While looking at investing in large-cap stocks, investors have quite a few options available to them.

Mutual Funds

Previously, we discussed ‘Top 100’ funds — funds that invest in the largest market-cap stocks. This is one way to go about adding large-cap exposure to your portfolio. However, the expense ratios of more than 2% will eat into your returns. Remember, returns are not predictable, but fees are forever.

Passive ETFs

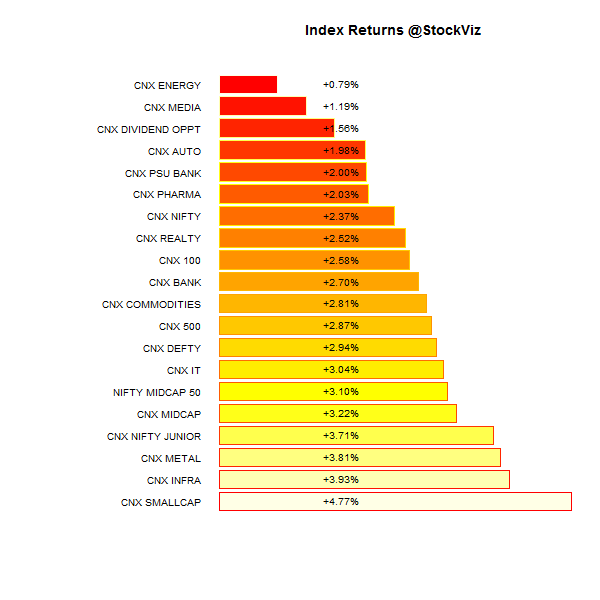

You can buy an equal proportion of the NIFTYBEES and the JUNIORBEES ETFs. Since these are exchange traded, you don’t have to go through the hassle of “surrendering” your mutual fund “units” and keeping track of exit-loads etc. Besides, NIFTYBEES’ expense ratio is 0.5% and JUNIORBEES’ 1%. Overall, you pay 0.75% to Goldman Sachs to manage the ETFs.

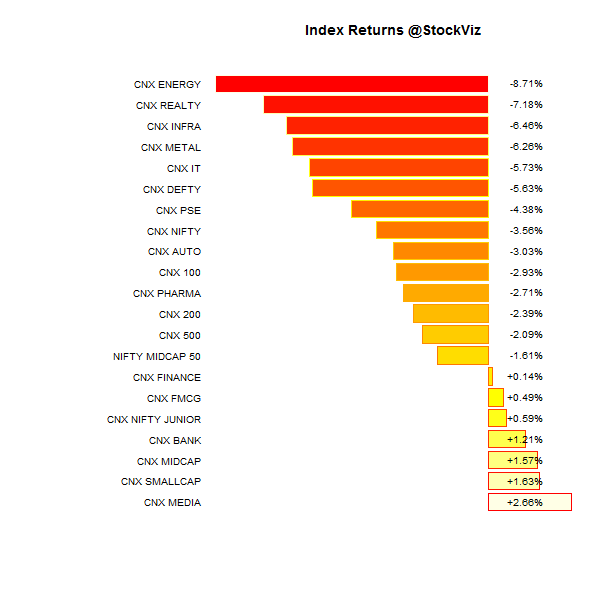

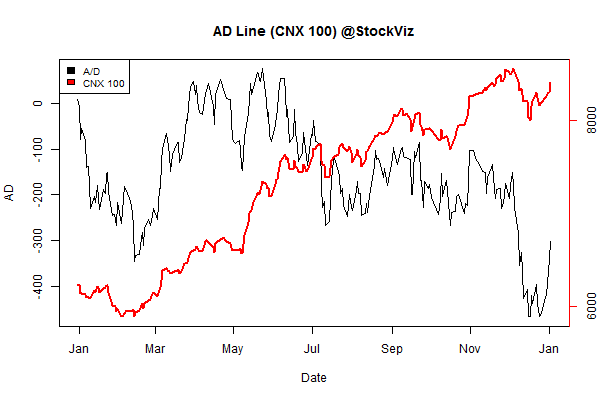

Not a bad deal, considering that you end up tracking the CNX 100 index which represents the top 100 stocks by market cap.

Active ETFs

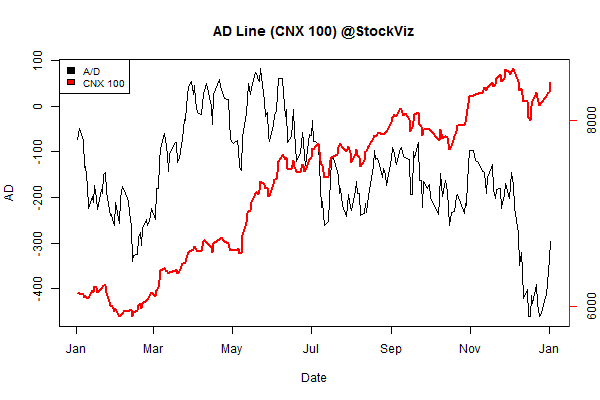

We have a Theme that takes a tactical route when it comes to tracking the CNX 100 index. Its called the CNX 100 50-Day Tactical Theme. The basic idea is to switch between (NIFTYBEES + JUNIORBEES) and LIQUIDBEES depending on whether the CNX 100 index is trading above or below its 50-day moving average. Details of the strategy can be found here.

The drawback is that in flat markets, you end up getting whipsawed a lot. But if you have the discipline to stick with it for over 5-years, it has the ability to deliver superior risk-adjusted returns.

Conclusion

Each of the approaches described above have their advantages and disadvantages. With mutual funds, you have a brand-name manager who is working for you. With the passive route, you save on fees. The tactical route will probably lessen drawdowns during a market crash and preserve capital.

What you end up investing in finally boils down to whatever sails your boat.