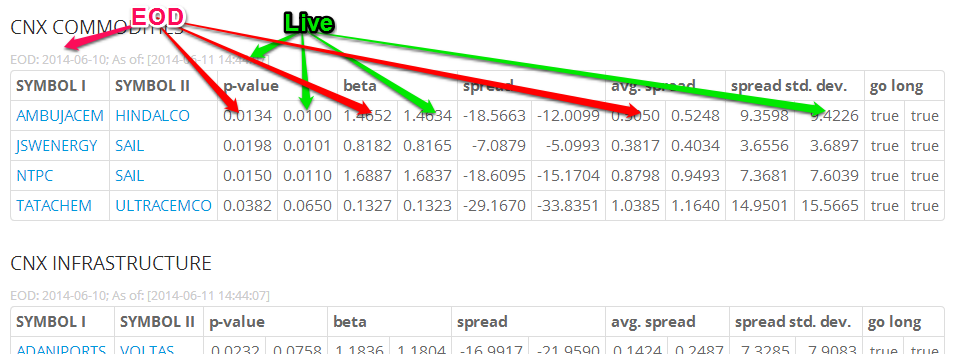

During our back-testing for pair trading strategies, we found that we were most comfortable in going long the spread (when the spread is below its historical average) and betting on pairs within the same index. We have bundled all the assumptions into an easy to use pair trading “tip-sheet” that can be found here.

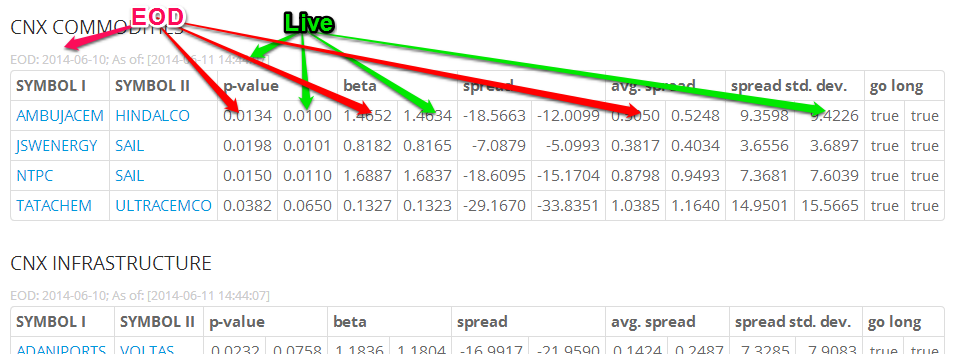

The pairs are computed at the end-of-day and live pair status is computed roughly once an hour. The p-value, beta and spread display both end-of-day data and live status side-by-side so that you can decide for yourself if going long the pair makes sense or not.

It is still rough around the edges – you cannot really add a pair to your portfolio and track like you can do with option strategies. But once it is fleshed out, it will be available exclusively to your trading/demat customers.

Pair trading equity futures is not for the faint of heart. The capital at risk is bigger than what most individual investors can stomach. But when done right, the returns are commensurate with the risks.