Equities

| MINTs | |

|---|---|

| JCI(IDN) | +8.65% |

| INMEX(MEX) | +4.12% |

| NGSEINDX(NGA) | -3.37% |

| XU030(TUR) | +6.45% |

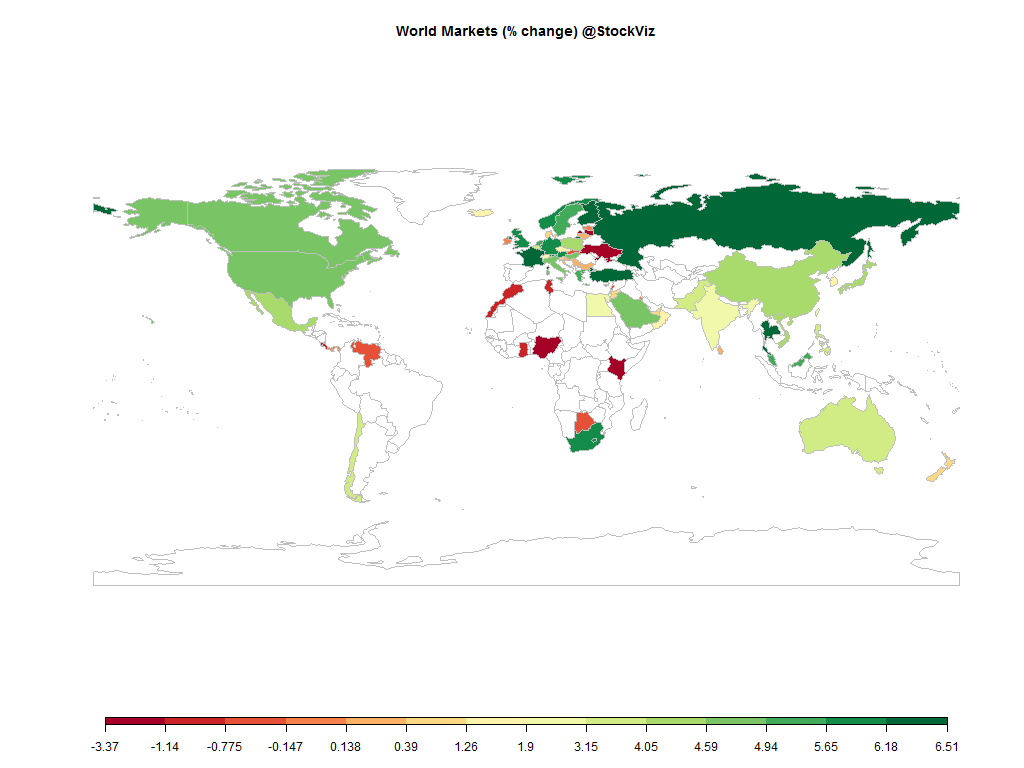

| BRICS | |

|---|---|

| IBOV(BRA) | +8.88% |

| SHCOMP(CHN) | +4.27% |

| NIFTY(IND) | +3.00% |

| INDEXCF(RUS) | +6.24% |

| TOP40(ZAF) | +5.65% |

Commodities

| Energy | |

|---|---|

| Brent Crude Oil | +9.37% |

| Natural Gas | +4.09% |

| Heating Oil | +3.53% |

| Ethanol | -2.34% |

| RBOB Gasoline | +3.14% |

| WTI Crude Oil | +9.25% |

| Metals | |

|---|---|

| Copper | +4.76% |

| Silver 5000oz | +8.97% |

| Palladium | +5.16% |

| Platinum | +8.59% |

| Gold 100oz | +3.85% |

Currencies

| MINTs | |

|---|---|

| USDIDR(IDN) | -8.85% |

| USDMXN(MEX) | -2.69% |

| USDNGN(NGA) | +0.43% |

| USDTRY(TUR) | -3.89% |

| BRICS | |

|---|---|

| USDBRL(BRA) | -6.14% |

| USDCNY(CHN) | -0.19% |

| USDINR(IND) | -1.19% |

| USDRUB(RUS) | -6.23% |

| USDZAR(ZAF) | -4.16% |

| Agricultural | |

|---|---|

| Cocoa | -2.16% |

| Coffee (Robusta) | +3.98% |

| Cotton | +3.77% |

| Sugar #11 | +7.09% |

| Lean Hogs | +1.75% |

| Lumber | +8.36% |

| Orange Juice | +10.30% |

| Soybean Meal | +1.05% |

| White Sugar | +3.09% |

| Coffee (Arabica) | +7.78% |

| Feeder Cattle | +6.87% |

| Wheat | -2.17% |

| Cattle | +8.30% |

| Corn | -1.86% |

| Soybeans | +0.83% |

Credit Indices

| Index | Change |

|---|---|

| Markit CDX EM | +1.73% |

| Markit CDX NA HY | +2.03% |

| Markit CDX NA IG | -9.85% |

| Markit iTraxx Asia ex-Japan IG | -18.19% |

| Markit iTraxx Australia | -11.71% |

| Markit iTraxx Europe | -7.10% |

| Markit iTraxx Europe Crossover | -37.22% |

| Markit iTraxx Japan | -8.18% |

| Markit iTraxx SovX Western Europe | -2.20% |

| Markit LCDX (Loan CDS) | +0.00% |

| Markit MCDX (Municipal CDS) | -6.68% |

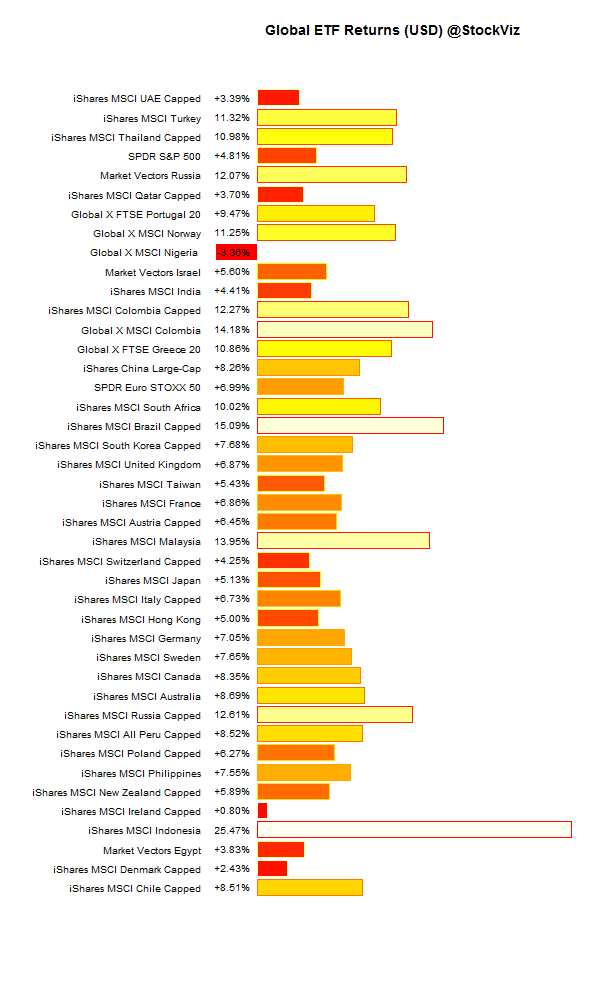

Global ETFs (USD)

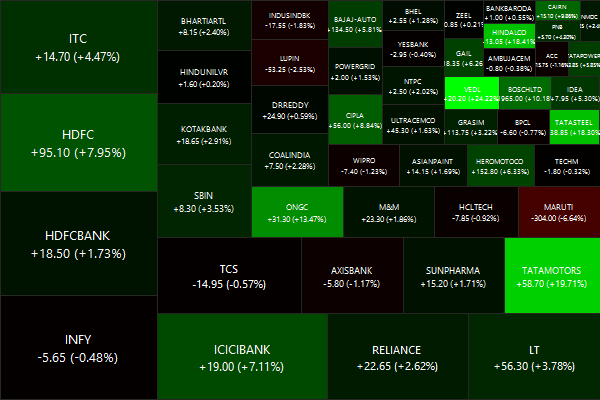

Nifty Heatmap

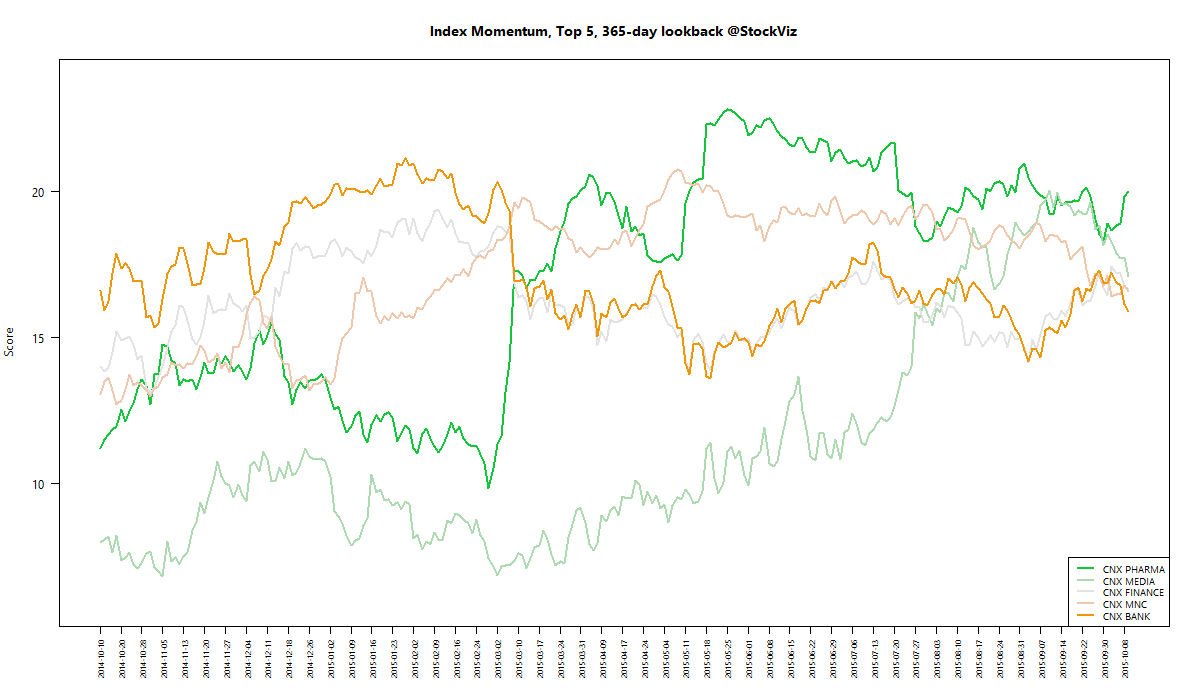

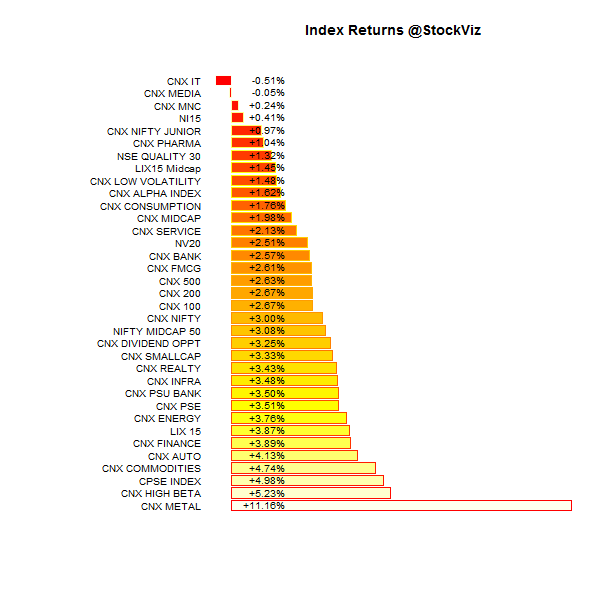

Index Returns

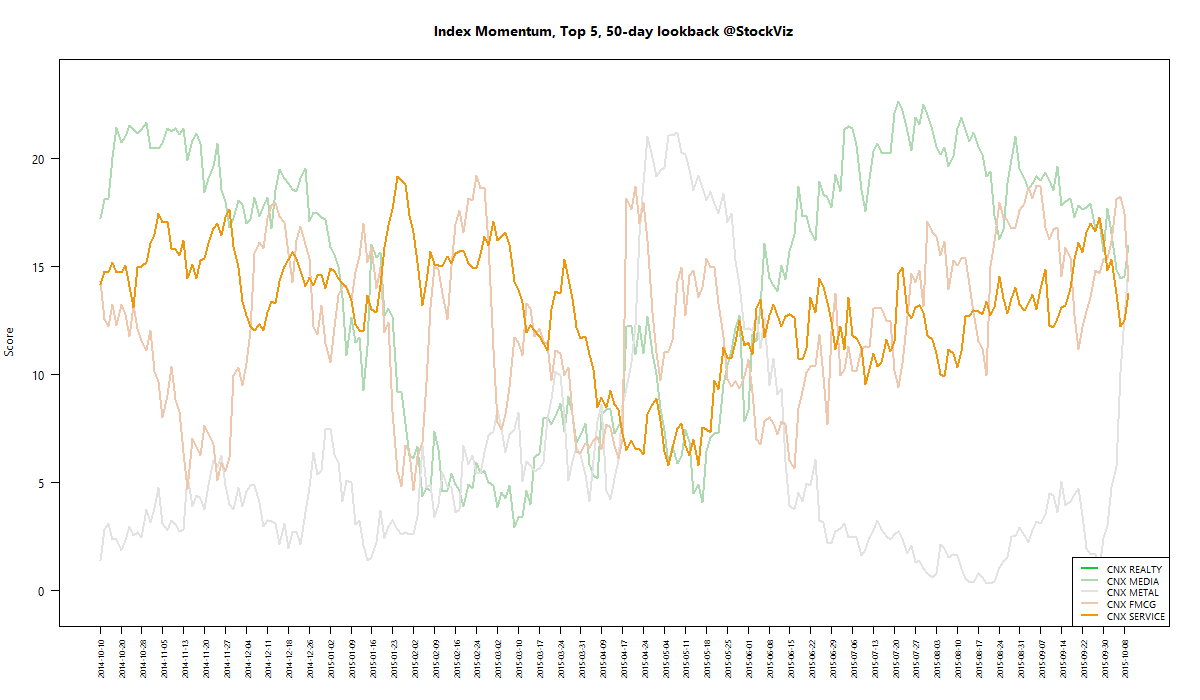

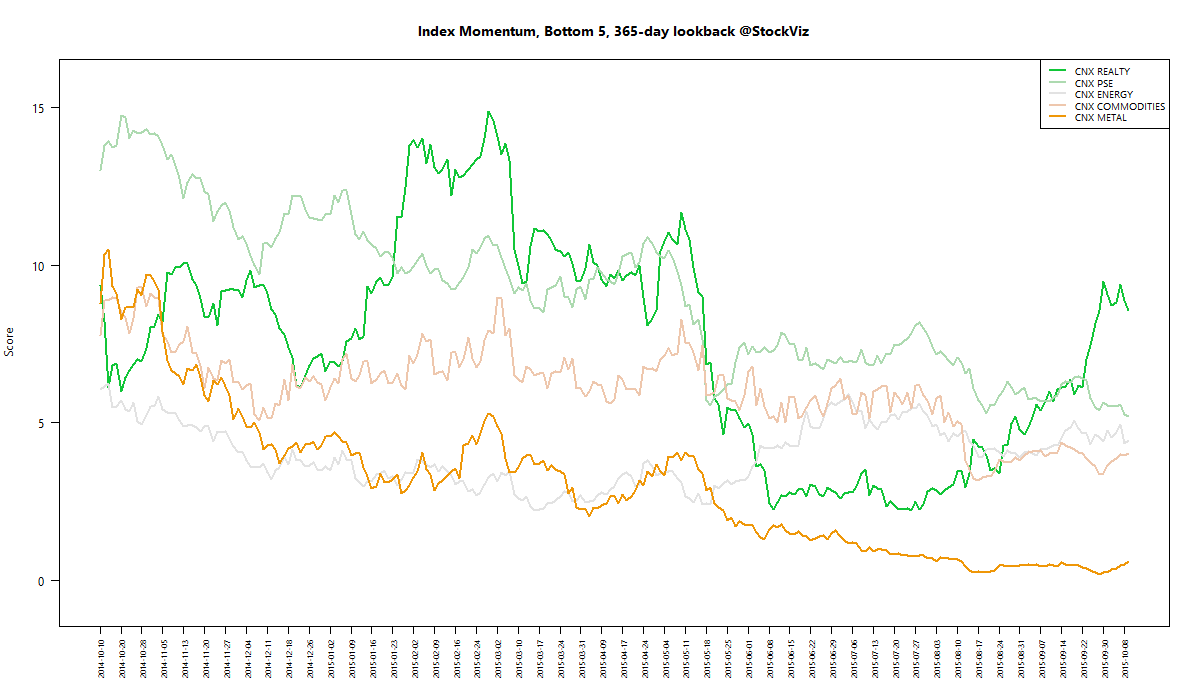

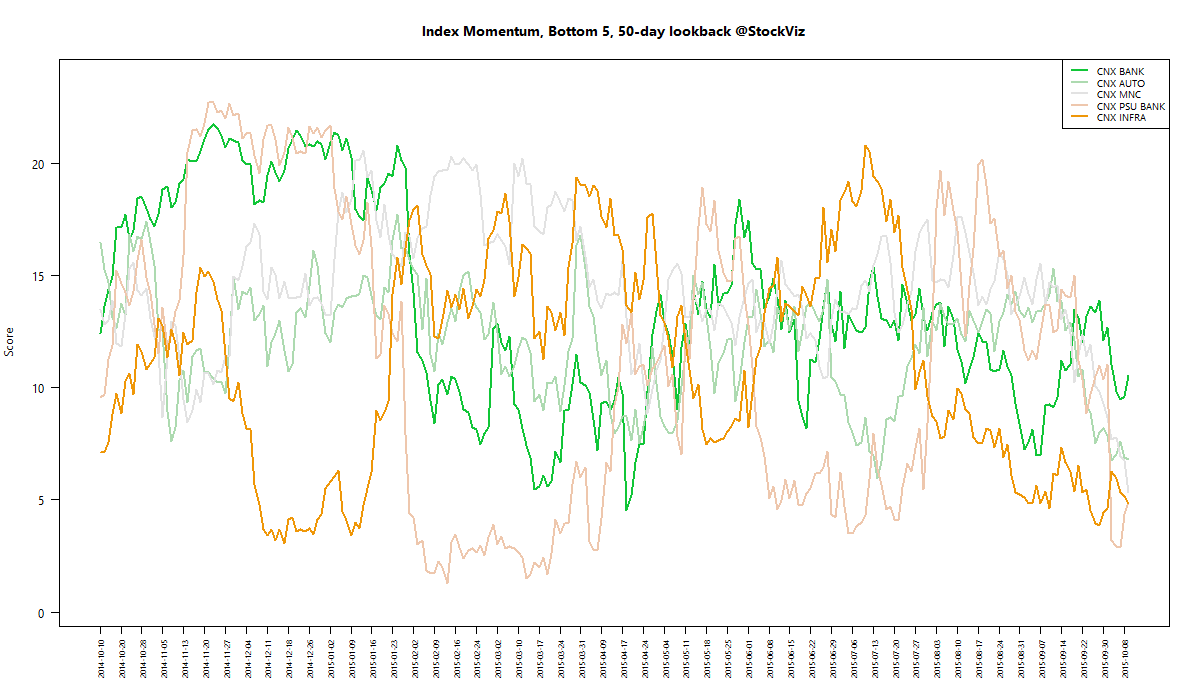

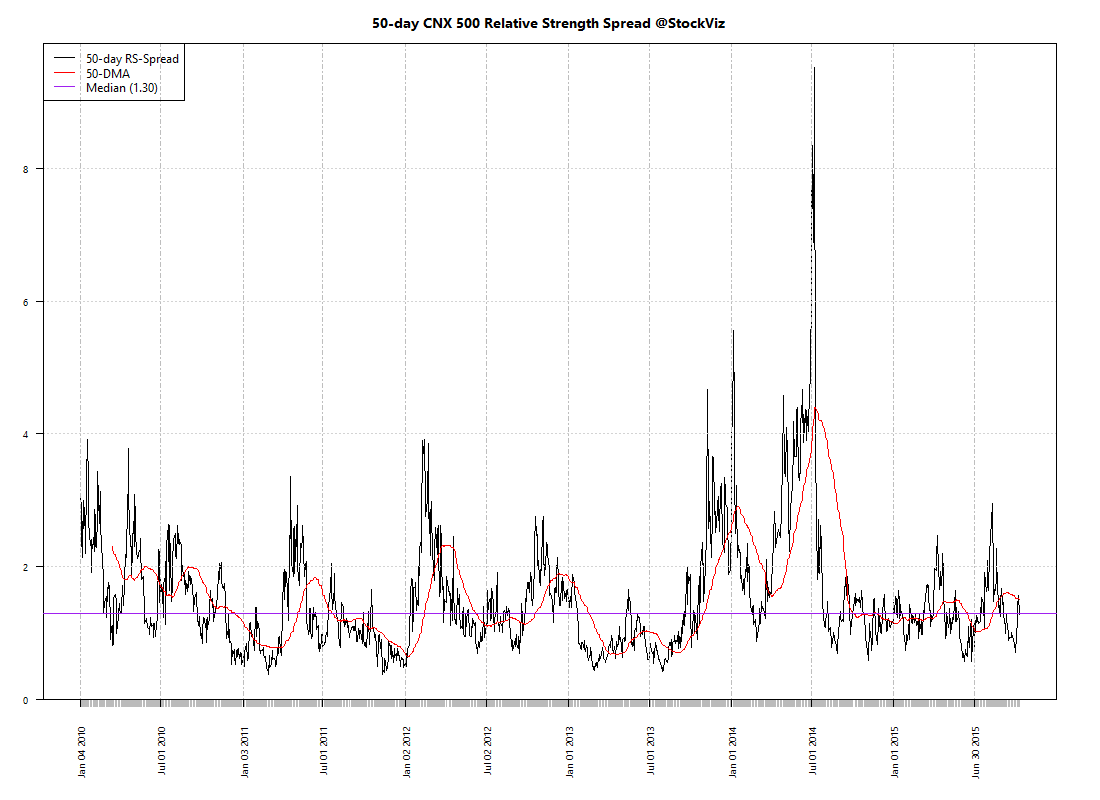

For a deeper dive into indices, check out our weekly Index Update.

Market Cap Decile Performance

| Decile | Mkt. Cap. | Adv/Decl |

|---|---|---|

| 1 (micro) | +4.84% | 74/57 |

| 2 | +7.45% | 83/47 |

| 3 | +4.50% | 76/54 |

| 4 | +6.77% | 74/56 |

| 5 | +5.63% | 74/56 |

| 6 | +5.99% | 71/60 |

| 7 | +4.23% | 71/59 |

| 8 | +3.29% | 74/56 |

| 9 | +1.77% | 66/64 |

| 10 (mega) | +1.89% | 65/66 |

Top Winners and Losers

| HINDALCO | +18.41% |

| TATAMOTORS | +19.71% |

| VEDL | +24.22% |

| MARUTI | -6.64% |

| IBULHSGFIN | -6.62% |

| RECLTD | -3.99% |

ETF Performance

| CPSEETF | +5.23% |

| PSUBNKBEES | +4.51% |

| INFRABEES | +2.98% |

| NIFTYBEES | +2.86% |

| BANKBEES | +2.65% |

| GOLDBEES | +1.96% |

| JUNIORBEES | +1.59% |

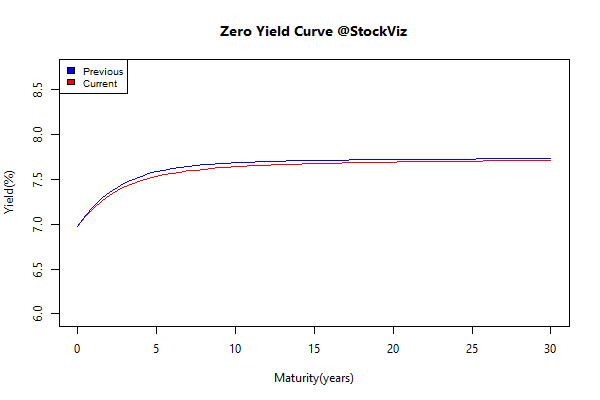

Yield Curve

Bond Indices

| Sub Index | Change in YTM | Total Return(%) |

|---|---|---|

| 0 5 | -0.02 | +0.22% |

| 5 10 | -0.04 | +0.37% |

| 10 15 | -0.04 | +0.47% |

| 15 20 | -0.03 | +0.45% |

| 20 30 | -0.04 | +0.59% |

Investment Theme Performance

| Momentum | +5.64% |

| ADAG stocks | +4.50% |

| High Beta | +4.48% |

| Velocity | +4.07% |

| Next Trillion | +2.64% |

| ASK Life | +2.56% |

| The RBI Restricted List | +2.51% |

| PPFAS Long Term Value | +2.35% |

| Magic Formula | +1.95% |

| Quality to Price | +1.94% |

| CNX 100 Enterprise Yield | +1.81% |

| Financial Strength Value | +1.79% |

| Low Volatility | +1.57% |

| Balance Sheet Strength | +0.67% |

| Tactical CNX 100 | +0.00% |

Equity Mutual Funds

Bond Mutual Funds

Thought for the weekend

- High stock prices, just like high house prices, are harbingers of low returns.

- Investing in price-depressed residential rental property in Atlanta is like investing in EM equities today—the future expected long-term yield is much superior to their respective high-priced alternatives.

- Many parallels exist between the political/economic environment and the relative valuation of U.S. and EM equities in the periods from 1994 to 2002 and 2008 to 2015.

- Our forecast of the 10-year real return for U.S. equities is 1% compared to that of EM equities at 8%, now valued at less than half the U.S. CAPE.

Source: Investing versus Flipping