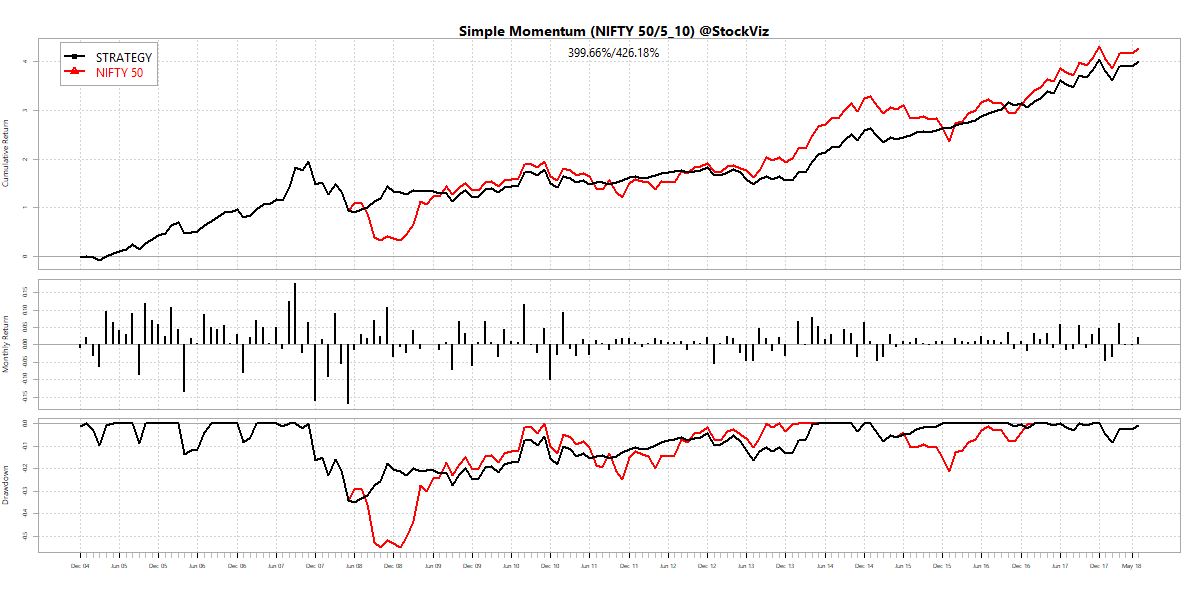

Michael Batnick, in his blog titled “Simple Momentum,” proposes a strategy that follows a simple rule:

If the S&P 500 outperformed 5-year U.S. treasury notes over the previous twelve months, invest 100% of this portfolio in the S&P 500 in the following month. If the 5-year U.S. treasury notes outperformed the S&P 500 over the previous twelve months, invest 100% of this portfolio in bonds in the following month.

It outperformed the S&P 500 with significantly lower drawdowns. Could the same strategy work with Indian indices? We took NIFTY 50 and MIDCAP 100 indices and paired it with the 5-10 year tenure gilts.

Returns

The strategy returns are significantly lower than a simple buy and hold. December 2004 through June 2018, the NIFTY 50 version of it under performed buy and hold by 6% and the MIDCAP 100 version by 34%. This is before transaction costs and taxes. Here are the cumulative return charts:

Drawdowns

The simple momentum strategy did have lower peak drawdowns than a buy and hold:

What keeps you out of the troughs also ends up keeping you out of the peaks. This is highlighted by how the strategy behaved in 2008 and 2009:

Conclusion

The simple momentum strategy is perhaps too simple. The backtest doesn’t capture transaction costs and taxes that would further ding the already lagging gross returns.

You can peruse the code and the charts used in this blog on github.