Equities

Commodities

| Energy |

| Natural Gas |

-10.56% |

| RBOB Gasoline |

+23.79% |

| Brent Crude Oil |

-3.03% |

| Ethanol |

-7.64% |

| Heating Oil |

-8.72% |

| WTI Crude Oil |

-10.42% |

| Metals |

| Gold 100oz |

-0.07% |

| Palladium |

-7.66% |

| Platinum |

-5.79% |

| Silver 5000oz |

+5.73% |

| Copper |

-3.17% |

| Agricultural |

| Cocoa |

-3.70% |

| Lean Hogs |

-23.73% |

| Lumber |

-16.98% |

| Soybean Meal |

-9.07% |

| Cattle |

-2.64% |

| Coffee (Arabica) |

-21.60% |

| Corn |

-5.31% |

| Feeder Cattle |

-0.42% |

| Orange Juice |

-11.80% |

| Sugar #11 |

-17.63% |

| White Sugar |

-9.27% |

| Coffee (Robusta) |

-10.31% |

| Cotton |

+3.69% |

| Soybeans |

-3.67% |

| Wheat |

-12.19% |

Credit Indices

| Index |

Change |

| Markit CDX EM |

-2.01% |

| Markit CDX NA HY |

+1.59% |

| Markit CDX NA IG |

-1.99% |

| Markit iTraxx Asia ex-Japan IG |

-2.45% |

| Markit iTraxx Australia |

-11.70% |

| Markit iTraxx Europe |

-12.30% |

| Markit iTraxx Europe Crossover |

-79.11% |

| Markit iTraxx Japan |

-13.85% |

| Markit iTraxx SovX Western Europe |

-4.07% |

| Markit LCDX (Loan CDS) |

+0.17% |

| Markit MCDX (Municipal CDS) |

+6.37% |

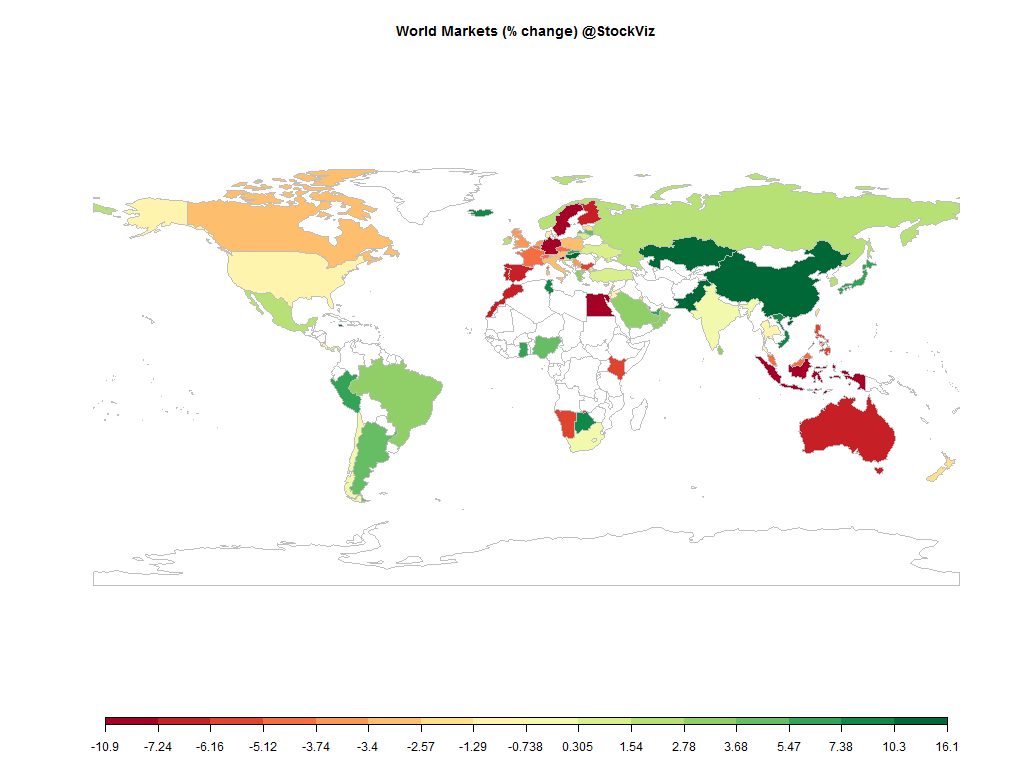

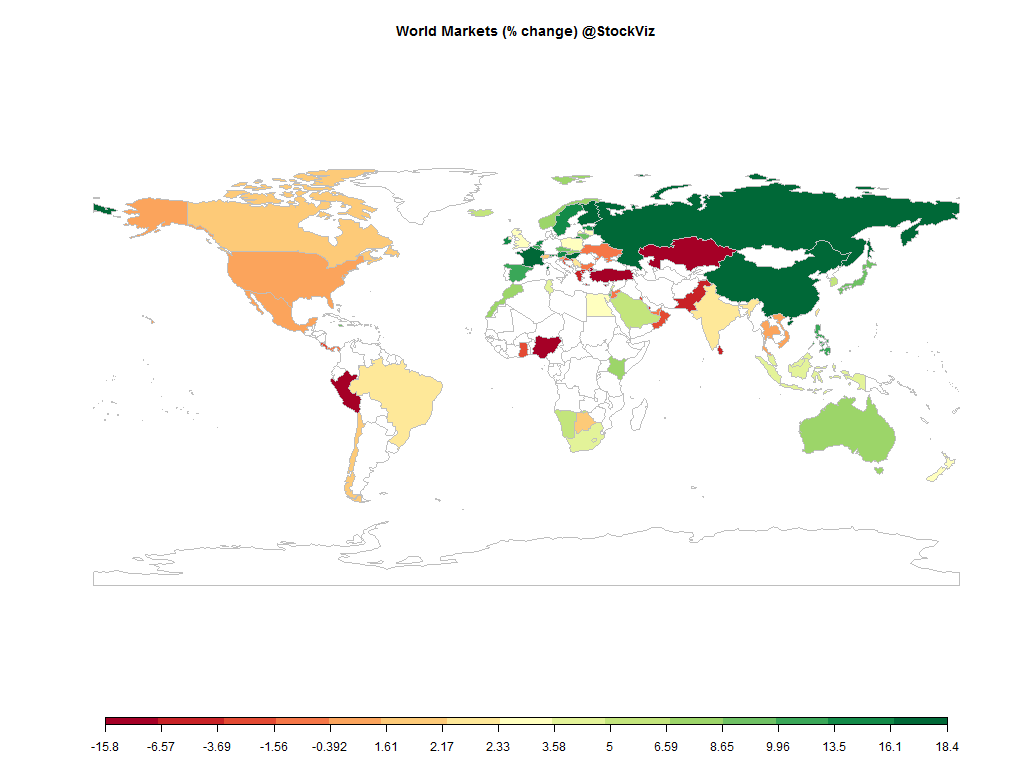

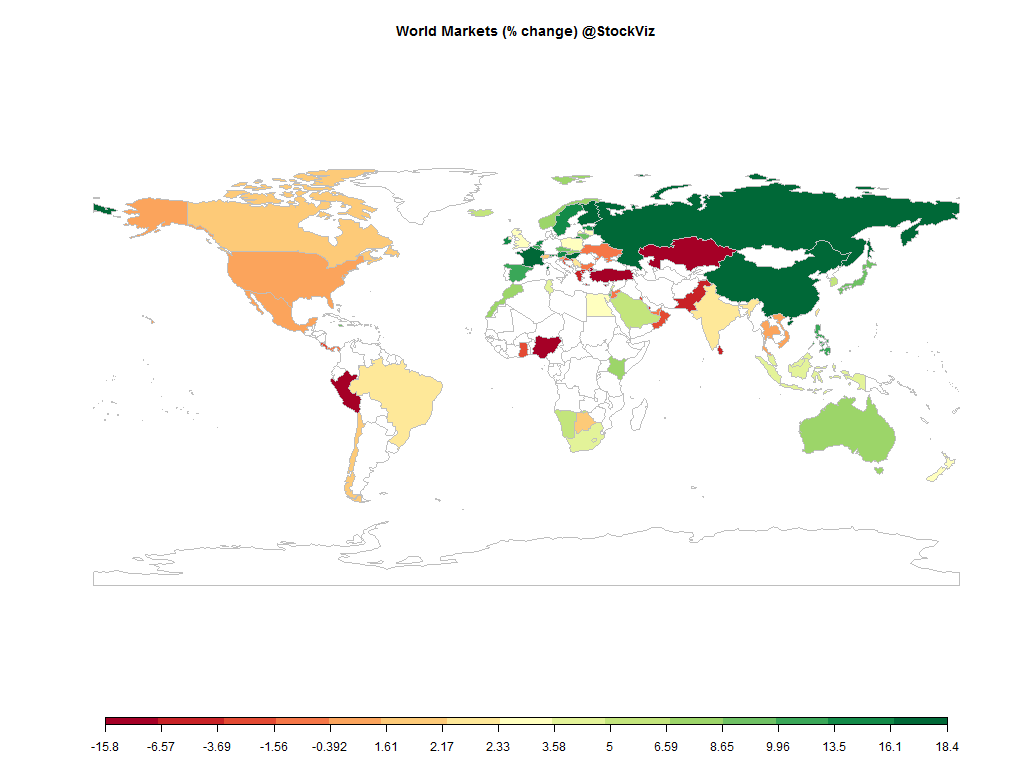

The Nifty managed to squeeze out a dribble of green but was nowhere near the best performing market Germany that clocked in a QE induced +22.03% whopper.

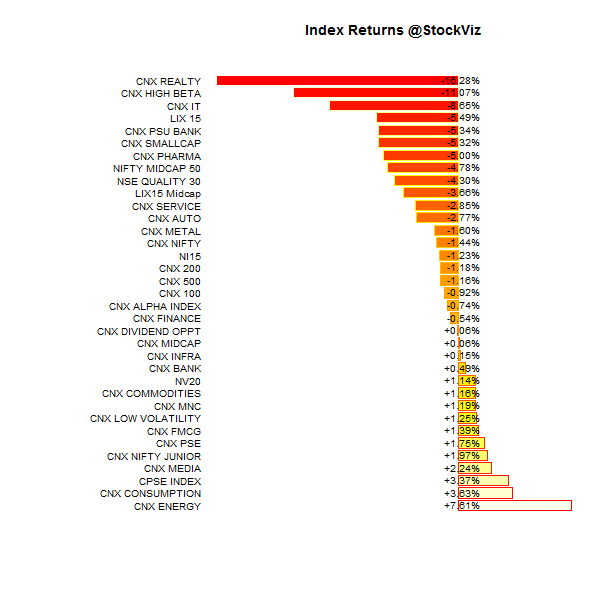

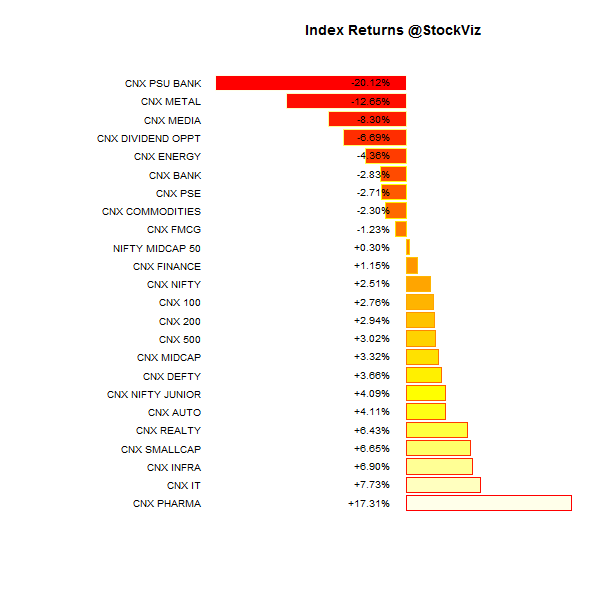

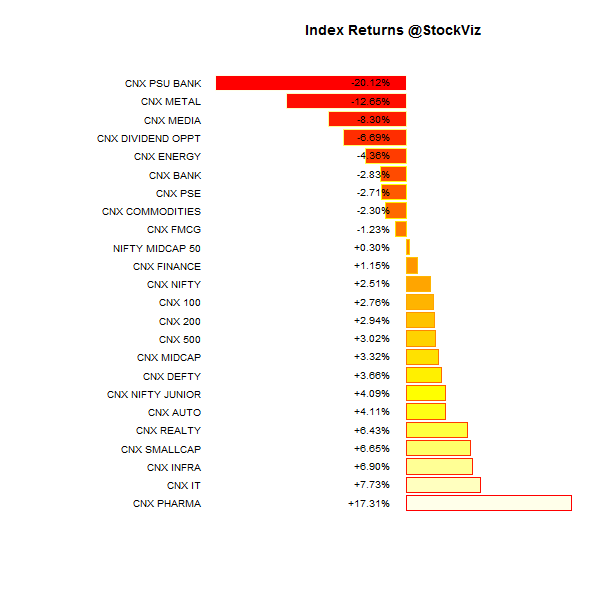

Index Returns

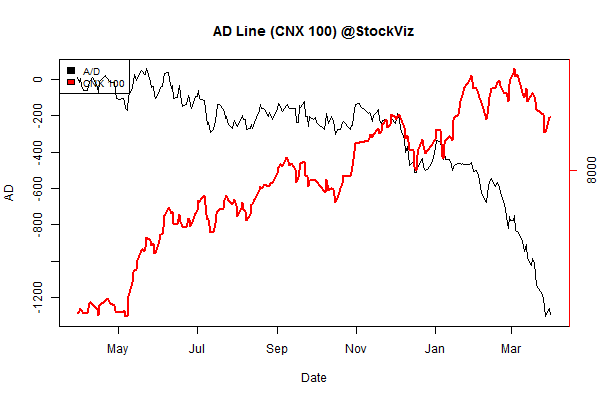

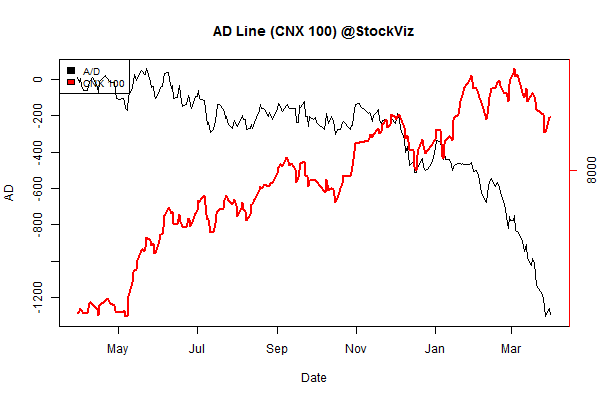

Advance Decline

Market Cap Decile Performance

| Decile |

Mkt. Cap. |

Adv/Decl |

| 1 (micro) |

-16.75% |

60/74 |

| 2 |

-9.15% |

54/79 |

| 3 |

-8.44% |

55/78 |

| 4 |

-5.13% |

55/78 |

| 5 |

-2.03% |

52/81 |

| 6 |

+1.01% |

65/68 |

| 7 |

+6.19% |

69/64 |

| 8 |

+6.27% |

76/57 |

| 9 |

+5.97% |

72/61 |

| 10 (mega) |

+5.01% |

68/66 |

Large-caps out-performed small-caps.

Top Winners and Losers

PSU banks got rightfully pummeled. You know shit is bad when government employees stage a dharna on NPAs.

ETF Performance

Infrastructure was a surprise winner…

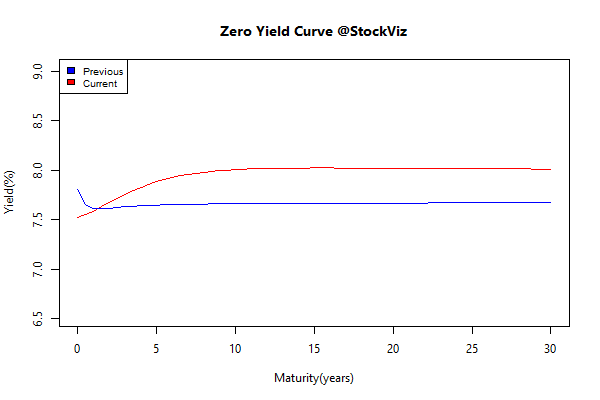

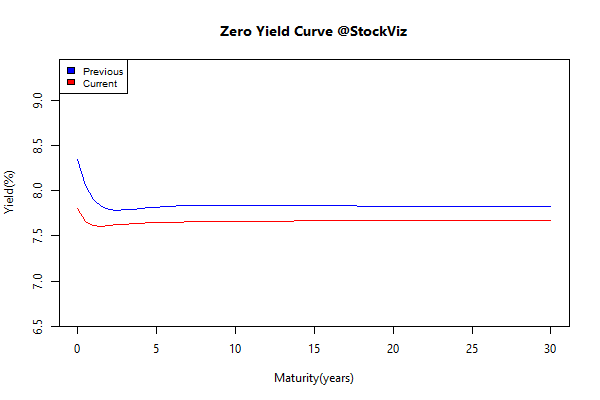

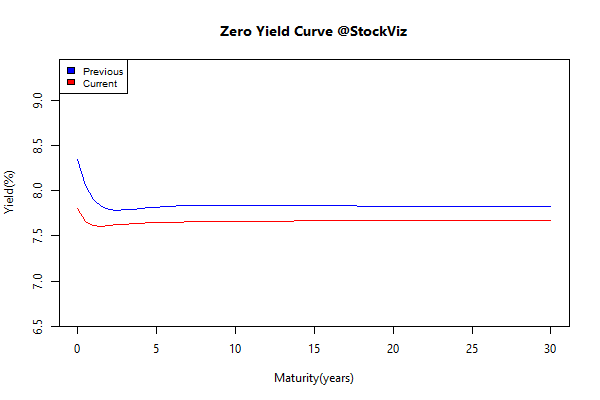

Yield Curve

Bond Indices

| Sub Index |

Change in YTM |

Total Return(%) |

| GSEC TB |

-0.30 |

+2.03% |

| GSEC SUB 1-3 |

-0.53 |

+1.43% |

| GSEC SUB 3-8 |

-0.10 |

+2.45% |

| GSEC SUB 8 |

-0.19 |

+2.27% |

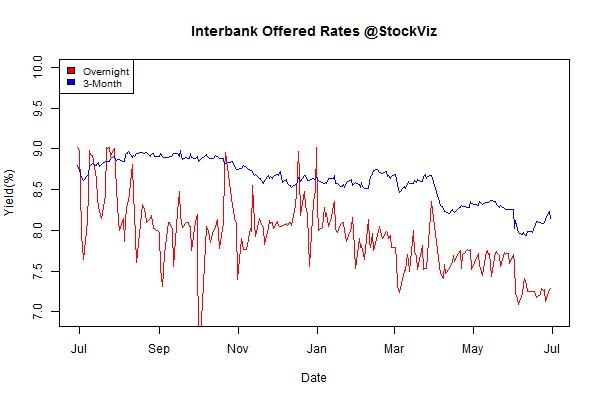

Rate cuts and lower inflation gave bonds a boost…

Investment Theme Performance

Momentum worked, low volatility worked better. High beta was left behind. Quality-to-price out-performed midcaps…

Equity Mutual Funds

Bond Mutual Funds

Refactored Indices

Housekeeping

A number of cool things happened on StockViz this quarter:

- We released our Android app. It is plain torture to develop. Hope you find it useful.

- We moved our website to SSL to ensure that your browsing is encrypted.

- We have a tax report that our investors will find useful during filing time. We will soon have tools that will optimize your trades with taxes in mind.