Nifty Rolling Returns

In our earlier post, we saw how selling NIFTY butterflies has been profitable this year. To understand why, let’s have a look at the rolling returns of the NIFTY.

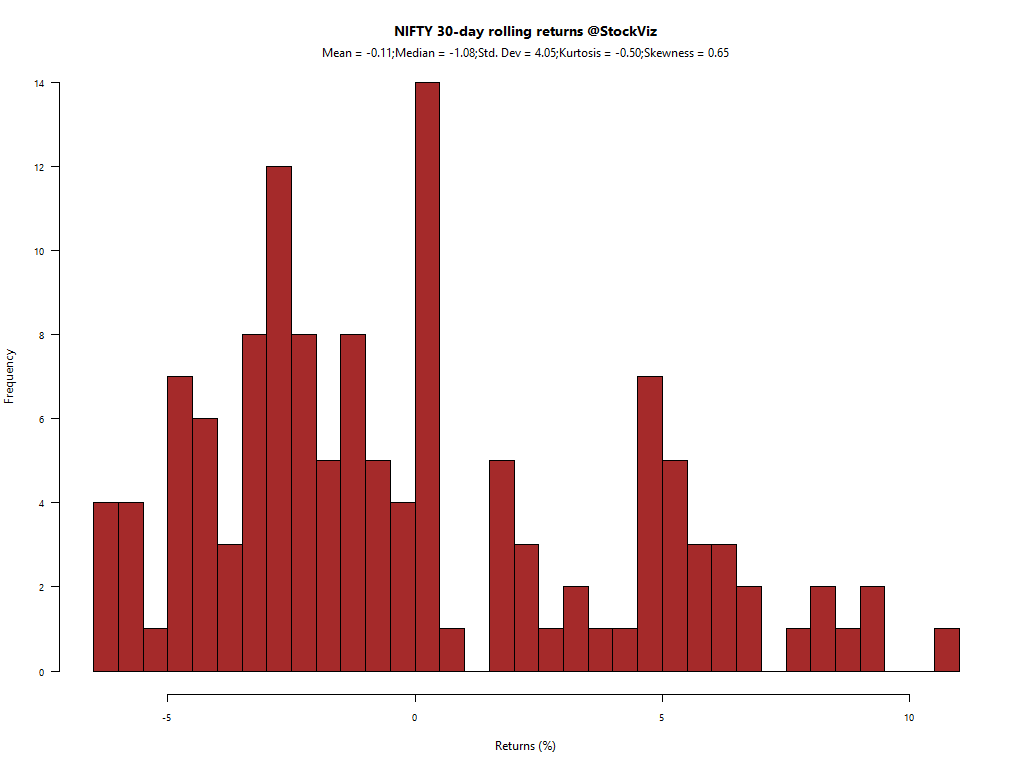

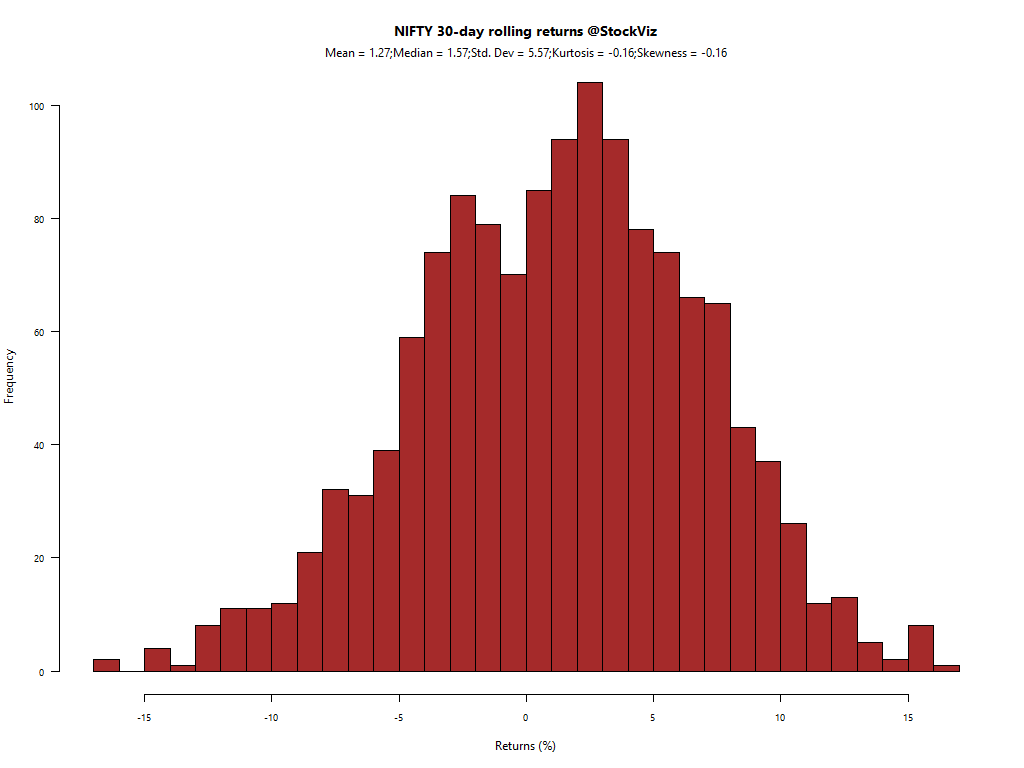

Here’s the 30-day rolling returns of the NIFTY, from 2010 to the present, the whole population:

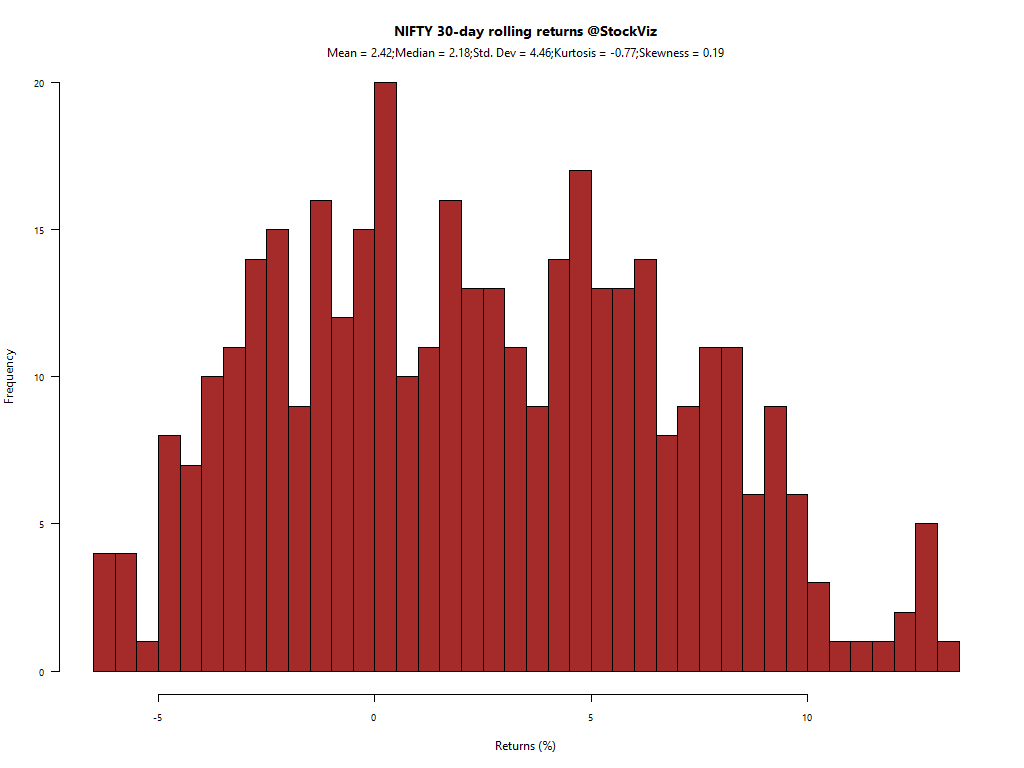

Beginning of 2015-present:

Median: -1.08%

Profitability

For a short-call butterfly to be profitable, NIFTY has to expire away from the either of the wings. Each wing is 100 points away. With NIFTY at 8500, that’s a 1.12% move. Whereas back when NIFTY was around 6000, this trade would require a 1.67% move to be profitable. So as the NIFTY rises, if they don’t widen the distance between the listed strikes, your hit ratio with selling butterflies will increase. However, the total profitability will decrease because everybody will think this way.

Summary

If NIFTY continues to exhibit the same pattern of returns, a rising NIFTY will make selling butterflies more profitable.

Comments are closed, but trackbacks and pingbacks are open.