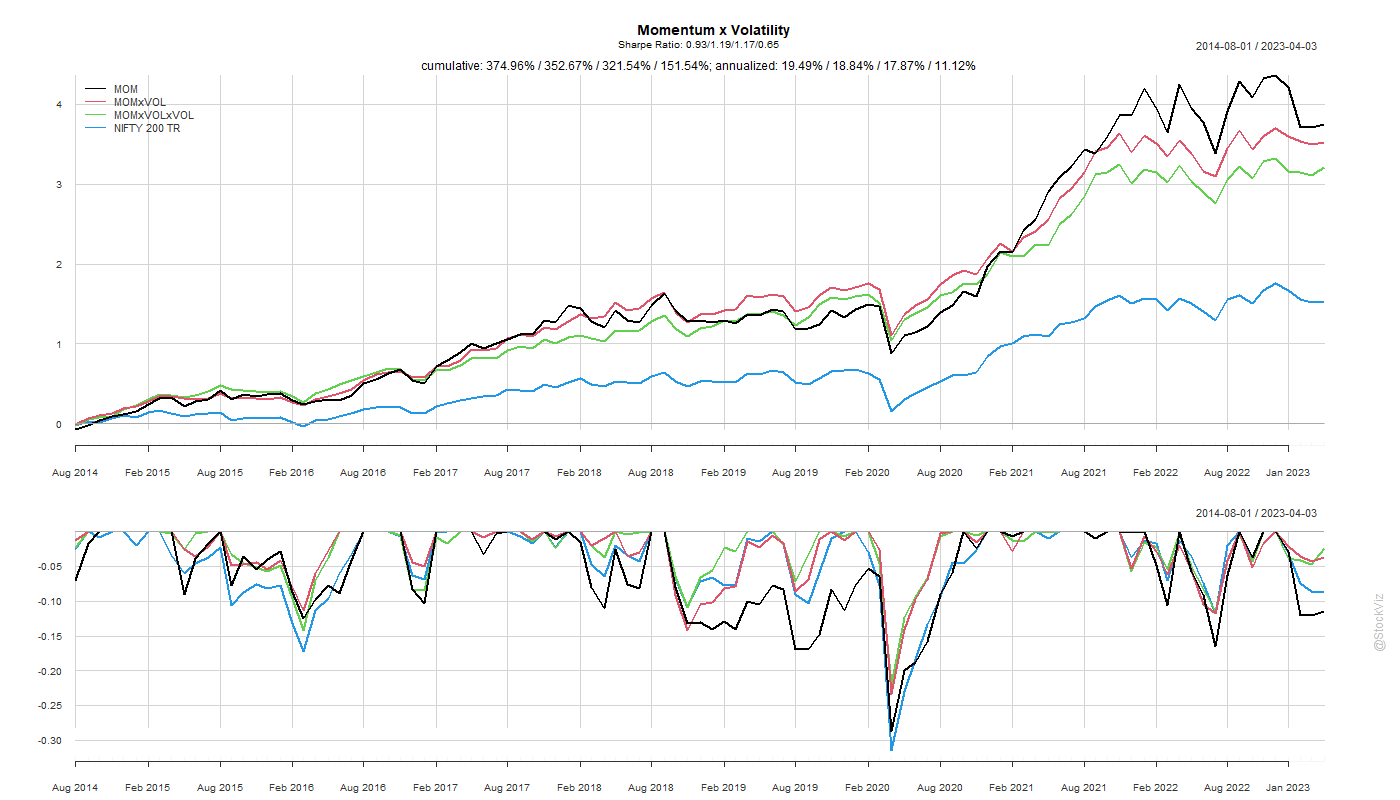

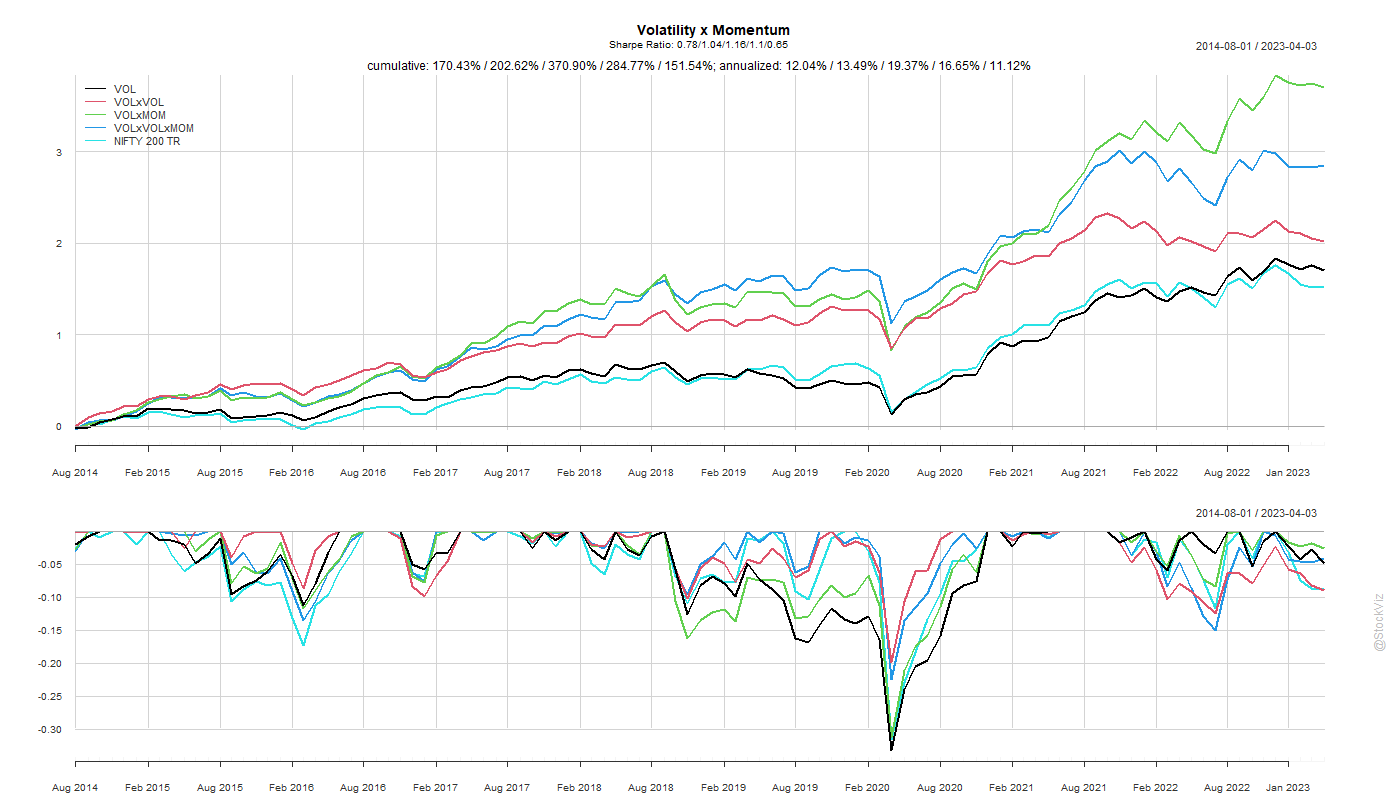

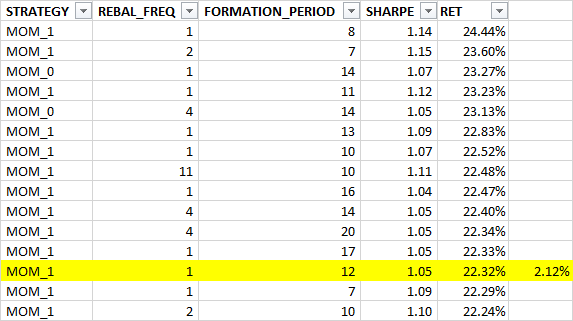

Previously, we looked at skip-months and rebalance frequencies for momentum portfolios. A 1-month skip & monthly rebalance turned out to be ideal. However, we did these analyses keeping the formation period the same at 12-months. What if we changed that as well?

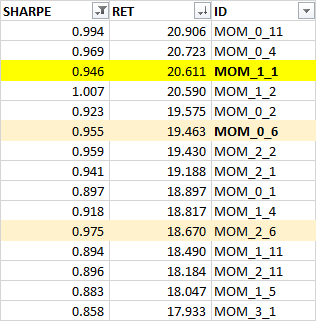

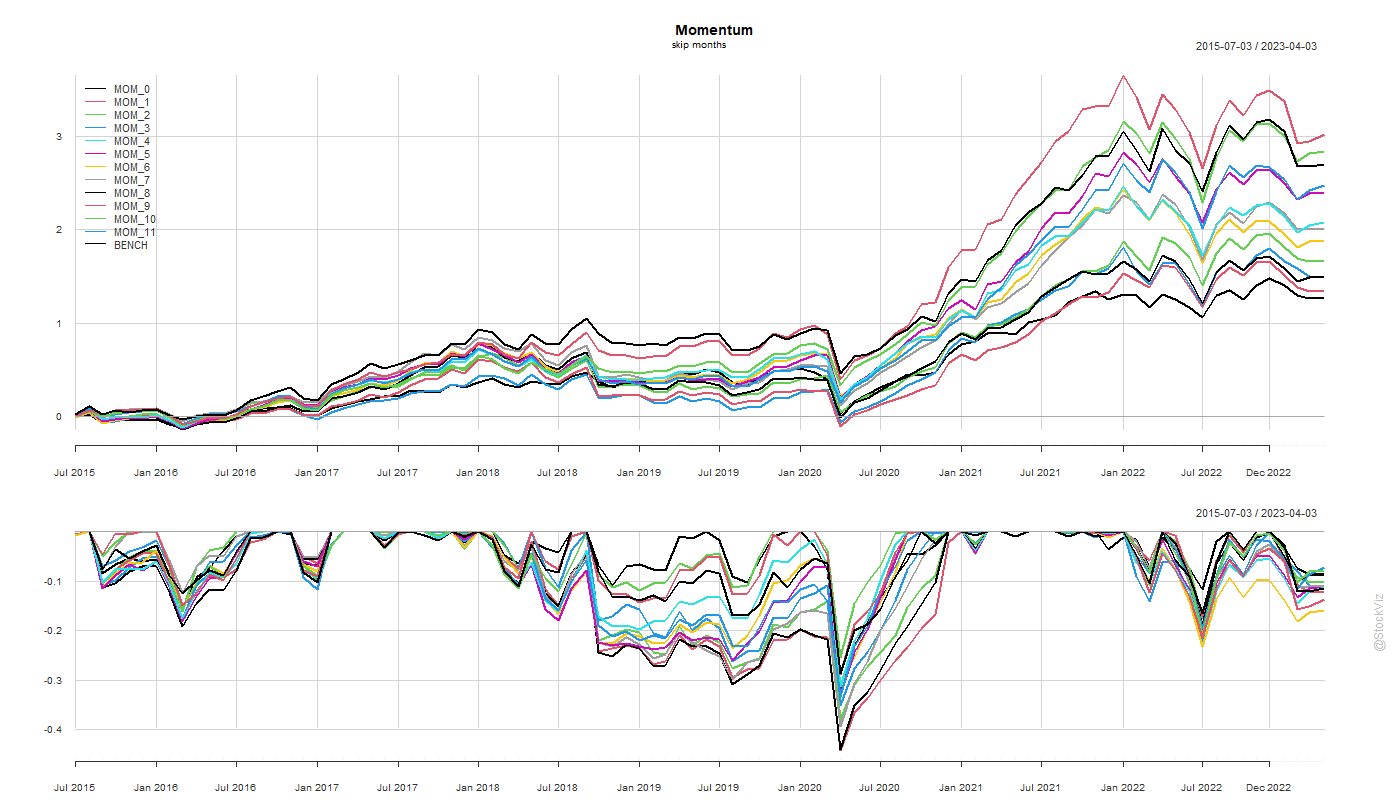

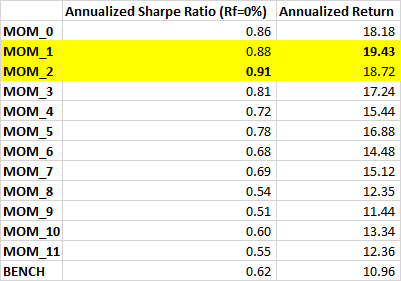

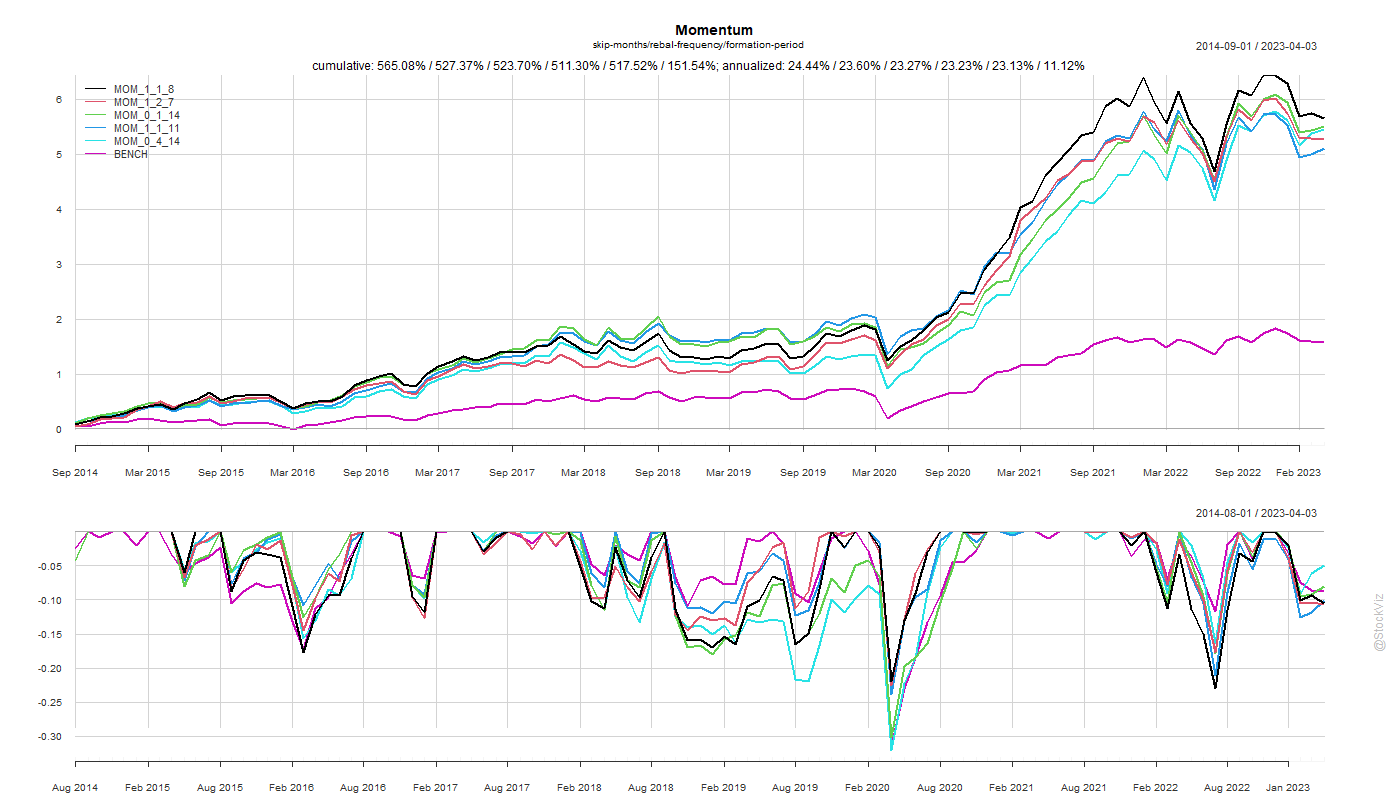

Turns out, there is no single “ideal” formation period where all stats converge. However, if set the rebalance frequency to 1-month, the average of the formation periods of the top performing portfolios works out to 12-months.

If the momentum fund is large enough, then it could probably be sliced into multiple sub-portfolios, each with different configs to avoid this magic 12-month formation.

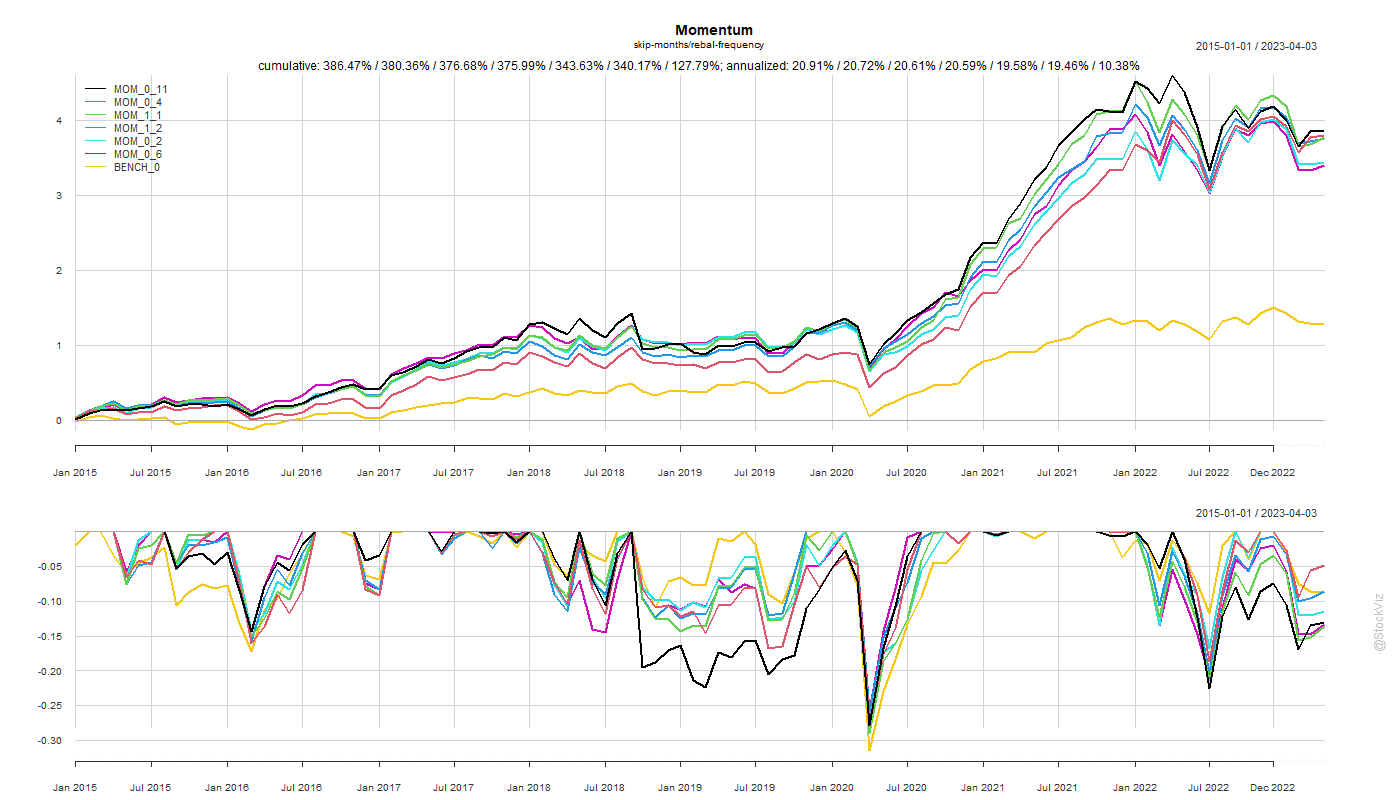

Also, since the underlying process creating these portfolios is the same, the equity curves come out all bunched together. There maybe differences in month-over-month performances but they are all highly correlated.

Code, charts and statistics on github.