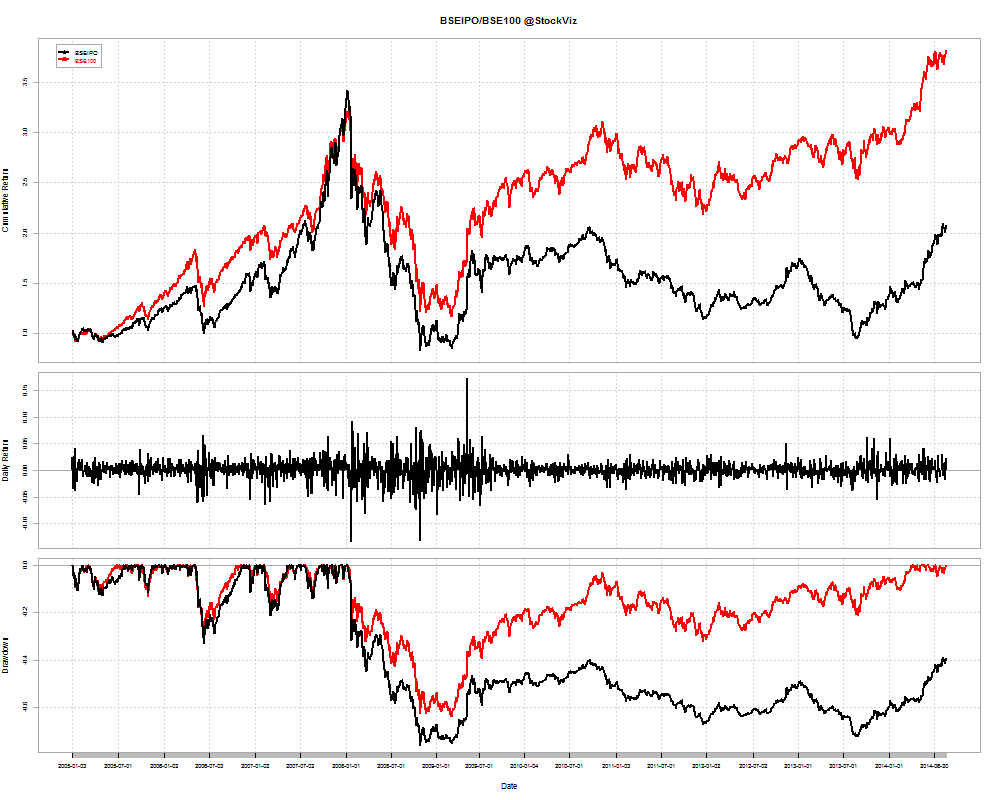

Most theories of how the stock market works are based on the idea that investors sit around thinking about what a stock might be worth. Together, by buying and selling stock, Mr. Market comes to some conclusion.

But the consumption-based asset pricing model says that’s not the way it works at all. Investors, actually, spend very little time thinking about whether a company’s shares are undervalued or overvalued. Instead, most investors make their investment decisions based on how much money they have and when they will spend it.

Source: How market selloffs happen

Origins of Stock Market Fluctuations

- On a quarterly basis, risk aversion shocks explain roughly 75% of variation in the log difference of stock market wealth.

- Over the long term, factors share shock that shifts the rewards of production between workers and shareholders plays a larger role in stock market returns.

- By contrast, technological progress that rewards both workers and shareholders plays a smaller role in stock market fluctuations.

Read the whole thing: