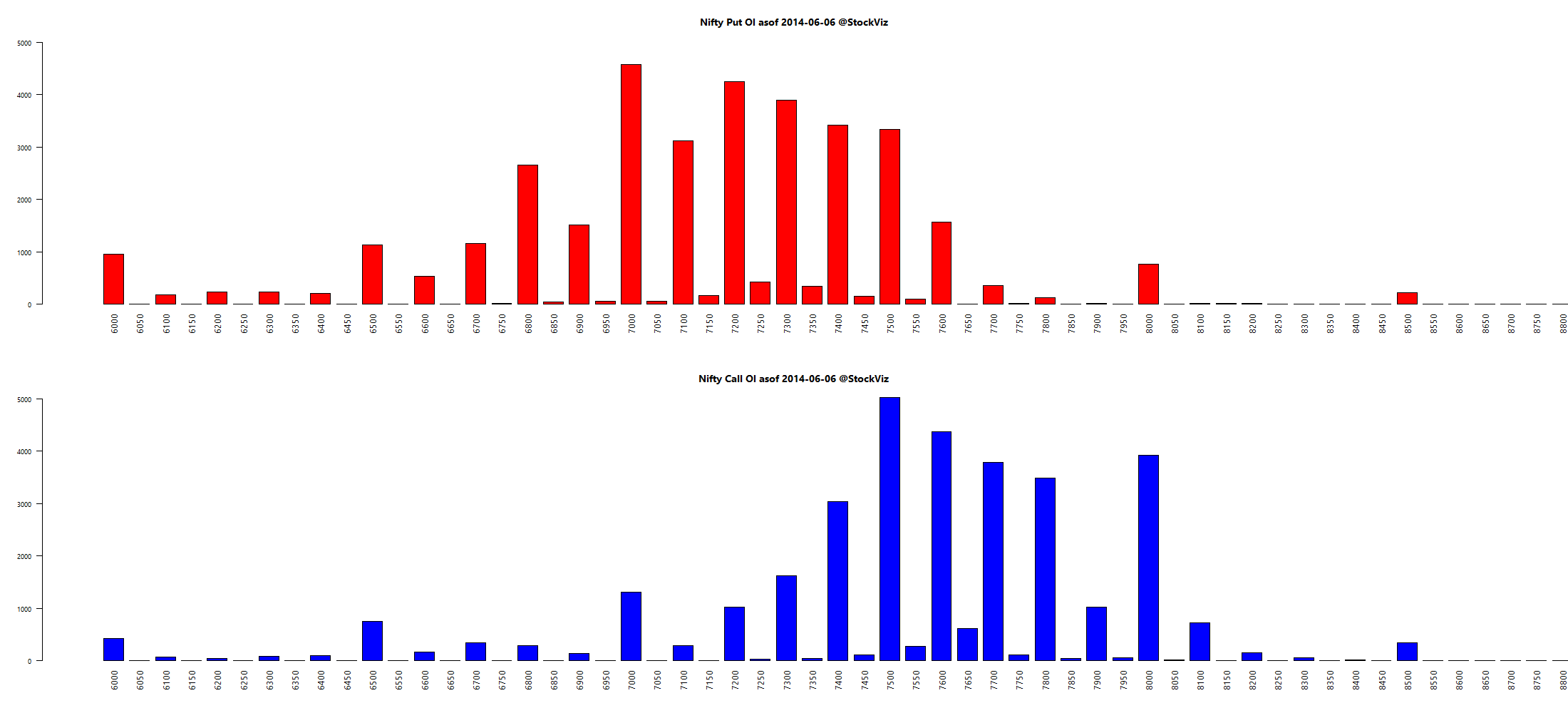

Performance Charts

WHAT SHOULD I DO NEXT?

You should open a demat account with StockViz and invest through our Themes.