Why Now?

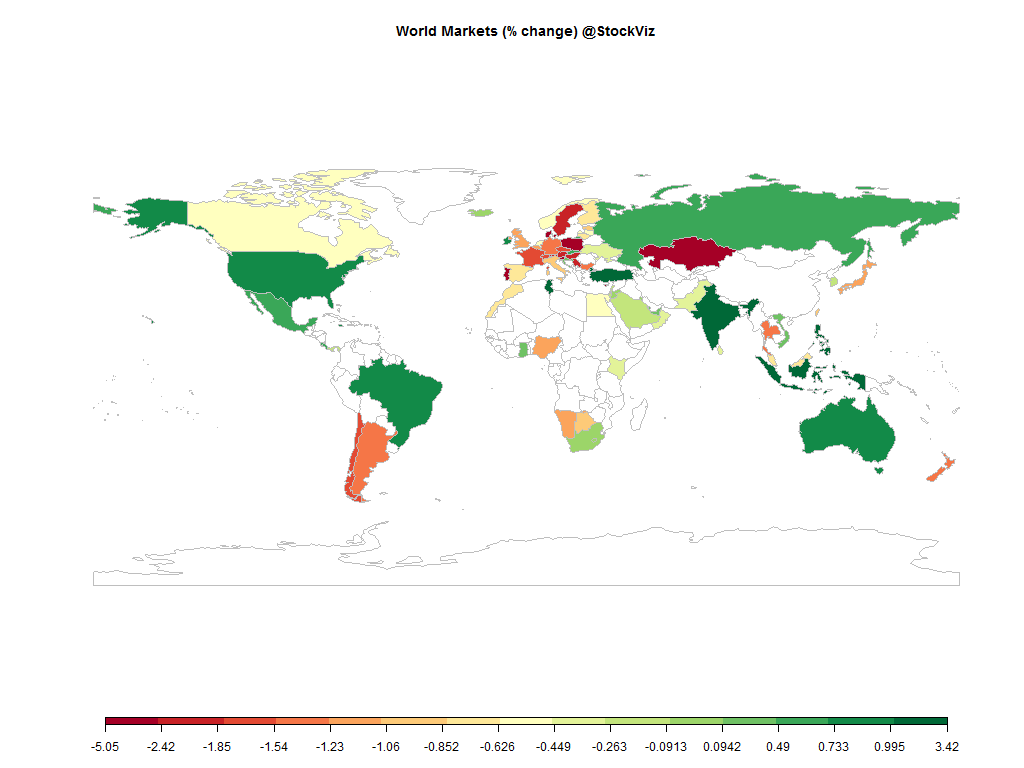

Here are the top 5 reasons why investors should look at European equities:

- The ECB’s $1.1 trillion bond-buying program is beginning to kick in.

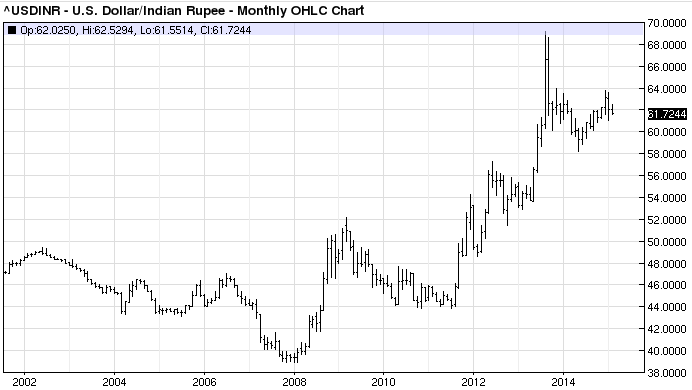

- The slide in the euro’s value against the dollar has also made European exports more competitive.

- Valuations appear attractive.

- Eurozone corporates are less leveraged, and their profitability has remained resilient.

- Greece is a source of uncertainty. Investing during uncertain times bears outsized returns.

How?

Unless you have a foreign equities trading account, the only way you can invest in European equities are through feeder funds or international funds. Feeder funds are just a wrapper around another fund. One such fund is the Religare Invesco Pan European Equity Fund. It feeds into the Invesco Pan European Equity Fund (MorningStar.)

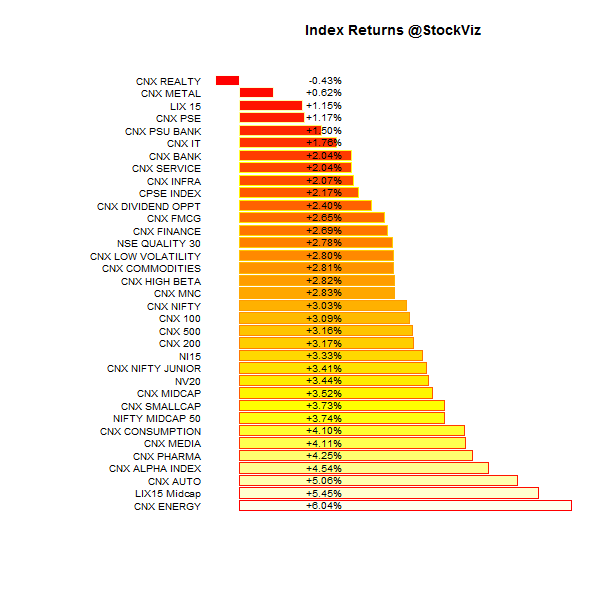

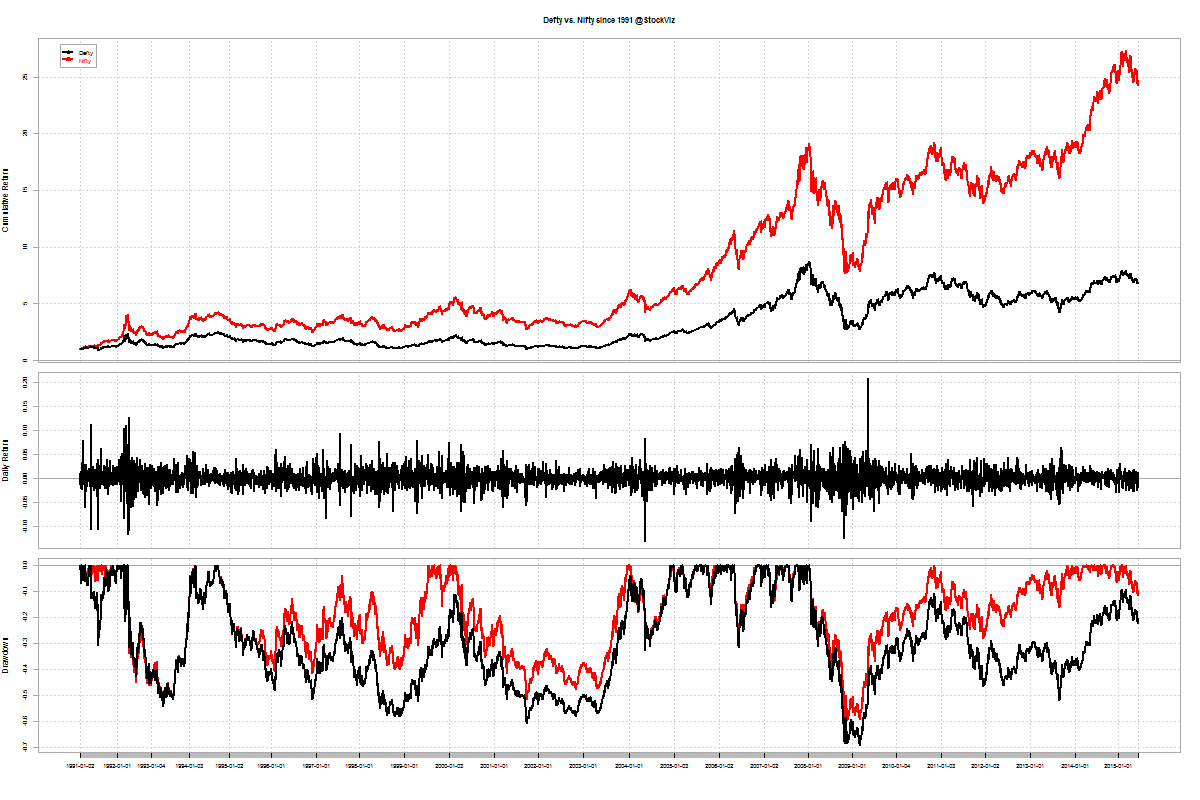

It can be argued that investing in a narrow geographic is riskier compared to investing in a broad international fund. We had highlighted one such fund, the Birla Sun Life International Equity Fund Plan A, in our post about investing in non-rupee assets. If you compare the two, between 2014-03-03 and 2015-06-25, Religare’s fund gave an IRR of 1.27% vs. Birla’s 7.14%![]() Although this blows when compared to the CNX Midcap (IRR of 48.41% in the same period), remember that investing is all about prospective returns.

Although this blows when compared to the CNX Midcap (IRR of 48.41% in the same period), remember that investing is all about prospective returns.

Risks

There is always the risk that Greece will blowup and drag Italy down with it, causing the Eurozone to implode. Tack on the risk of active management and currency risk (the rupee might appreciate against the euro), it becomes a pretty scary proposition. But remember, investing during uncertain times bears outsized returns.

Call us to discuss whether this fund is right for you.