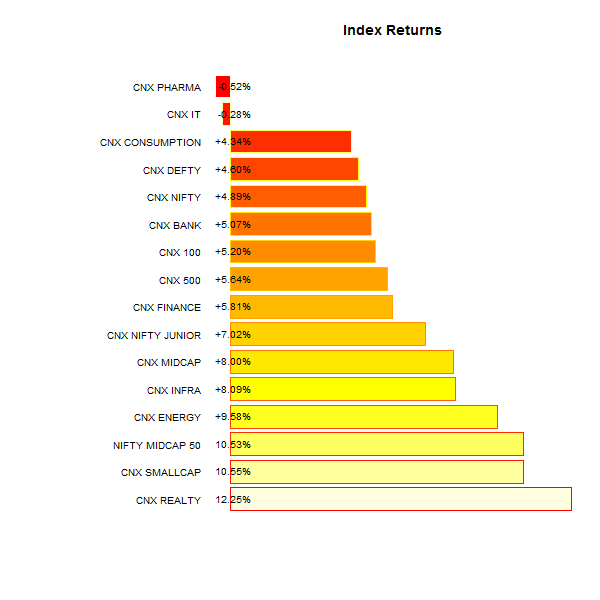

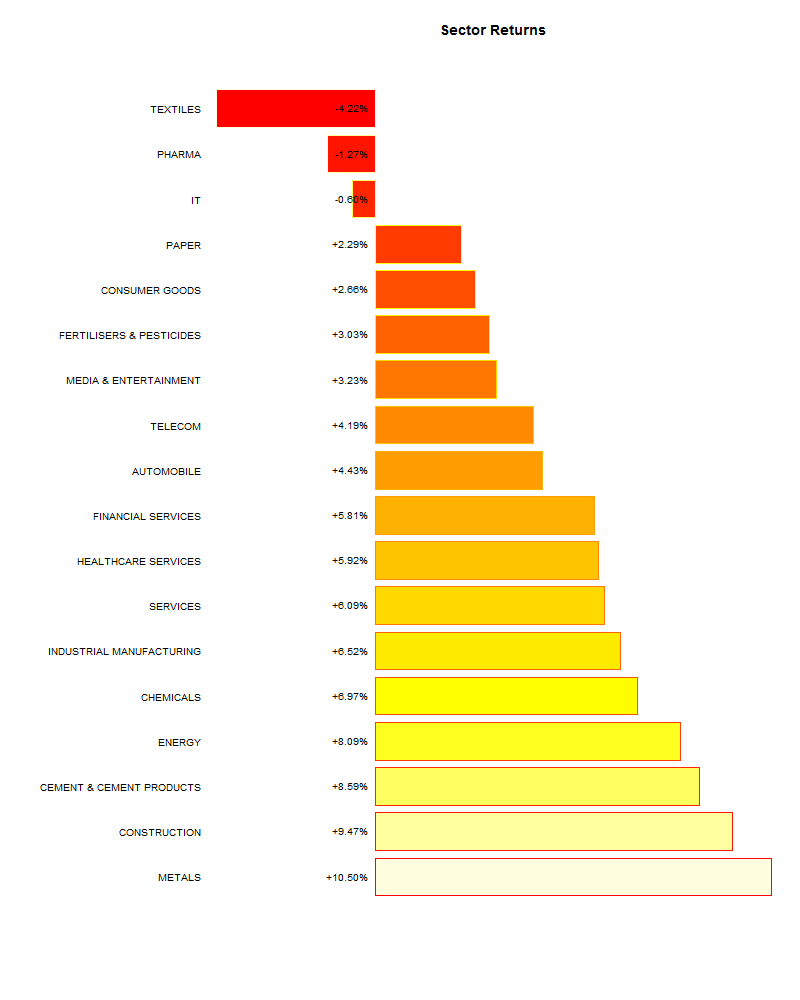

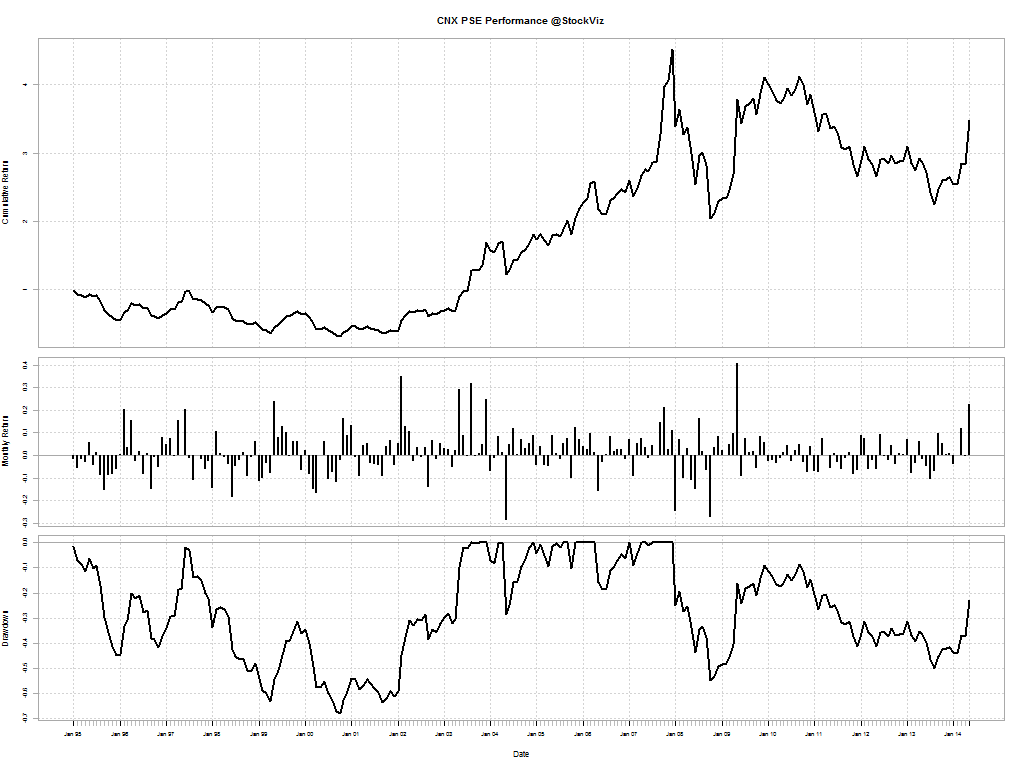

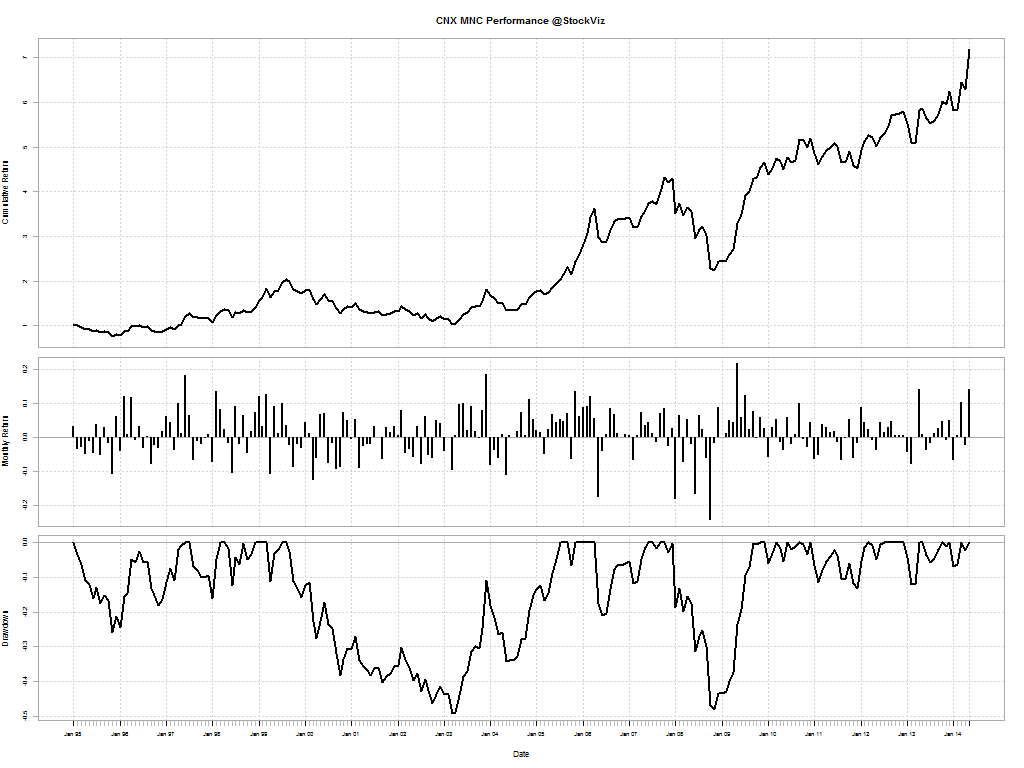

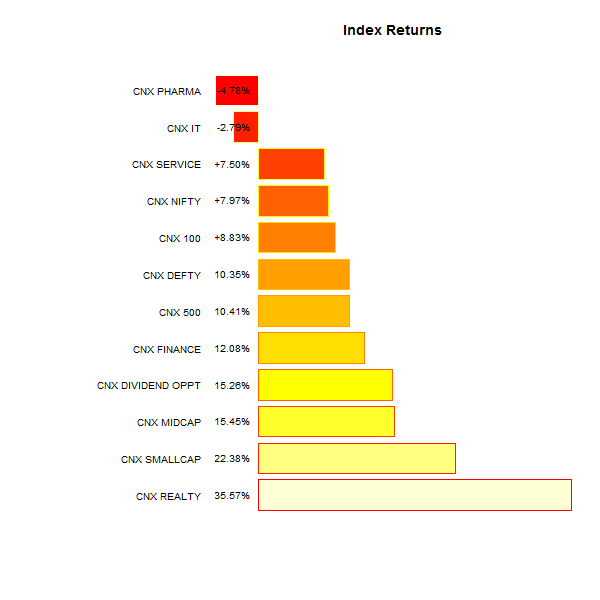

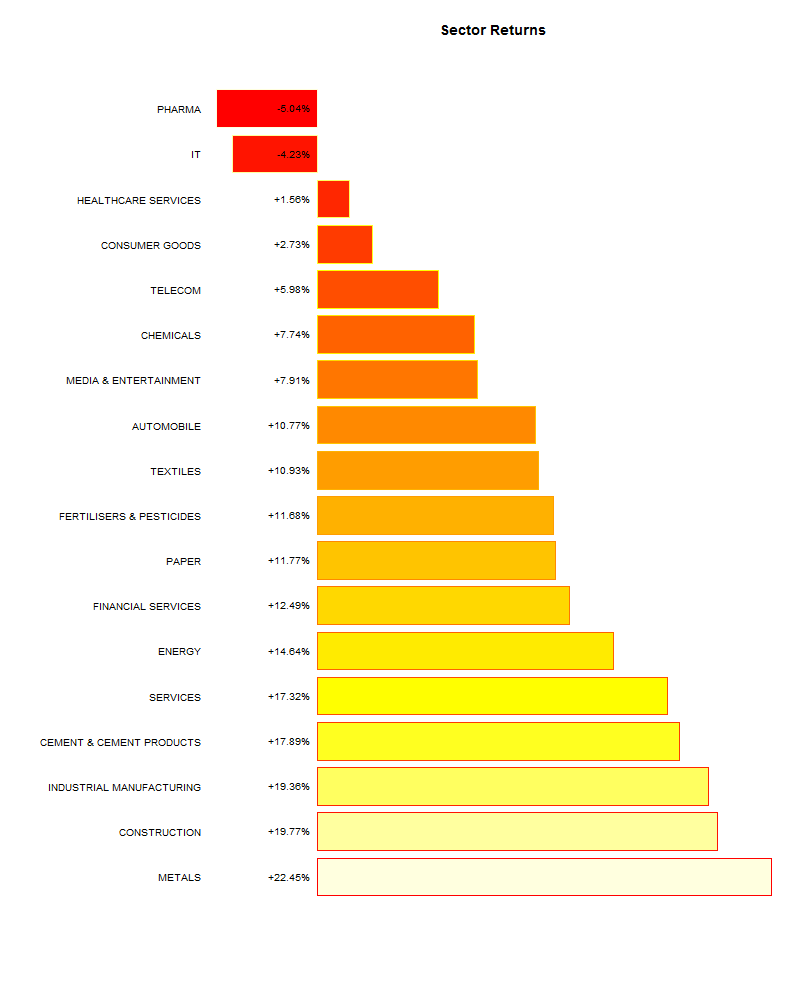

On the NSE, you can find two indices: CNX PSE and CNX MNC. They have been around since Jan-1995 – providing a quantifiable glimpse into how badly Nehruvian socialism has fared in modern India.

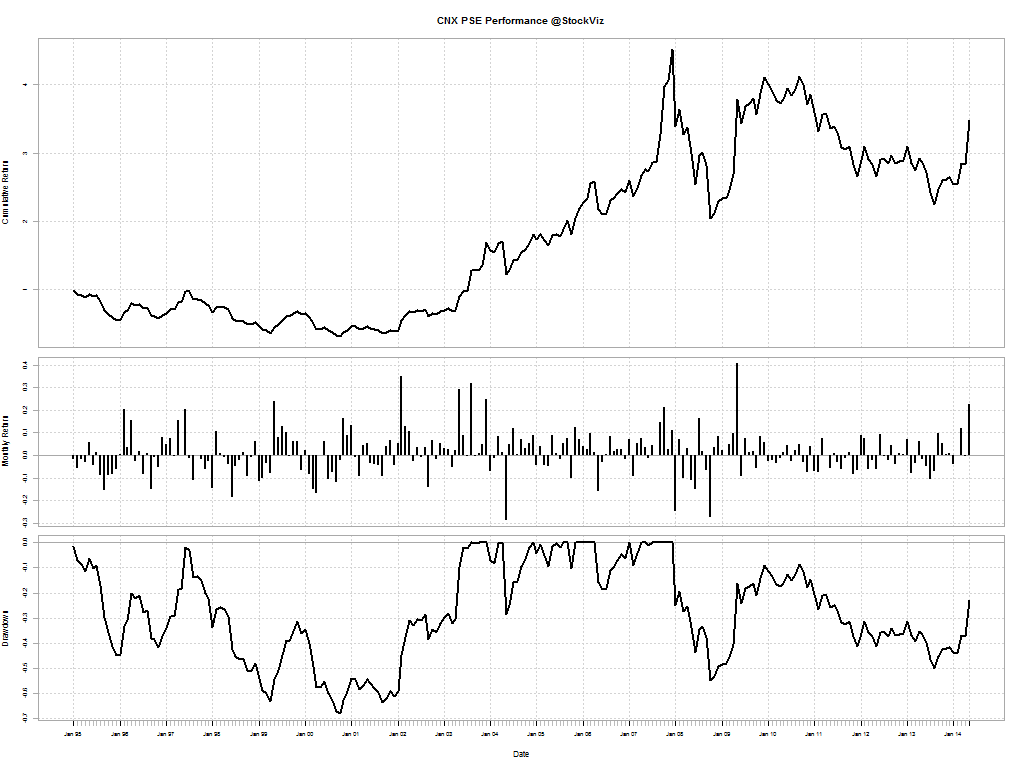

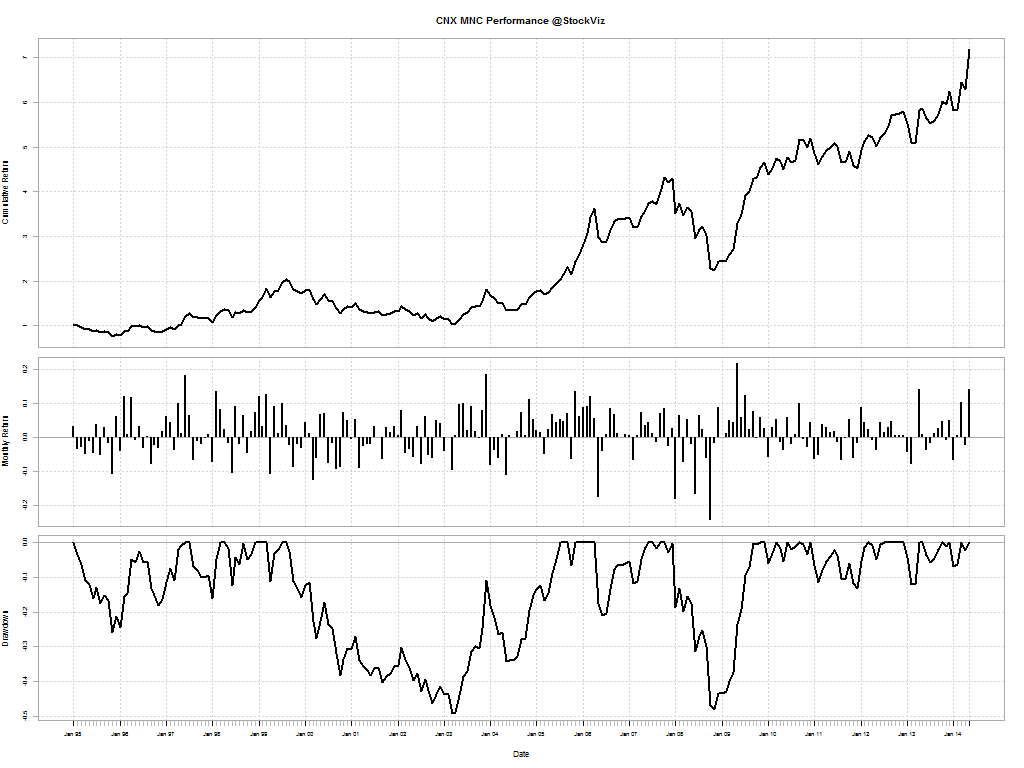

Cumulative Returns

CNX PSE: +247.69%

CNX MNC: +619.05%

Value traps

There has been a lot of talk recently about reforming PSEs. The SEBI wants the 25% public shareholding rule to apply to all public sector companies as well. The earlier (UPA-2) government, finding no takers for PSE stock, got Goldman to form an ETF to put some lipstick on the sector. The Rajiv Gandhi Equity Savings Scheme gave out tax sops to get retail investors into “Maharatna, Navratna, or Miniratna” stocks.

As much as I would like to believe that things are going to be different this time, you can’t dismiss the fact that PSEs have only lost money for investors. Once the crutches come off, these firms will anyway have to go through gut-wrenching transformations to compete in the real world. That would be a better trigger to enter these stocks (if and when they happen) rather than now when all we have are promises.