Introduction

A trailing stop is a percentage below the most recent high at which you exit a trade. It allows you to lock-in gains while avoiding catastrophic loss. There are lot of opinions about where these should be set. And more importantly, when to re-enter. What follows is a discussion on how different stops and re-entry rules affect trading frequency and returns.

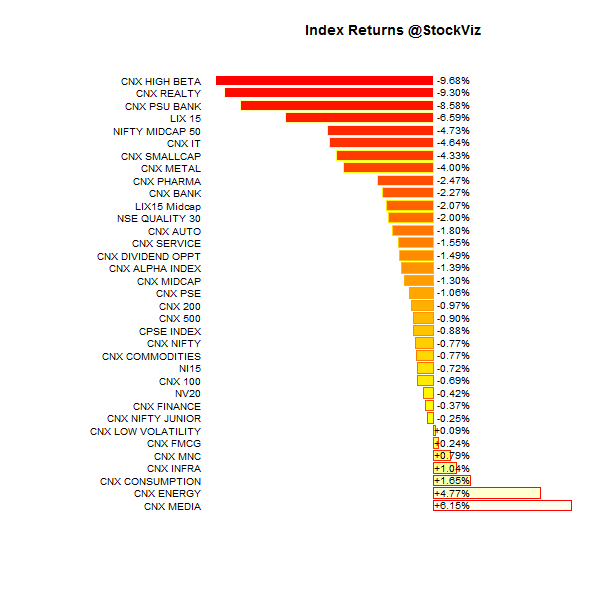

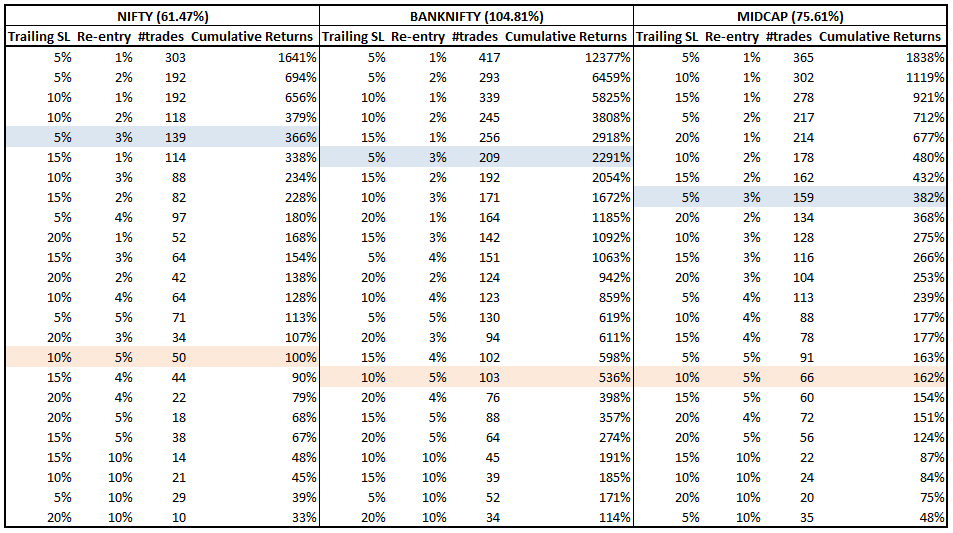

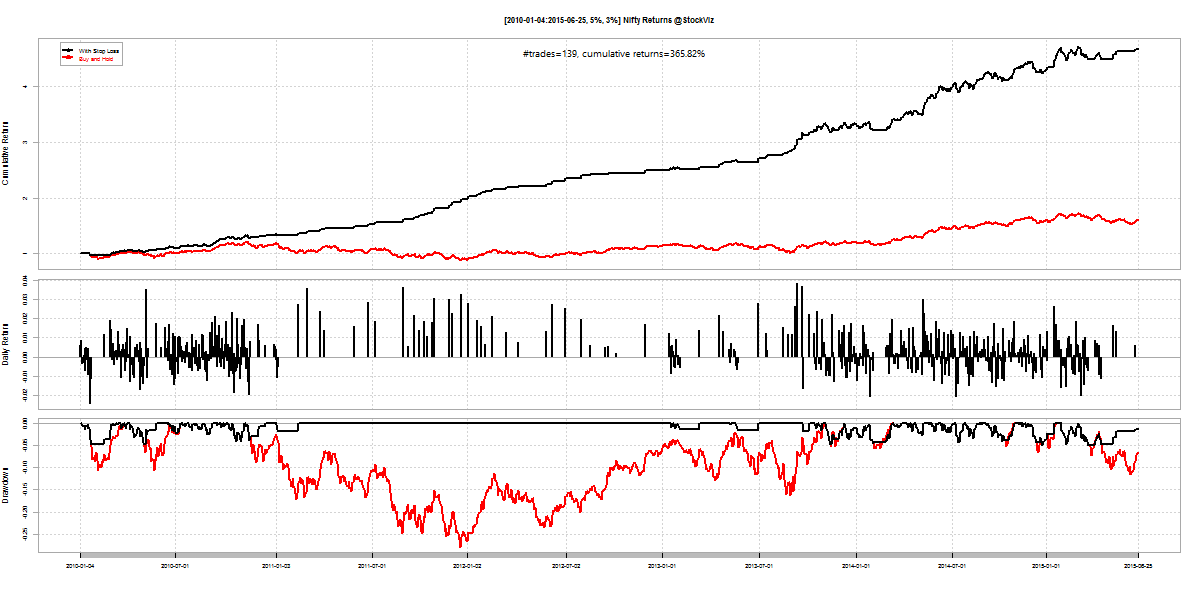

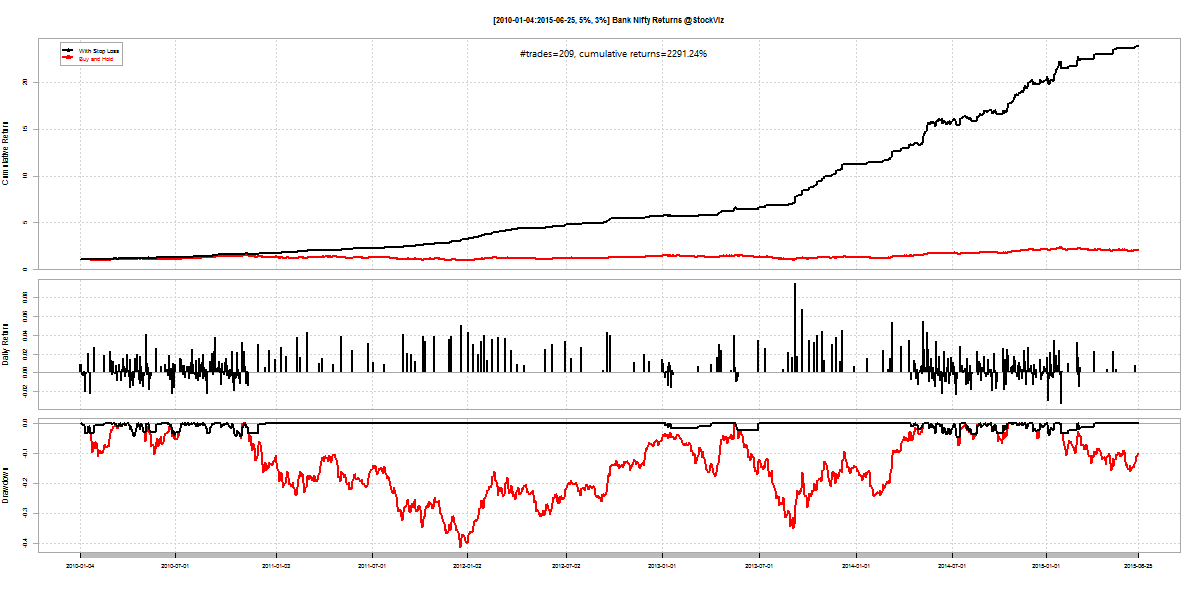

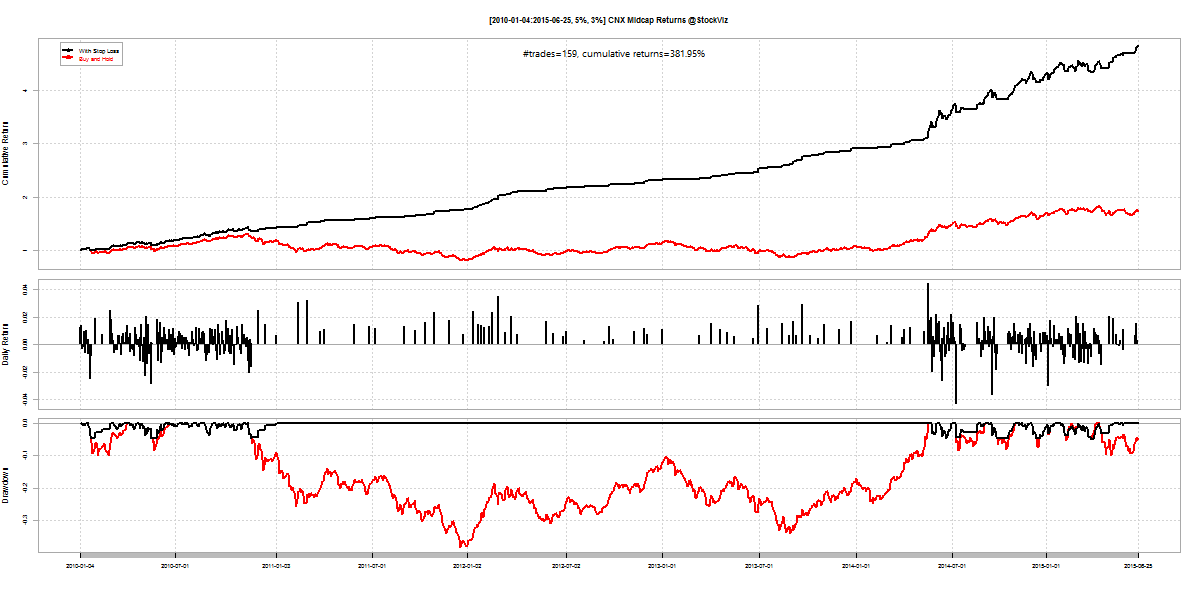

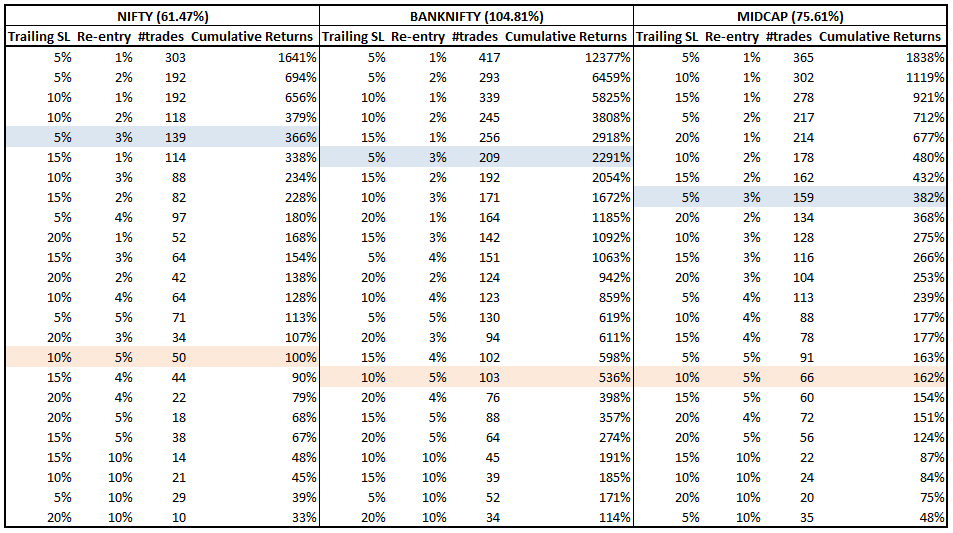

We will consider time-series from 2010 through now on the NIFTY, BANK NIFTY and CNX MIDCAP indices. During this time, the cumulative buy-and-hold returns were 61.47%, 104.81% and 75.61% respectively.

A simple 5-3 Rule

“A good plan violently executed now is better than a perfect plan executed next week.”

– George S. Patton

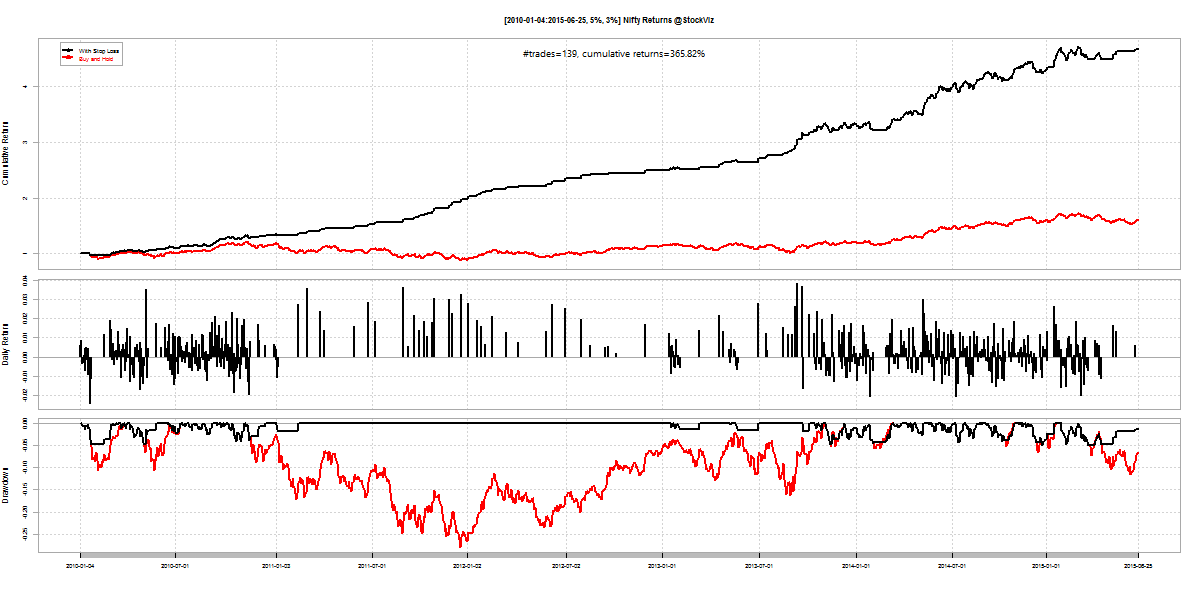

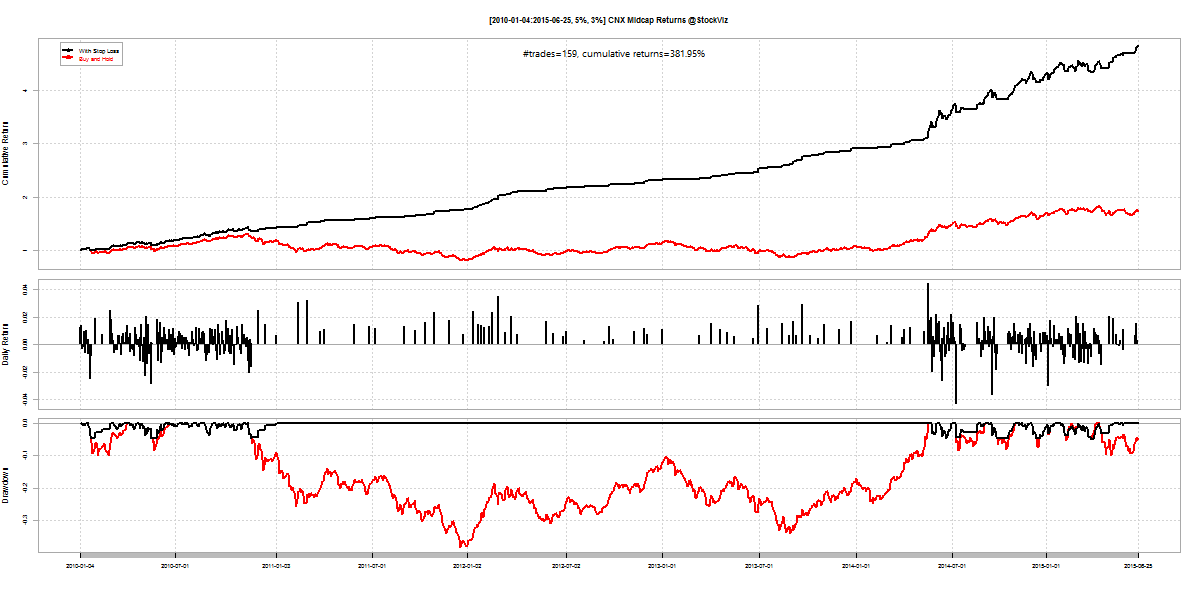

To get us started, we propose a trailing-stop loss at 5% and a re-entry rule that triggers when the index covers 3% from the lowest level since exiting the trade. This rule significantly increases returns and reduces draw-downs across all indices.

| Index |

#trades |

cum. returns |

| Nifty |

139 |

366% |

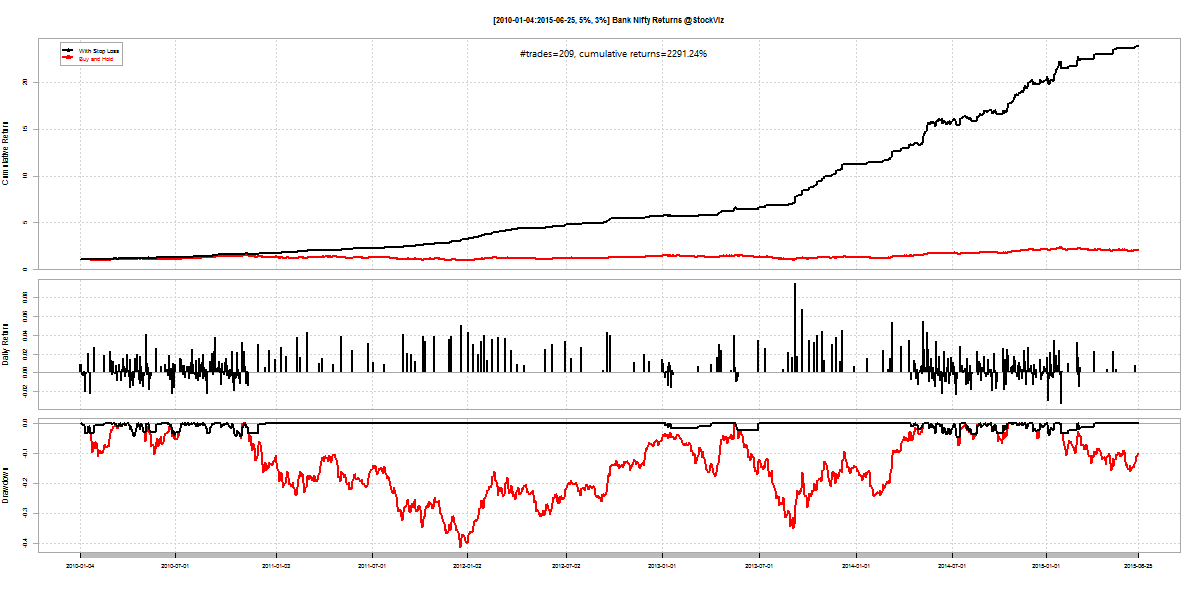

| Bank Nifty |

209 |

2291% |

| Midcap |

159 |

382% |

The boost in returns come at additional trading costs. And even though the average number of trades work out to less than one a week, there maybe periods where it might trigger every day.

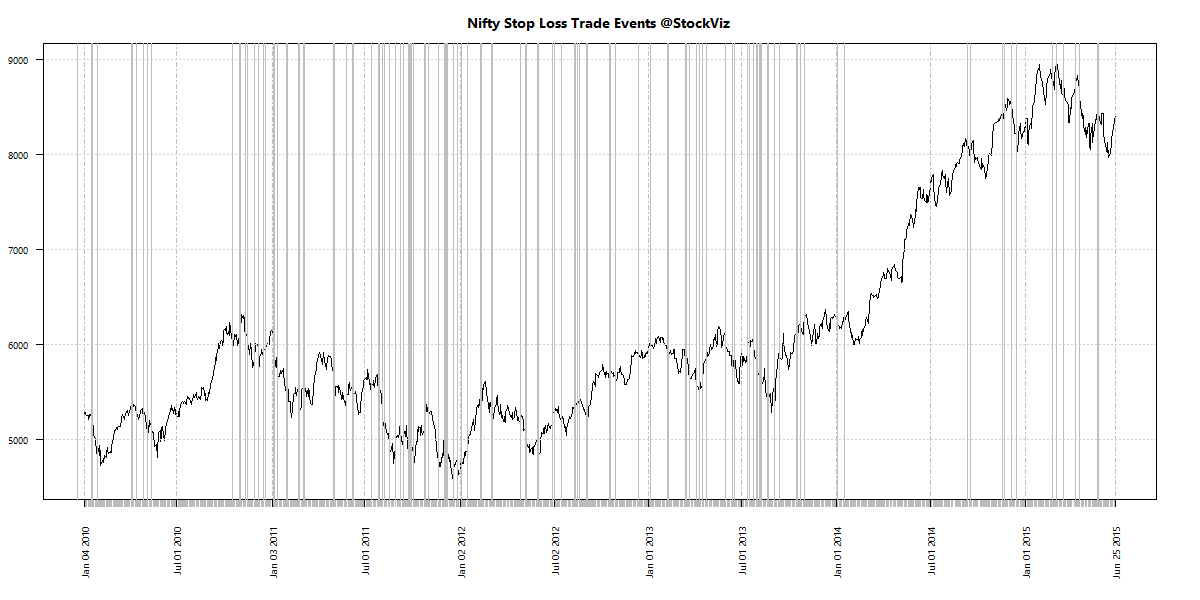

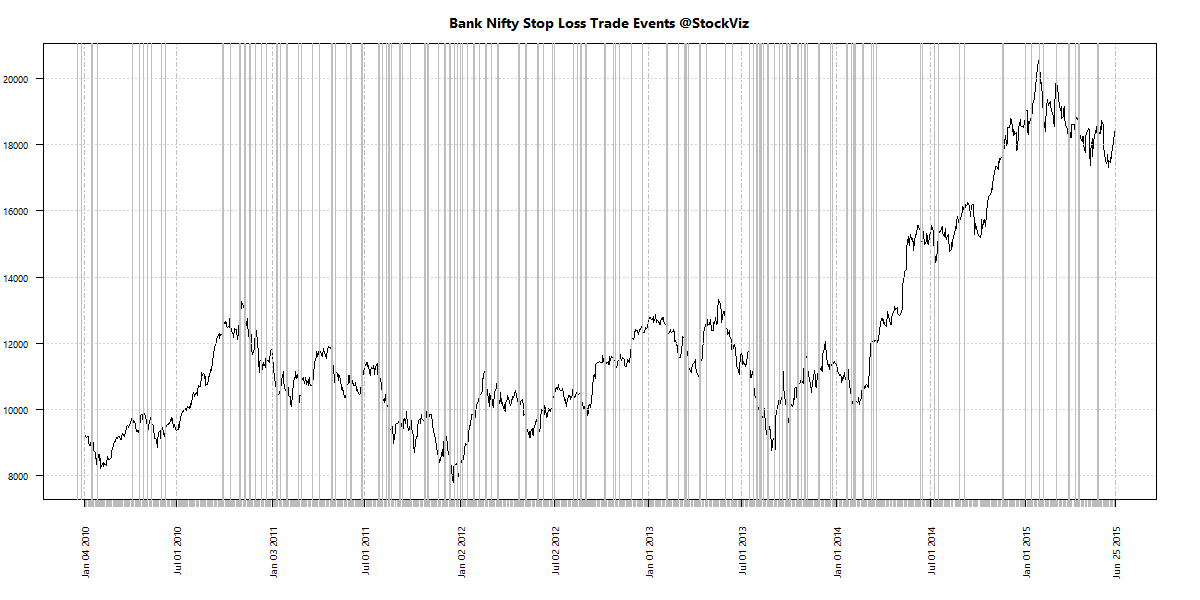

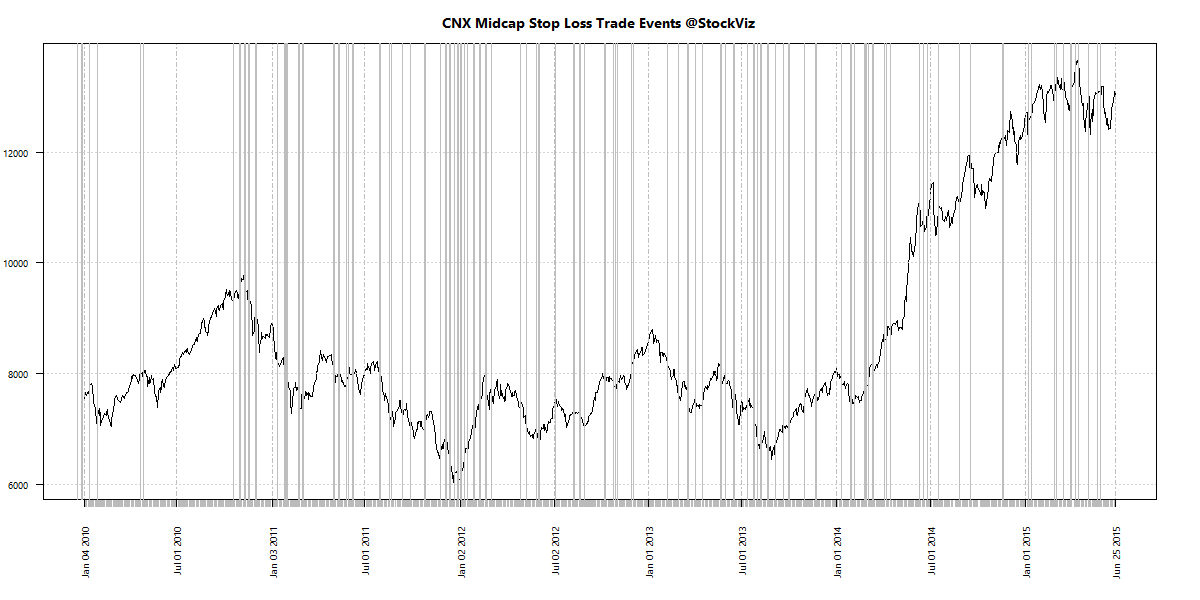

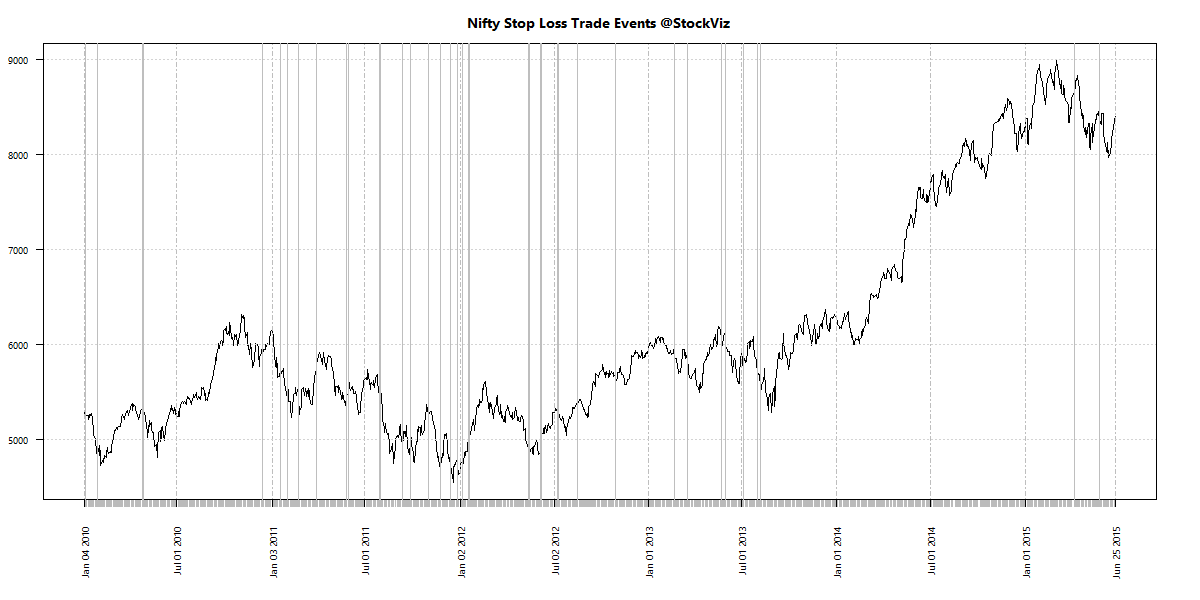

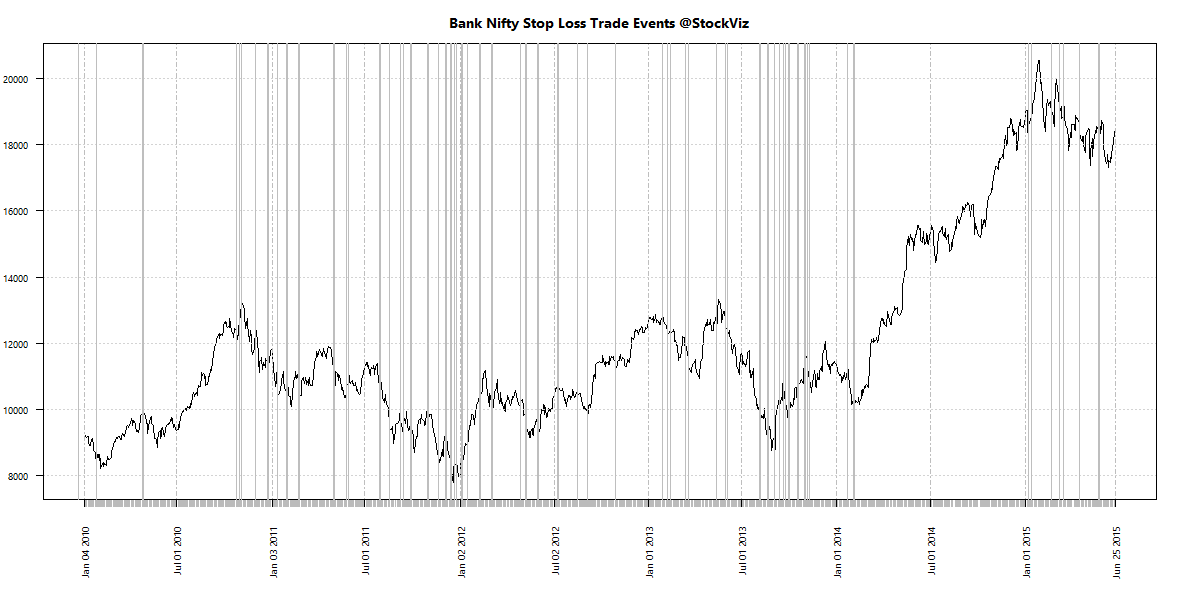

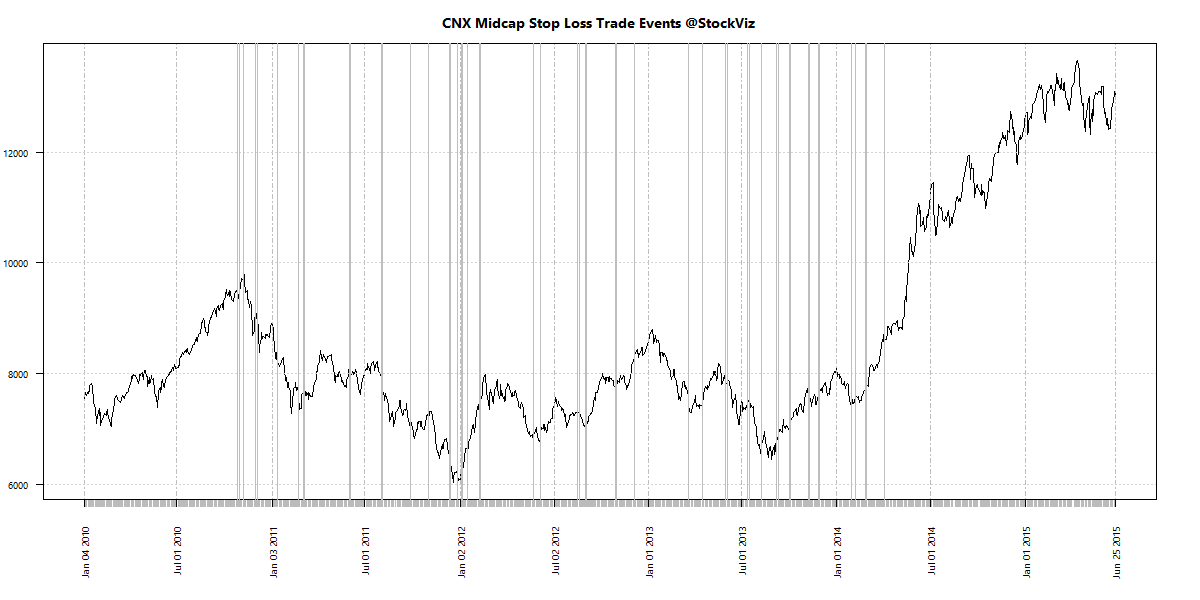

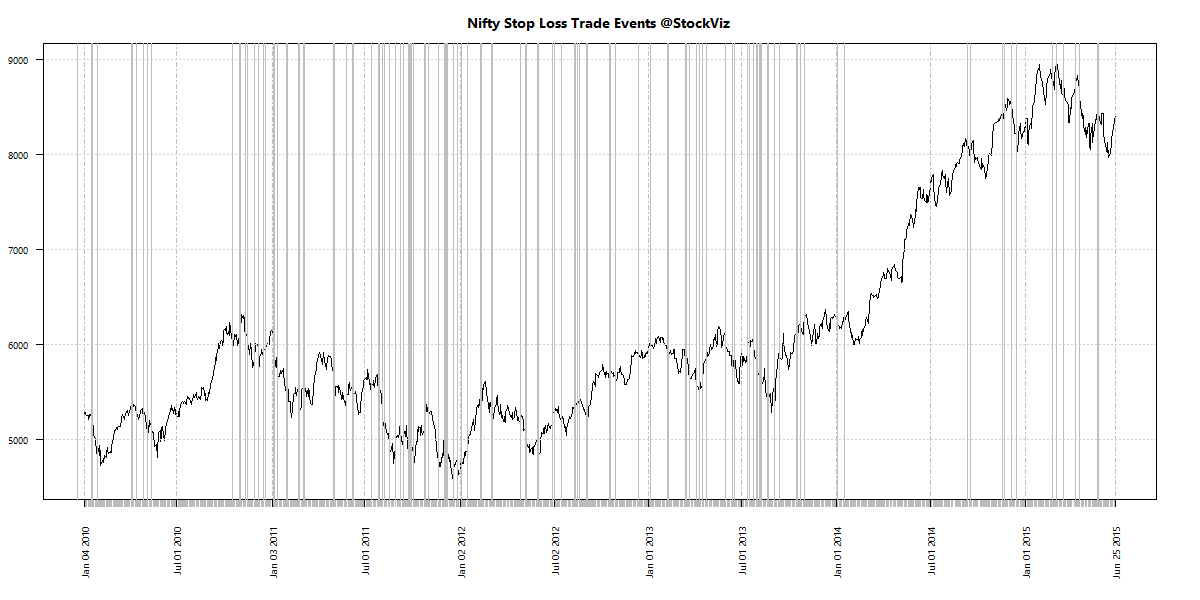

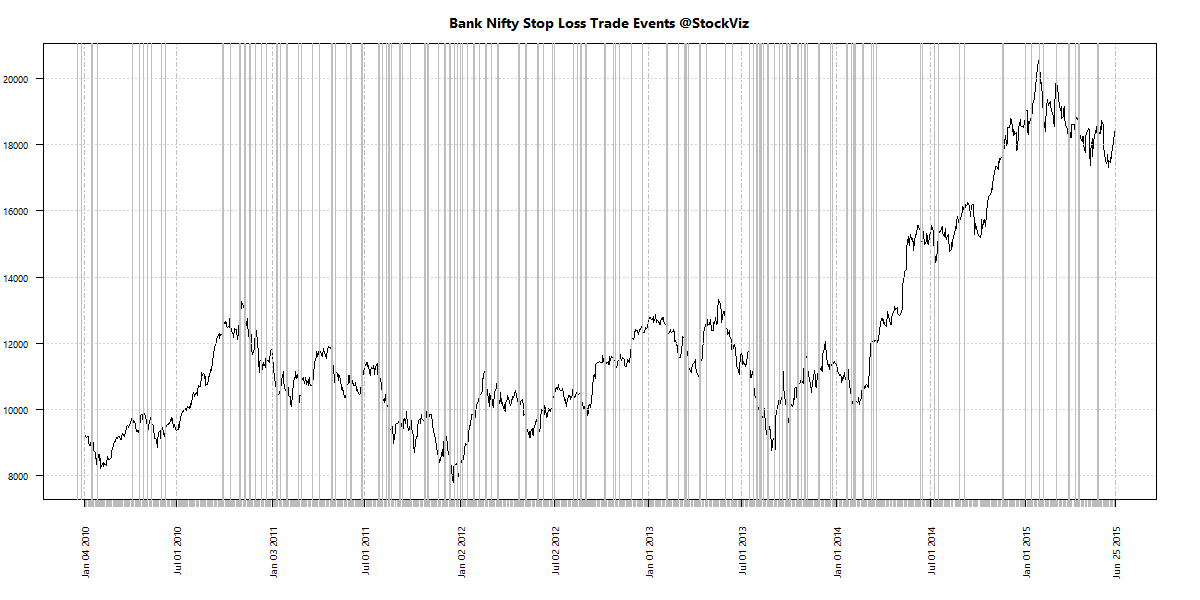

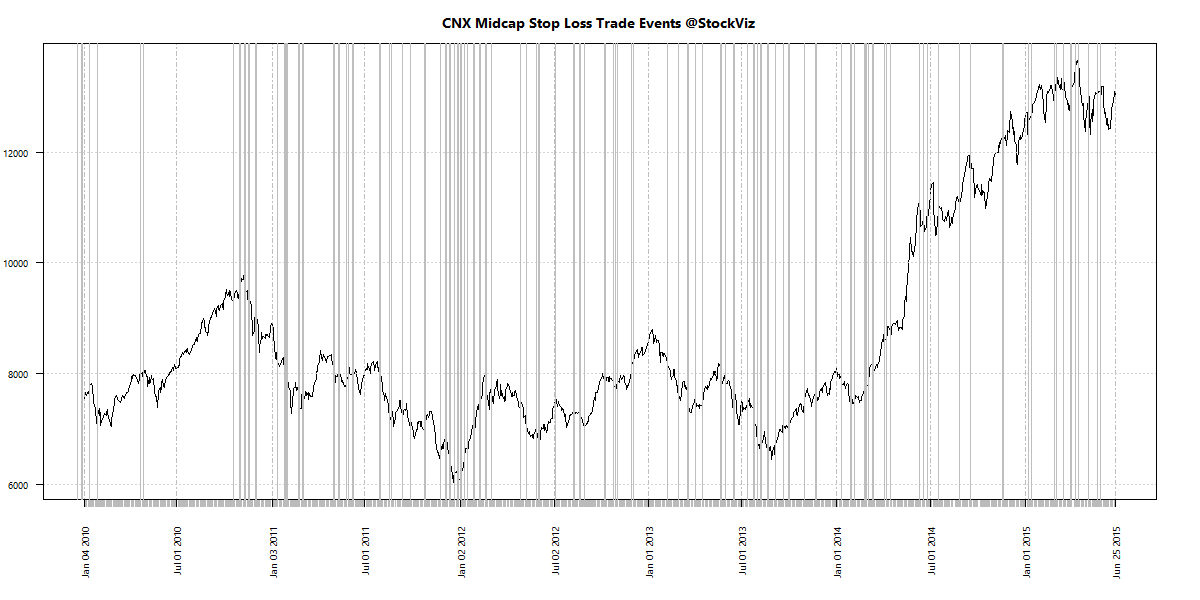

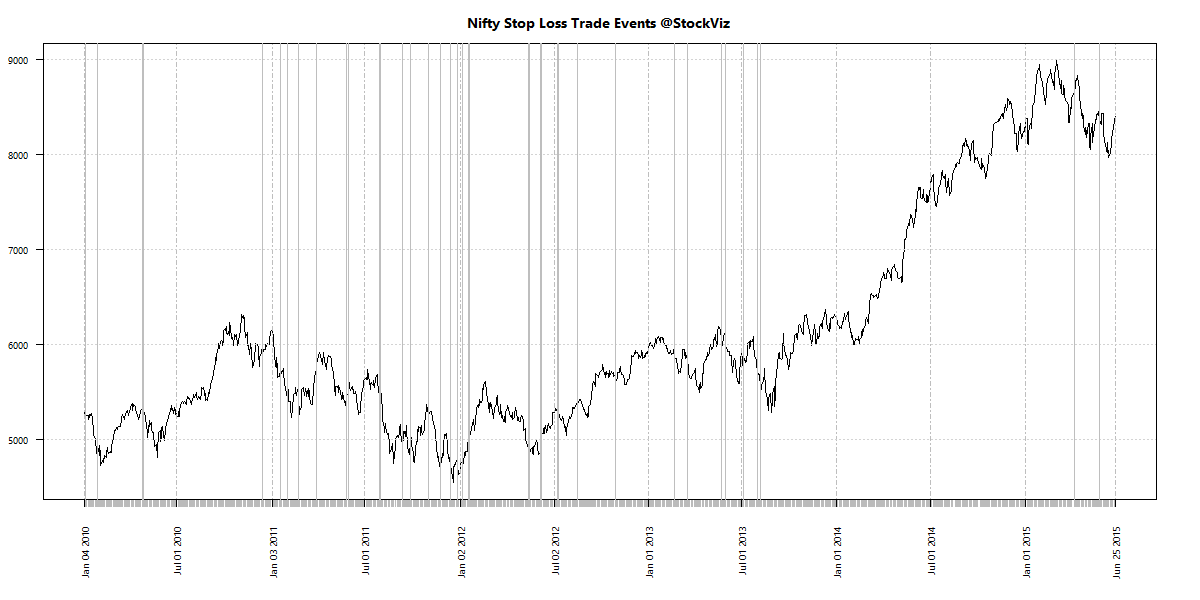

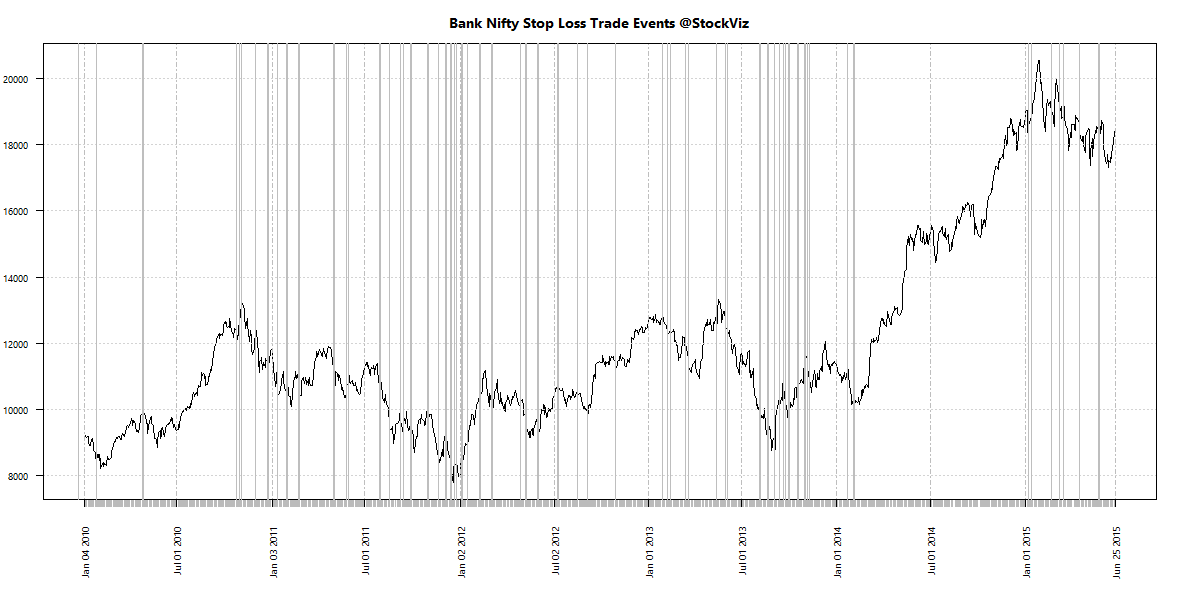

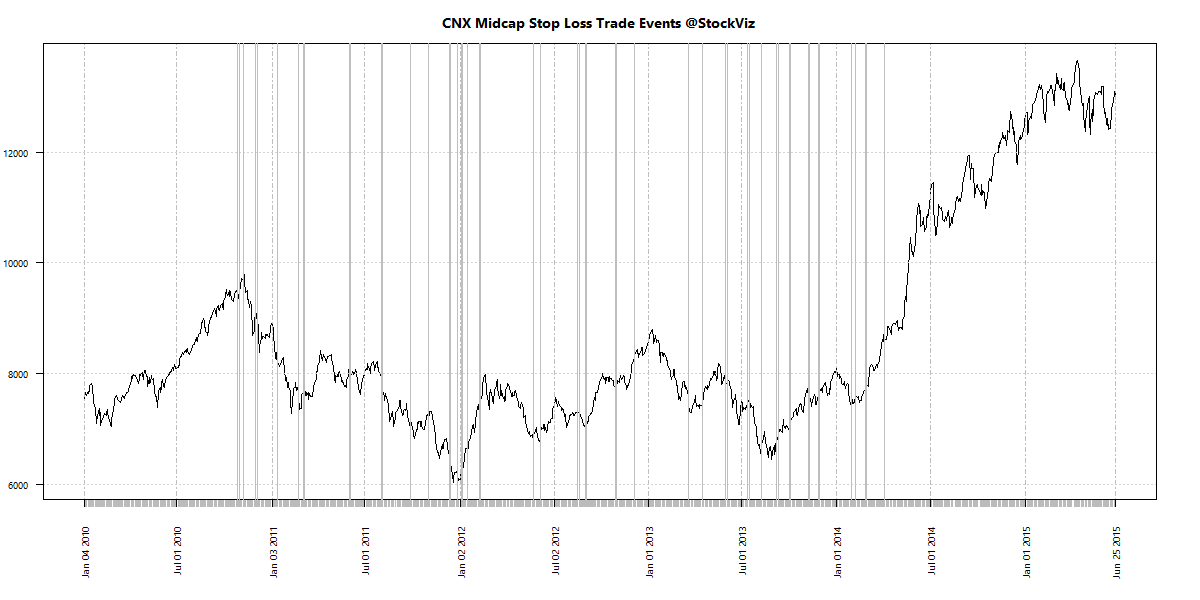

The 5-3 Trading frequency

Let’s plot the days on which this rule triggers (both buys and sells.)

By the looks of it, the stop-loss and re-entry bands are too narrow.

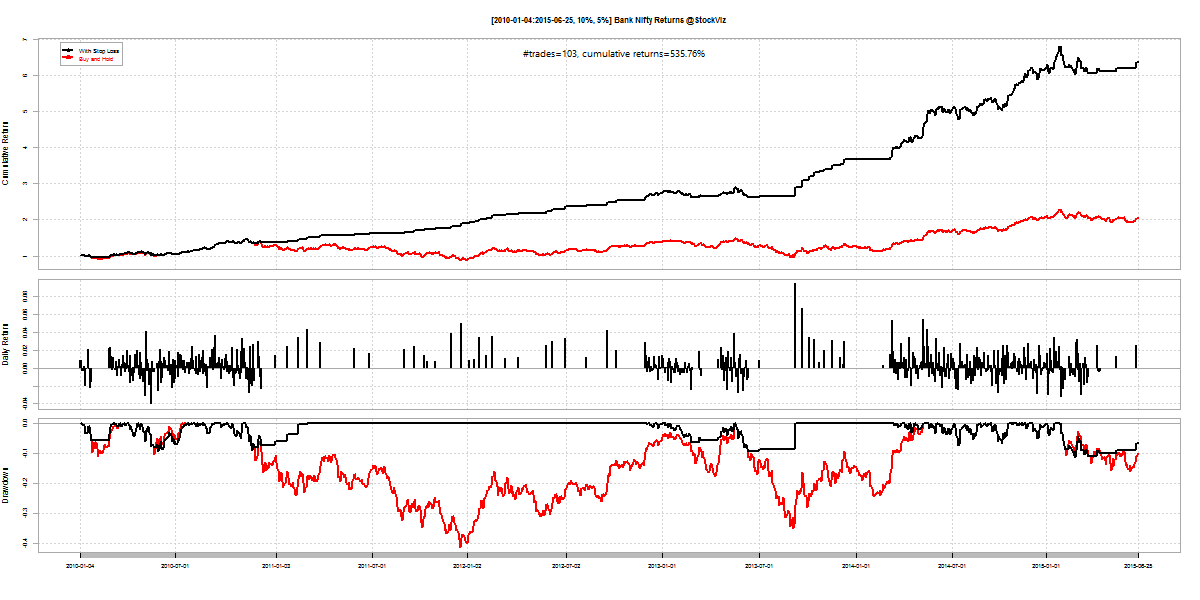

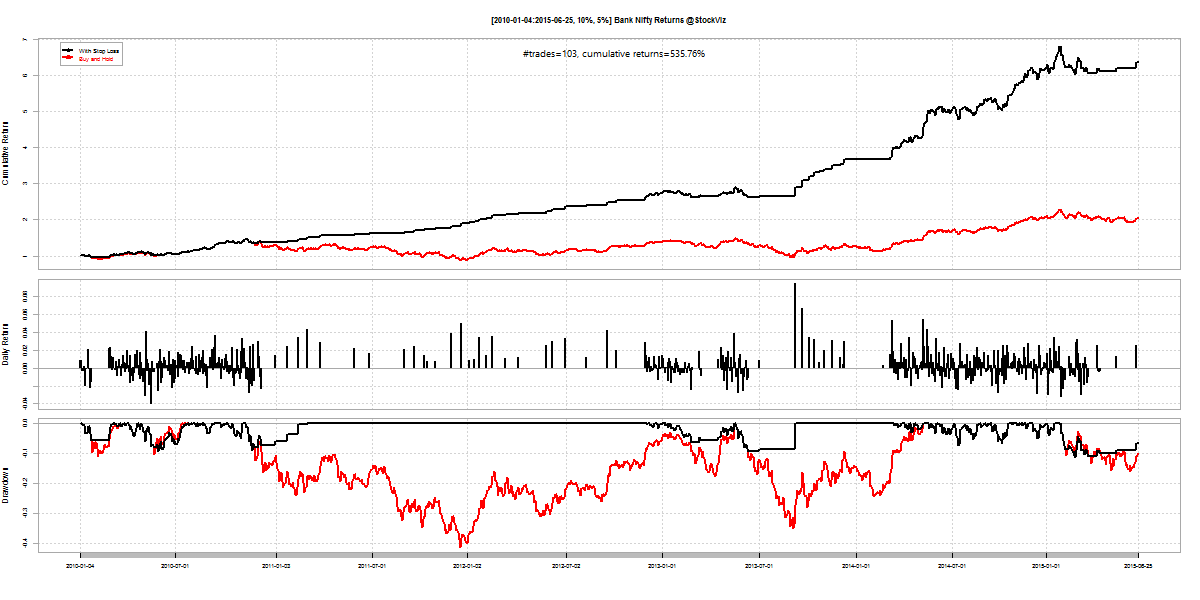

The 10-5 Rule

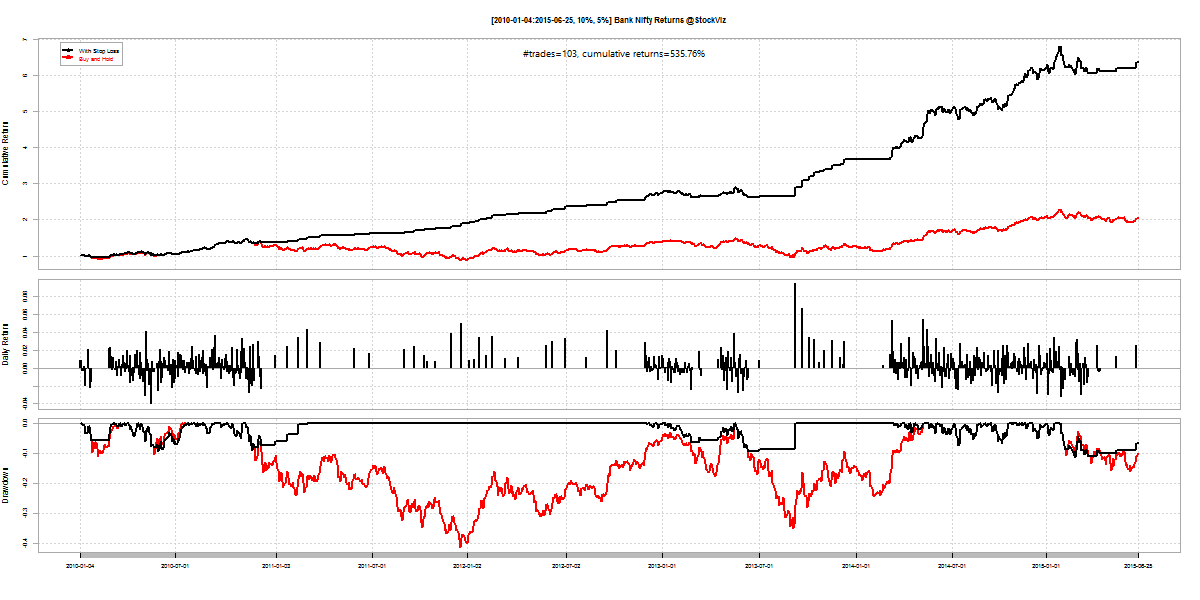

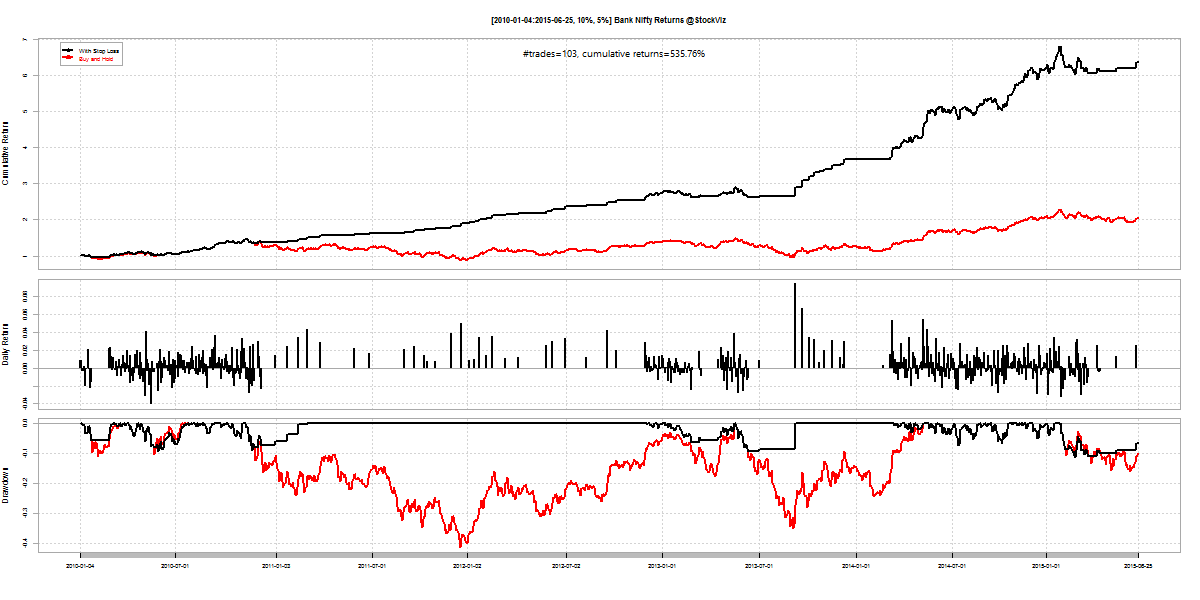

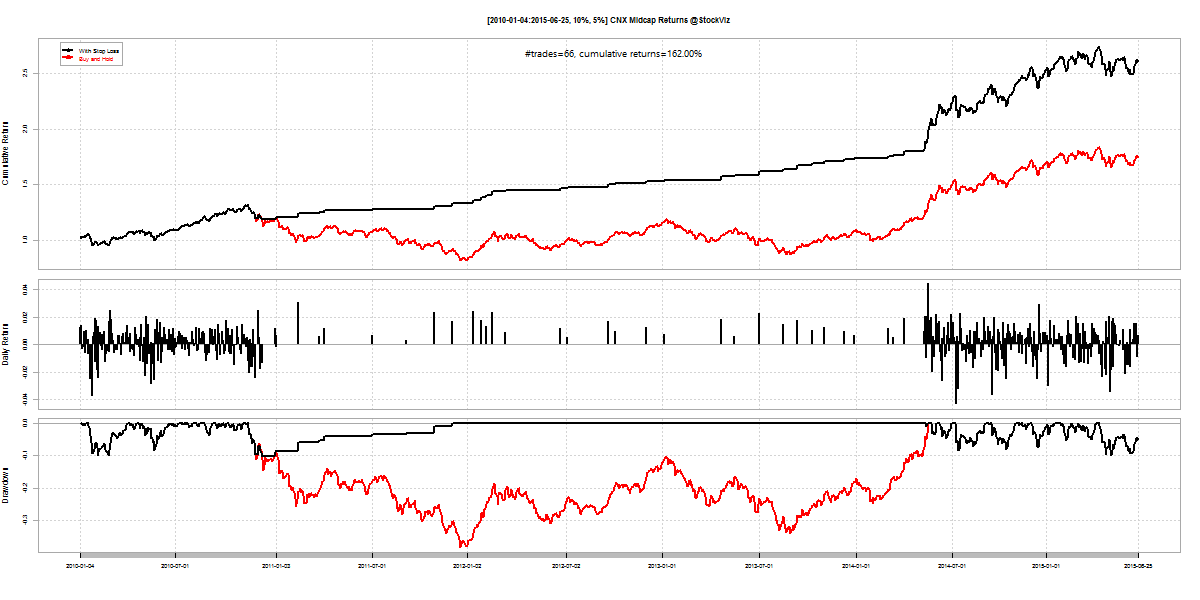

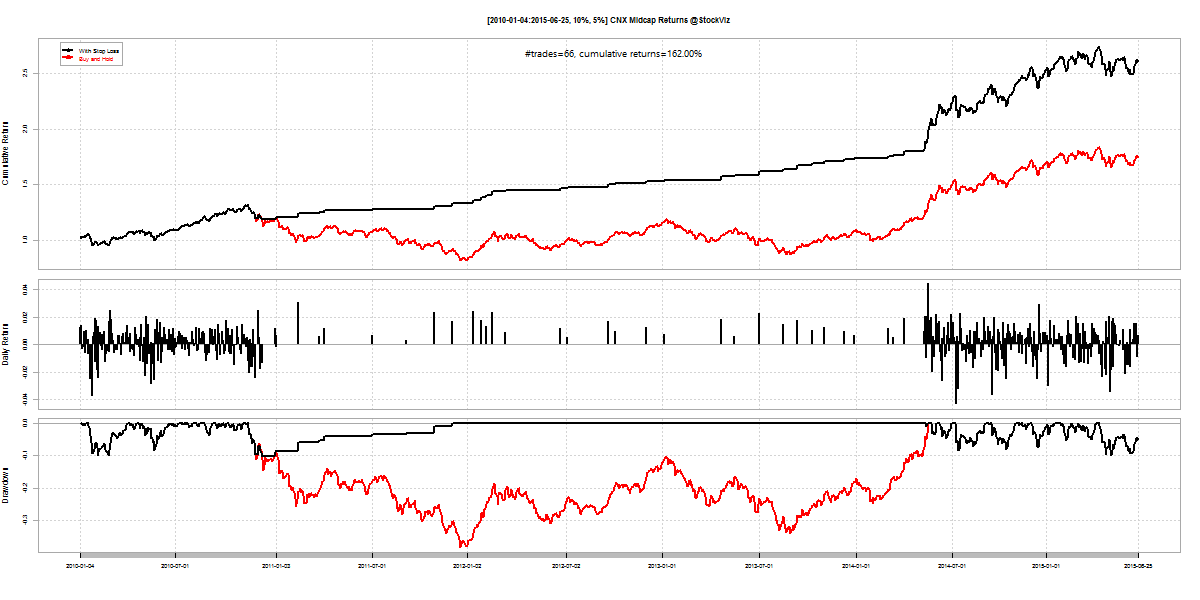

Suppose we set the trailing-stop loss at 10% and re-enter when the index covers 5%, we end up with a strategy with lower number of trades and yet, better returns and buy-and-hold.

| Index |

#trades |

cum. returns |

| Nifty |

50 |

100% |

| Bank Nifty |

103 |

536% |

| Midcap |

66 |

162% |

Lower trading but lower returns as well.

Returns:

Trading Events:

Trailing stop-loss and re-entry scenarios

The master list of different strategies, their trading frequencies and cumulative returns.

Conclusion

Having a trailing stop-loss and re-entry strategy enhances returns but at the price of increased trading frequency. No combination of strategies can escape the doldrums – where the index is basically flat and you are getting whipsawed.

With a 15% tax on short-term gains, over the 5-year period, you should handicap strategy returns by 75% to do an apples-to-apples comparison on the tax-free buy-and-hold returns. If you use the 10-5 rule, it means you will only come-out ahead trading the Bank Nifty. So you are better off with the 5-3 rule given where trading costs stand.