Stop loss

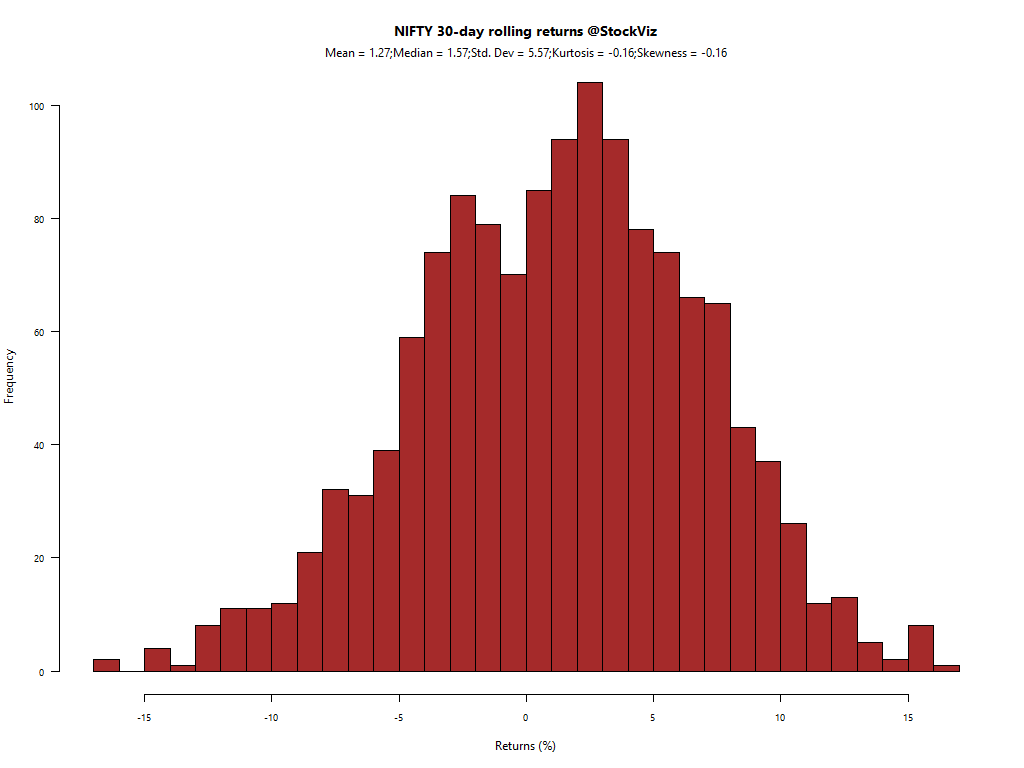

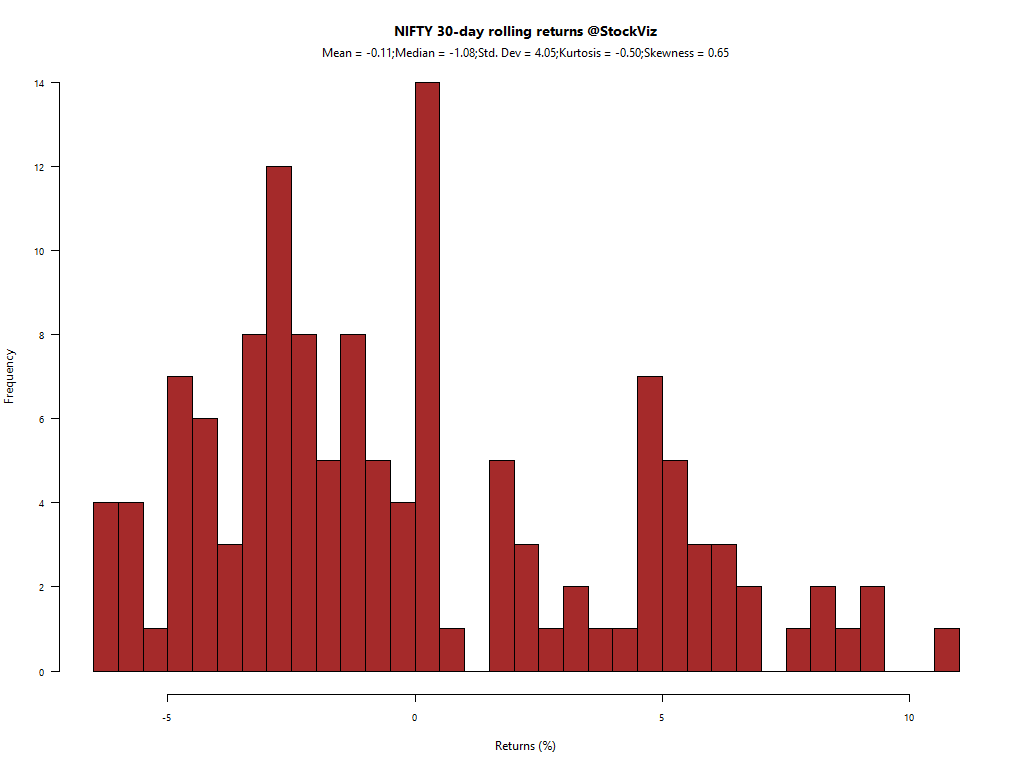

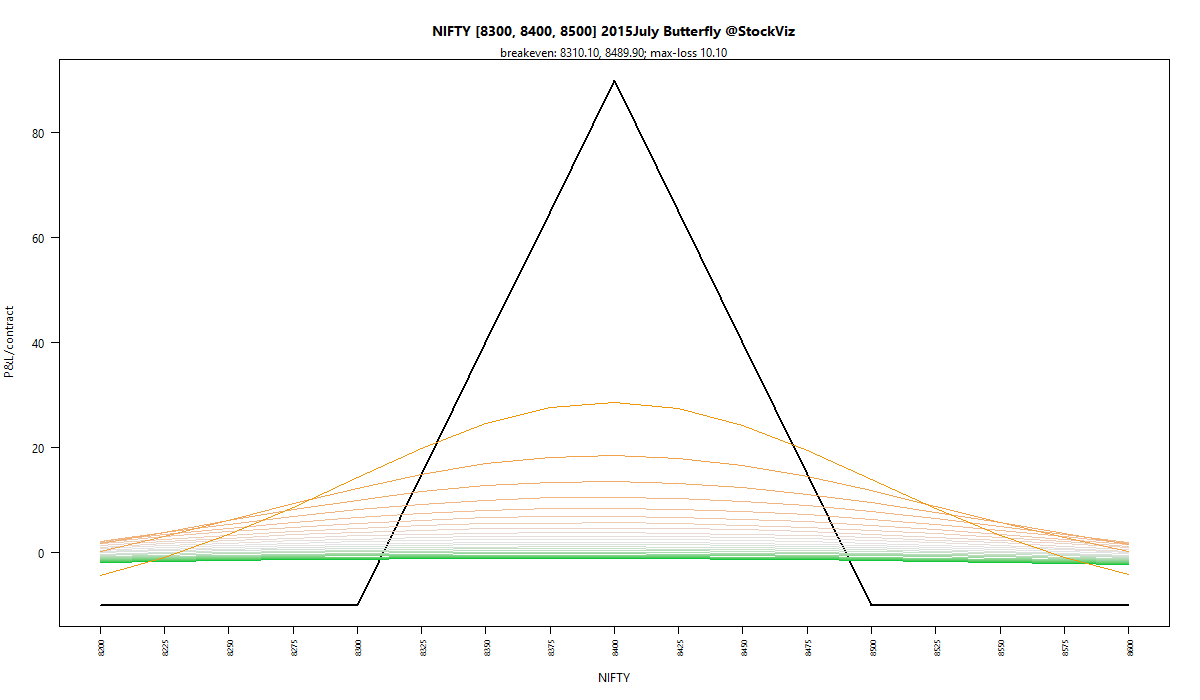

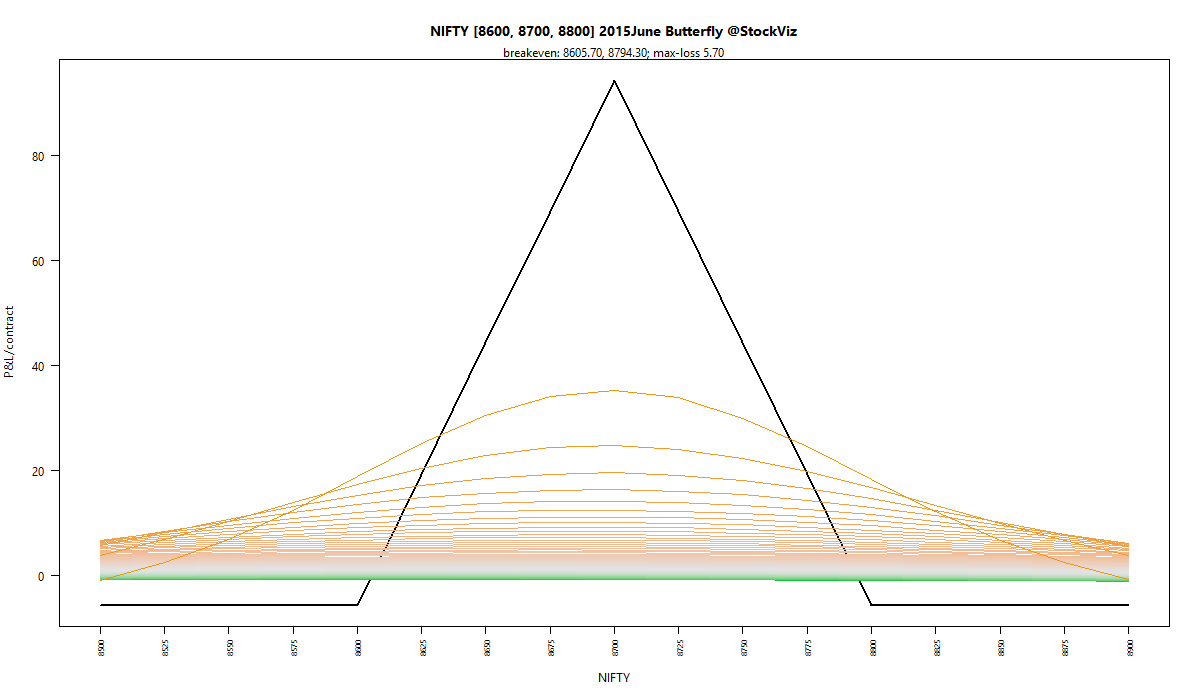

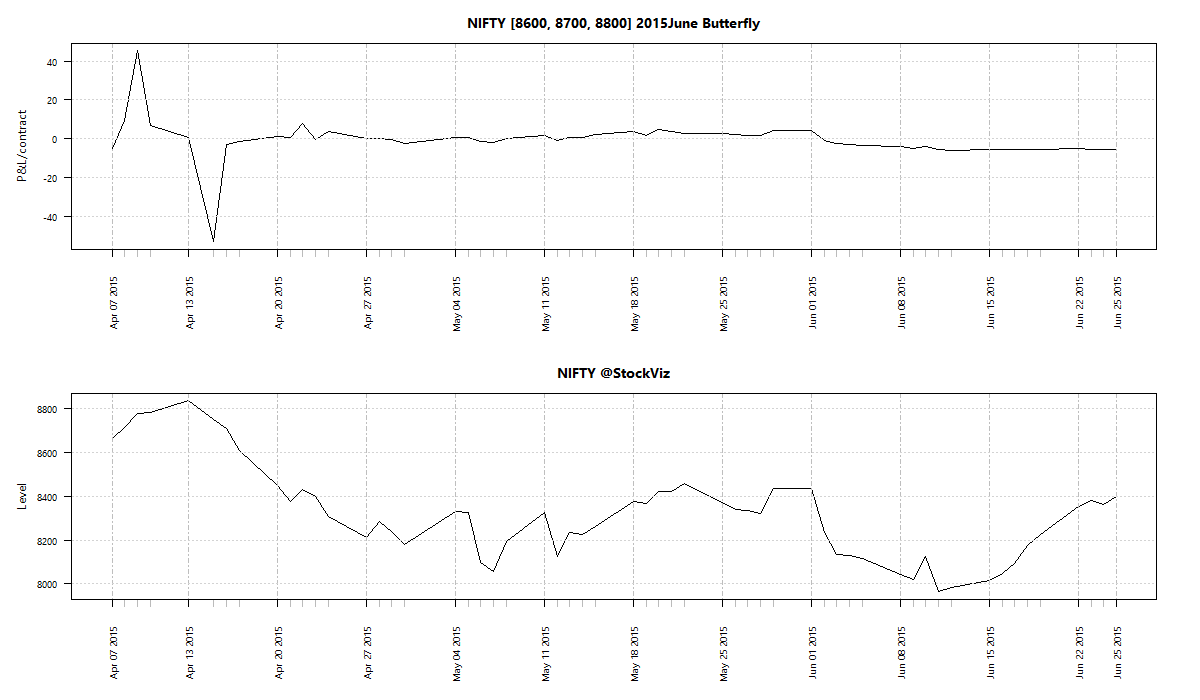

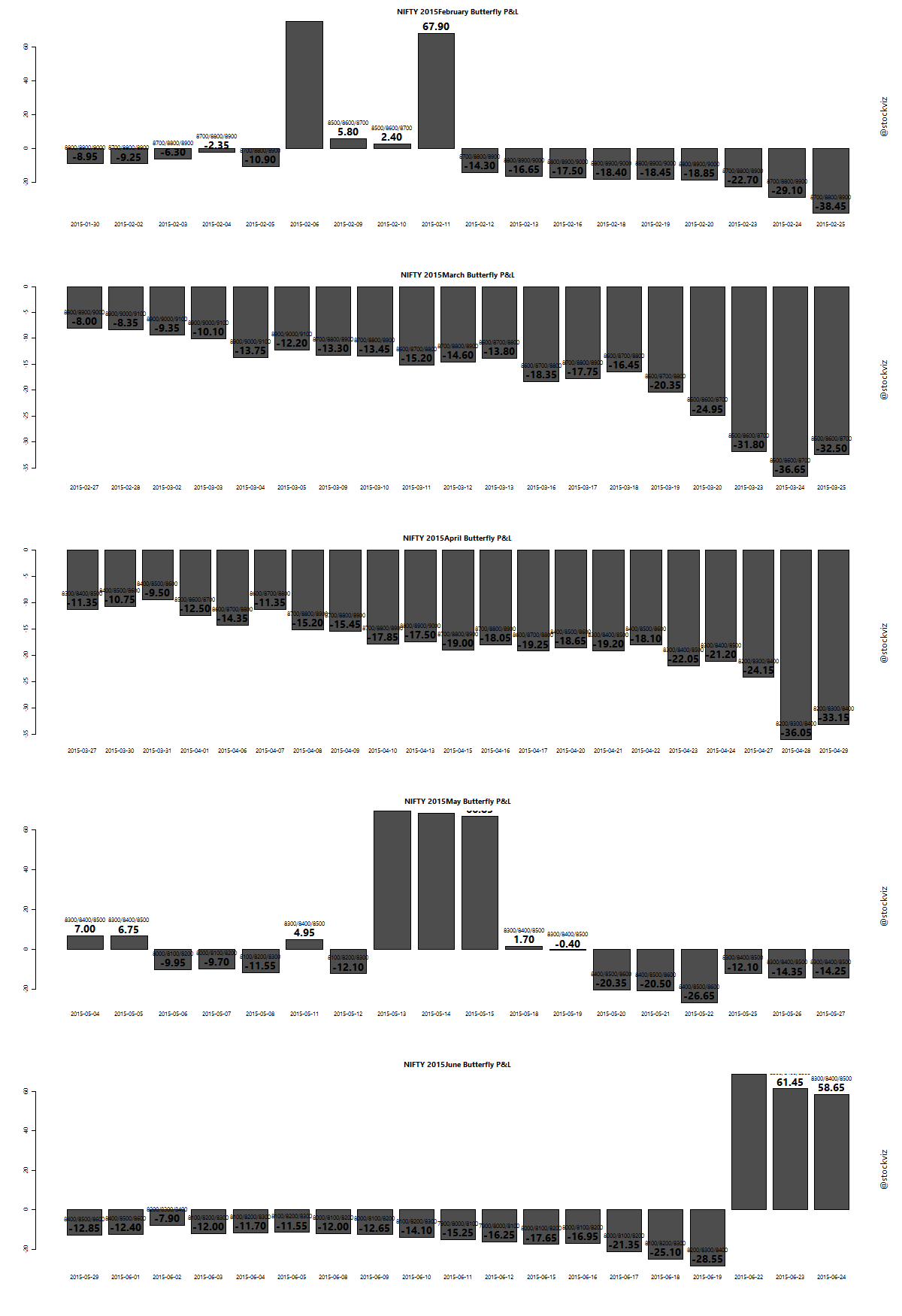

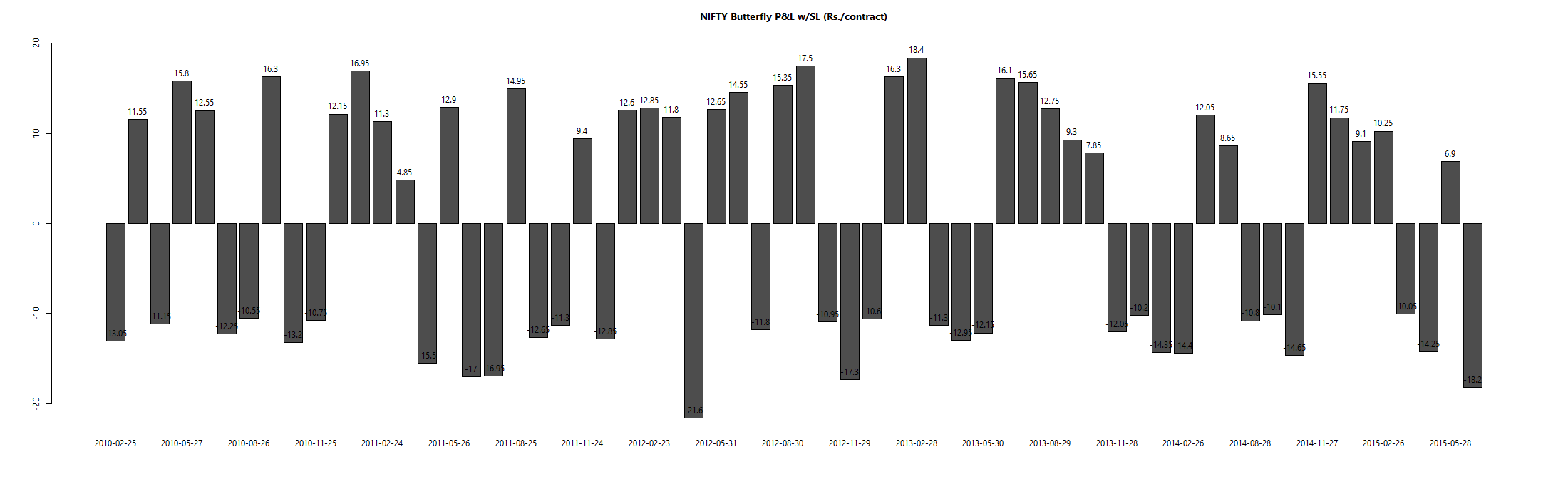

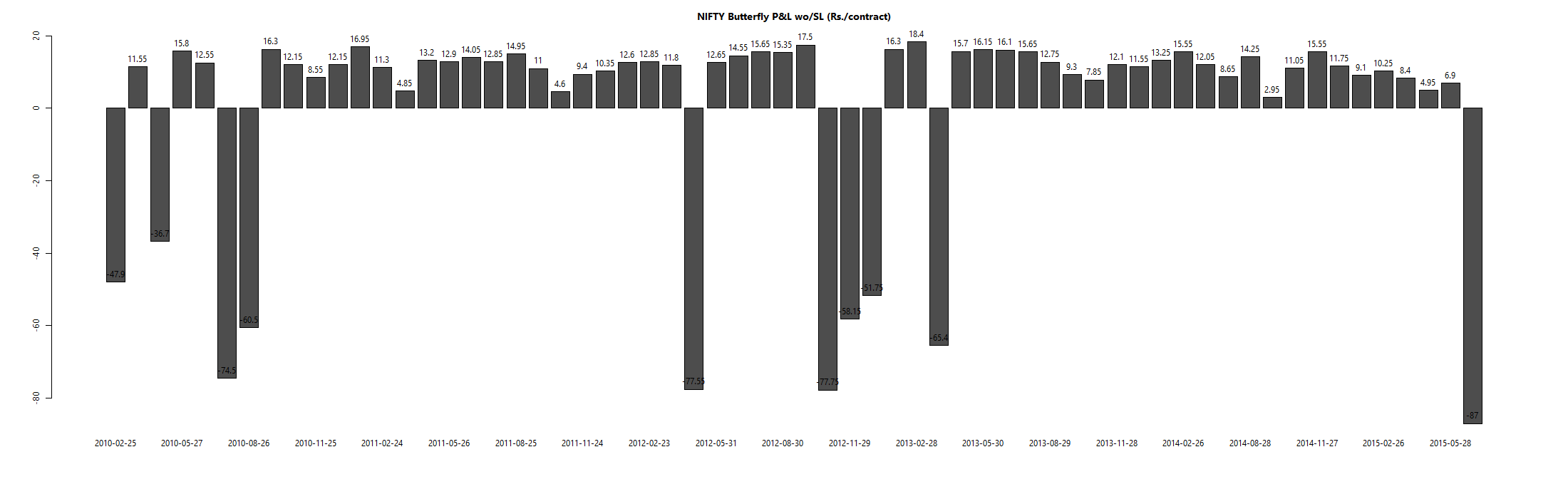

We saw earlier how infrequent but large losses in the short-call butterfly strategy can wipe out all the past profits earned. To figure out a stop-loss mechanism, we plotted individual expiry-to-expiry butterflies to find out how each one of them behaved. This data is available in the appendix below.

The stop-loss is set at 10 points (x lot-size) for the butterfly. But this kicks in only 10 days before the contracts expire (see how it gets “pulled” here.)

Returns comparison

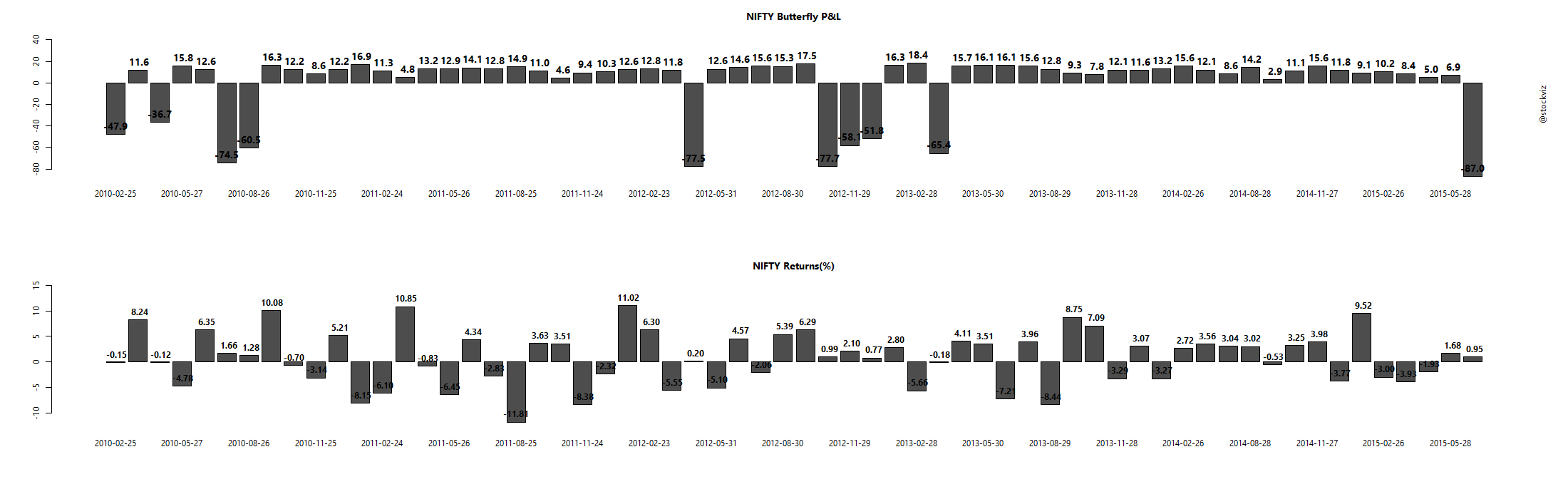

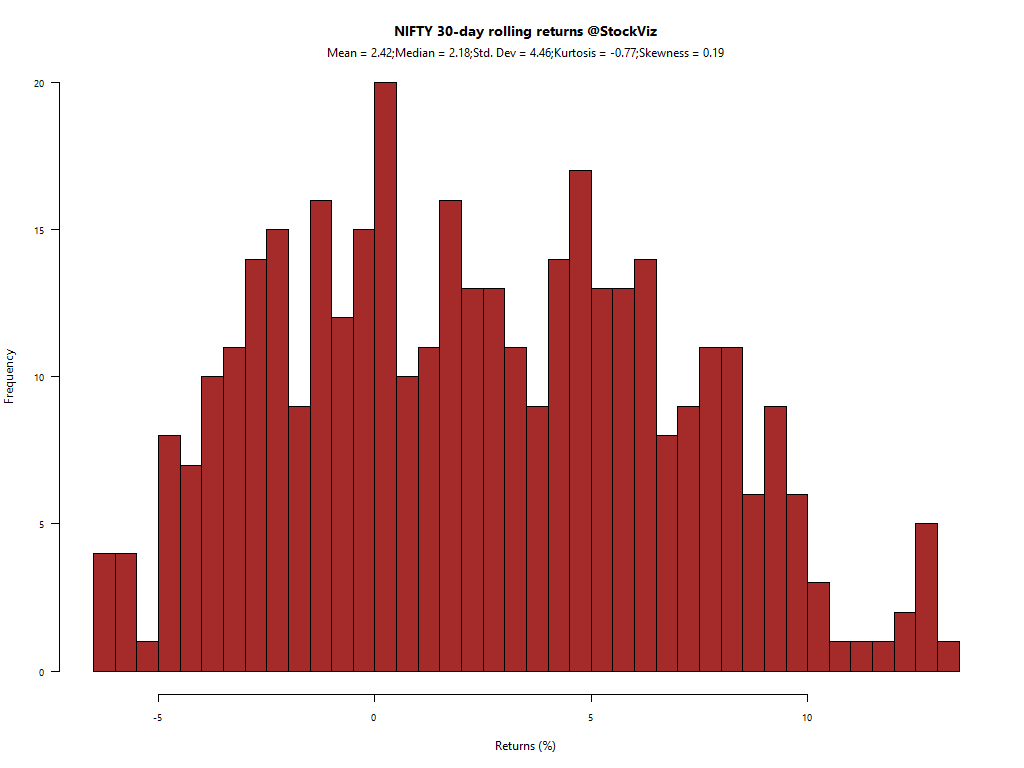

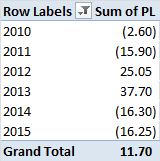

Here’s the month-over-month returns of a mechanical short-call butterfly strategy with stop-loss:

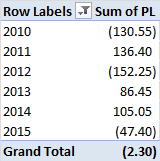

Here’s the month-over-month returns of a mechanical short-call butterfly strategy without stop-loss:

Because of the stop-loss, the frequency of losses increases but their magnitude decreases. However, stop-losses were hit about half the time.

Summary

Applying a stop-loss to a mechanical expiry-to-expiry short call butterfly strategy on the NIFTY seems to enhance returns by cutting out infrequent but large losses. However, the frequency of wins seems low given that only two out of 5 years resulted in net profit. If you did not use a stop-loss, you would have larger gains and would have had more positive years. However, losses in 2010 and 2012 were enough to wipe out all profits and more.

Appendix

https://www.scribd.com/doc/271141815/Nifty-Butterfly