Introduction

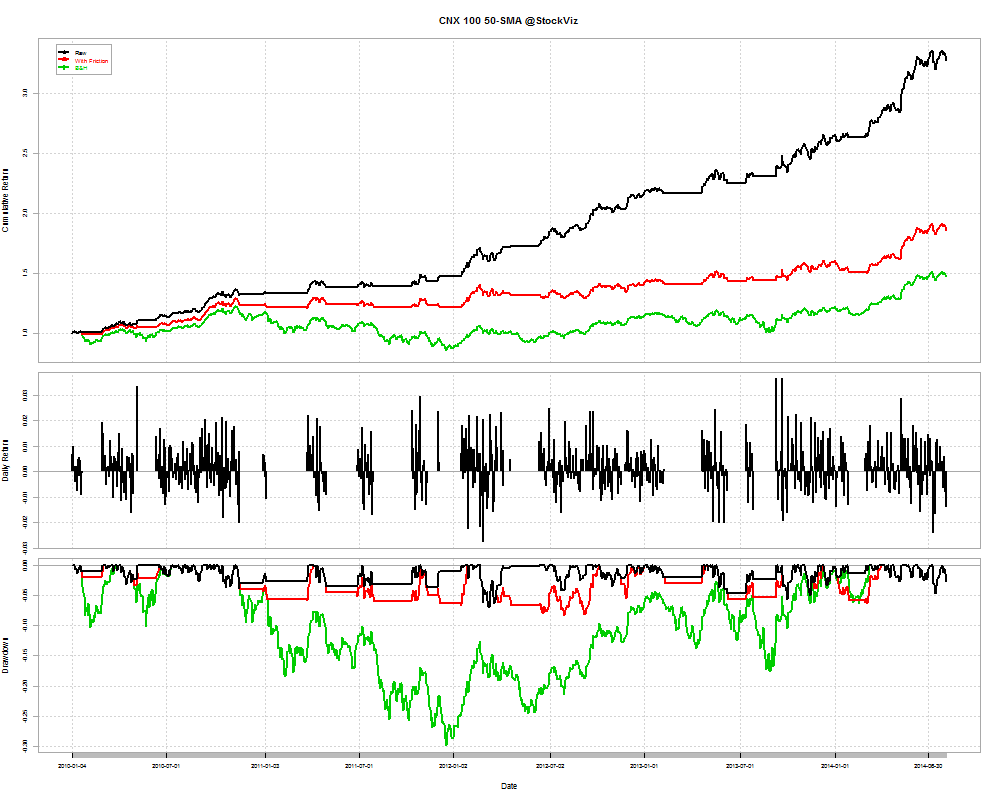

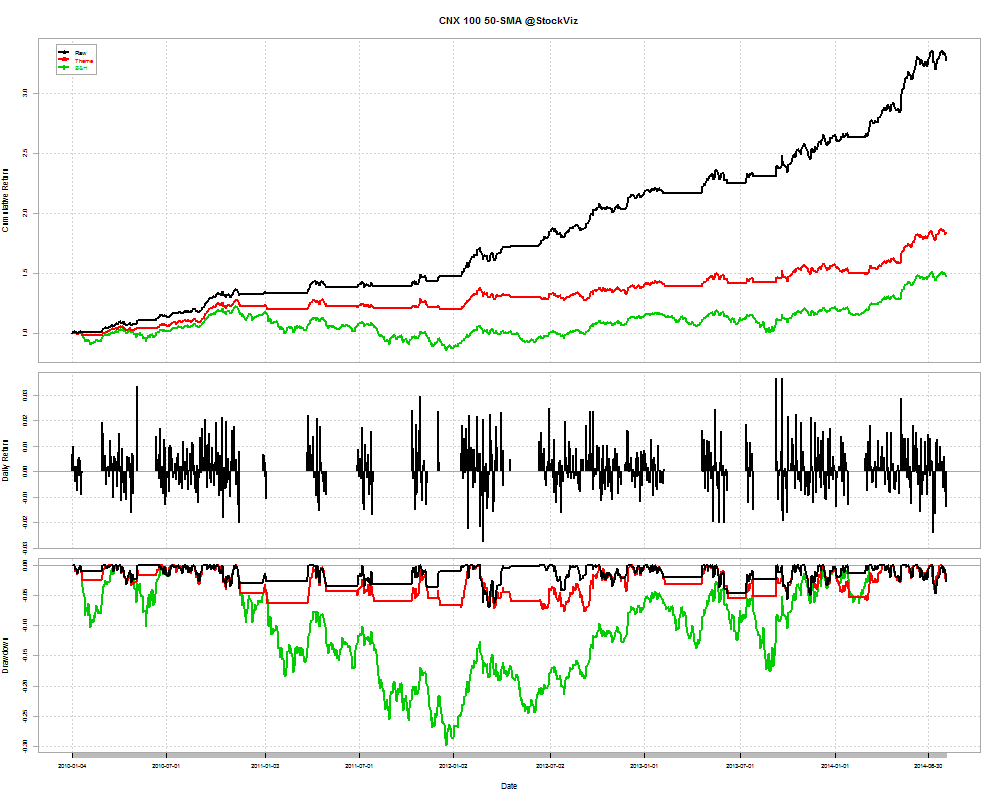

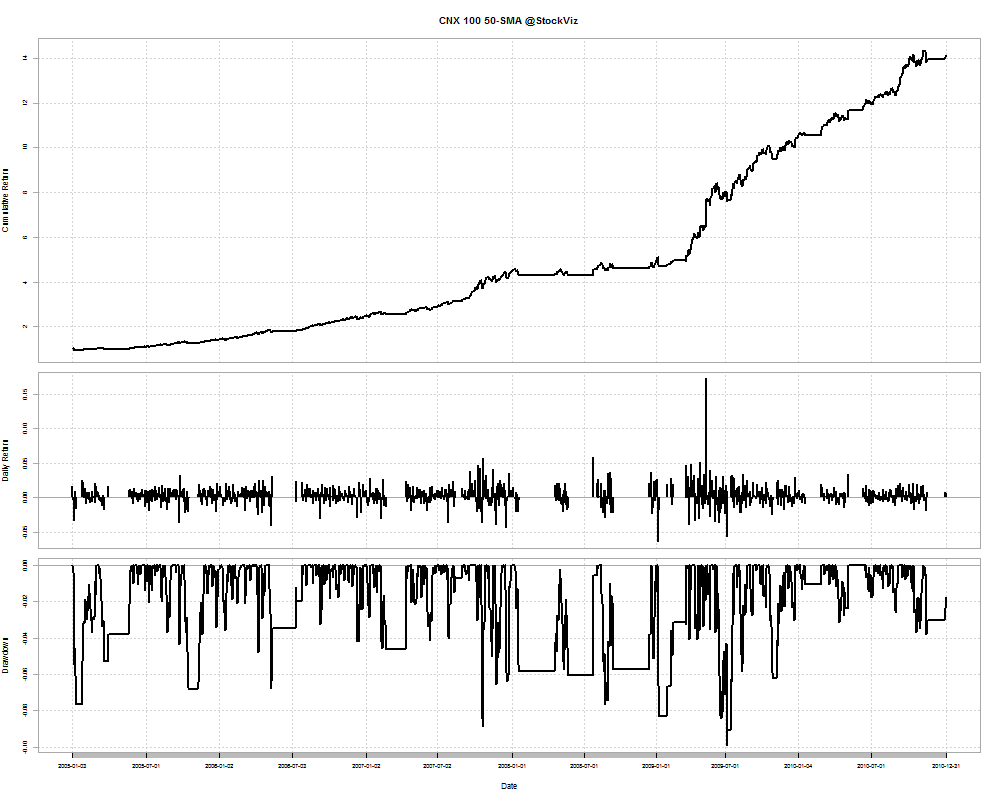

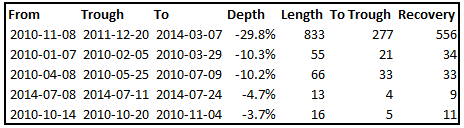

We saw how a CNX 100 50-day tactical investment strategy boosts returns of a naive buy-and-hold strategy (here) even while considering trading costs and other friction (here.) To visualize how this works, lets have a look at the histogram of daily returns since 2010 (1150 trading days.)

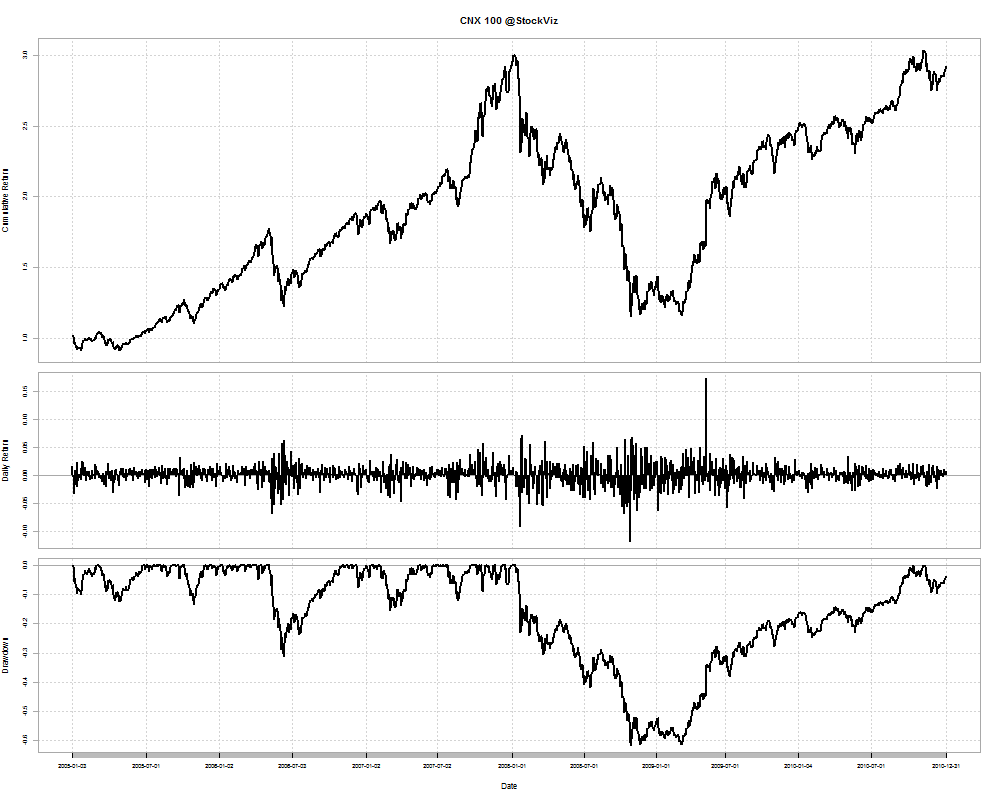

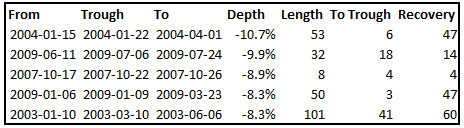

Naive buy-and-hold

| Daily Returns | |

|---|---|

|

<= -2%

|

36 days

|

|

<= -1%

|

165 days

|

|

>= +2%

|

41 days

|

|

>= +1%

|

188 days

|

|

Average

|

+0.04%

|

|

Std. Dev.

|

1.07

|

200-day SMA switch

| Daily Returns | |

|---|---|

|

<= -2%

|

16 days

|

|

<= -2%

|

85 days

|

|

>= +2%

|

21 days

|

|

>= +1%

|

122 days

|

|

Average

|

+0.07%

|

|

Std. Dev.

|

0.79

|

100-day SMA switch

| Daily Returns | |

|---|---|

|

<= -2%

|

11 days

|

|

<= -2%

|

66 days

|

|

>= +2%

|

21 days

|

|

>= +1%

|

114 days

|

|

Average

|

+0.09%

|

|

Std. Dev.

|

0.74

|

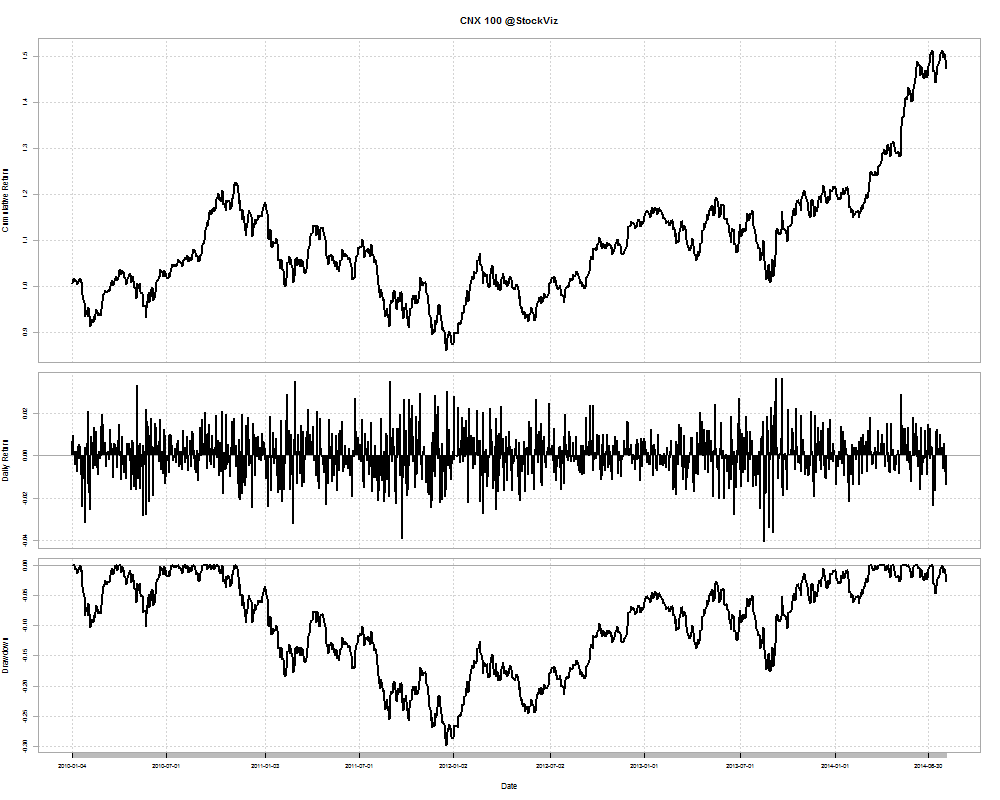

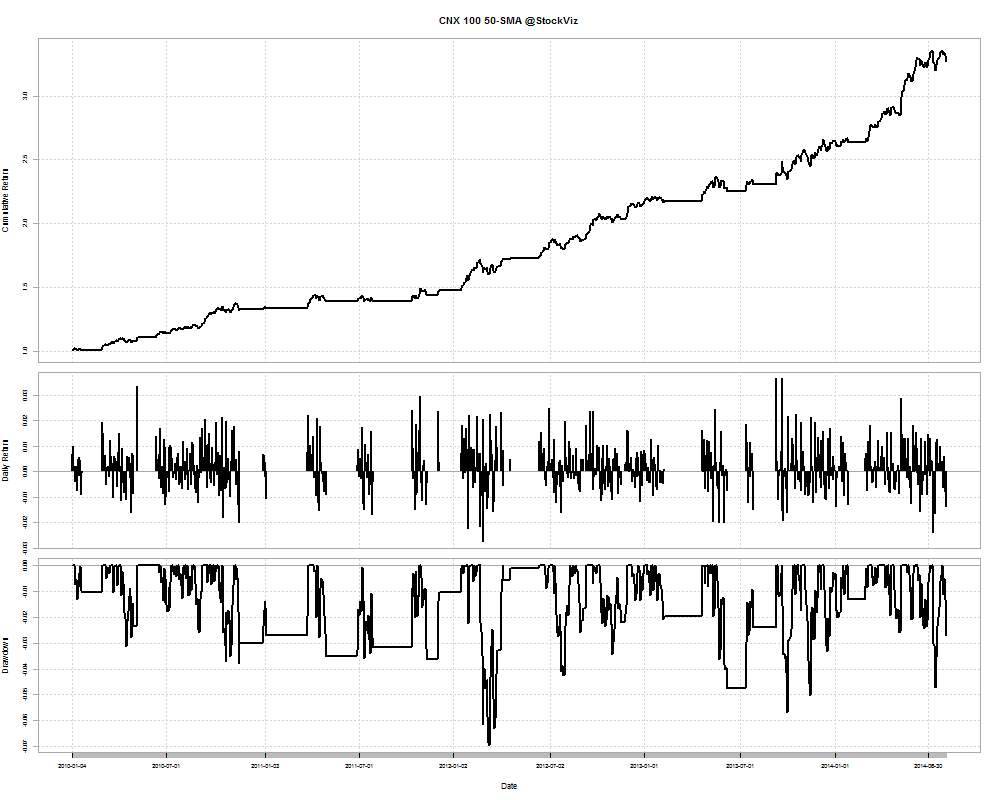

50-day SMA switch

| Daily Returns | |

|---|---|

|

<= -2%

|

7 days

|

|

<= -2%

|

53 days

|

|

>= +2%

|

24 days

|

|

>= +1%

|

110 days

|

|

Average

|

+0.11%

|

|

Std. Dev.

|

0.71

|

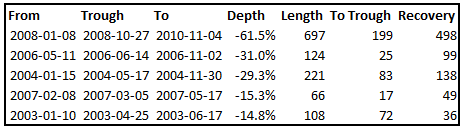

Conclusion

Even after considering trading costs, impact costs and tracking error, this strategy comes out way ahead of a naive buy-and-hold strategy. Better returns than buy-and-hold with lower volatility and at a low cost!

You can follow the Theme here.