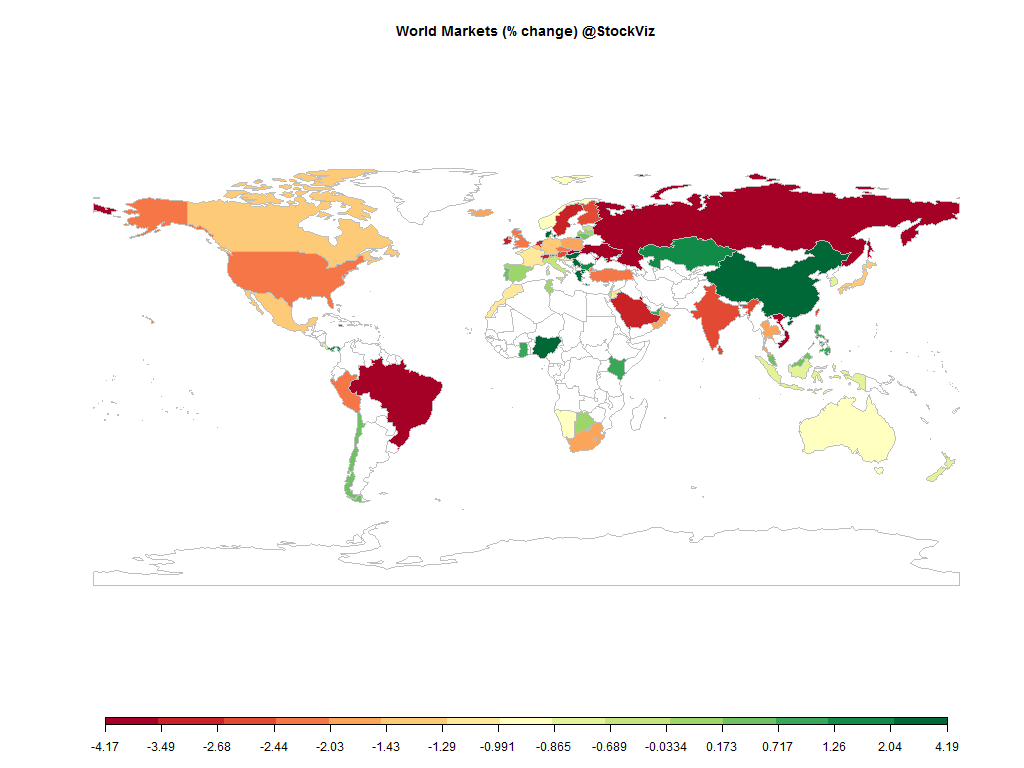

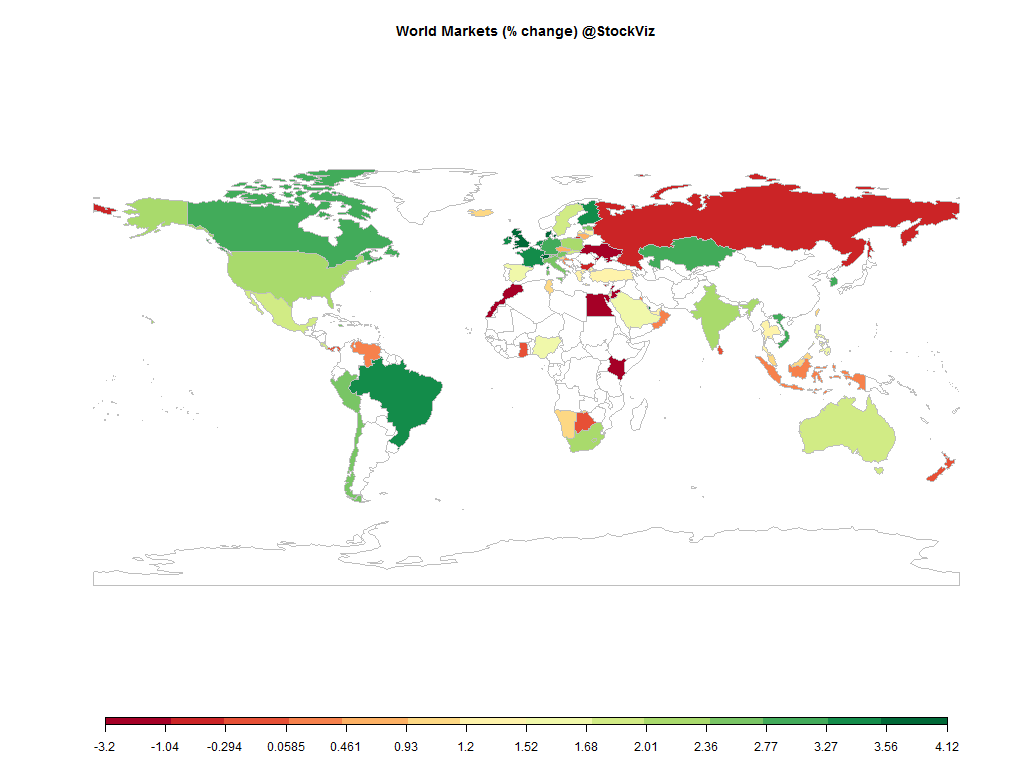

Equities

| MINTs | |

|---|---|

| JCI(IDN) | +0.45% |

| INMEX(MEX) | +2.01% |

| NGSEINDX(NGA) | +1.57% |

| XU030(TUR) | +1.23% |

| BRICS | |

|---|---|

| IBOV(BRA) | +3.42% |

| SHCOMP(CHN) | +5.88% |

| NIFTY(IND) | +2.26% |

| INDEXCF(RUS) | -0.29% |

| TOP40(ZAF) | +2.18% |

Commodities

| Energy | |

|---|---|

| Heating Oil | +1.02% |

| Brent Crude Oil | +1.01% |

| Ethanol | +1.03% |

| Natural Gas | -4.35% |

| RBOB Gasoline | -1.32% |

| WTI Crude Oil | +3.27% |

| Metals | |

|---|---|

| Silver 5000oz | -1.20% |

| Palladium | +3.72% |

| Platinum | +0.60% |

| Copper | -0.36% |

| Gold 100oz | +0.17% |

Currencies

| MINTs | |

|---|---|

| USDIDR(IDN) | -0.93% |

| USDMXN(MEX) | +0.66% |

| USDNGN(NGA) | +0.01% |

| USDTRY(TUR) | +1.17% |

| BRICS | |

|---|---|

| USDBRL(BRA) | -3.03% |

| USDCNY(CHN) | +0.17% |

| USDINR(IND) | -0.28% |

| USDRUB(RUS) | -6.78% |

| USDZAR(ZAF) | +0.07% |

| Agricultural | |

|---|---|

| Sugar #11 | +4.55% |

| Coffee (Arabica) | +1.08% |

| Coffee (Robusta) | +6.95% |

| Corn | -1.18% |

| Feeder Cattle | -3.00% |

| White Sugar | +2.18% |

| Cotton | +3.65% |

| Lean Hogs | -0.53% |

| Lumber | -2.52% |

| Orange Juice | -9.96% |

| Soybean Meal | -6.64% |

| Soybeans | -3.82% |

| Cattle | -1.88% |

| Cocoa | +0.99% |

| Wheat | -0.57% |

Credit Indices

| Index | Change |

|---|---|

| Markit CDX EM | +1.47% |

| Markit CDX NA HY | +0.49% |

| Markit CDX NA IG | -3.14% |

| Markit iTraxx Asia ex-Japan IG | -4.97% |

| Markit iTraxx Australia | -4.50% |

| Markit iTraxx Europe | -0.71% |

| Markit iTraxx Europe Crossover | -11.21% |

| Markit iTraxx Japan | -1.42% |

| Markit iTraxx SovX Western Europe | -0.56% |

| Markit LCDX (Loan CDS) | -0.09% |

| Markit MCDX (Municipal CDS) | -0.14% |

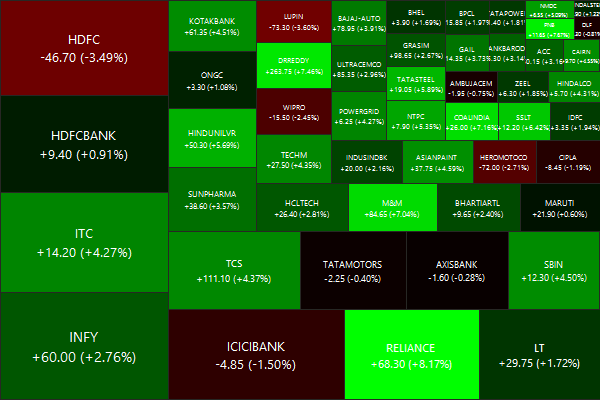

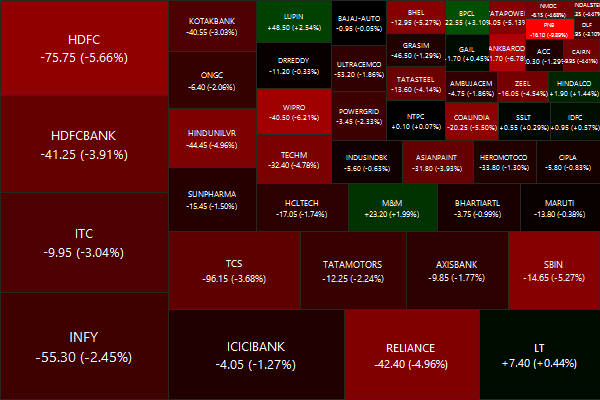

Nifty Heatmap

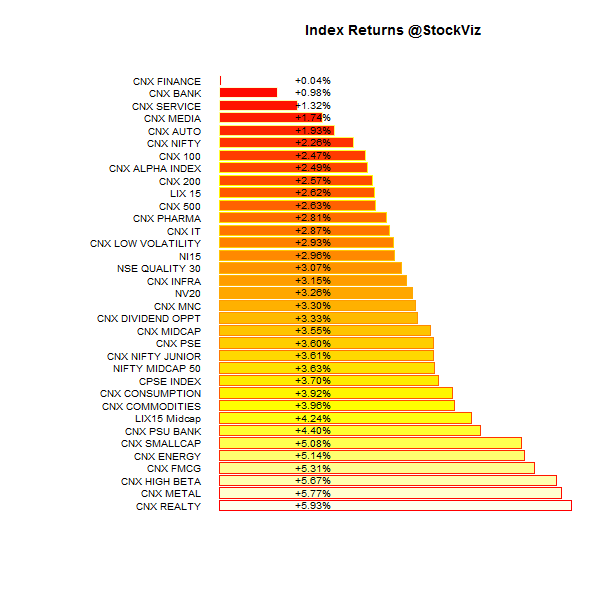

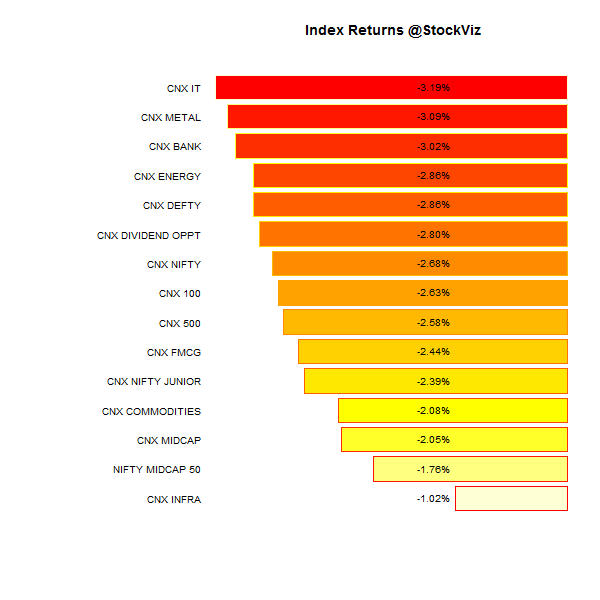

Index Returns

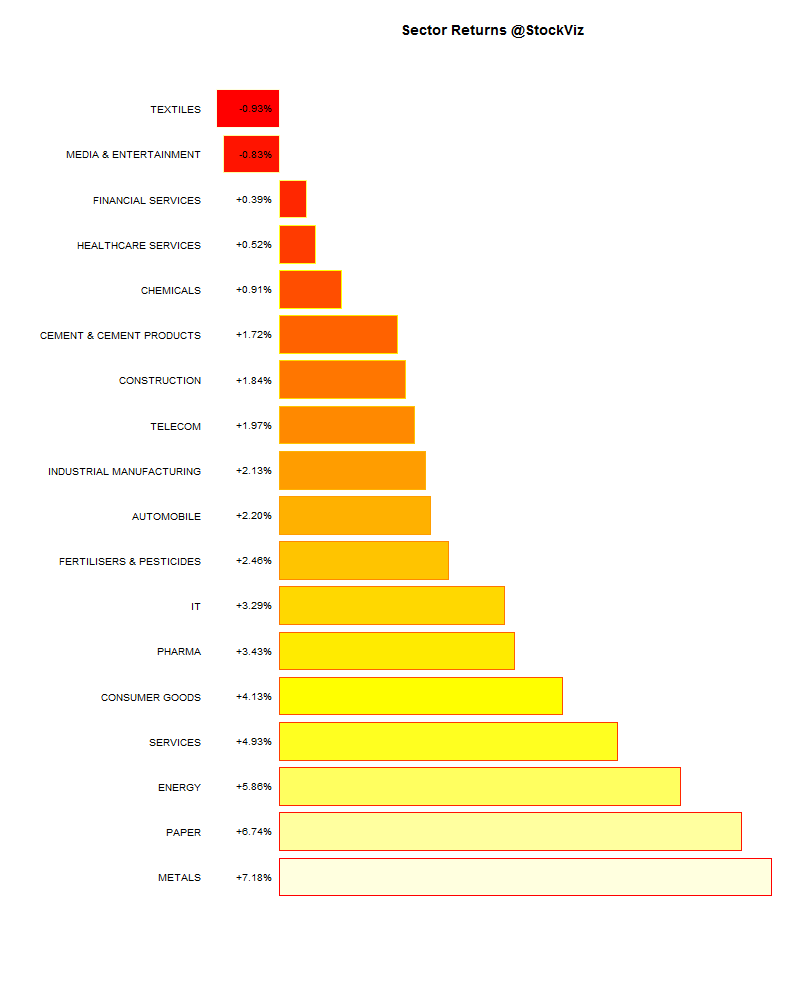

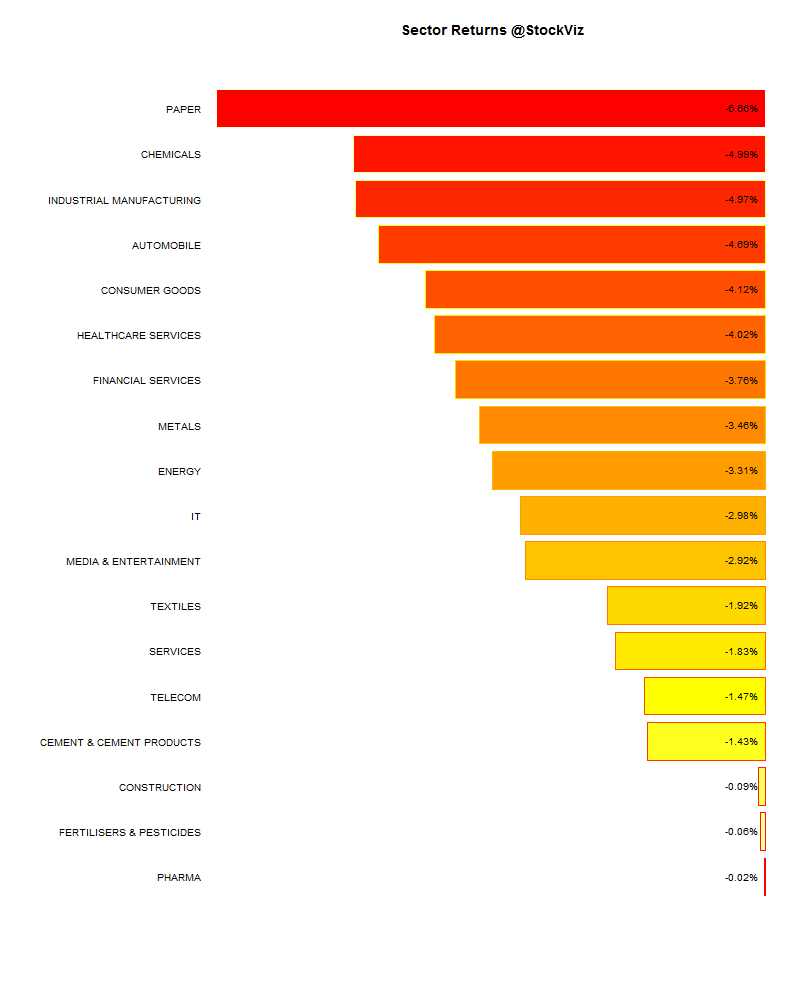

Sector Performance

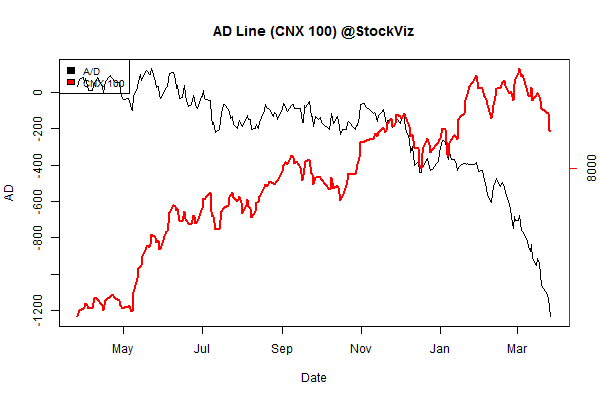

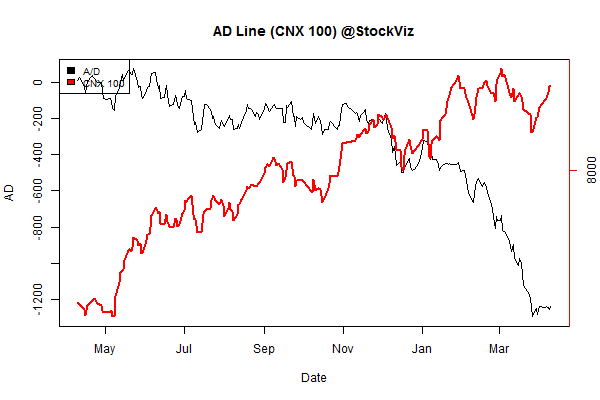

Advance Decline

Market Cap Decile Performance

| Decile | Mkt. Cap. | Adv/Decl |

|---|---|---|

| 1 (micro) | +10.90% | 78/53 |

| 2 | +11.87% | 85/46 |

| 3 | +12.22% | 86/45 |

| 4 | +11.65% | 83/47 |

| 5 | +9.90% | 86/45 |

| 6 | +8.36% | 79/52 |

| 7 | +8.67% | 78/52 |

| 8 | +5.18% | 73/58 |

| 9 | +4.27% | 70/61 |

| 10 (mega) | +3.25% | 71/60 |

Top Winners and Losers

ETF Performance

| JUNIORBEES | +4.48% |

| CPSEETF | +3.62% |

| PSUBNKBEES | +3.57% |

| NIFTYBEES | +2.22% |

| BANKBEES | +1.07% |

| INFRABEES | +1.07% |

| GOLDBEES | +0.83% |

Gold vs. Midcaps

You can send this to your mother-in-law. (http://svz.bz/1CCWifr)

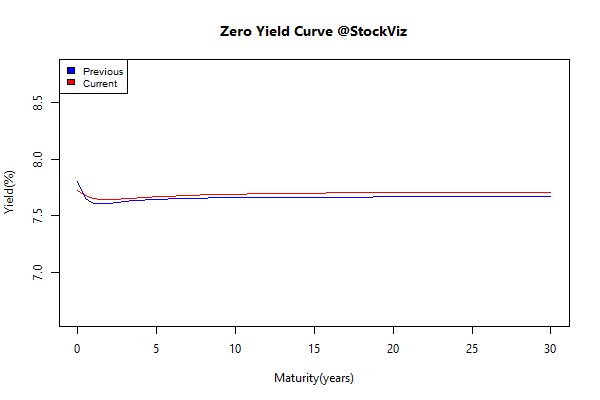

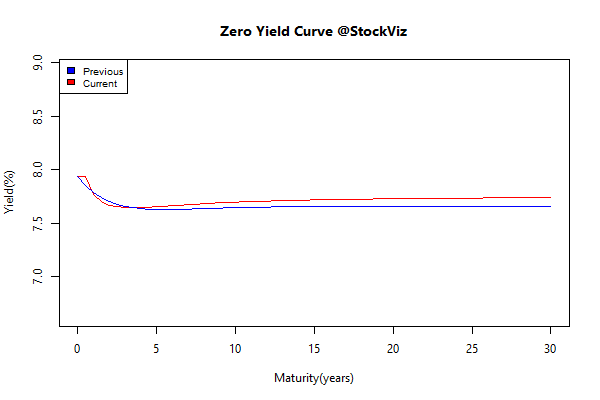

Yield Curve

Bond Indices

| Sub Index | Change in YTM | Total Return(%) |

|---|---|---|

| GSEC TB | +0.01 | +0.21% |

| GSEC SUB 1-3 | +0.14 | +0.19% |

| GSEC SUB 3-8 | +0.09 | -0.00% |

| GSEC SUB 8 | +0.11 | -0.48% |

Investment Theme Performance

| Financial Strength Value | +11.00% |

| Momentum | +10.31% |

| Quality to Price | +10.22% |

| ADAG stocks | +10.04% |

| Textile, Metals, Chemicals, Paper and Energy Quality to Price | +6.96% |

| High Beta | +6.56% |

| Auto and Consumer Goods Quality to Price | +5.58% |

| Media, Health, IT, Telecom, Services, Pharma Quality To Price | +4.90% |

| Magic Formula | +4.84% |

| PPFAS Long Term Value | +4.68% |

| Tactical CNX 100 | +4.50% |

| Balance Sheet Strength | +4.33% |

| ASK Life | +4.32% |

| CNX 100 Enterprise Yield | +3.67% |

| Low Volatility | +3.05% |

| Next Trillion | +2.22% |

Equity Mutual Funds

Bond Mutual Funds

Thought for the weekend

When prices are even a little sticky, bursts of technological progress actually hurt the economy for a short while, by causing a burst of deflation, before eventually boosting growth.