Introduction

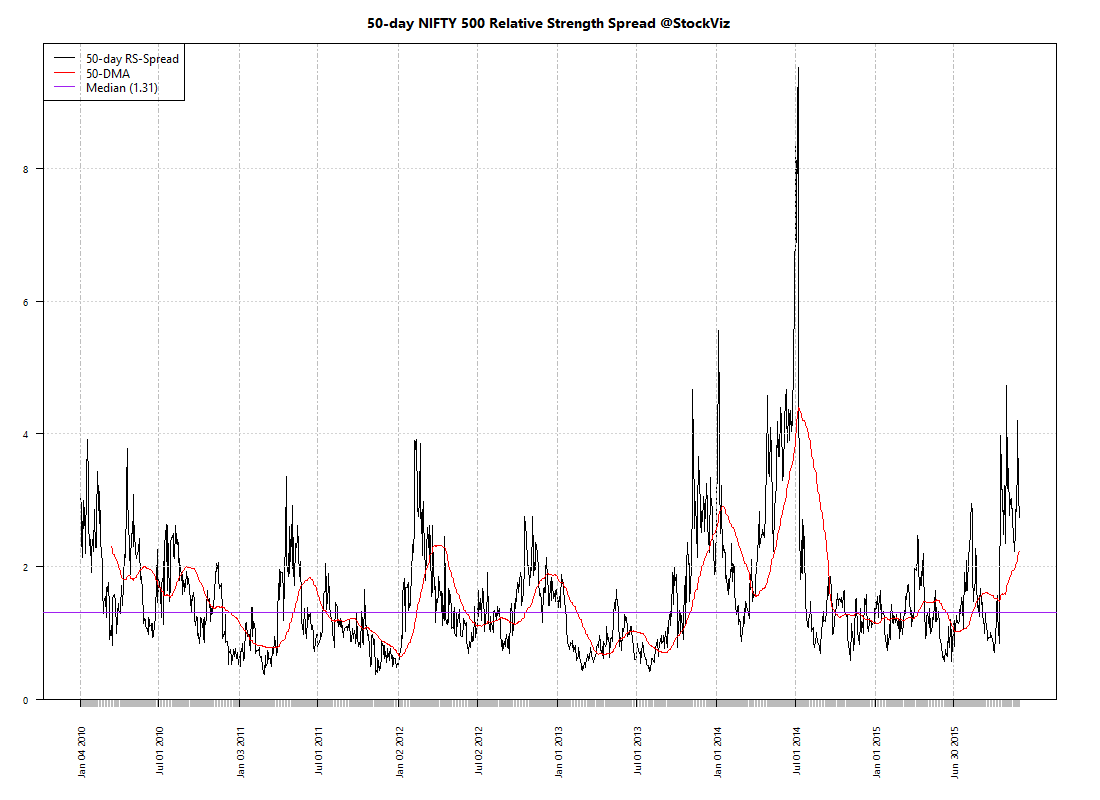

Momentum strategies are based on measures of “speed” – change in price (distance traveled) over a specific unit of time. Acceleration goes one step further and measures the rate of change of momentum. This strategy is relatively new – we set it up in the middle of November. It would be interesting to see how this strategy pans out.

Performance summary

| held since | returns (%) | |

|---|---|---|

| 8KMILES |

2015-Nov-19

|

+0.54

|

| GODFRYPHLP |

2015-Nov-19

|

+19.06

|

| RAJESHEXPO |

2015-Nov-19

|

+3.81

|

| GAYAPROJ |

2015-Nov-19

|

+9.19

|

| JUBILANT |

2015-Nov-19

|

+2.91

|

| COSMOFILMS |

2015-Nov-19

|

+1.02

|

| RUSHIL |

2015-Nov-19

|

+3.29

|

| MANGALAM |

2015-Nov-19

|

+40.62

|

| HIMATSEIDE |

2015-Nov-19

|

+6.74

|

| ALLSEC |

2015-Nov-19

|

+18.78

|

| TVSELECT |

2015-Nov-19

|

+2.29

|

| NIITLTD |

2015-Nov-19

|

+7.47

|

| PTL |

2015-Nov-19

|

+8.51

|

| ESTER |

2015-Nov-19

|

+8.71

|

| TRIGYN |

2015-Nov-19

|

+25.91

|

| EMMBI |

2015-Nov-19

|

+22.39

|

| TRIDENT |

2015-Nov-19

|

+8.37

|

| GUFICBIO |

2015-Nov-19

|

+24.46

|

| NITCO |

2015-Nov-19

|

+20.29

|

| MERCATOR |

2015-Nov-19

|

+4.63

|

You can find more details about the Acceleration Theme here.