Earlier this year, AQR had published a paper that showed momentum behavior also exists in equity factors (like value, quality, etc.) and not just in vanilla equities.

In this article, the authors document robust momentum behavior in a large collection of 65 widely-studied, characteristic-based equity factors around the globe. They show that, in general, individual factors can be reliably timed based on their own recent performance. A time series “factor momentum” portfolio that combines timing strategies of all factors earns an annual Sharpe ratio of 0.84. Factor momentum adds significant incremental performance to investment strategies that employ traditional momentum, industry momentum, value, and other commonly studied factors. Their results demonstrate that the momentum phenomenon is driven in large part by persistence in common return factors and not solely by persistence in idiosyncratic stock performance.

Factor Momentum Everywhere – Tarun Gupta, Bryan T. Kelly (AQR)

We put this idea to the test by constructing a long-only portfolio with five of the strongest factors – Momentum, Quality, Low-volatility, Value and Small-cap. The strategy was to go long whatever factor had the best returns over the last 12-months. We also looked at going long the best factor from the previous month. In both cases, the portfolio was re-balanced every month.

The representative indices and ETFs used for this back-test can be perused from the code: factor-momentum-india.ipynb and factor-momentum-US.ipynb

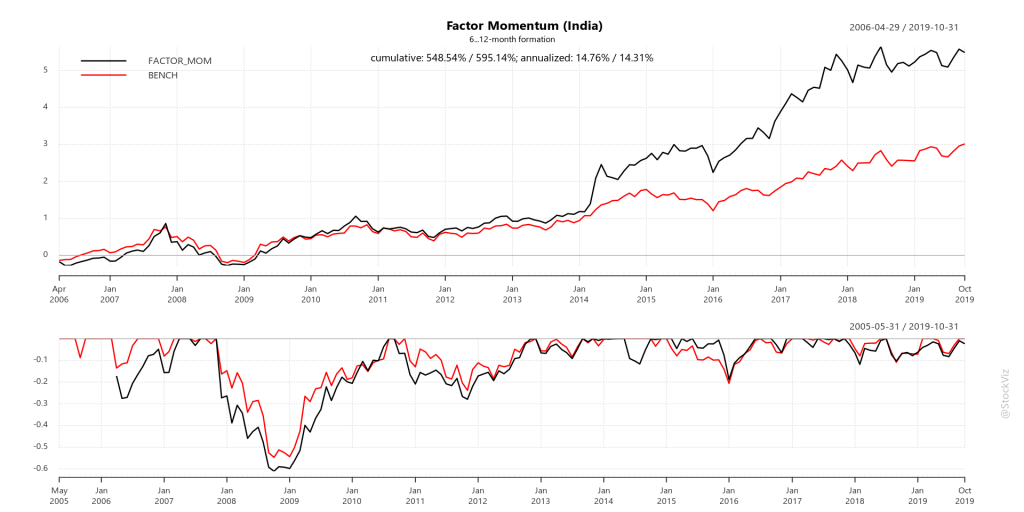

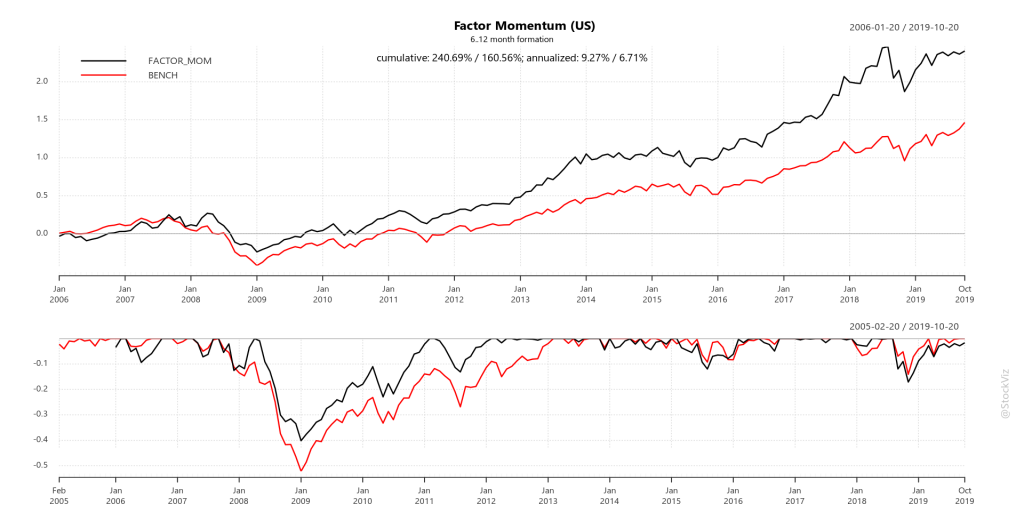

Results

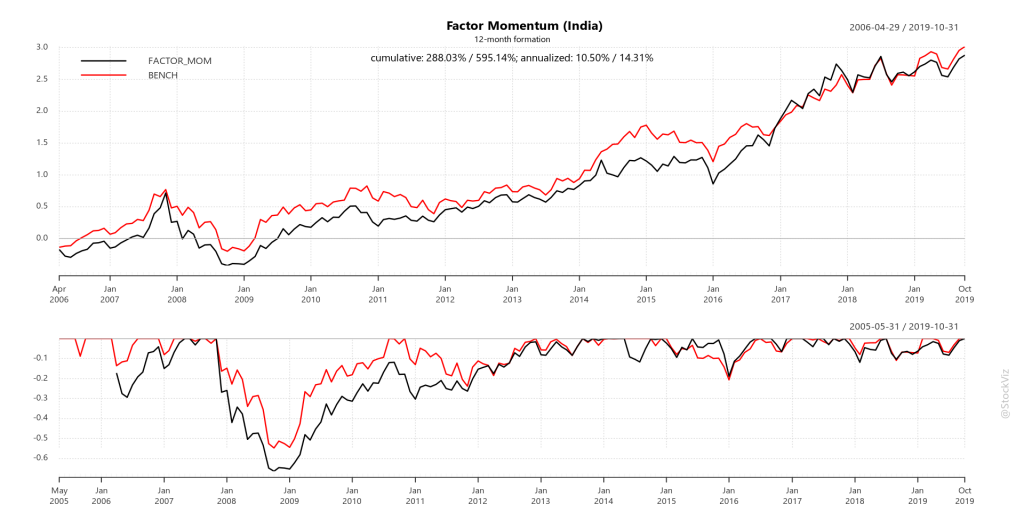

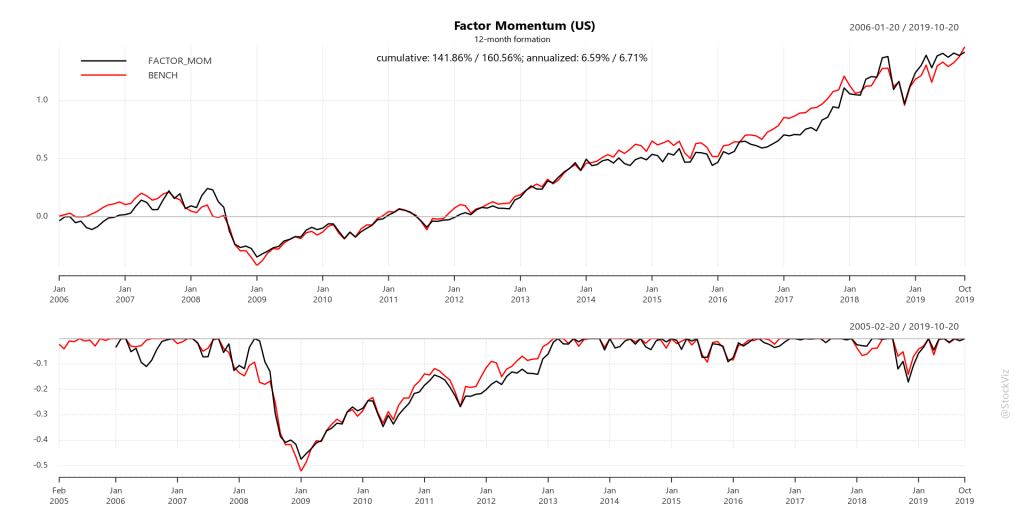

The strategy using a 12-month formation period was a disappointment. There was no discernible improvement over a buy-and-hold of the large-cap index.

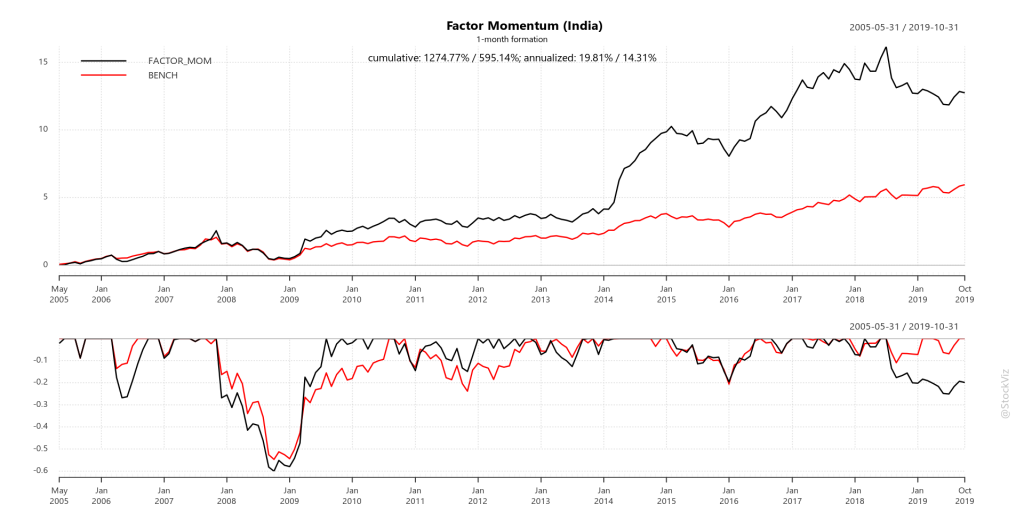

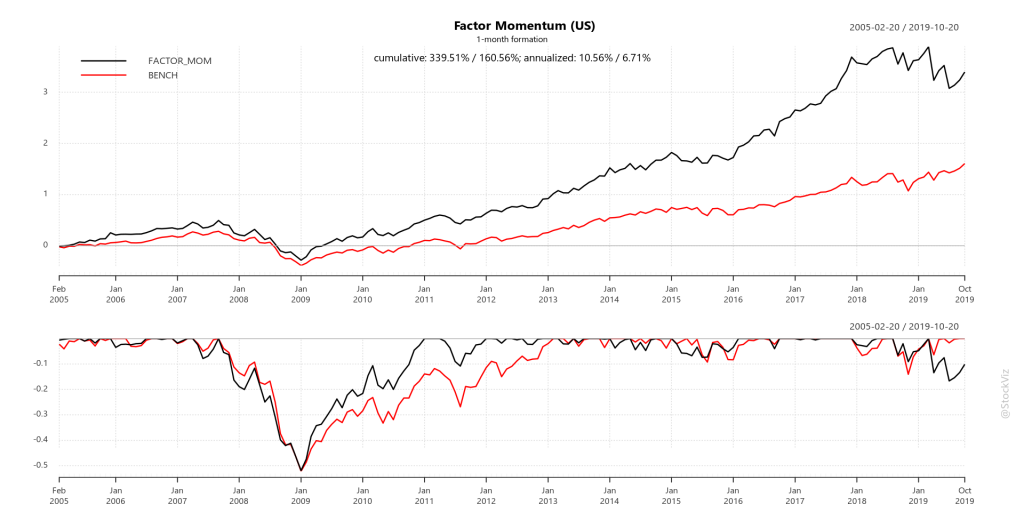

However, the one-month formation period widely out-performed the large-cap benchmark.

Needless to say, shorter the look-back period, larger the number of trades. So we added another back-test that averaged factor returns over 6-through-12 months to check if there was an acceptable middle-ground. Turns out, there is.

Forward Test

We setup US portfolios back in May this year when we first got to know about this paper. The 12-month and the 6…12-month formation period portfolios can be found here and here. They both seem to have out-performed SPY and MTUM so far.

We constructed the Factor Momentum 6-12 Theme for Indian equities that tracks the last strategy outlined above but given the lack of liquidity in factor ETFs, it trades the underlying stocks directly.

Investing in Factor Momentum

Indian investors can use brokers like TD Ameritrade or Interactive Brokers to invest in US stocks. The trades are posted on the slack channel mentioned on the pages linked above. You can execute the trades yourself by monitoring the messages on the channel.

If you are interested in executing this strategy on Indian equities, talk to us!

Related:

Factor Holding Periods for Excess Returns

Funding Your Dollar Dreams

Questions? Slack me!