Market timing is a very divisive topic in investing. For traders, it has been the search for the holy grail. For passive investors, a source of derision.

Does it mean investors should just remain long all the time? Hardly, according to the latest research by Meb Faber (ssrn).

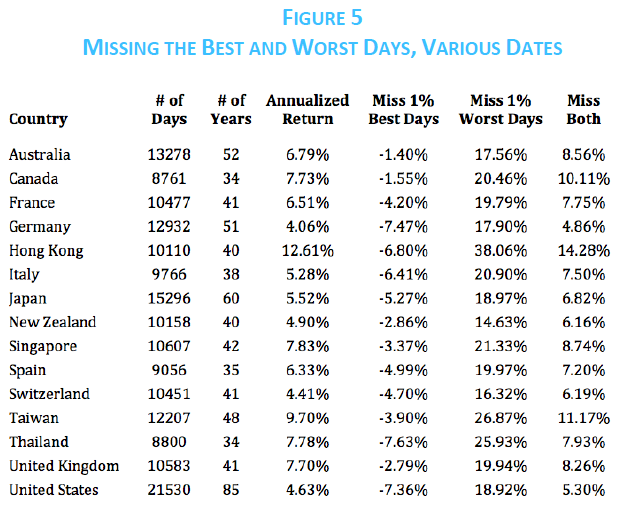

Data for international markets show that volatility increases in declining markets. Any strategy that keeps you out of those periods, will improve your portfolio returns. The outline of his strategy is simple: go long the market if it is trading more than its 200-day SMA and stay out of the market otherwise.

It works across most international markets:

Unfortunately, the paper doesn’t discuss the Indian markets, so lets try and fix that.

Best and worst days

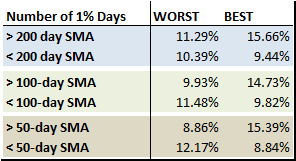

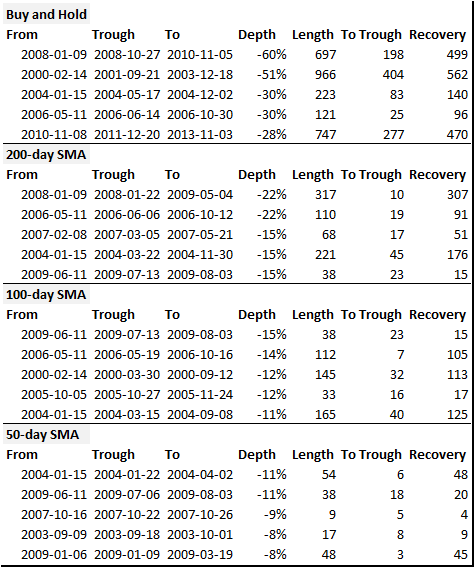

The table below shows that in a rising market, +1% days (BEST) outnumber -1% days (WORST) and the reverse is true of declining markets. Also, as you decrease the look-back period, the WORST to BEST ratio increases in a declining market.

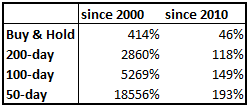

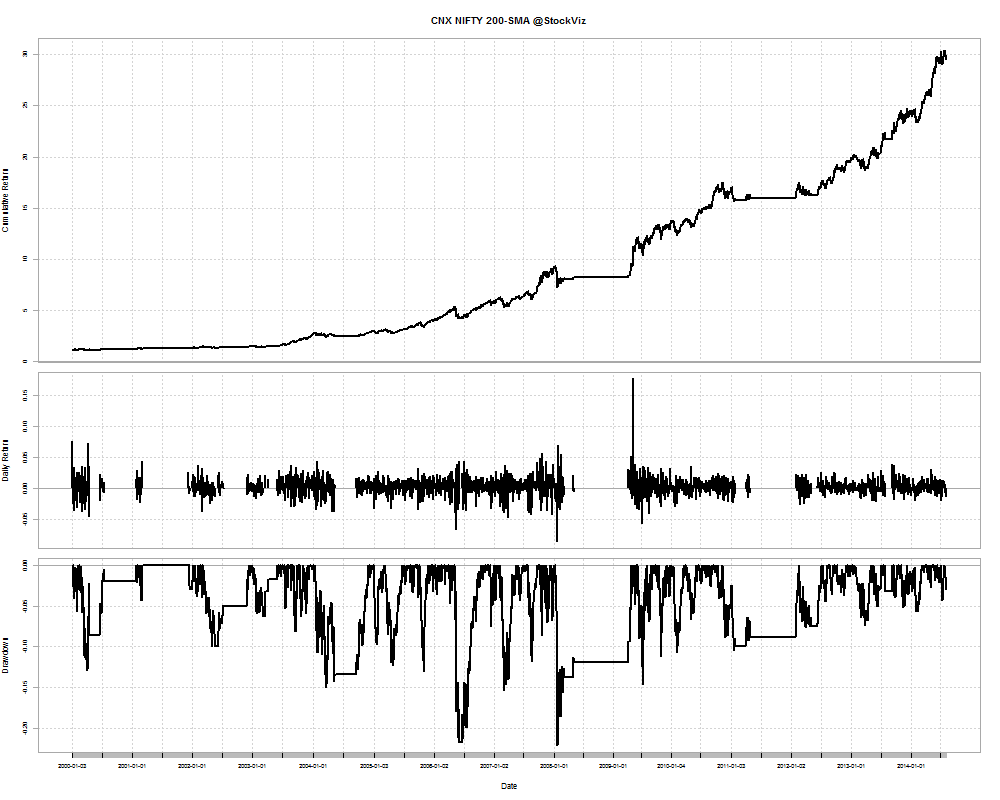

Cumulative Returns

If you apply the SMA switch to the Nifty index, here’s how the cumulative returns look like:

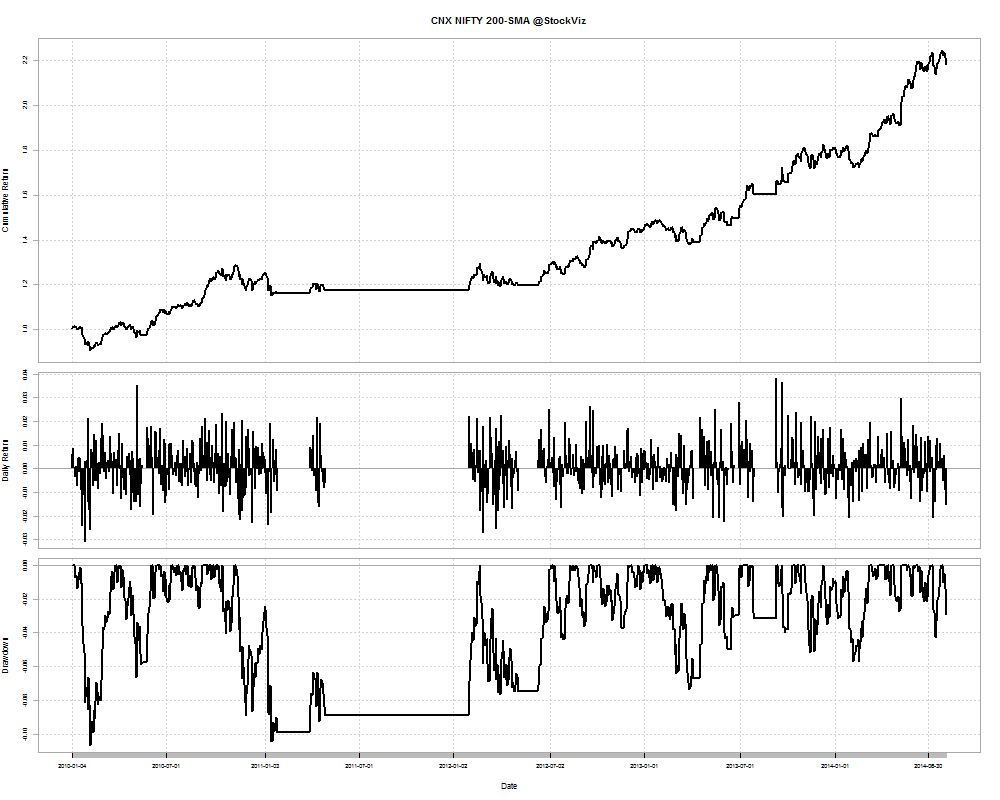

200-day SMA Cumulative Return Chart

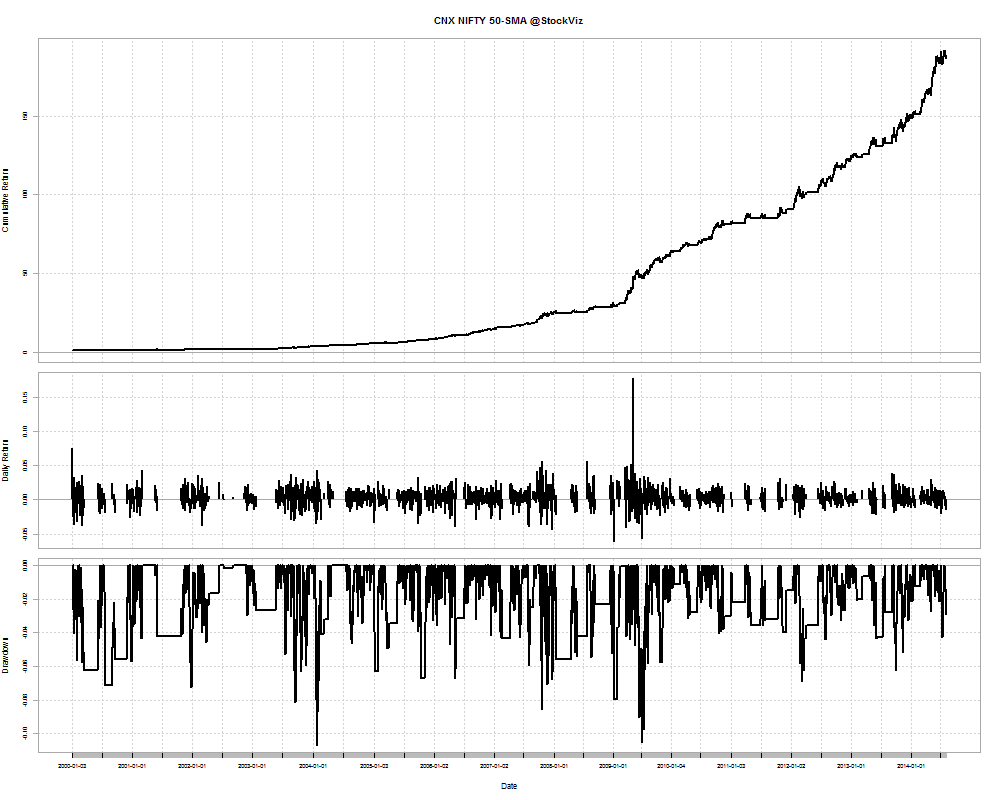

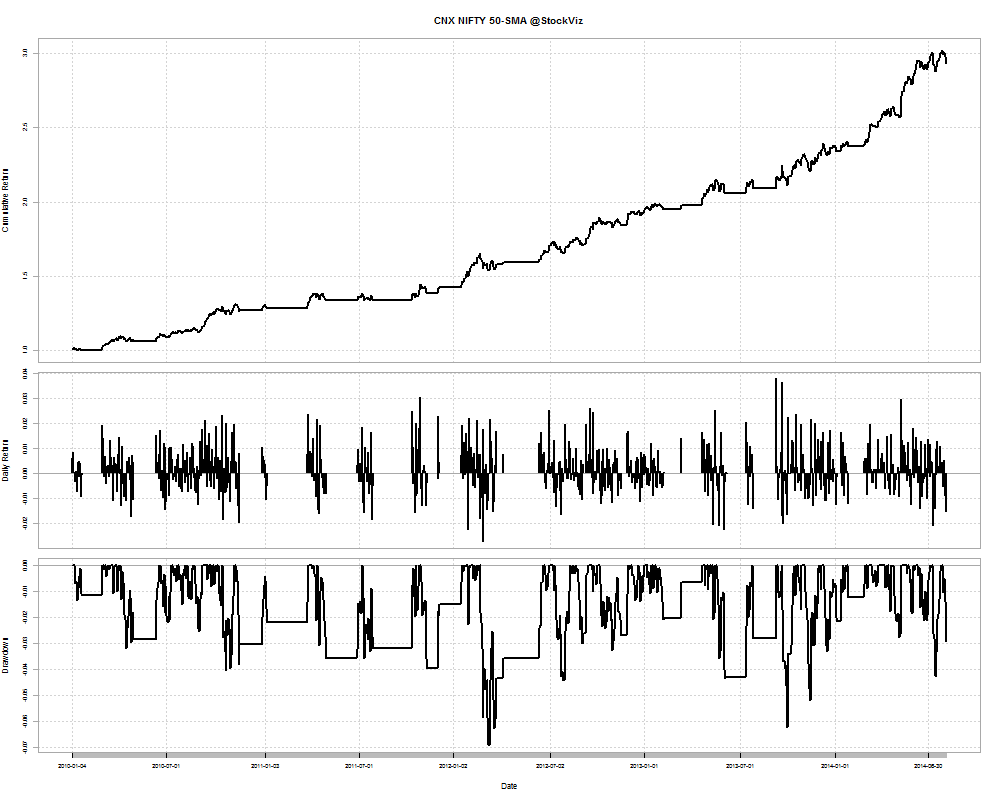

50-day SMA Cumulative Return Chart

Drawdowns

If the SMA rule really helped investors stay out of negative fat tails, then it should manifest itself in the drawdowns.

Conclusion

Using a simple SMA rule helps investors avoid drawdowns and boost returns as compared to a naive buy and hold strategy. The smaller the look-back period, the better the returns and lower the drawdowns.

The Nifty 200SMA backtesting result seems incorrect as the total return from 2010 to 2018 would be around 46%. Your results seems to have trade biases. Do check.

Lost the code for that one. So have been making R scripts related to blogs public. Have a look at https://stockviz.biz/2019/02/07/sma-strategies-using-etfs/ and its related code… see if it jives.