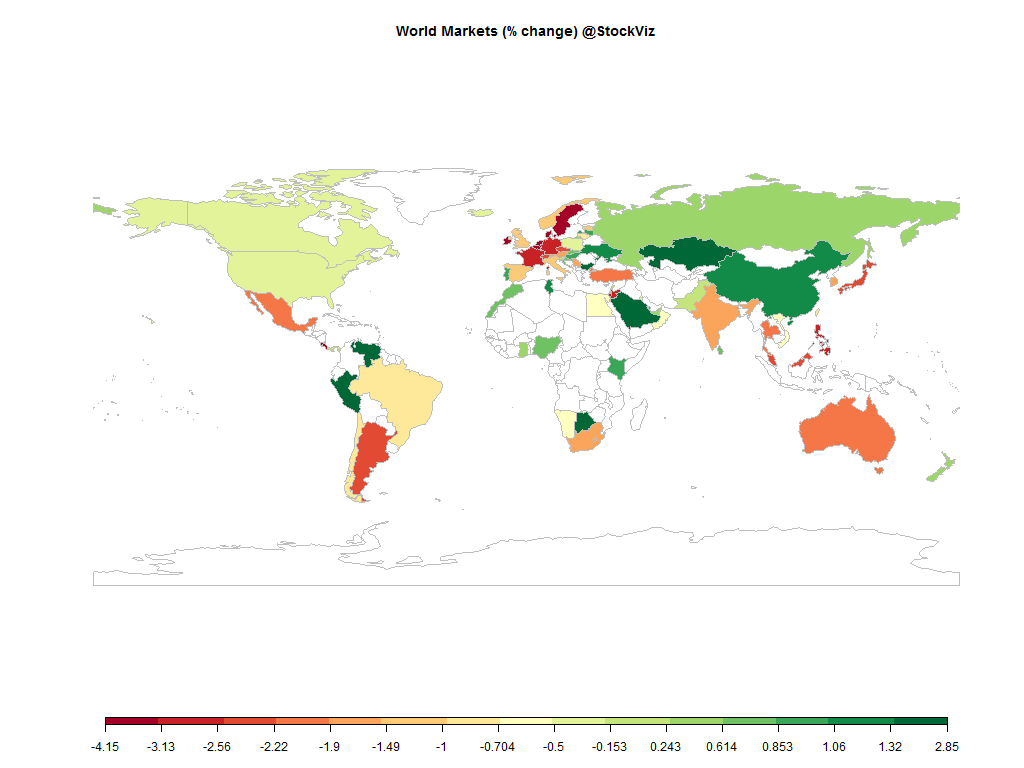

Equities

| MINTs | |

|---|---|

| JCI(IDN) | -6.42% |

| INMEX(MEX) | -1.97% |

| NGSEINDX(NGA) | +0.64% |

| XU030(TUR) | -1.90% |

| BRICS | |

|---|---|

| IBOV(BRA) | -0.74% |

| SHCOMP(CHN) | +1.09% |

| NIFTY(IND) | -1.49% |

| INDEXCF(RUS) | +0.34% |

| TOP40(ZAF) | -1.57% |

Commodities

| Energy | |

|---|---|

| Heating Oil | +3.51% |

| Ethanol | -0.06% |

| Brent Crude Oil | +2.61% |

| Natural Gas | +9.66% |

| RBOB Gasoline | +2.36% |

| WTI Crude Oil | +3.93% |

| Metals | |

|---|---|

| Gold 100oz | +0.07% |

| Palladium | +0.62% |

| Copper | +6.91% |

| Platinum | +0.85% |

| Silver 5000oz | +1.90% |

Currencies

| MINTs | |

|---|---|

| USDIDR(IDN) | +0.20% |

| USDMXN(MEX) | +1.01% |

| USDNGN(NGA) | -0.26% |

| USDTRY(TUR) | -0.40% |

| BRICS | |

|---|---|

| USDBRL(BRA) | +1.68% |

| USDCNY(CHN) | +0.14% |

| USDINR(IND) | -0.22% |

| USDRUB(RUS) | +1.76% |

| USDZAR(ZAF) | -0.36% |

| Agricultural | |

|---|---|

| Cocoa | +0.61% |

| Coffee (Arabica) | -7.30% |

| Coffee (Robusta) | -3.84% |

| Cotton | +1.74% |

| Cattle | -7.32% |

| Lean Hogs | +6.12% |

| Lumber | -1.59% |

| Orange Juice | -0.83% |

| Soybeans | -0.05% |

| Sugar #11 | -1.75% |

| Feeder Cattle | -0.68% |

| Wheat | -3.04% |

| White Sugar | -0.35% |

| Corn | -1.17% |

| Soybean Meal | +0.13% |

Credit Indices

| Index | Change |

|---|---|

| Markit CDX EM | -0.13% |

| Markit CDX NA HY | -0.15% |

| Markit CDX NA IG | +1.38% |

| Markit iTraxx Asia ex-Japan IG | -0.23% |

| Markit iTraxx Australia | +0.03% |

| Markit iTraxx Europe | +0.76% |

| Markit iTraxx Europe Crossover | +7.53% |

| Markit iTraxx Japan | +0.72% |

| Markit iTraxx SovX Western Europe | -0.02% |

| Markit LCDX (Loan CDS) | +0.00% |

| Markit MCDX (Municipal CDS) | -0.41% |

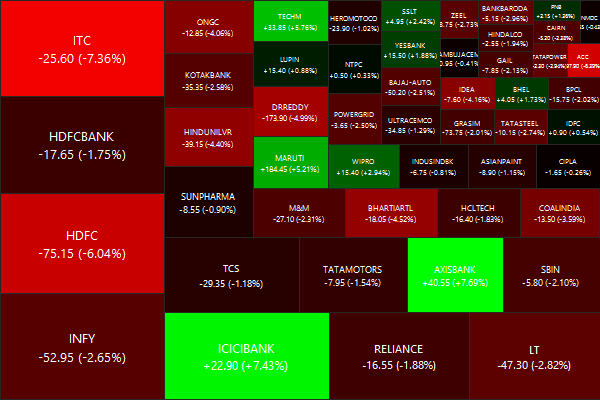

Nifty Heatmap

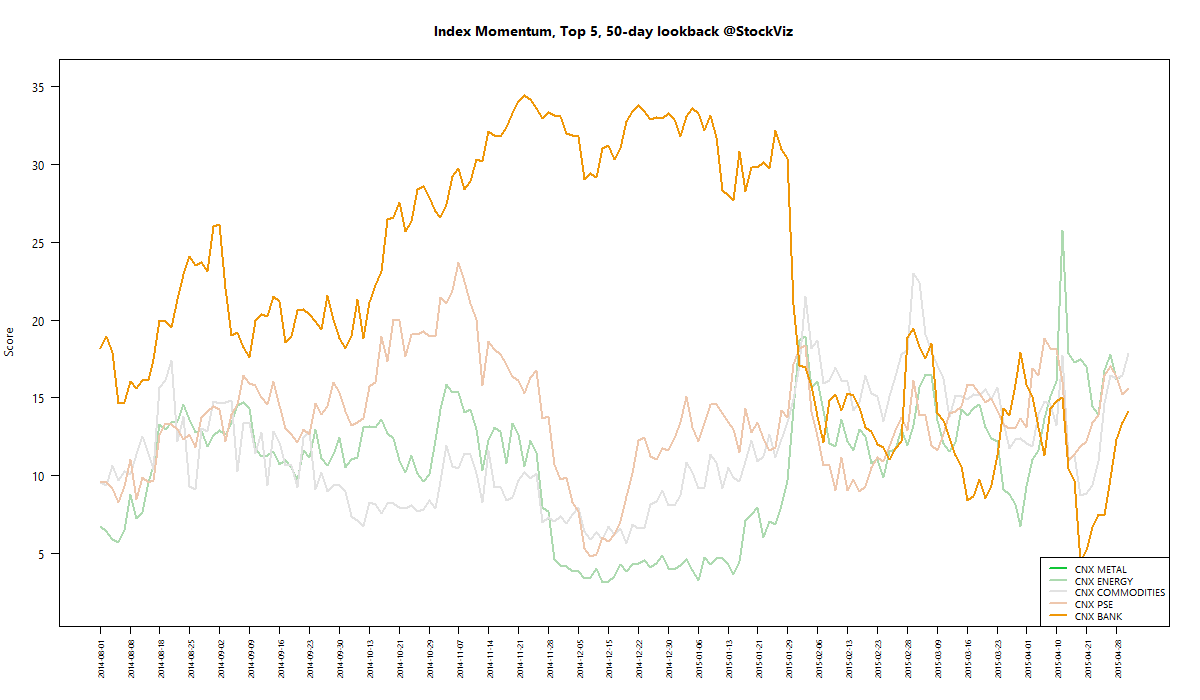

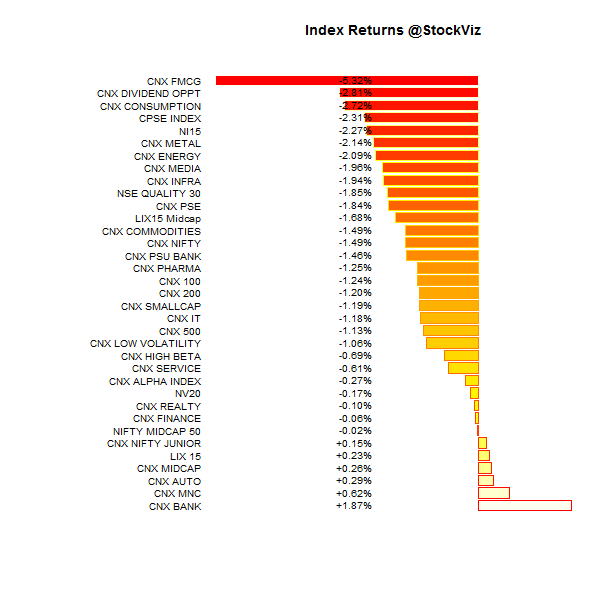

Index Returns

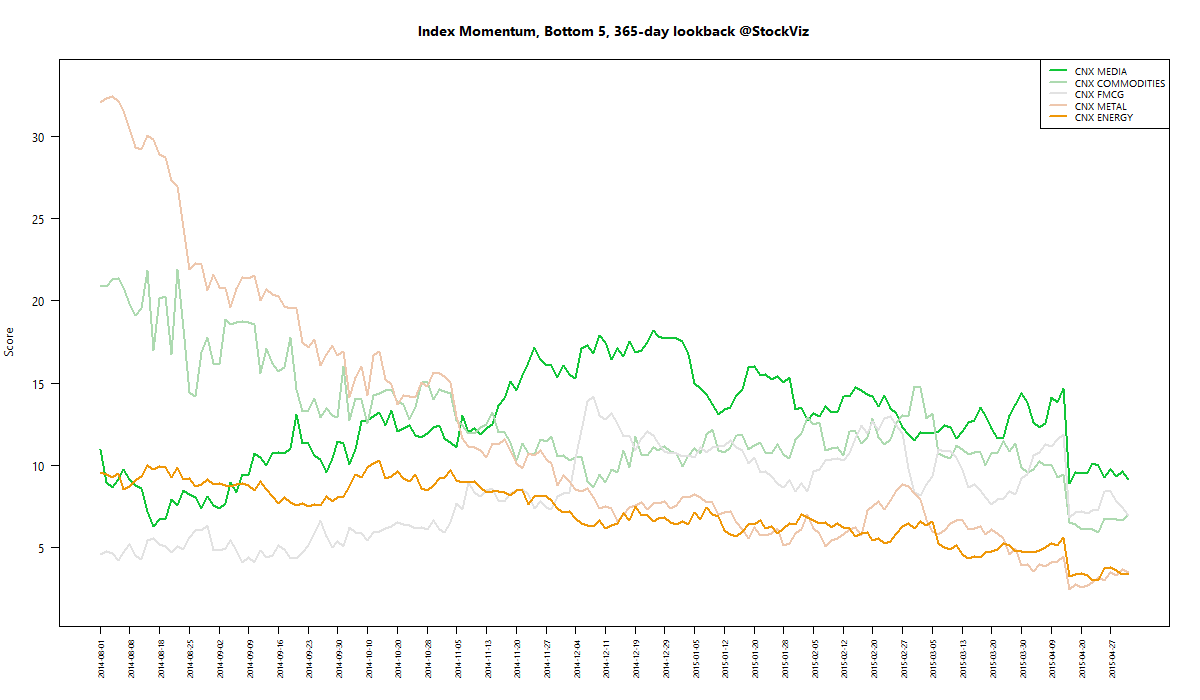

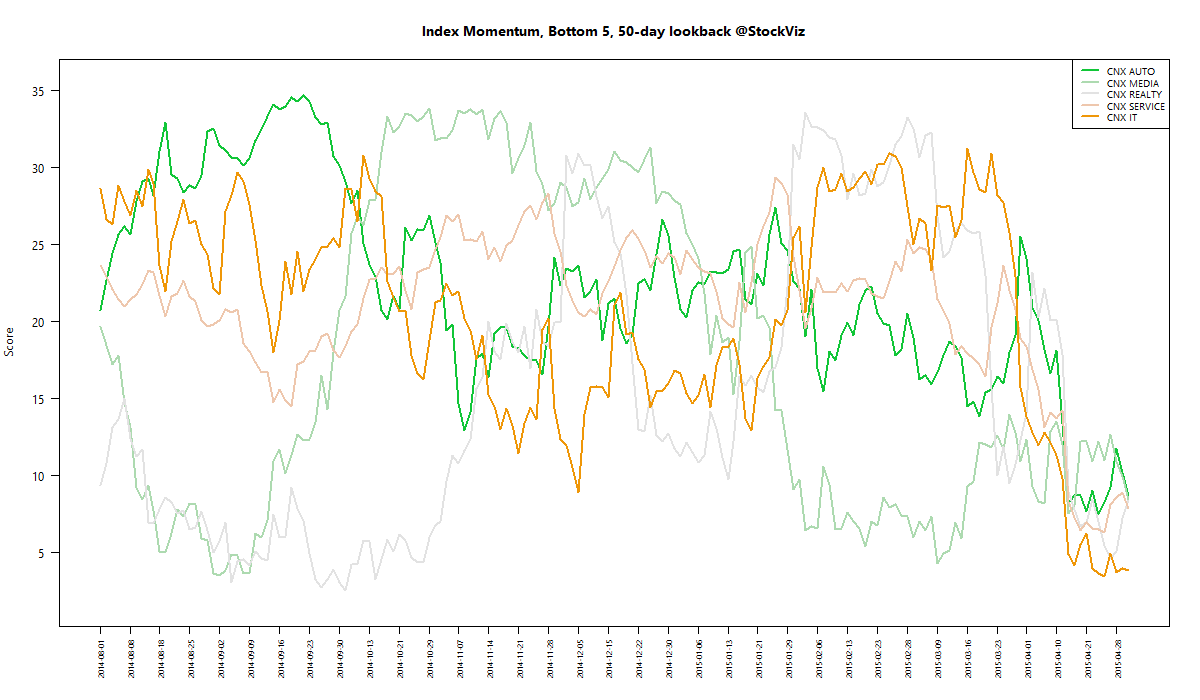

For a deeper dive into indices, check out our weekly Index Update.

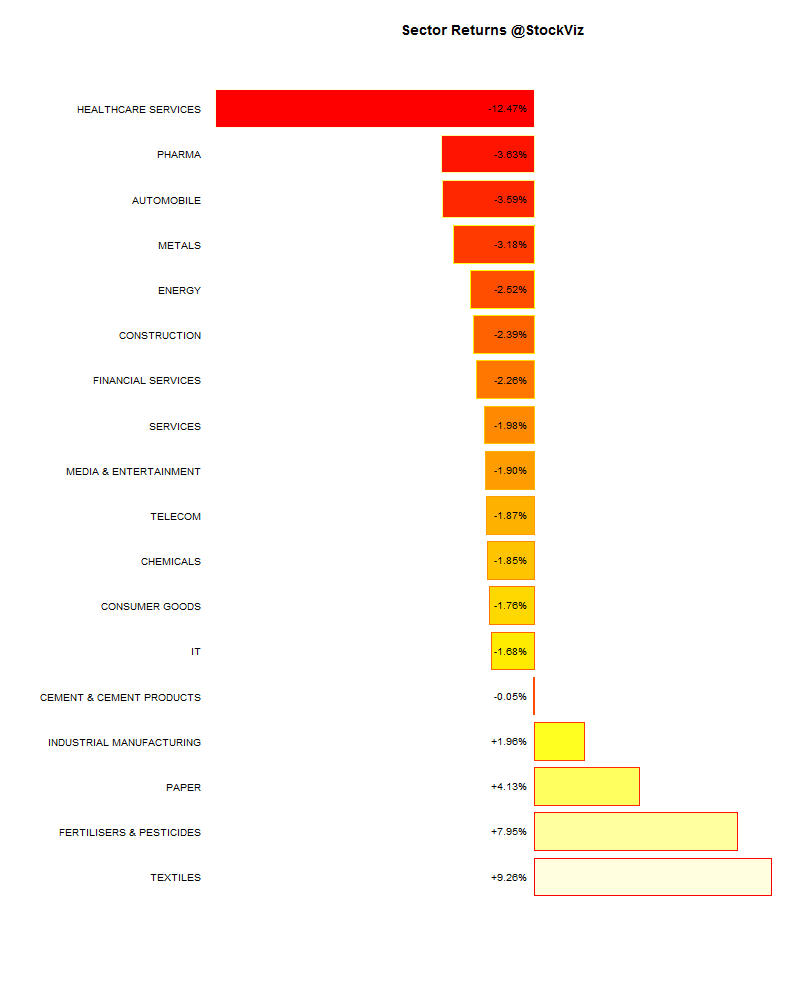

Sector Performance

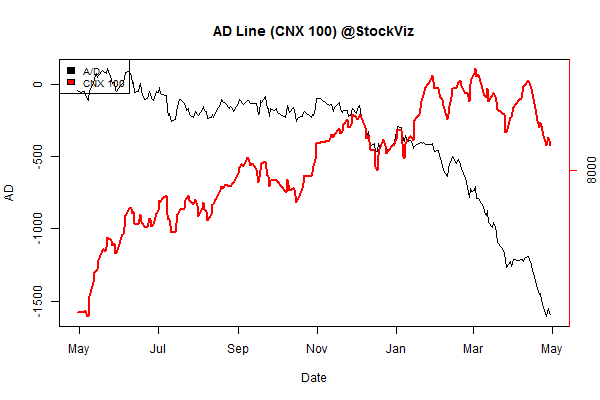

Advance Decline

Market Cap Decile Performance

| Decile | Mkt. Cap. | Adv/Decl |

|---|---|---|

| 1 | -8.22% | 64/68 |

| 2 | -5.11% | 56/75 |

| 3 | -5.87% | 50/81 |

| 4 | -3.93% | 57/74 |

| 5 | -4.40% | 62/69 |

| 6 | -3.90% | 61/70 |

| 7 | -3.51% | 56/75 |

| 8 | -4.70% | 64/67 |

| 9 | -4.26% | 59/72 |

| 10 | -1.21% | 70/62 |

Top Winners and Losers

| MOTHERSUMI | +7.93% |

| SIEMENS | +10.80% |

| UPL | +12.87% |

| UBL | -12.70% |

| APOLLOHOSP | -12.21% |

| ITC | -7.36% |

ETF Performance

| BANKBEES | +2.20% |

| GOLDBEES | +1.00% |

| JUNIORBEES | -0.71% |

| NIFTYBEES | -1.19% |

| PSUBNKBEES | -1.47% |

| CPSEETF | -2.27% |

| INFRABEES | -3.91% |

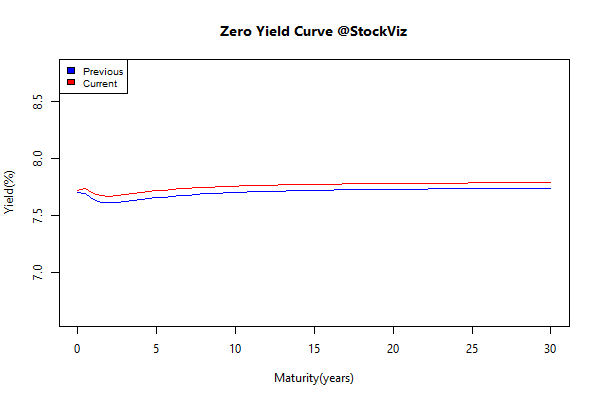

Yield Curve

Bond Indices

| Sub Index | Change in YTM | Total Return(%) |

|---|---|---|

| GSEC TB | -0.18 | +0.18% |

| GSEC SUB 1-3 | -0.04 | +0.34% |

| GSEC SUB 3-8 | -0.00 | +0.26% |

| GSEC SUB 8 | +0.02 | +0.12% |

Investment Theme Performance

| Textile, Metals, Chemicals, Paper and Energy Quality to Price | +2.46% |

| Financial Strength Value | +2.29% |

| Next Trillion | +1.99% |

| Media, Health, IT, Telecom, Services, Pharma Quality To Price | +1.03% |

| Low Volatility | +0.86% |

| Auto and Consumer Goods Quality to Price | +0.83% |

| The RBI Restricted List | +0.37% |

| Tactical CNX 100 | -0.00% |

| CNX 100 Enterprise Yield | -0.17% |

| PPFAS Long Term Value | -0.52% |

| ASK Life | -0.55% |

| Momentum | -0.98% |

| High Beta | -1.18% |

| Balance Sheet Strength | -1.46% |

| ADAG stocks | -3.10% |

| Quality to Price | -3.23% |

| Magic Formula | -5.12% |

Equity Mutual Funds

Bond Mutual Funds

Thought for the weekend

The issue of inequality has never been about the fairness of the results, but should focus on the equality of opportunity.

The neo-classical solutions that the markets will take care of everything risks the kind of social instability seen in places like Ferguson, Baltimore, or worse.

You can use comparative advantages, such as low labor costs and convenient geographic proximity to markets, to spur development. But the Porter-Jacobs framework doesn’t explain why India and China succeeded and Kenya and Egypt didn’t.

You are left with culture: both the Jews and the Romani (Gypsies) have historically been outcasts in Europe. How did one group succeed and acquire power (e.g., the Rothchilds) and the other remains shunned throughout the region?