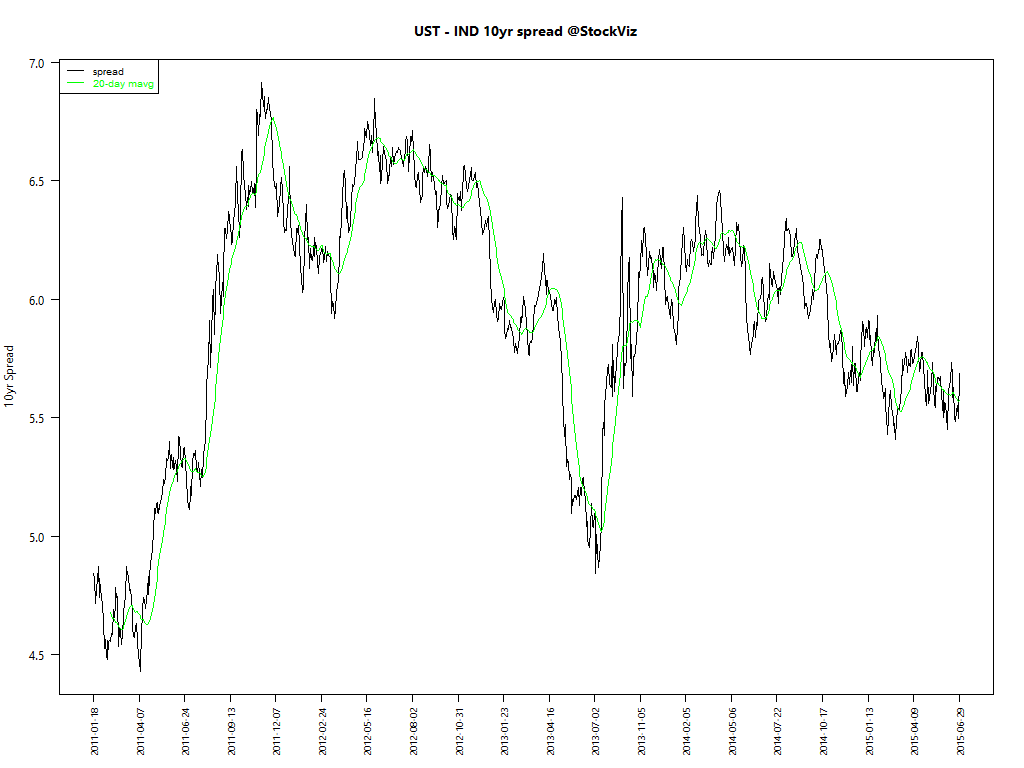

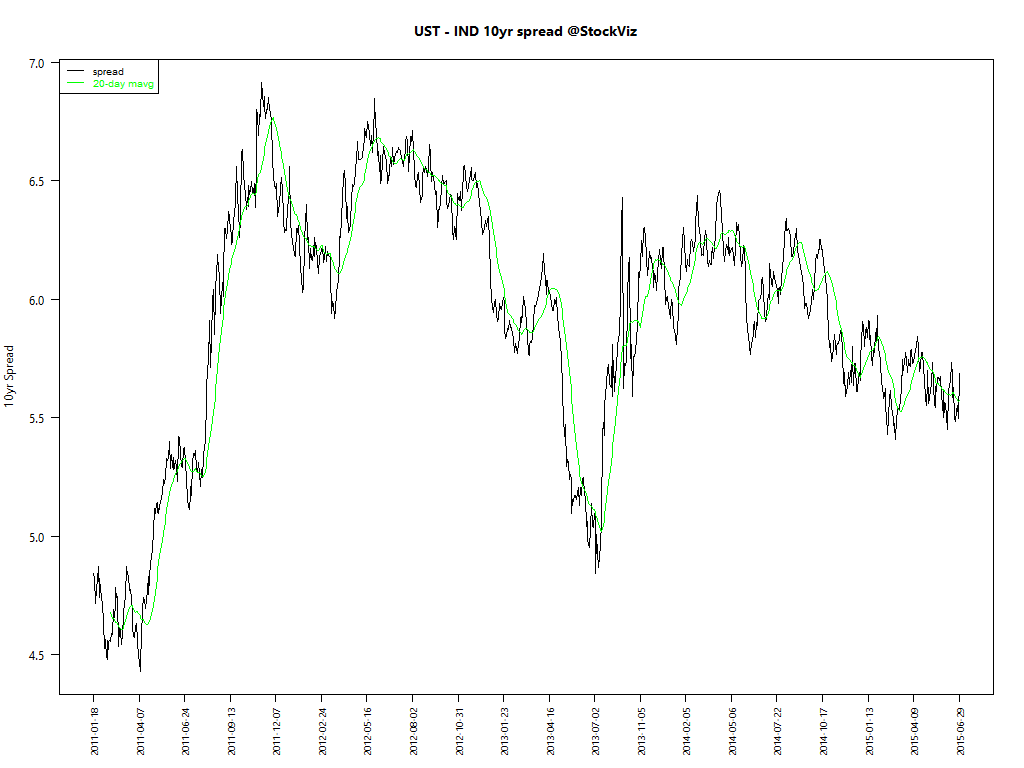

US TREASURIES VS. GILT SPREAD

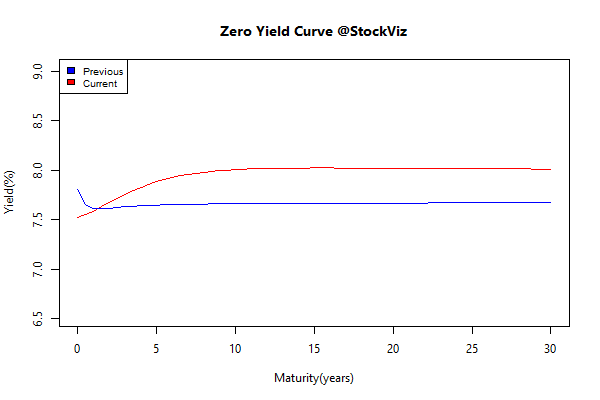

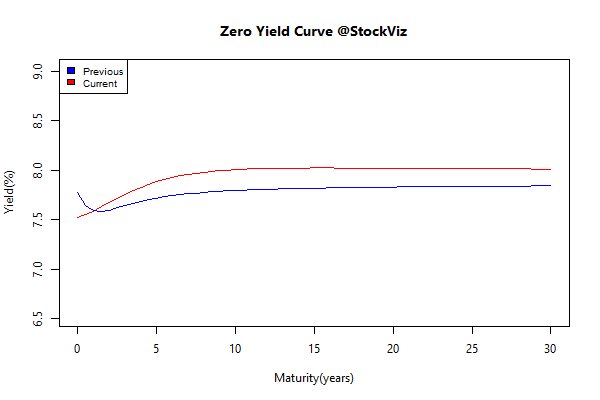

The spread between 10yr US Treasuries and Indian Gilts remained within a tight range this month.

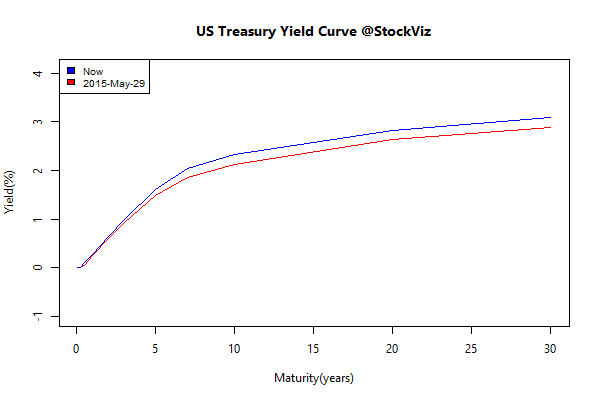

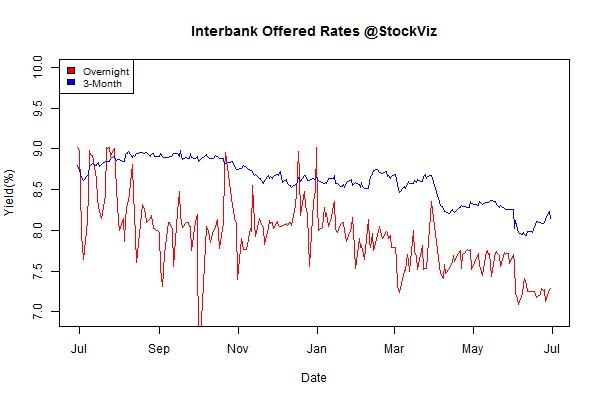

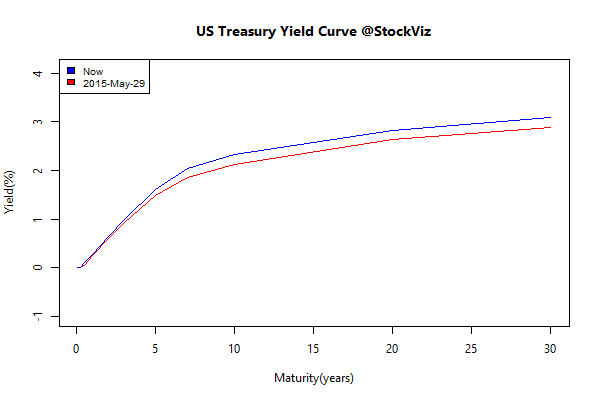

Long-term bond yields continued their ascent:

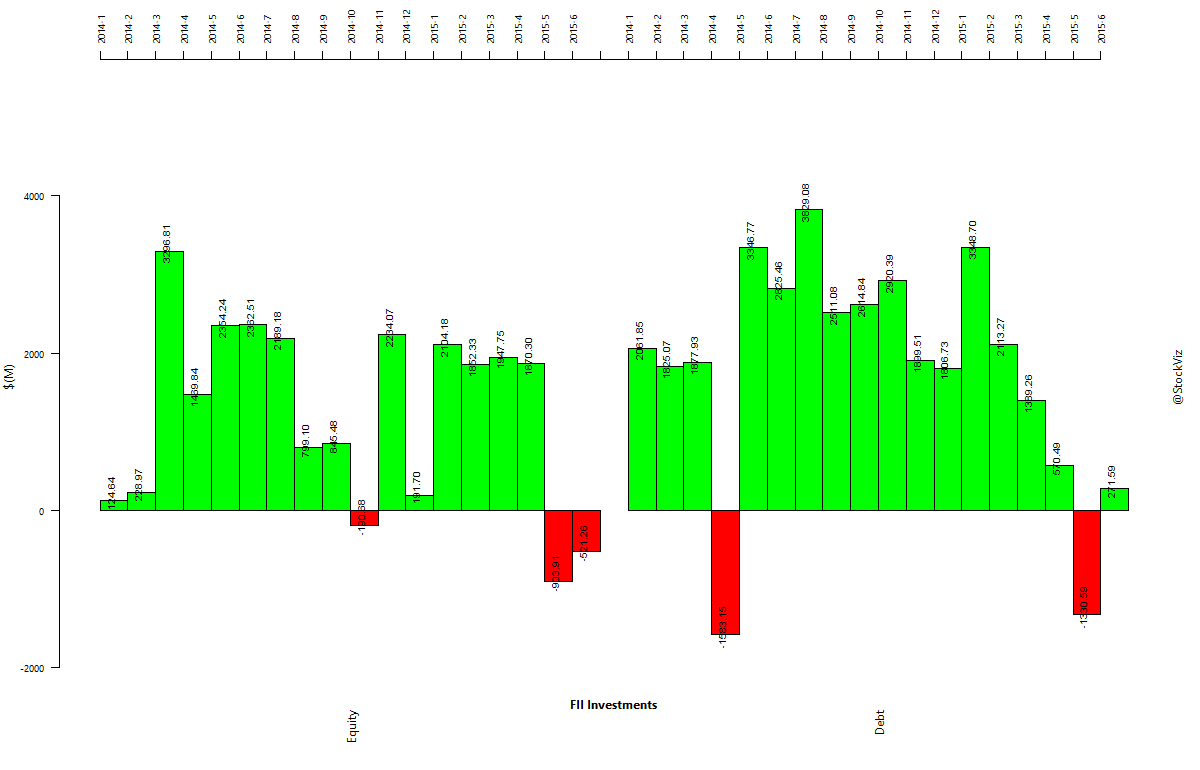

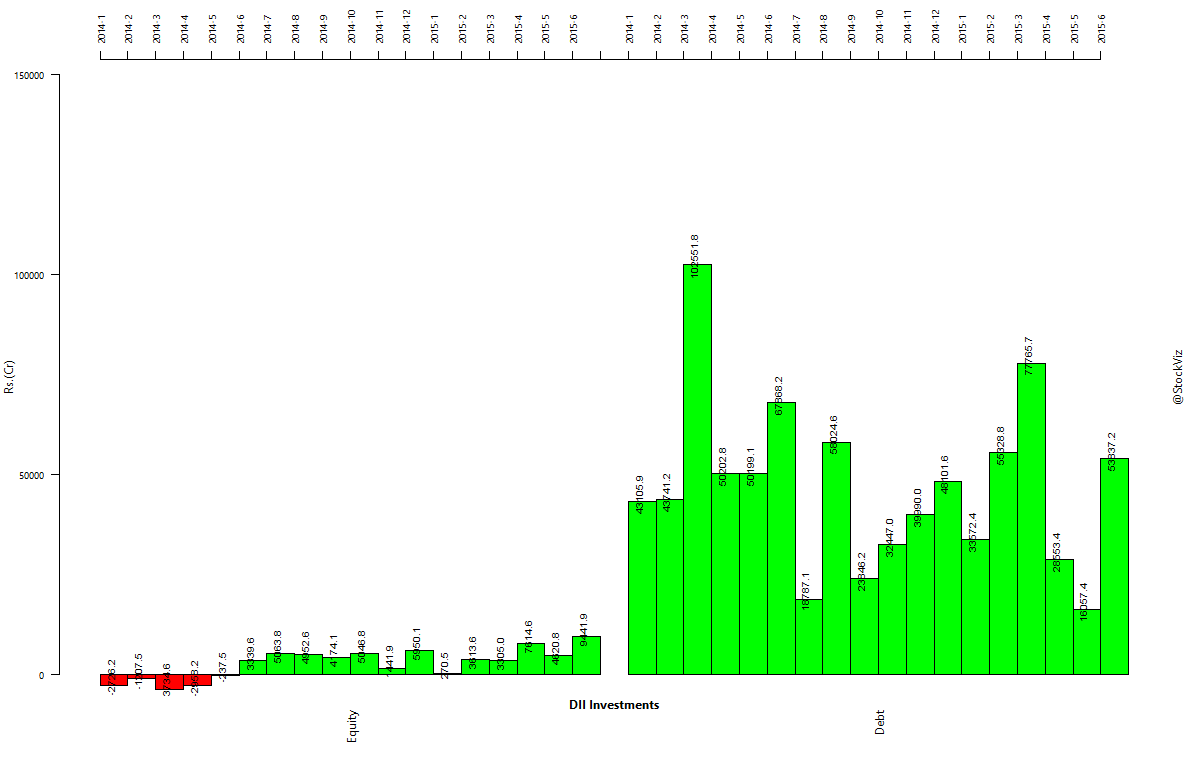

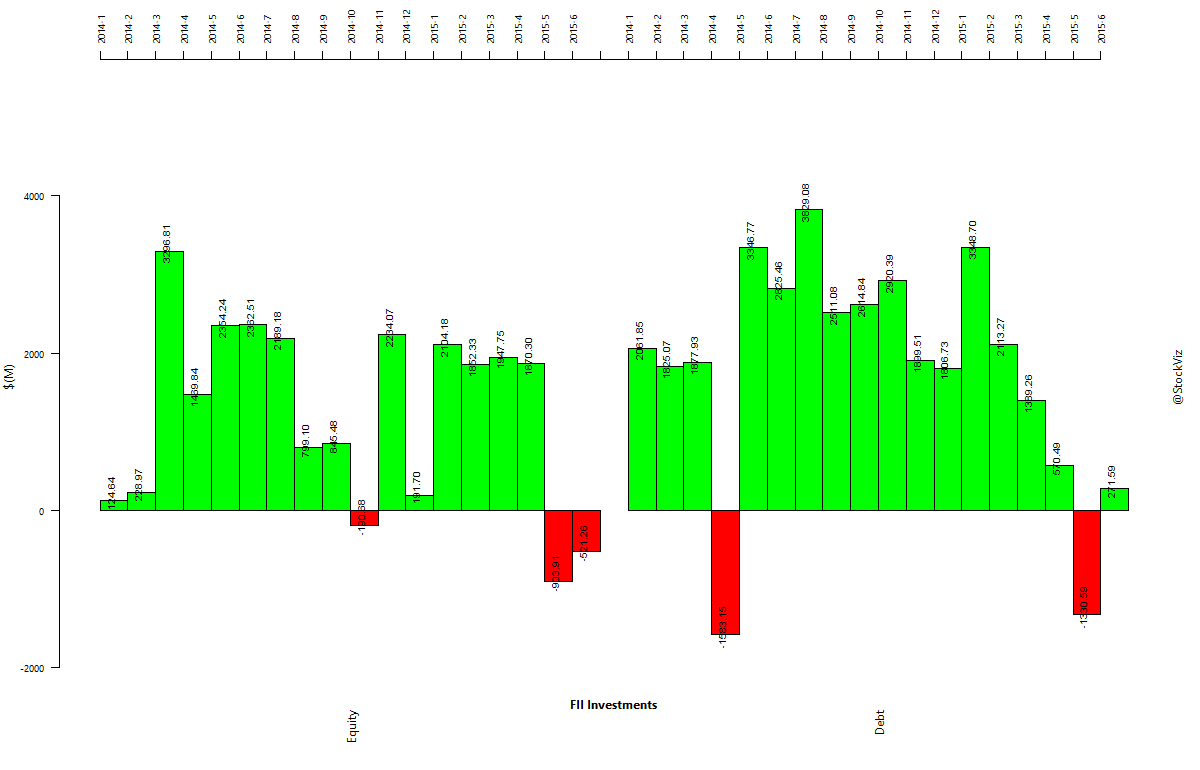

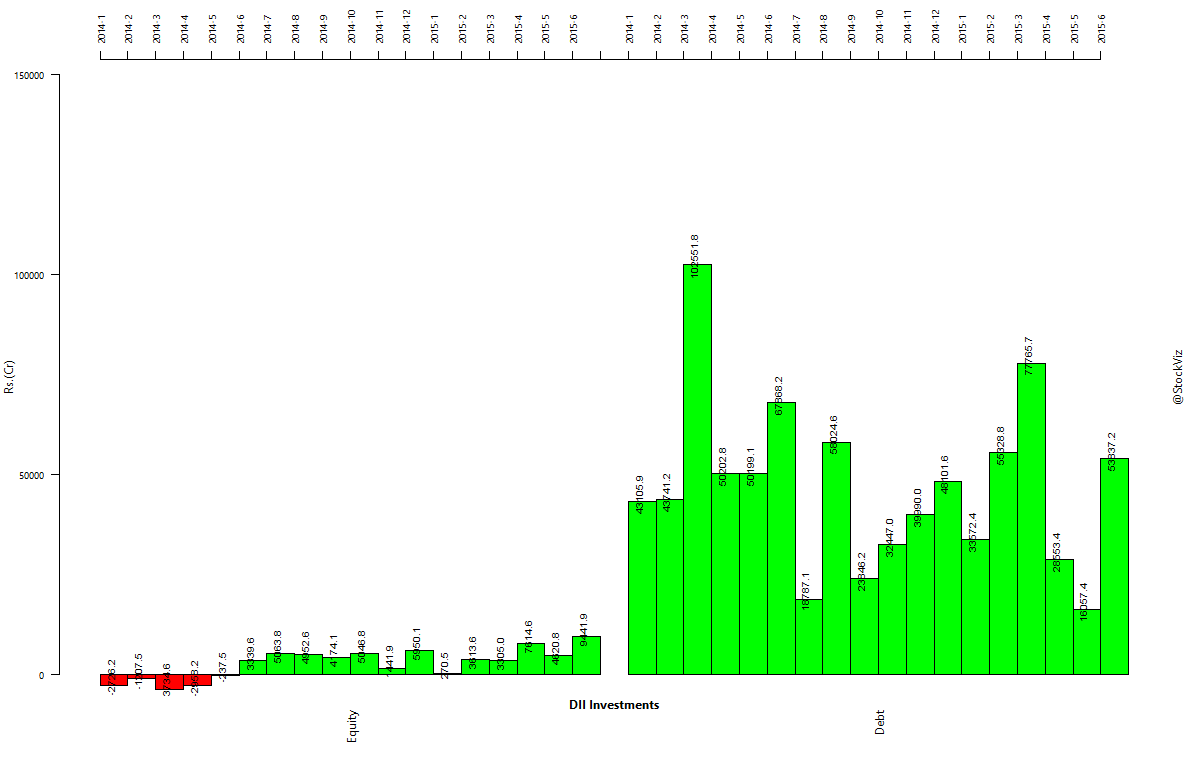

INSTITUTIONAL INVESTMENTS

FIIs came back to the debt market but took money out of equities…

… while DIIs gulped down debt as well.

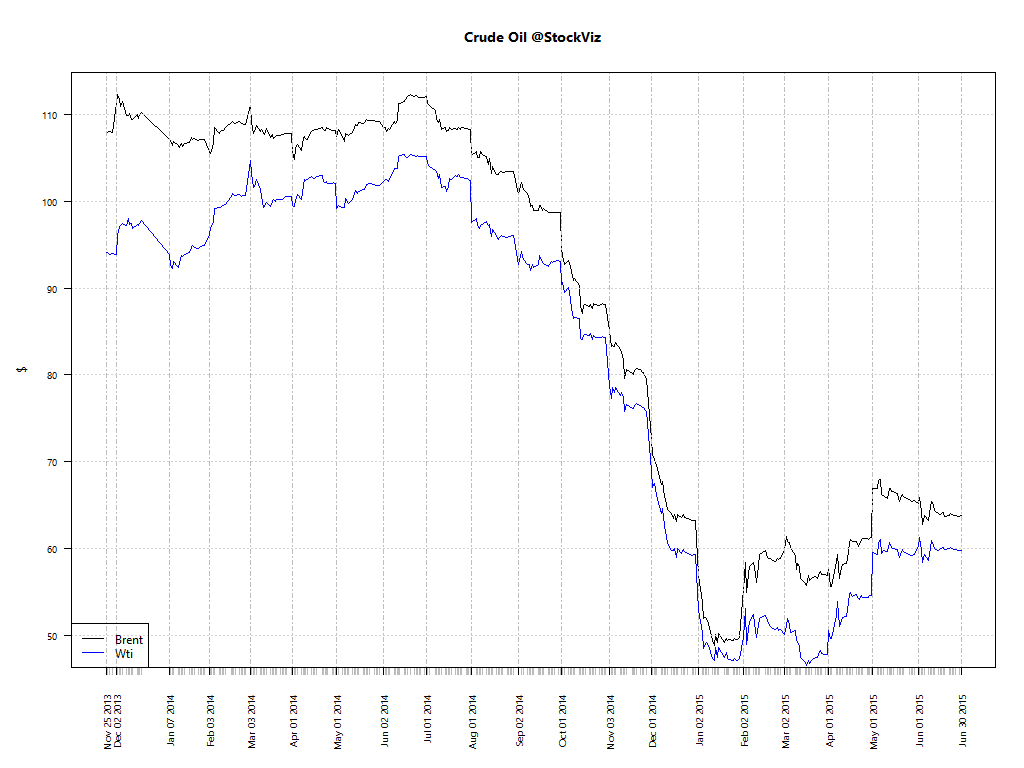

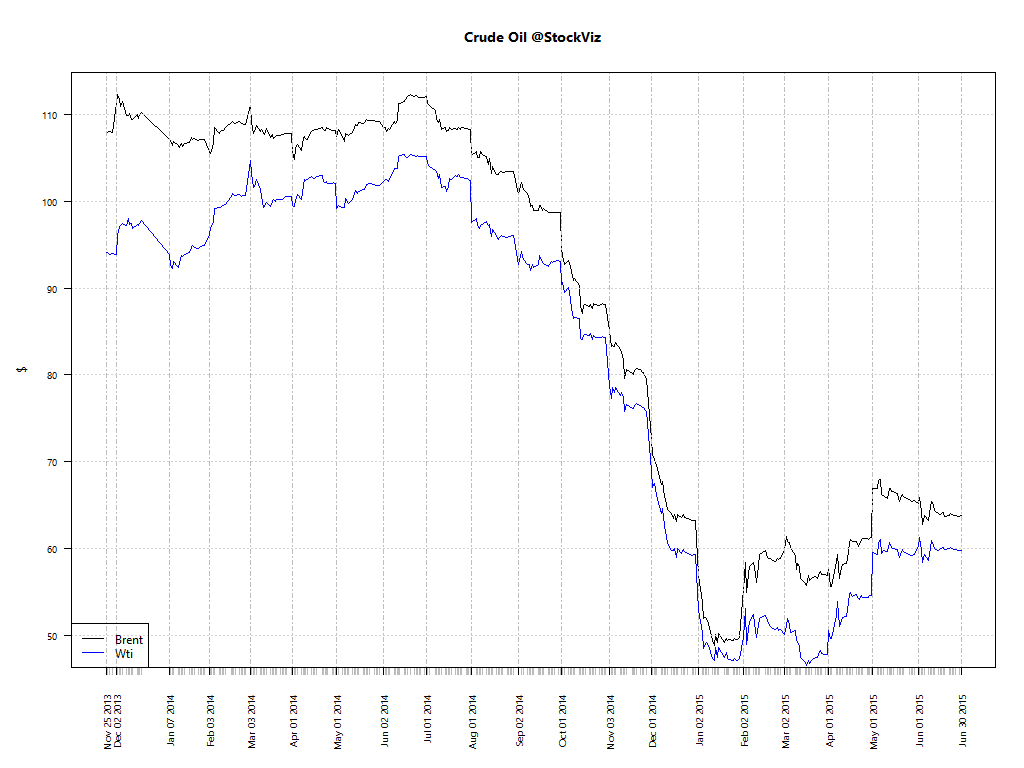

Oil

Oil futures remained flat.

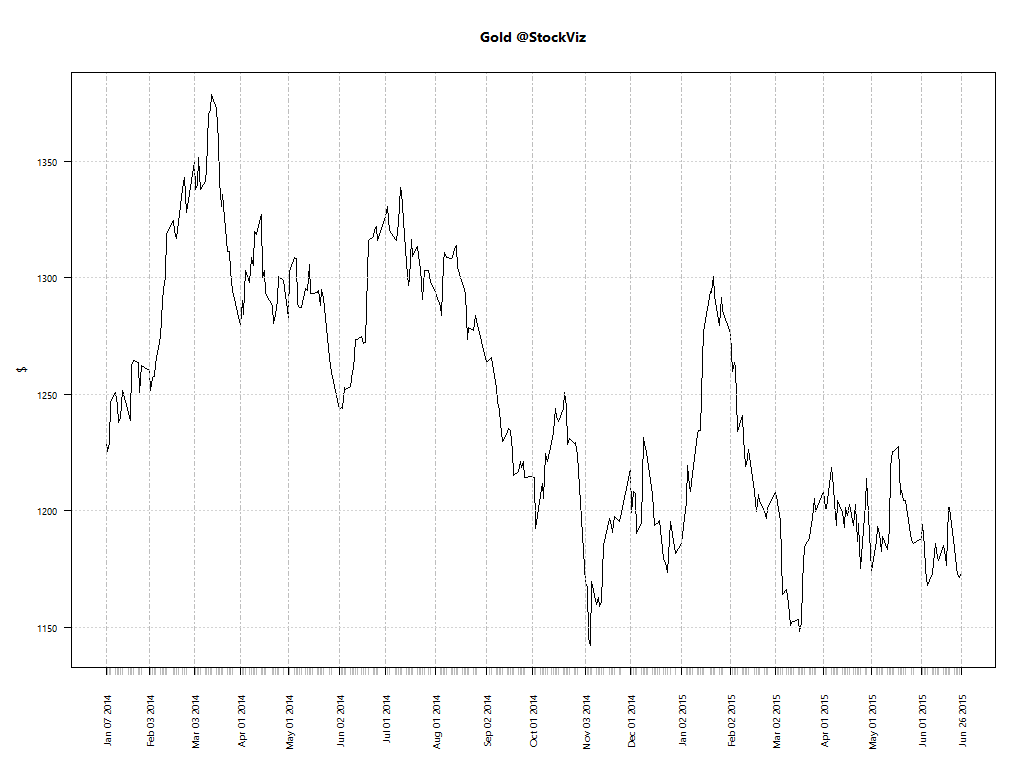

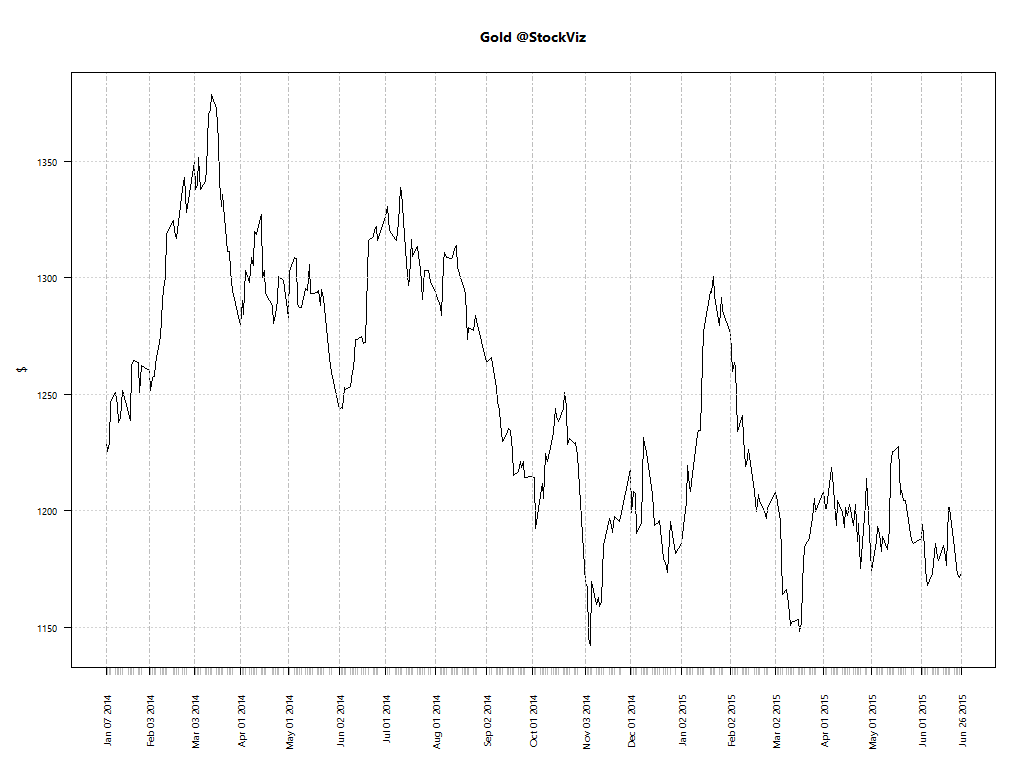

Gold

If all the uncertainties cannot move gold up, I am not sure what will.

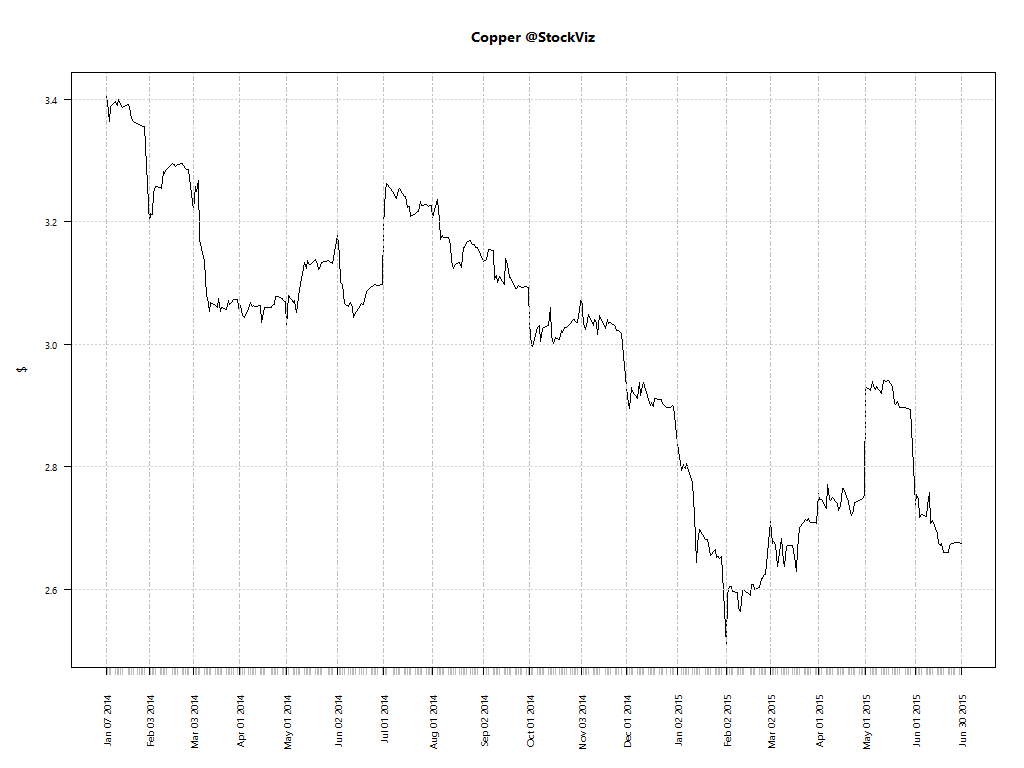

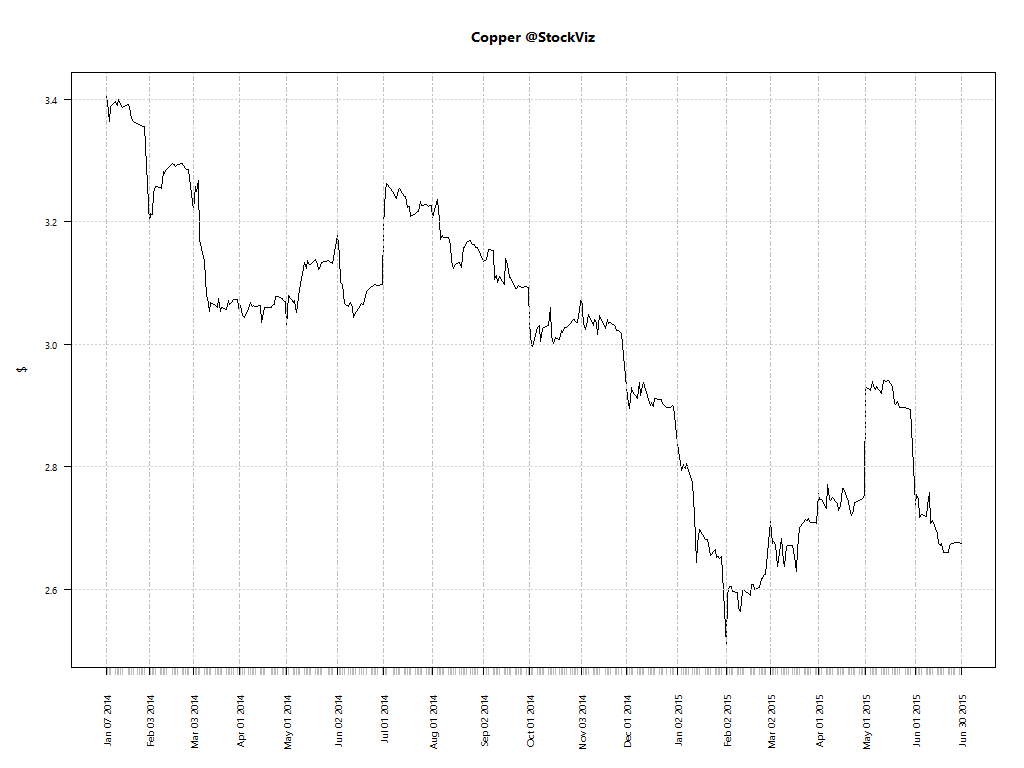

Copper

After a brief period of enthusiasm, it looks like copper has given up on industrial growth again.

Dollar Index

Looks like the dollar index (DXY) has found a range.

Outlook

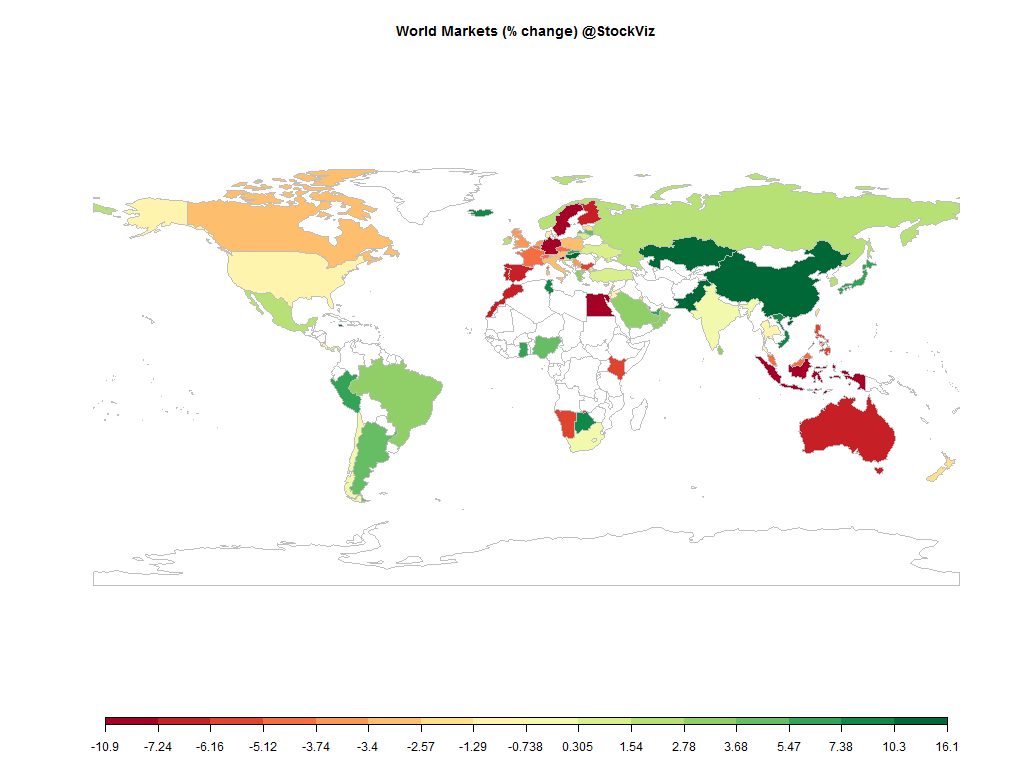

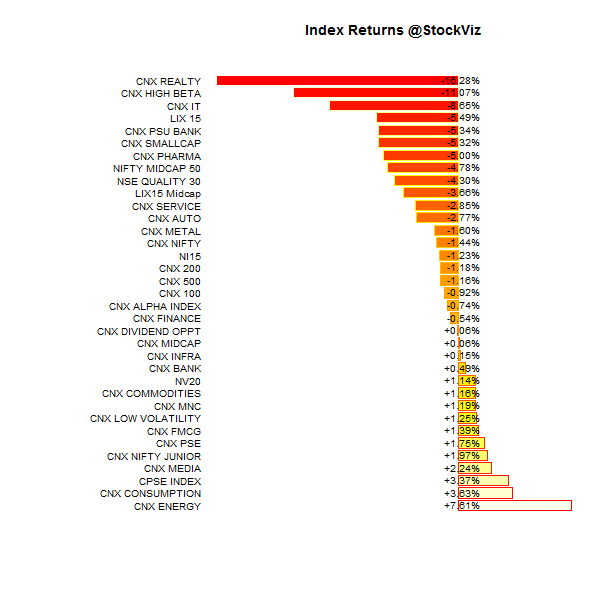

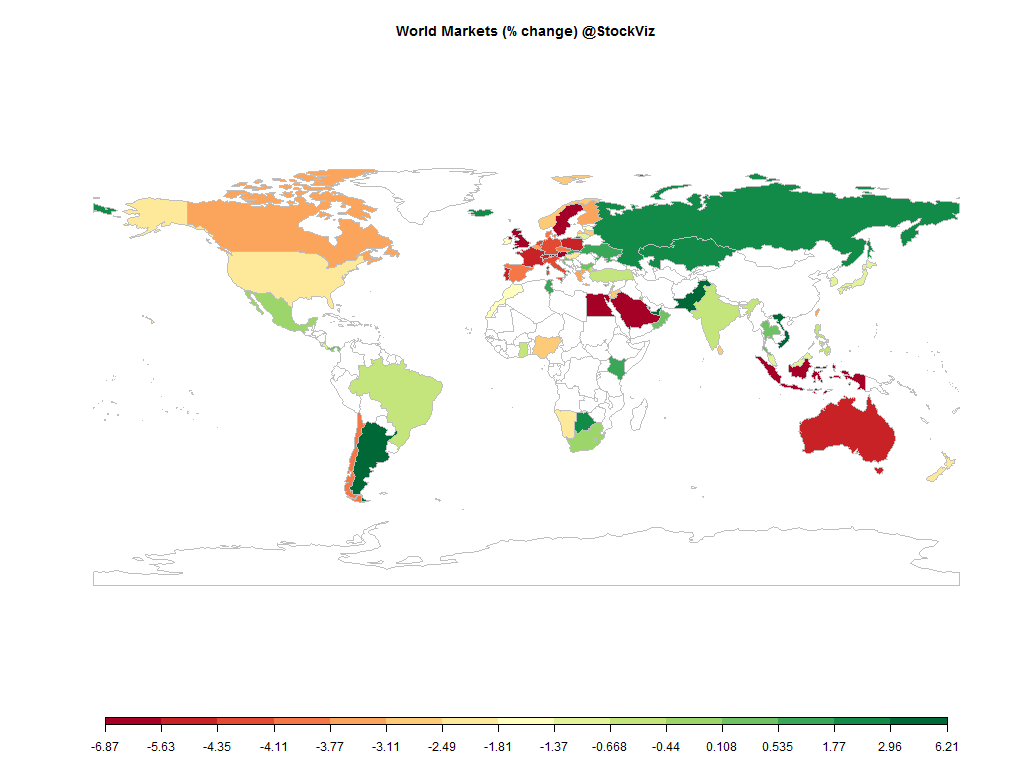

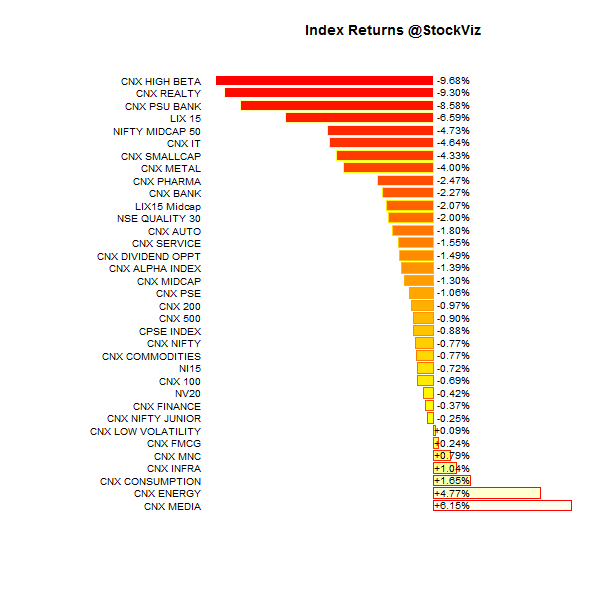

Although the Indian markets have shrugged off Grexit for now, nobody really knows the extent to which the contagion can spread. It’s basically a known unknown at this point.

With the monsoon expected to be normal and earnings to begin in earnest only by the end of July, the first couple of weeks of July is going to be driven by optimism.